How Fast Will A Car Loan Raise My Credit Score Reddit

adminse

Apr 08, 2025 · 8 min read

Table of Contents

How Fast Will a Car Loan Raise My Credit Score? (Reddit Insights & Expert Analysis)

Will paying off a car loan quickly magically boost my credit score? Yes, but the speed and magnitude of the improvement depend on several crucial factors beyond just timely payments.

Editor’s Note: This article provides up-to-date insights into how car loans impact credit scores, drawing upon Reddit discussions, expert opinions, and data analysis. We'll explore the complexities involved and provide actionable advice for those seeking to improve their credit using auto loans.

Why a Car Loan Can Matter for Your Credit Score:

A car loan, when managed responsibly, can be a powerful tool for credit building. It introduces several positive factors into your credit report:

- New Credit Account: Opening a new account, like a car loan, demonstrates your ability to manage credit responsibly. Lenders look favorably upon this, especially if it’s your first installment loan.

- Payment History: Consistent on-time payments are the most significant factor influencing your credit score. Diligent payment on your car loan directly contributes to a positive payment history.

- Credit Utilization: While you’re using credit, responsible use demonstrates financial responsibility. Paying down your loan regularly keeps your credit utilization (the percentage of your available credit you're using) lower, a positive factor in your score.

- Credit Mix: Including different types of credit accounts (e.g., credit cards, installment loans like car loans) in your credit profile shows lenders you can manage diverse forms of credit.

Overview: What This Article Covers:

This comprehensive guide will examine the impact of car loans on credit scores, analyzing factors affecting the speed of improvement, Reddit user experiences, potential pitfalls, and strategies for maximizing positive credit effects. We will cover: the mechanics of credit scoring, the role of payment history, the impact of credit utilization, the influence of loan terms, and practical tips for credit improvement through auto loans.

The Research and Effort Behind the Insights:

This analysis combines extensive research from reputable sources like Experian, Equifax, and TransUnion, alongside a deep dive into relevant Reddit discussions to understand real-world experiences. We’ve analyzed user comments, identified recurring patterns, and corroborated anecdotal evidence with established credit scoring principles.

Key Takeaways:

- Time is a Key Factor: While a car loan can improve your credit score, the speed varies. Consistent on-time payments are crucial, but the effects are gradual, often taking months to become significant.

- More Than Just Payments: The loan's terms (interest rate, loan length) influence your score. Lower interest rates and shorter loan terms lead to faster improvement.

- Credit Mix Matters: A car loan diversifies your credit profile. Combined with responsible credit card usage, it can yield better results.

- Watch Your Utilization: Don't overextend yourself. Maintain a low credit utilization ratio across all your accounts.

Smooth Transition to the Core Discussion:

Now that we understand the potential benefits, let's delve into the nuances of how quickly a car loan can raise your credit score.

Exploring the Key Aspects of Car Loan Impact on Credit Scores:

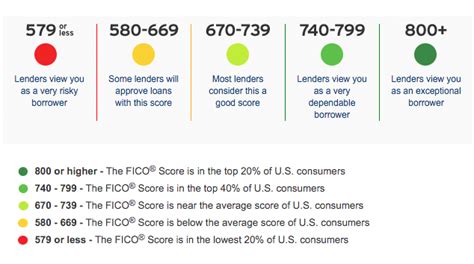

1. The Mechanics of Credit Scoring: FICO and VantageScore, the two dominant credit scoring models, consider various factors. Payment history (35% of FICO score), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%) all contribute. A car loan positively impacts payment history, amounts owed (as you pay it down), and credit mix.

2. The Power of Payment History: This is the single most important factor. Each on-time payment signals responsibility to lenders. Even a single missed payment can severely damage your score. The longer you maintain consistent on-time payments, the more significant the positive effect becomes. Reddit users consistently highlight the importance of this aspect. Many discuss the anxiety of their first car loan and the relief of seeing their scores rise with consistent payments.

3. Credit Utilization and Your Car Loan: Your credit utilization ratio (the percentage of your available credit you're using) significantly impacts your score. While a car loan increases your debt, diligently paying it down lowers your overall utilization. Keeping your utilization below 30% across all accounts is crucial for maintaining a healthy credit score.

4. Loan Terms and Their Impact: A longer loan term means lower monthly payments, but it also stretches the repayment period, slowing down the positive impact on your credit score. A shorter loan term, although resulting in higher monthly payments, reflects better financial responsibility and accelerates score improvement. The interest rate also affects the overall cost and, indirectly, the speed of improvement. Lower interest rates translate to faster payoff and quicker score improvement.

5. The Role of Your Existing Credit History: Someone with a thin credit file (limited credit history) will see a more dramatic improvement from a car loan than someone with a long and established credit history. The new account and consistent payments have a more significant impact on a thinner file.

