What Is A Money Market Account Interest Rate

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Decoding the Money Market Account Interest Rate: A Comprehensive Guide

What if securing a competitive return on your savings hinged on understanding the intricacies of a money market account interest rate? This seemingly simple concept plays a crucial role in your financial well-being, influencing your investment strategy and overall wealth accumulation.

Editor’s Note: This comprehensive guide to money market account interest rates was published today, providing readers with the most up-to-date information and insights to help them make informed financial decisions.

Why Money Market Account Interest Rates Matter:

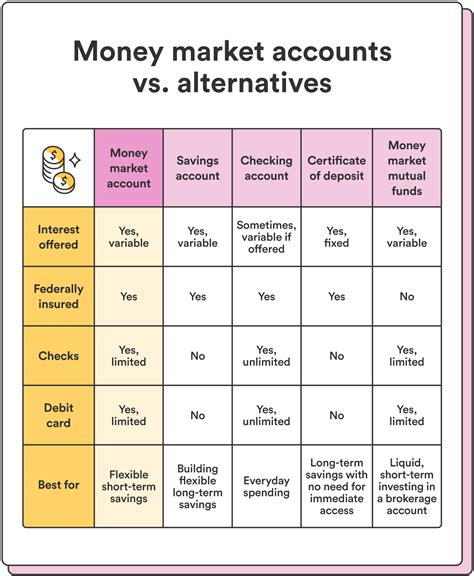

Money market accounts (MMAs) are popular savings vehicles offering a blend of accessibility and interest-earning potential. Understanding the interest rate associated with these accounts is vital because it directly impacts your return on investment. Unlike traditional savings accounts, which often offer minimal interest, MMAs typically provide higher yields, making them attractive options for short-term savings goals, emergency funds, or bridging between investments. The rate influences the growth of your savings, impacting your financial planning and ability to reach future goals. Knowing how these rates are determined and how to find the best options is crucial for maximizing your financial returns. Furthermore, the interest rate serves as a key indicator of the overall economic climate and the general direction of interest rates within the financial markets.

Overview: What This Article Covers:

This article provides a thorough examination of money market account interest rates. We will explore the definition of these rates, the factors influencing their fluctuations, how to compare rates effectively, and strategies for maximizing returns. We will also delve into the differences between MMAs and other savings accounts, examine the implications of interest rate risk, and address frequently asked questions.

The Research and Effort Behind the Insights:

This article is based on extensive research, drawing upon reputable financial sources, industry reports, and analyses of current market trends. Information provided is intended to be factual and reliable, assisting readers in navigating the complexities of MMA interest rates and making informed financial choices. Data and examples used are illustrative and may not represent specific institutions or current market conditions without qualification.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of money market account interest rates and their relationship to other financial instruments.

- Factors Influencing Rates: An in-depth analysis of the economic and market conditions affecting MMA interest rates.

- Comparing Rates Effectively: Practical strategies for comparing rates across different financial institutions.

- Maximizing Returns: Methods to optimize returns from money market accounts.

- Risk Management: Understanding and mitigating the risk associated with fluctuating interest rates.

Smooth Transition to the Core Discussion:

Now that we understand the importance of understanding money market account interest rates, let’s delve into the specifics. We'll begin by defining these rates and exploring the factors that shape them.

Exploring the Key Aspects of Money Market Account Interest Rates:

1. Definition and Core Concepts:

A money market account interest rate is the annual percentage yield (APY) or annual percentage rate (APR) a financial institution pays on the balance in a money market account. The APY takes into account the effect of compounding interest, providing a more accurate representation of the total return over a year. The APR simply reflects the nominal interest rate without compounding. MMAs typically offer variable interest rates, meaning they fluctuate based on various market factors, unlike certificates of deposit (CDs) which usually offer a fixed rate for a specific period. The interest earned is generally paid out monthly or quarterly.

2. Factors Influencing Money Market Account Interest Rates:

Several interconnected factors influence the interest rates offered on money market accounts. These include:

- Federal Funds Rate: The Federal Reserve's target rate for overnight lending between banks is a significant driver. Increases in the federal funds rate often lead to increases in MMA interest rates, as banks adjust their lending and deposit rates accordingly.

- Inflation: High inflation typically leads to higher interest rates as lenders try to maintain the real value of their investments. Central banks often raise interest rates to combat inflation.

- Economic Growth: Strong economic growth can lead to higher interest rates as increased demand for loans drives up borrowing costs.

- Market Demand: The level of demand for money market accounts influences rates. If demand is high, institutions might offer slightly lower rates to attract customers. Conversely, low demand might lead to slightly higher rates to encourage deposits.

- Competition: Competition among financial institutions is a key factor. Institutions often adjust their rates to remain competitive and attract customers.

- Credit Risk: The perceived risk of lending money influences interest rates. During periods of economic uncertainty, banks might be more cautious, resulting in higher rates for borrowers and possibly lower rates for savers.

3. Comparing Rates Effectively:

Comparing money market account interest rates requires careful attention to detail. Here’s how to approach the comparison process effectively:

- Focus on APY: Always compare based on the annual percentage yield (APY), not just the nominal rate. The APY provides a more accurate reflection of the return over a year.

- Consider Fees: Pay close attention to any fees associated with the account, such as maintenance fees, minimum balance fees, or transaction fees. These fees can significantly reduce your overall returns.

