What Is The Highest Credit Limit You Can Get On A Credit Card

adminse

Apr 06, 2025 · 7 min read

Table of Contents

What's the Highest Credit Limit You Can Get on a Credit Card? Unlocking the Secrets to Maximum Approval

What if your access to credit could significantly impact your financial goals, from large purchases to emergency funds? Obtaining a high credit limit on a credit card is more attainable than many believe, requiring a strategic approach and a deep understanding of credit scoring and lender policies.

Editor’s Note: This article on maximizing credit card limits was published today, offering readers up-to-date information and strategies for improving their creditworthiness and securing higher credit lines.

Why a High Credit Limit Matters: Relevance, Practical Applications, and Financial Significance

A high credit limit offers several key advantages. It can provide a crucial financial safety net for unexpected expenses, improve your credit utilization ratio (a key factor in credit scoring), and potentially offer better interest rates and rewards. Businesses benefit as well, using high-limit cards for business expenses and managing cash flow efficiently. The ability to access a substantial line of credit can influence purchasing power, allowing for larger investments or the ability to negotiate better terms with vendors. Furthermore, having a high credit limit can enhance your overall financial profile, potentially influencing decisions from loan approvals to rental applications.

Overview: What This Article Covers

This article explores the factors influencing credit card limit approvals, including credit scores, income, debt-to-income ratio, credit history length, and credit utilization. It dives into strategies to increase your credit limit, examines the potential risks associated with high-limit cards, and addresses frequently asked questions. Readers will gain actionable insights and a clear understanding of how to responsibly pursue a higher credit limit.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing on data from reputable financial institutions, credit reporting agencies, and expert opinions from financial advisors and credit specialists. Information on credit scoring models, credit utilization best practices, and strategies for increasing credit limits is supported by credible sources, ensuring accuracy and trustworthiness.

Key Takeaways:

- Understanding Credit Scores: A deep dive into FICO and VantageScore, highlighting their impact on credit limit approvals.

- Income and Debt-to-Income Ratio: How income verification and responsible debt management influence eligibility for higher credit limits.

- Credit History and Length: The importance of a long and positive credit history in securing higher credit lines.

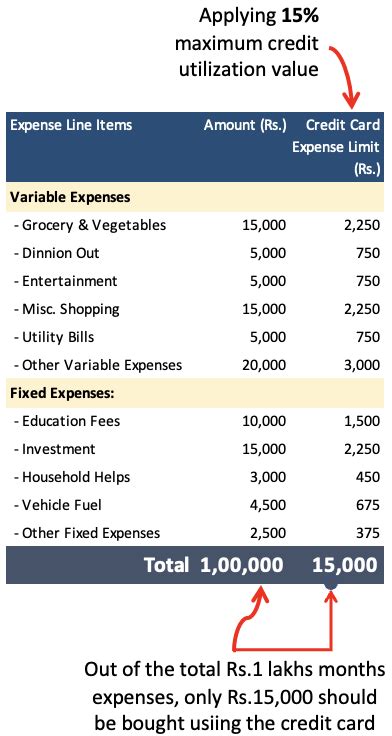

- Credit Utilization: Optimizing credit utilization to positively impact credit scores and increase approval chances.

- Strategies for Increasing Credit Limits: Actionable steps, including credit limit increases requests and responsible card usage.

- Risks and Mitigation: Navigating the potential dangers of high credit limits and implementing responsible spending habits.

Smooth Transition to the Core Discussion

Having established the importance of understanding credit card limits, let's delve into the specific factors influencing their approval and strategies for maximizing your credit potential.

Exploring the Key Aspects of Credit Card Limits

1. Definition and Core Concepts: A credit limit is the maximum amount of credit a lender extends to a cardholder. It's a pre-approved amount that can be borrowed, but exceeding this limit results in penalties and negative impacts on credit scores.

2. Applications Across Industries: Credit cards with high limits cater to various needs, from personal expenses and large purchases to business operations and travel. Businesses often require higher limits to manage inventory, payroll, and other operational expenses. High-net-worth individuals may also seek higher limits to manage larger spending habits.

3. Challenges and Solutions: Securing a high credit limit presents challenges, including stringent credit requirements and the need for a strong financial history. Addressing these challenges requires proactive credit management, including responsible spending, timely payments, and maintaining a low credit utilization ratio.

4. Impact on Innovation: The evolution of credit card technology and financial products reflects the growing demand for higher credit lines. Financial institutions continually refine their risk assessment models to balance the need for lending with responsible credit practices.