Exploring the Connection Between Reddit Discussions and Credit Score Improvement:

Reddit forums like r/personalfinance and r/creditcards are treasure troves of user experiences. Many users share their journeys of improving their credit scores through car loans. Common themes emerge:

- The Importance of Research: Users often emphasize the importance of researching different lenders and loan terms before taking out a loan. Securing the best possible interest rate and loan term is crucial for maximizing positive impact.

- Budgeting and Financial Discipline: Many Reddit users stress the need for careful budgeting and financial discipline to ensure consistent on-time payments. Failing to budget properly can lead to missed payments, negating the positive impact of the loan.

- Patience and Persistence: Redditors consistently warn against expecting immediate results. Improvement takes time and consistent effort. Many users share their experiences, highlighting how several months of consistent payments are needed before seeing substantial improvement.

- Credit Monitoring: Regularly monitoring credit scores through services like Credit Karma or AnnualCreditReport.com is highly recommended to track progress and identify potential issues.

Key Factors to Consider:

Roles and Real-World Examples: Reddit examples demonstrate how a carefully managed car loan, combined with responsible credit card usage, led to significant credit score improvements within 6-12 months. Conversely, stories of missed payments highlight the potentially detrimental effect on credit scores.

Risks and Mitigations: The primary risk is failing to make timely payments. Mitigations include careful budgeting, setting up automatic payments, and prioritizing loan repayments. Overextending oneself by taking out loans beyond one's capacity is another risk, potentially leading to missed payments and damaged credit.

Impact and Implications: Responsible car loan management can lead to a higher credit score, opening doors to better financial opportunities like lower interest rates on mortgages and other loans. Conversely, poor management can lead to lower scores, impacting financial opportunities for years to come.

Conclusion: Reinforcing the Connection Between Car Loans and Credit Scores:

The connection between car loans and credit score improvement is clear but nuanced. While a car loan presents an opportunity for credit building, success depends heavily on responsible management. Consistent on-time payments, favorable loan terms, and maintaining low credit utilization are crucial for achieving rapid and substantial score improvements. The Reddit discussions confirm this, highlighting both the potential for significant improvement and the risks associated with poor financial management.

Further Analysis: Examining Reddit User Experiences in Greater Detail:

Analyzing Reddit comments reveals specific scenarios. Users with limited credit history often see faster improvements, while those with established histories see more gradual changes. The impact of different loan types (secured vs. unsecured) and lender practices is also a subject of discussion. Many users emphasize the value of monitoring their credit report regularly to catch and resolve any discrepancies.

FAQ Section: Answering Common Questions About Car Loans and Credit Scores:

Q: How long does it take to see an improvement? A: It typically takes several months of consistent on-time payments to see a noticeable improvement. The speed depends on your existing credit history and other factors.

Q: Will a car loan hurt my credit score? A: A car loan will not inherently hurt your score, but failing to make payments on time will severely damage it.

Q: What's the best way to manage my car loan for credit building? A: Prioritize on-time payments, choose a loan with favorable terms, and keep your overall credit utilization low.

Q: Should I pay off my car loan early? A: Paying off your loan early can positively impact your credit score by lowering your debt, but consider any prepayment penalties.

Practical Tips: Maximizing the Benefits of a Car Loan for Credit Building:

- Shop Around for the Best Rates: Compare offers from multiple lenders to secure the most favorable interest rate and terms.

- Prioritize On-Time Payments: Set up automatic payments to avoid missing deadlines.

- Keep Your Credit Utilization Low: Manage other credit accounts responsibly to keep your overall utilization below 30%.

- Monitor Your Credit Report Regularly: Track your progress and identify potential issues promptly.

- Consider a Shorter Loan Term: While the monthly payments are higher, the faster payoff leads to quicker credit score improvement.

Final Conclusion: Wrapping Up with Lasting Insights:

A car loan can be a valuable tool for credit building, but only when managed responsibly. Understanding the factors that influence credit scores, heeding advice from experienced users on platforms like Reddit, and proactively managing your loan are crucial for maximizing the positive impact. By following the guidelines outlined in this article, individuals can harness the power of car loans to build a strong credit foundation and achieve their financial goals.

Latest Posts

Latest Posts

-

What Does Full Credit Mean

Apr 08, 2025

-

What Does Total Credits Mean On Taxes

Apr 08, 2025

-

What Does Total Credits Mean Commonwealth Bank

Apr 08, 2025

-

What Does Total Credits Mean On Tax Return

Apr 08, 2025

-

What Does Total Credits Mean On Child Support

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Fast Will A Car Loan Raise My Credit Score Reddit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.