What Is The Minimum Student Loan Repayment

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Decoding the Minimum Student Loan Repayment: A Comprehensive Guide

What if navigating student loan repayment felt less daunting and more manageable? Understanding the minimum payment is the crucial first step towards achieving financial freedom.

Editor’s Note: This article on minimum student loan repayments was published today and provides up-to-date information on federal and private loan repayment options. We aim to empower borrowers with the knowledge they need to make informed decisions about their student loan debt.

Why Minimum Student Loan Repayment Matters:

Student loan debt is a significant financial burden for many, impacting their ability to save, invest, and build long-term financial security. Understanding the minimum repayment amount is vital for several reasons:

- Avoiding Delinquency: Failing to make even the minimum payment can lead to delinquency, negatively impacting your credit score and potentially triggering collection actions.

- Managing Cash Flow: Knowing your minimum payment allows you to budget effectively and prioritize this crucial expense.

- Strategic Repayment Planning: While minimum payments may seem appealing, understanding them helps determine if a more aggressive repayment strategy is feasible and beneficial in the long run.

- Exploring Repayment Options: Awareness of minimum payments enables borrowers to explore different repayment plans and choose the one that best aligns with their financial situation.

Overview: What This Article Covers

This article delves into the complexities of minimum student loan repayments, covering federal and private loan structures, repayment plan options, the impact of minimum payments on long-term debt, and strategies for managing repayment effectively. Readers will gain a comprehensive understanding of minimum payments and actionable insights to navigate their student loan journey successfully.

The Research and Effort Behind the Insights:

This article is the product of extensive research, drawing on information from the U.S. Department of Education, reputable financial institutions, and expert analysis of student loan repayment trends. The information provided aims to be accurate and up-to-date, reflecting the current landscape of student loan repayment.

Key Takeaways:

- Definition of Minimum Repayment: Understanding the calculation and variation across loan types.

- Federal Loan Repayment Plans: Exploring different plans and their minimum payment implications.

- Private Loan Repayment Plans: Analyzing the differences between federal and private loan minimum payments.

- Long-Term Implications of Minimum Payments: Assessing the impact on total interest paid and repayment timeline.

- Strategies for Effective Repayment: Practical tips for managing student loan debt effectively.

Smooth Transition to the Core Discussion:

Now that we understand the importance of minimum student loan payments, let’s delve into the specifics of calculating and managing these payments effectively.

Exploring the Key Aspects of Minimum Student Loan Repayment:

1. Definition and Core Concepts:

The minimum student loan repayment is the smallest amount a borrower is required to pay each month to remain in good standing with their lender. This amount varies depending on several factors, including:

- Loan Type: Federal student loans (subsidized and unsubsidized Stafford Loans, PLUS Loans, etc.) and private student loans have different repayment structures.

- Loan Amount: Larger loan balances generally lead to higher minimum payments.

- Interest Rate: Higher interest rates result in larger minimum payments, as a portion goes towards covering accrued interest.

- Repayment Plan: The chosen repayment plan significantly influences the minimum monthly payment.

2. Federal Student Loan Repayment Plans:

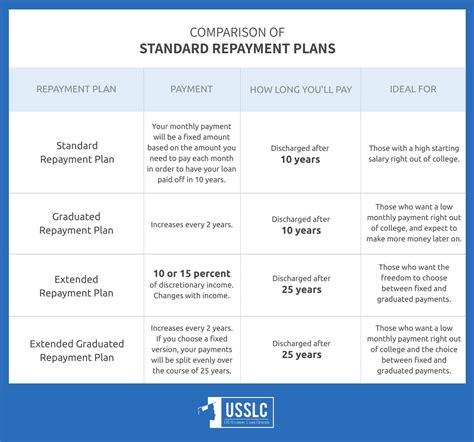

The U.S. Department of Education offers several repayment plans for federal student loans, each with varying minimum payment calculations:

- Standard Repayment Plan: This plan typically involves a 10-year repayment period, with a fixed monthly payment calculated based on the total loan amount, interest rate, and repayment term.

- Graduated Repayment Plan: Payments start low and gradually increase over time, often making early payments more manageable but leading to higher payments later.

- Extended Repayment Plan: This plan extends the repayment period to 25 years, resulting in lower monthly payments but significantly higher total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans (Income-Based Repayment, Pay As You Earn, Revised Pay As You Earn, Income-Contingent Repayment) tie monthly payments to a borrower's income and family size. Minimum payments are calculated based on a percentage of discretionary income, offering potentially lower monthly payments but potentially extending the repayment period significantly.

3. Private Student Loan Repayment Plans:

Private student loans are offered by banks, credit unions, and other financial institutions. Minimum payments are usually determined by the lender and are often based on a similar calculation as federal loans' standard repayment plan, considering loan amount, interest rate, and repayment term. However, the lack of government oversight means less flexibility and fewer options for borrowers facing financial hardship.

