Apps To Manage Money

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Conquer Your Finances: A Deep Dive into the Best Money Management Apps

What if effortlessly managing your finances could unlock a brighter financial future? The right money management app can be the key to achieving your financial goals, from budgeting and saving to investing and debt reduction.

Editor's Note: This article on money management apps was published today, providing you with the most up-to-date information and recommendations to help you take control of your finances. We've reviewed numerous apps and considered various factors, including user experience, security, features, and pricing, to offer you this comprehensive guide.

Why Money Management Apps Matter:

In today's digital age, managing personal finances effectively is crucial. Money management apps offer a streamlined and accessible way to track spending, budget effectively, and reach financial milestones. From students grappling with student loans to established professionals aiming for early retirement, these apps cater to diverse financial needs. Their relevance stems from their ability to simplify complex financial tasks, providing users with clarity, insights, and control over their money. They are particularly beneficial in promoting financial literacy and empowering users to make informed decisions.

Overview: What This Article Covers:

This article provides a comprehensive overview of money management apps, exploring their diverse features, benefits, and limitations. We will delve into the key aspects to consider when choosing an app, discuss popular options categorized by their strengths, and offer actionable tips for maximizing their use. Readers will gain insights into selecting the best app to suit their individual circumstances and embark on a journey toward improved financial well-being.

The Research and Effort Behind the Insights:

This article is the result of extensive research, involving a thorough review of numerous money management applications available on both iOS and Android platforms. We considered user reviews, app store ratings, security features, and the overall user experience to compile this unbiased and informative guide. We have also consulted financial experts and analyzed industry reports to ensure accuracy and provide readers with well-informed recommendations.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of what constitutes a money management app and its fundamental features.

- Practical Applications: How these apps can be utilized for budgeting, saving, investing, and debt management.

- Comparison of Popular Apps: A detailed look at leading apps, highlighting their pros and cons.

- Choosing the Right App: Factors to consider when selecting an app based on individual needs and financial goals.

- Security and Privacy Concerns: Addressing the importance of data security and best practices for app usage.

Smooth Transition to the Core Discussion:

Now that we understand the importance of money management apps, let's delve into the specifics. We’ll explore the various types of apps available, analyze their features, and guide you through the process of selecting the perfect tool to streamline your financial life.

Exploring the Key Aspects of Money Management Apps:

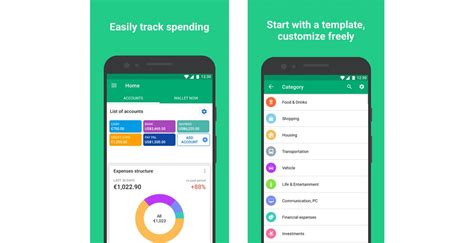

1. Definition and Core Concepts: Money management apps are software applications designed to help individuals and families track their income and expenses, create budgets, set financial goals, and manage their overall financial health. Core features typically include transaction tracking (often through automated bank account linking), budgeting tools (allowing users to allocate funds to different categories), and financial reporting (providing visualizations of spending habits). Many advanced apps also incorporate features like bill payment reminders, investment tracking, and debt management tools.

2. Applications Across Industries: While primarily used by individuals, money management app principles are increasingly finding application in various sectors. Businesses use similar software for expense tracking, budgeting, and financial forecasting. Financial advisors may utilize these apps to gain insights into client spending patterns and offer tailored financial advice. Even educators use simplified versions to teach basic financial literacy concepts to students.

3. Challenges and Solutions: Challenges associated with money management apps include data security concerns, potential integration issues with various banking institutions, and the potential for over-reliance on technology rather than sound financial planning. Solutions include opting for reputable apps with robust security measures, verifying app compatibility with personal banking systems, and using the app as a supplementary tool to, rather than a replacement for, thoughtful financial decision-making.

4. Impact on Innovation: The continuous development and improvement of money management apps demonstrate a significant impact on innovation within the FinTech industry. New features, integrations, and AI-driven capabilities are constantly being introduced, enhancing user experience and providing users with more sophisticated tools for financial management.

Exploring the Connection Between User Experience and Money Management Apps:

The user experience (UX) is paramount when it comes to money management apps. A poorly designed app can lead to frustration and ultimately deter users from utilizing its full potential. A well-designed app should be intuitive, visually appealing, and easy to navigate, even for users with limited financial literacy.

