What Is A 610 Credit Score Considered

adminse

Apr 07, 2025 · 9 min read

Table of Contents

What does a 610 credit score really mean, and what are the implications?

A 610 credit score is a significant challenge, but not an insurmountable one. With strategic planning and consistent effort, improvement is possible.

Editor’s Note: This article on what a 610 credit score signifies was published today, providing readers with up-to-date information on credit scoring and strategies for improvement. Understanding your credit score is crucial for financial health, and this guide offers actionable insights for navigating this important aspect of personal finance.

Why a 610 Credit Score Matters: Relevance, Practical Applications, and Industry Significance

A credit score is a three-digit number that lenders use to assess the risk associated with lending you money. It summarizes your creditworthiness based on your past borrowing and repayment behavior. A 610 credit score falls squarely into the "fair" range, according to most scoring models like FICO and VantageScore. While not disastrous, it significantly limits your financial options and typically comes with higher borrowing costs. This score reflects a history of missed payments, high credit utilization, or a short credit history – all factors that make lenders hesitant to extend credit. Understanding the implications of a 610 score is crucial for making informed financial decisions and improving your future financial prospects. The practical applications of this knowledge are far-reaching, affecting your ability to secure loans, rent an apartment, obtain insurance, and even land certain jobs.

Overview: What This Article Covers

This article will comprehensively examine a 610 credit score. We'll explore its meaning within the broader credit scoring landscape, delve into the factors contributing to such a score, outline the practical implications for obtaining credit and insurance, discuss strategies for improvement, and answer common questions surrounding credit repair. Readers will gain actionable insights to help them navigate their financial situation and improve their credit health.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing on data from reputable credit bureaus like Experian, Equifax, and TransUnion, as well as analysis of industry reports and expert opinions from financial advisors and credit counseling agencies. The information presented is intended to be objective and factual, offering readers a clear understanding of the complexities of credit scoring and its impact on personal finance.

Key Takeaways: Summarize the Most Essential Insights

-

Definition and Core Concepts: A 610 credit score is considered "fair," indicating a moderate risk to lenders. It's significantly below the prime range, resulting in limited access to favorable credit terms.

-

Practical Applications: Obtaining loans (mortgages, auto loans, personal loans) will be challenging, with higher interest rates and potentially stricter requirements. Securing favorable insurance rates will also be difficult.

-

Challenges and Solutions: Addressing the underlying causes of a 610 score, such as late payments and high credit utilization, is crucial for improvement. This requires careful budgeting, debt management, and consistent positive credit behavior.

-

Future Implications: Improving a 610 credit score takes time and effort but will unlock significant financial opportunities. Higher credit scores translate to lower interest rates, better loan terms, and greater financial flexibility.

Smooth Transition to the Core Discussion

With a foundational understanding of what a 610 credit score represents, let’s delve deeper into its intricacies, exploring its causes, consequences, and the pathways to improvement.

Exploring the Key Aspects of a 610 Credit Score

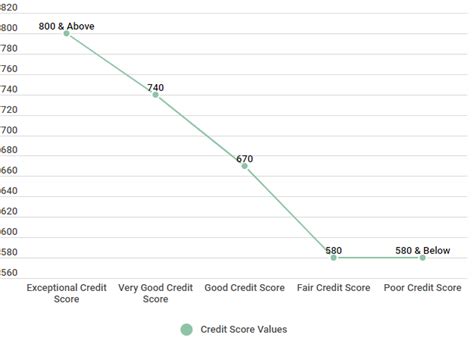

Definition and Core Concepts: Credit scores are calculated using different models, the most prevalent being FICO and VantageScore. While the specific scoring algorithms differ, they all consider similar factors: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). A 610 score typically signifies a history of missed payments, high credit utilization (the percentage of available credit used), or a short credit history. It falls below the generally accepted "good" range (670-739), making it challenging to qualify for the most favorable lending terms.

Applications Across Industries: The impact of a 610 credit score extends beyond loan applications. Landlords often use credit reports to assess tenant reliability, and a low score might result in rejection or the demand for a larger security deposit. Insurance companies also use credit scores (in many jurisdictions) to determine premiums, and a fair score usually translates to higher insurance costs. In some cases, even employers might check credit reports, although this practice is increasingly scrutinized for potential bias.

Challenges and Solutions: The challenges posed by a 610 credit score are significant, but not insurmountable. Addressing the underlying issues is paramount. This usually involves:

-

Paying Bills on Time: This is the single most impactful factor in credit scoring. Establish a system to ensure timely payments, whether through automatic payments or setting reminders.

-

Lowering Credit Utilization: Keep credit card balances below 30% of your available credit limit. Paying down debt is crucial for improving your score.

-

Building a Longer Credit History: The longer your responsible credit history, the better. Avoid opening numerous new accounts in a short period.

-

Maintaining a Healthy Credit Mix: Having a variety of credit accounts (credit cards, installment loans) demonstrates responsible credit management. However, this should not involve opening new accounts simply to diversify.

-

Dispute Errors on Your Credit Report: Carefully review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and dispute any inaccuracies.