4. Impact on Innovation:

While not directly related to innovation in the traditional sense, understanding minimum repayment impacts financial planning and resource allocation. This understanding frees up resources, encouraging individuals to pursue entrepreneurial ventures and contribute to economic innovation.

5. Challenges and Solutions:

The most significant challenge with minimum payments is that they often only cover the accrued interest, not the principal loan amount. This means borrowers may spend years making payments without significantly reducing their overall debt balance. Strategies to overcome this include:

- Aggressive Repayment: Making payments exceeding the minimum amount to reduce the principal balance faster.

- Refinancing: Consolidating loans with a lower interest rate to reduce the overall cost of borrowing and potentially lower monthly payments.

- Debt Avalanche or Snowball Method: Prioritizing high-interest debt or smaller debts first for faster repayment.

Closing Insights: Summarizing the Core Discussion

Minimum student loan repayment is a fundamental aspect of managing student loan debt. Understanding the factors affecting minimum payments, the different repayment plans available, and the long-term implications is crucial for borrowers to make informed decisions and avoid financial hardship.

Exploring the Connection Between Financial Literacy and Minimum Student Loan Repayment:

Financial literacy plays a crucial role in understanding and managing minimum student loan repayments effectively. A lack of financial knowledge can lead to poor repayment decisions, resulting in delinquency, higher interest costs, and prolonged debt burdens.

Key Factors to Consider:

- Roles and Real-World Examples: Many borrowers fail to understand the long-term implications of only making minimum payments, leading to significant debt accumulation over time. For example, a borrower with a $50,000 loan at 6% interest might take decades to repay under a minimum payment plan, accumulating substantially more in interest than they initially borrowed.

- Risks and Mitigations: The primary risk associated with relying on minimum payments is the accumulation of significant interest, extending the repayment timeline and increasing the overall cost. Mitigation strategies include seeking financial counseling, exploring alternative repayment plans, and actively working towards aggressive repayment.

- Impact and Implications: Poor understanding of minimum payments can negatively affect credit scores, financial stability, and overall well-being. Conversely, informed decision-making can lead to faster debt repayment, improved credit scores, and increased financial security.

Conclusion: Reinforcing the Connection

The link between financial literacy and effective student loan repayment is undeniable. By equipping themselves with the necessary knowledge and understanding of minimum payments, borrowers can navigate their debt more effectively, make informed decisions, and achieve long-term financial success.

Further Analysis: Examining Financial Literacy in Greater Detail:

Financial literacy encompasses various aspects, including budgeting, saving, investing, debt management, and understanding credit scores. For student loan borrowers, a strong grasp of these concepts is paramount in making informed decisions about repayment strategies. Accessing resources such as financial counseling services, educational workshops, and online tools can significantly enhance financial literacy and improve debt management.

FAQ Section: Answering Common Questions About Minimum Student Loan Repayment:

- What is the minimum student loan repayment amount? There's no single answer; it depends on the loan type, amount, interest rate, and chosen repayment plan. Federal loan minimums are outlined on the federal student aid website, while private loan minimums are determined by the lender.

- What happens if I don't make my minimum payment? Delinquency will impact your credit score, and eventually, collection actions may be taken.

- Can I change my repayment plan? You can generally switch federal loan repayment plans, but there may be limitations. Private loan options are limited to what your lender offers.

- What are the benefits of paying more than the minimum? Paying extra reduces your principal balance faster, lowering the total interest paid and shortening the repayment timeline.

Practical Tips: Maximizing the Benefits of Understanding Minimum Student Loan Repayment:

- Understand your loan terms: Obtain a clear understanding of your loan amount, interest rate, and repayment terms for both federal and private loans.

- Explore repayment plan options: Research different federal repayment plans to find the one best suited to your financial situation. Contact your private lender to see their options.

- Budget effectively: Create a budget that includes your minimum student loan payment as a priority expense.

- Consider aggressive repayment: Explore making payments that exceed the minimum to accelerate your debt reduction.

- Seek professional guidance: Consult with a financial advisor or credit counselor if you need help managing your student loan debt.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your minimum student loan repayment is not just about making payments; it’s about gaining control of your financial future. By actively managing your debt, educating yourself on available options, and seeking support when needed, you can effectively navigate the complexities of student loan repayment and achieve long-term financial well-being. Remember, informed action is the key to successfully managing your student loans and building a secure financial future.

Latest Posts

Latest Posts

-

Irs Payment Plan Minimum Payment

Apr 06, 2025

-

What Is The Typical Irs Payment Plan

Apr 06, 2025

-

How Are Irs Payment Plans Calculated

Apr 06, 2025

-

What Is The Minimum Monthly Payment For An Irs Installment Plan

Apr 06, 2025

-

What Is The Minimum Irs Payment Plan

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Student Loan Repayment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.