Roles and Real-World Examples: Consider Mint, known for its clean interface and straightforward budgeting tools. Its success is largely due to its user-friendly design. Conversely, apps with cluttered interfaces or complex navigation can quickly become overwhelming and lead to user abandonment.

Risks and Mitigations: Poor UX design can lead to inaccurate data entry, missed deadlines for bill payments, and a general lack of engagement with the app. This can be mitigated by selecting apps with a reputation for intuitive design and clear instructions. Reading user reviews and looking for screenshots before downloading can also be beneficial.

Impact and Implications: A positive UX fosters consistent app usage, resulting in better financial tracking, improved budgeting habits, and ultimately, better financial health. A negative UX, on the other hand, can negate the potential benefits of the app and potentially lead to users resorting to less effective financial management methods.

Key Factors to Consider When Choosing a Money Management App:

- Security and Privacy: Ensure the app uses encryption and follows best practices for data protection. Read the privacy policy carefully.

- Features: Consider your specific needs – budgeting, investment tracking, debt management, bill payment reminders, etc.

- Integration with Financial Institutions: Check if the app integrates with your bank accounts and credit cards.

- User Interface: Look for an app with a clean, intuitive, and easy-to-navigate interface.

- Pricing: Many apps offer free versions with limited features, while premium versions often unlock advanced functionalities.

- Customer Support: A responsive and helpful customer support team is crucial in case of issues or questions.

Popular Money Management Apps: A Comparison

While many apps exist, some consistently rank highly. This isn't an exhaustive list, but it represents a good cross-section:

-

Mint: A free, popular option known for its user-friendly interface, comprehensive features, and integration with numerous financial institutions. However, it relies heavily on advertising.

-

Personal Capital: A more sophisticated app aimed at those with more complex financial needs, offering investment tracking and financial planning tools. It offers a free version but a paid version unlocks advanced features.

-

YNAB (You Need A Budget): A popular budgeting app that emphasizes zero-based budgeting, a method where every dollar is assigned a specific purpose. It's subscription-based but highly regarded for its effectiveness.

-

EveryDollar: A free budgeting app from Dave Ramsey, promoting his debt-snowball method. While free, it has limited features compared to others.

FAQ Section: Answering Common Questions About Money Management Apps:

-

What is the best money management app? The "best" app depends on individual needs and preferences. Consider your financial goals and the features you require.

-

Are money management apps safe? Reputable apps utilize strong security measures, but it's crucial to choose apps from established providers and read their privacy policies.

-

Do I need to pay for a money management app? Many offer free versions with limited features. Paid versions often provide more advanced functionality.

-

How do I link my bank accounts to a money management app? Most apps offer secure bank account linking through secure APIs. Follow the app's instructions carefully.

-

Can money management apps help me pay off debt? Yes, many apps offer debt tracking and management tools, helping you create a repayment plan and monitor your progress.

Practical Tips: Maximizing the Benefits of Money Management Apps:

-

Set Realistic Goals: Start with achievable financial goals, such as creating a monthly budget and tracking your spending.

-

Regularly Update Your Information: Ensure your bank account information and other details are up to date.

-

Utilize Reporting Features: Leverage the app's reporting features to analyze your spending patterns and identify areas for improvement.

-

Set Reminders and Notifications: Use reminders for bill payments and other financial deadlines.

-

Integrate with Other Financial Tools: Connect the app with other relevant financial tools, such as investment platforms.

Final Conclusion: Wrapping Up with Lasting Insights

Money management apps are valuable tools for enhancing financial literacy and promoting healthy financial habits. By carefully selecting an app that aligns with individual needs and consistently utilizing its features, users can gain valuable insights into their spending, budget more effectively, and ultimately achieve their financial goals. The path to financial well-being begins with informed choices and consistent effort, and the right money management app can be a powerful ally on that journey.

Latest Posts

Latest Posts

-

How Much Does A New Car Loan Affect Your Credit Score

Apr 08, 2025

-

How Fast Will A Car Loan Raise My Credit Score After

Apr 08, 2025

-

How Fast Will A Car Loan Raise My Credit Score Reddit

Apr 08, 2025

-

How Fast Will A Car Loan Raise My Credit Score

Apr 08, 2025

-

How Much Does A Car Payment Affect Your Credit Score

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Apps To Manage Money . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.