Closing Insights: Summarizing the Core Discussion

The pursuit of a higher credit limit requires a comprehensive understanding of credit scoring, financial responsibility, and strategic planning. By consistently managing credit responsibly, individuals can significantly improve their chances of obtaining a higher credit line. However, responsible usage remains paramount; a high credit limit should be viewed as a tool for financial management, not an invitation for overspending.

Exploring the Connection Between Credit Score and Credit Limit

The relationship between your credit score and the credit limit you can obtain is undeniably crucial. A higher credit score significantly increases your chances of approval for a high credit limit. Lenders use credit scores as a primary indicator of your creditworthiness, assessing your risk of defaulting on payments. A FICO score above 750, generally considered excellent, usually leads to higher credit limit approvals. VantageScore uses a similar scoring system.

Key Factors to Consider:

-

Roles and Real-World Examples: A high credit score showcases responsible credit management, influencing lenders’ confidence in approving higher credit limits. Individuals with consistently high scores often receive pre-approved offers for cards with higher limits.

-

Risks and Mitigations: While a high credit score is beneficial, it's not a guarantee of receiving the highest possible limit. Other factors such as income, debt-to-income ratio, and credit history length play significant roles. Mitigation strategies involve improving other aspects of your credit profile.

-

Impact and Implications: The impact of a high credit score extends beyond credit limits. It influences interest rates, loan approvals, and even rental applications. A strong credit score represents financial stability and responsible borrowing habits.

Conclusion: Reinforcing the Connection

The connection between credit score and credit limit is undeniably strong. A higher credit score significantly improves the probability of obtaining a higher credit limit. However, other financial factors must be considered. A holistic approach to credit management is crucial, focusing not just on the score but also on overall financial responsibility.

Further Analysis: Examining Income and Debt-to-Income Ratio in Greater Detail

Income verification is a cornerstone of credit limit approvals. Lenders assess your income to determine your repayment capacity. A higher income demonstrates a greater ability to manage debt, increasing the likelihood of approval for a higher credit limit. The debt-to-income (DTI) ratio, which represents the percentage of your monthly income dedicated to debt repayment, is another critical factor. A lower DTI ratio signifies responsible debt management and makes you a less risky borrower, improving your chances of securing a higher credit limit.

FAQ Section: Answering Common Questions About Credit Card Limits

Q: What is the highest credit limit I can realistically expect?

A: There's no single answer; it depends on several factors, including your credit score, income, debt-to-income ratio, and credit history. While some cards offer limits exceeding $50,000 or even $100,000 for high-net-worth individuals, most people will see limits in the thousands.

Q: How can I increase my existing credit limit?

A: You can usually request a credit limit increase directly from your credit card issuer. This request is often reviewed based on your recent credit history and financial standing.

Q: What happens if I exceed my credit limit?

A: Exceeding your credit limit typically results in over-limit fees and potentially negative impacts on your credit score. It signals to lenders that you may be struggling to manage your debt.

Q: Is a high credit limit always better?

A: Not necessarily. A high credit limit offers benefits, but it also increases the risk of overspending and accumulating debt. Responsible credit management is crucial, regardless of your credit limit.

Practical Tips: Maximizing the Benefits of a High Credit Limit

- Build a Strong Credit History: Consistently make on-time payments and maintain a low credit utilization ratio.

- Increase Income: Demonstrate a stable and higher income to lenders to show your capacity for repayment.

- Lower Your Debt-to-Income Ratio: Reduce your outstanding debts to improve your financial standing.

- Monitor Your Credit Report: Regularly check your credit report for any errors or inaccuracies.

- Request Credit Limit Increases: Periodically request increases from your credit card issuer as your financial situation improves.

- Use Credit Cards Responsibly: Avoid overspending and always pay your balances in full or on time.

Final Conclusion: Wrapping Up with Lasting Insights

Securing a high credit limit requires a strategic and responsible approach. Understanding your credit score, income, and debt-to-income ratio is crucial. While a high credit limit offers financial flexibility, responsible usage is paramount to avoiding debt and maximizing the positive impacts on your credit profile. By focusing on building a strong financial foundation and managing credit responsibly, you can significantly improve your chances of accessing a higher credit limit.

Latest Posts

Latest Posts

-

Trw Credit Meaning

Apr 08, 2025

-

What Is A Trw

Apr 08, 2025

-

What Is A Trw Report

Apr 08, 2025

-

Which Credit Score Do You Go By Transunion Or Equifax

Apr 08, 2025

-

What Happened To Trw Credit Reporting

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Is The Highest Credit Limit You Can Get On A Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.