What Is The Minimum Monthly Payment For An Irs Installment Plan

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Decoding the IRS Installment Agreement: Understanding Minimum Monthly Payments

What are the minimum monthly payment requirements for an IRS installment agreement, and how are they determined?

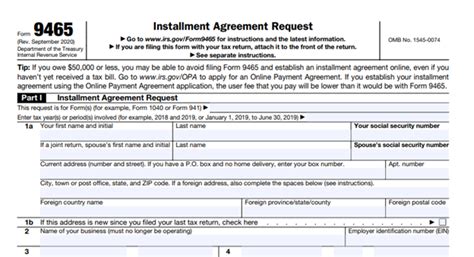

Securing an IRS installment agreement offers a lifeline to taxpayers facing insurmountable tax debt, but understanding the minimum payment stipulations is crucial for successful enrollment.

Editor’s Note: This article on IRS installment agreement minimum monthly payments was published today, providing up-to-date information and insights for taxpayers navigating tax debt. We've consulted official IRS sources and tax professionals to ensure accuracy.

Why Understanding Minimum IRS Installment Agreement Payments Matters

Facing a significant tax debt can be overwhelming. The IRS offers an installment agreement (IA) program to provide taxpayers with a manageable payment plan. However, the minimum monthly payment isn't a fixed amount; it's dynamically calculated based on several factors. Understanding these factors and the calculation process is vital for several reasons:

- Avoiding Default: Failing to meet the minimum payment triggers penalties and could lead to wage garnishment, bank levy, or even asset seizure.

- Budgeting Effectively: Knowing the minimum payment allows for accurate budgeting and financial planning.

- Negotiating a Favorable Plan: Understanding the calculation allows taxpayers to potentially negotiate a more manageable payment schedule.

- Avoiding Unnecessary Fees: Late or missed payments incur additional fees, increasing the overall tax burden.

Overview: What This Article Covers

This comprehensive guide explores the intricacies of IRS installment agreement minimum monthly payments. We'll delve into the factors influencing the calculation, the process of determining the minimum payment, options for modifying payments, and frequently asked questions. Readers will gain a clear understanding of how the minimum payment is determined and strategies for managing their tax debt effectively.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon official IRS publications (Publication 594, The IRS's website), and analysis of relevant tax codes and case studies. The information presented is intended to provide accurate and up-to-date guidance, but it’s not a substitute for professional tax advice. Always consult with a qualified tax professional for personalized guidance.

Key Takeaways:

- Understanding the Factors: Income, total tax liability, and available assets significantly impact the minimum monthly payment.

- Calculation Process: The IRS uses a formula to compute the minimum payment, considering both the total debt and the taxpayer's ability to pay.

- Payment Options: Taxpayers may explore options like partial payments or modifications to their payment plan if needed.

- Consequences of Default: Non-compliance can lead to severe financial repercussions.

Smooth Transition to the Core Discussion:

Now that we understand the importance of understanding the minimum payment calculation, let's dive into the specifics.

Exploring the Key Aspects of IRS Installment Agreement Minimum Payments

1. Factors Influencing the Minimum Payment:

Several key factors determine the minimum monthly payment for an IRS installment agreement. These include:

- Total Tax Liability: This encompasses the total amount owed to the IRS, including principal, penalties, and interest. The larger the debt, the higher the minimum payment.

- Taxpayer's Income: The IRS considers the taxpayer's income to determine their ability to repay the debt. Higher income generally leads to higher minimum payments. This assessment considers adjusted gross income (AGI) from the most recent tax return. Proof of income is required, often in the form of pay stubs, W-2s, or tax returns.

- Available Assets: The IRS assesses the taxpayer's assets (like savings accounts, investments, and other liquid assets) to determine their repayment capacity. Significant assets might result in a higher minimum payment.

- Type of Tax Debt: The type of tax debt (e.g., income tax, payroll tax) doesn't directly influence the minimum payment calculation but impacts the overall eligibility for an IA.

- Payment History: A history of consistent tax payments shows a good payment record and might influence the terms of the agreement (though it doesn't directly influence the minimum payment calculation itself).

2. The Calculation Process:

The IRS doesn't publicly disclose the precise formula used to calculate the minimum monthly payment. However, it generally involves assessing the taxpayer's ability to pay based on income, expenses, and available assets. The IRS aims to create a payment plan that is affordable without causing undue financial hardship.

The calculation process often involves an internal assessment of the taxpayer’s financial situation. This involves submitting detailed financial documentation, including income statements, bank statements, and asset information. The IRS will review this information and determine a minimum monthly payment amount that they deem feasible and sufficient to repay the debt over the agreed-upon timeframe.

The IRS Online Payment Agreement tool provides a preliminary estimate of the monthly payment. This is a helpful starting point, but the final payment may differ after a thorough review of the taxpayer's financial situation.

3. Options for Modifying Payments:

If the initial minimum payment seems unattainable, taxpayers can explore options like:

- Requesting a Lower Payment: Taxpayers can request a modification to their payment plan if circumstances change, such as job loss or unexpected medical expenses. Supporting documentation is essential for justifying the request.