- Check for Minimum Balance Requirements: Some MMAs have minimum balance requirements to qualify for the advertised interest rate. If you cannot maintain the minimum balance, a lower rate may apply, potentially negating the higher advertised rate’s advantage.

- Compare Across Institutions: Research and compare rates across multiple banks, credit unions, and brokerage firms. Different institutions often offer varying rates.

- Look Beyond the Rate: While the interest rate is critical, consider other factors such as the convenience of access, online banking features, customer service, and the institution's financial stability.

4. Maximizing Returns from Money Market Accounts:

While MMA interest rates are variable, you can take steps to maximize your returns:

- Maintain High Balances: Some institutions offer tiered interest rates, with higher rates for larger balances.

- Shop Around Regularly: Rates fluctuate. Periodically check for better rates offered by other institutions. Consider switching if you find a more favorable option.

- Use Online Banks: Online banks often offer higher rates than traditional brick-and-mortar banks due to lower operating costs.

- Negotiate Rates: While uncommon, some institutions might be willing to negotiate higher rates for larger deposits.

5. Impact on Innovation:

The competitive landscape of MMAs constantly drives innovation. Financial institutions are constantly seeking ways to enhance their offerings, including introducing features like higher yields, increased transaction limits, and improved online banking platforms. Technological advancements have also enhanced the accessibility and management of these accounts, adding to their overall appeal.

Exploring the Connection Between Interest Rate Risk and Money Market Accounts:

Interest rate risk is an inherent aspect of money market accounts due to the variable nature of their interest rates. When interest rates rise, the value of the account's yield increases, benefiting the account holder. However, when interest rates fall, the account's yield decreases, potentially affecting the overall return.

Key Factors to Consider:

- Roles and Real-World Examples: A period of rising interest rates, for instance, can lead to increased earnings on MMAs, allowing for faster growth of savings. Conversely, during a period of declining rates, the earnings would decrease, potentially impacting savings growth plans. This underscores the dynamic nature of MMA returns.

- Risks and Mitigations: The primary risk associated with MMAs is the potential for lower returns due to declining interest rates. Mitigation strategies include diversifying investments, regularly monitoring rates, and considering alternatives such as CDs during periods of anticipated low rates.

- Impact and Implications: Fluctuations in MMA interest rates directly impact the attractiveness of MMAs as a savings vehicle. Understanding these implications allows for informed decisions regarding savings and investment strategies, enabling better financial planning.

Conclusion: Reinforcing the Connection:

The relationship between interest rate risk and money market accounts highlights the importance of understanding the market dynamics affecting interest rates. By acknowledging the fluctuating nature of returns and employing appropriate strategies, individuals can effectively manage risks and maximize the benefits of utilizing MMAs as part of a diversified investment plan.

Further Analysis: Examining the Federal Funds Rate in Greater Detail:

The Federal Funds Rate, set by the Federal Open Market Committee (FOMC), profoundly influences money market account interest rates. The FOMC's decisions are based on a comprehensive assessment of economic indicators, including inflation, unemployment, and economic growth. An increase in the Federal Funds Rate generally leads to higher borrowing costs across the economy, impacting the rates offered on various financial products, including MMAs.

FAQ Section: Answering Common Questions About Money Market Account Interest Rates:

-

What is a money market account interest rate? It's the annual percentage yield (APY) or annual percentage rate (APR) paid on the balance in a money market account.

-

How often are money market account interest rates adjusted? Interest rates on MMAs are typically variable and adjusted periodically, usually reflecting changes in the broader economic landscape and monetary policy.

-

Are money market accounts FDIC insured? Yes, MMAs offered by banks are typically insured by the FDIC (Federal Deposit Insurance Corporation) up to a specified limit, protecting depositors against potential losses.

-

How do I compare money market account interest rates? Always focus on the APY, compare rates across various institutions, consider associated fees, and evaluate minimum balance requirements before making a decision.

-

Can I withdraw money from a money market account easily? Generally, yes. MMAs typically offer easy access to funds, though there might be limits on the number of withdrawals allowed in a given period.

Practical Tips: Maximizing the Benefits of Money Market Accounts:

- Regularly monitor interest rates: Stay informed about market trends and changes in interest rates to make informed decisions.

- Consider laddering CDs: Combine MMAs with CDs of varying maturities to manage interest rate risk and potentially optimize returns.

- Diversify your savings: Don't put all your savings into a single MMA. Diversify across different accounts and investment vehicles to minimize risk.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding money market account interest rates is crucial for optimizing your savings strategy and achieving your financial goals. By understanding the influencing factors, comparing rates effectively, and implementing appropriate risk management techniques, individuals can harness the potential of MMAs while minimizing exposure to interest rate fluctuations. Remember, continuous monitoring and informed decisions are essential for maximizing returns and making the most of your savings.

Latest Posts

Latest Posts

-

What Is The Highest Credit Limit You Can Get On A Credit Card

Apr 06, 2025

-

Cara Mengatur Money Management

Apr 06, 2025

-

Cara Kerja Fund Manager

Apr 06, 2025

-

Cara Money Management

Apr 06, 2025

-

Money Management Group Activities

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about What Is A Money Market Account Interest Rate . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.