Impact on Innovation: The credit scoring industry is constantly evolving, with new models and technologies being developed. The focus is increasingly on incorporating alternative data sources, such as rent and utility payments, to provide a more holistic picture of creditworthiness. This innovation aims to provide fairer assessments for individuals with limited traditional credit histories.

Closing Insights: Summarizing the Core Discussion

A 610 credit score presents challenges, limiting access to favorable credit terms and potentially impacting insurance rates and rental applications. However, it's not a permanent roadblock. By proactively addressing the underlying issues, such as late payments and high credit utilization, and by implementing sound financial habits, improvement is achievable. Consistency and patience are key.

Exploring the Connection Between Debt Management and a 610 Credit Score

The relationship between effective debt management and a 610 credit score is profound. High levels of debt and difficulties managing payments are often the primary contributors to a lower credit score. Understanding this connection is crucial for devising a strategy to improve one's creditworthiness.

Key Factors to Consider:

Roles and Real-World Examples: Someone with a 610 credit score likely has a high debt-to-income ratio, indicating that a large portion of their income is dedicated to debt repayment. This can manifest in numerous ways: multiple outstanding credit card balances, overdue payments on loans, or collection accounts. For example, consistently exceeding credit card limits and making only minimum payments can severely impact a credit score, pushing it down into the fair range.

Risks and Mitigations: The risks associated with a 610 score include higher interest rates on loans, difficulty securing credit, and potentially higher insurance premiums. Mitigation strategies include creating a realistic budget, prioritizing debt repayment (perhaps focusing on high-interest debt first), and exploring debt consolidation options. Seeking professional advice from a credit counselor can also be beneficial.

Impact and Implications: The long-term impact of not addressing debt issues can be substantial. It can hinder major financial goals like buying a home or a car, limit career opportunities (in certain fields), and perpetuate a cycle of debt.

Conclusion: Reinforcing the Connection

The connection between debt management and a 610 credit score is undeniable. By strategically managing debt, prioritizing repayment, and developing responsible spending habits, individuals can significantly improve their credit scores and unlock a wider range of financial opportunities.

Further Analysis: Examining Debt Consolidation in Greater Detail

Debt consolidation involves combining multiple debts into a single loan or payment. This can simplify repayment, potentially lower interest rates, and improve credit scores over time, particularly for those with a 610 score.

The process often involves securing a personal loan or balance transfer credit card with a lower interest rate than the existing debts. Once consolidated, the individual makes a single monthly payment, simplifying their finances and reducing the likelihood of missed payments. However, it's crucial to carefully consider the terms and conditions of any consolidation option to ensure it aligns with financial goals and doesn't create further debt.

FAQ Section: Answering Common Questions About a 610 Credit Score

What is a 610 credit score? A 610 credit score is considered "fair" and indicates a moderate risk to lenders. It suggests a history of some credit challenges, impacting access to favorable loan terms and potentially impacting insurance premiums.

How can I improve my 610 credit score? Focus on paying bills on time, lowering credit utilization, and building a longer credit history. Dispute any errors on your credit reports, and consider professional credit counseling if needed.

What are the consequences of having a 610 credit score? Expect higher interest rates on loans, difficulty securing credit, potentially higher insurance premiums, and challenges with renting or securing certain jobs.

How long does it take to improve a credit score? Improving a credit score takes time and consistent effort. It's a gradual process, and seeing significant improvement might take several months or even years.

Can I get a loan with a 610 credit score? It's possible, but it will likely come with higher interest rates and stricter requirements. Consider securing a secured loan or exploring options with credit unions or smaller lenders.

Practical Tips: Maximizing the Benefits of Credit Score Improvement

-

Monitor your credit reports regularly: Check your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) at least annually to identify and dispute any errors.

-

Create a realistic budget: Track your income and expenses to identify areas where you can cut back and allocate funds towards debt repayment.

-

Prioritize high-interest debts: Focus on paying down debts with the highest interest rates first to save money and improve your credit score more efficiently.

-

Communicate with creditors: If you're facing financial difficulties, contact your creditors to discuss potential payment plans or hardship programs.

-

Seek professional credit counseling: Credit counseling agencies can provide guidance and support in managing debt and improving your creditworthiness.

Final Conclusion: Wrapping Up with Lasting Insights

A 610 credit score presents challenges, but it's not a life sentence. By understanding the factors influencing credit scores, implementing effective debt management strategies, and consistently exhibiting responsible credit behavior, individuals can significantly improve their financial outlook and unlock a broader range of opportunities. Remember that improving credit takes time and perseverance; consistent effort is the key to success.

Latest Posts

Latest Posts

-

Acceptance Testing Definition Types And Examples

Apr 30, 2025

-

Acceptance Of Office By Trustee Definition

Apr 30, 2025

-

Acceptance Market Definition

Apr 30, 2025

-

Acceptable Quality Level Aql Definition And How It Works

Apr 30, 2025

-

Acceleration Principle Definition And How It Works In Economics

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is A 610 Credit Score Considered . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.