- Partial Payments: While not technically modifying the minimum payment, making partial payments above the minimum demonstrates commitment and can improve the chances of negotiation.

- Short-Term vs. Long-Term Agreements: A shorter repayment period will generally result in higher monthly payments, whereas a longer repayment period (up to 72 months) will have lower payments.

- Offering Collateral: In some circumstances, taxpayers may offer collateral to secure a more favorable payment plan.

4. Consequences of Default:

Failing to meet the minimum monthly payment obligations has severe consequences:

- Penalties and Interest: Additional penalties and interest accrue on the unpaid balance, significantly increasing the total debt.

- Wage Garnishment: The IRS can garnish a portion of the taxpayer's wages directly from their employer.

- Bank Levy: The IRS can levy funds directly from the taxpayer's bank accounts.

- Asset Seizure: In extreme cases, the IRS can seize and sell the taxpayer's assets to satisfy the debt.

- Negative Credit Impact: Defaulting on an IRS payment plan will negatively impact the taxpayer’s credit score.

Exploring the Connection Between Payment History and Installment Agreements

A positive payment history doesn't directly reduce the minimum monthly payment calculation, but it significantly influences the IRS's willingness to grant an installment agreement and the overall terms. A history of consistent tax payments demonstrates responsibility and financial stability. Conversely, a history of non-compliance makes obtaining an installment agreement more challenging and may result in stricter terms.

Key Factors to Consider:

- Roles and Real-World Examples: Taxpayers with consistent payment histories often have easier access to installment agreements with more favorable terms. Those with a history of missed payments face stricter scrutiny and might require a larger down payment or a shorter repayment period.

- Risks and Mitigations: Taxpayers with poor payment histories should be proactive in documenting their improved financial situation and demonstrating their commitment to repayment.

- Impact and Implications: A good payment history can significantly affect the overall cost of tax debt repayment, potentially saving considerable amounts in penalties and interest.

Conclusion: Reinforcing the Connection

The interplay between payment history and installment agreements highlights the importance of consistent tax payments. While payment history doesn't directly alter the minimum monthly payment calculation formula, it significantly impacts the IRS's decision-making process and the overall terms of the installment agreement.

Further Analysis: Examining the Role of Penalties and Interest

Penalties and interest are critical components of the total tax liability, directly influencing the minimum monthly payment calculation. The IRS charges penalties for late payment and interest on unpaid balances. These fees accumulate over time, exacerbating the overall debt. Understanding how these charges affect the minimum payment is crucial for effective debt management.

- Cause-and-Effect Relationships: Late payments trigger penalties, increasing the total tax liability and consequently the minimum monthly payment. The longer the debt remains unpaid, the more interest accrues, further compounding the problem.

- Significance: Penalties and interest can significantly increase the total amount owed, making it challenging to repay the debt.

- Real-World Applications: A taxpayer with a $10,000 tax liability might see their minimum payment increase dramatically due to significant penalty and interest charges incurred from late payments.

FAQ Section: Answering Common Questions About IRS Installment Agreement Minimum Payments

-

Q: What happens if I can't afford the minimum monthly payment?

- A: Contact the IRS immediately to discuss possible modifications to your payment plan. Provide supporting documentation to explain your circumstances.

-

Q: Can I negotiate the minimum monthly payment?

- A: While the IRS uses a formula, you can try to negotiate based on your financial situation. Provide thorough documentation of your income and expenses.

-

Q: What happens if I miss a payment?

- A: The IRS will likely notify you and allow a grace period. However, continued missed payments lead to penalties and potentially default.

-

Q: How long can an installment agreement last?

- A: Installment agreements can typically last up to 72 months, depending on the total amount owed and ability to repay.

-

Q: Is there a setup fee for an installment agreement?

- A: Yes, a setup fee may be required. This amount varies depending on the circumstances and the total debt.

Practical Tips: Maximizing the Benefits of an IRS Installment Agreement

- Understand the Basics: Thoroughly comprehend the terms and conditions of your installment agreement before signing.

- Accurate Financial Reporting: Provide accurate and complete financial information to the IRS.

- Maintain Communication: Keep open communication with the IRS throughout the repayment process.

- Budget Carefully: Create a realistic budget to ensure you can afford the minimum monthly payment.

- Seek Professional Help: Consult with a qualified tax professional for personalized guidance.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding the minimum monthly payment for an IRS installment agreement is paramount for taxpayers facing significant tax debt. While the precise calculation isn't publicly available, this article has provided a comprehensive overview of the factors involved, the potential consequences of non-compliance, and strategies for effective debt management. By being informed and proactive, taxpayers can navigate the IRS installment agreement process successfully and avoid the potentially devastating consequences of default. Remember, seeking professional guidance is always recommended for navigating complex tax situations.

Latest Posts

Latest Posts

-

What Is A 610 Credit Score Considered

Apr 07, 2025

-

Can You Get A Money Order With Credit Card At Walmart

Apr 07, 2025

-

Can I Buy A Money Order With Credit Card At Post Office

Apr 07, 2025

-

Can I Get A Money Order With A Credit Card At Walmart

Apr 07, 2025

-

Where Can I Pay For A Money Order With A Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Monthly Payment For An Irs Installment Plan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.