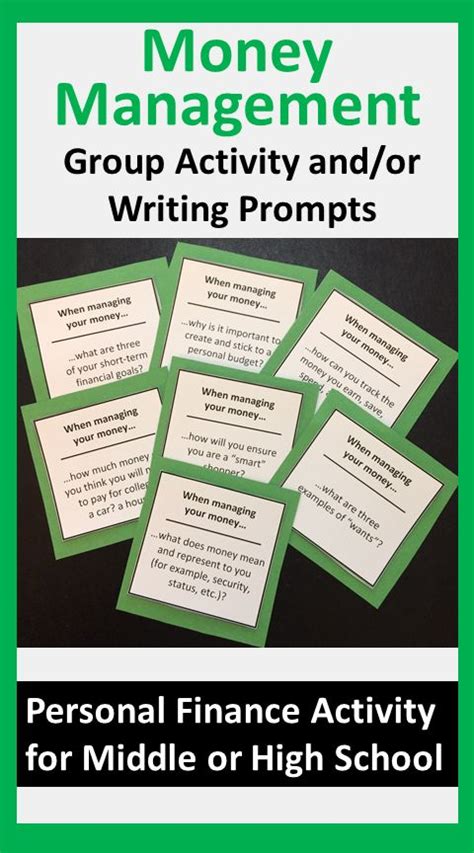

Money Management Group Activities

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Unlocking Financial Literacy: Engaging Money Management Group Activities

What if the key to widespread financial wellness lies in collaborative learning and engaging activities? Effective money management isn't just about individual discipline; it thrives in supportive communities that foster shared understanding and practical application.

Editor’s Note: This article on money management group activities was published today, offering readers up-to-date insights and practical strategies for improving their financial literacy through collaborative learning experiences.

Why Money Management Group Activities Matter

Financial illiteracy is a pervasive issue, impacting individuals across various demographics and socioeconomic backgrounds. The lack of understanding about budgeting, saving, investing, and debt management contributes significantly to financial stress, hindering personal growth and economic stability. Money management group activities offer a powerful solution by transforming the learning process from a solitary endeavor into a collaborative and engaging experience. These activities not only impart knowledge but also cultivate essential skills, promote positive financial habits, and foster a supportive community where individuals can share experiences and learn from one another. The benefits extend beyond personal finances, impacting family well-being, community development, and overall economic growth. Businesses also recognize the value of improving employee financial literacy, leading to increased productivity and reduced stress.

Overview: What This Article Covers

This article explores the diverse range of money management group activities suitable for various age groups and experience levels. We will delve into the theoretical underpinnings of effective group learning, examining practical applications, addressing common challenges, and exploring the future implications of collaborative financial education. Readers will gain actionable insights and strategies for designing and implementing engaging money management group activities.

The Research and Effort Behind the Insights

This article synthesizes research from behavioral economics, adult education principles, and financial literacy programs. Data from successful financial literacy initiatives and expert opinions are incorporated to support the recommendations. A structured approach, employing a combination of qualitative and quantitative research methodologies, ensures the accuracy and trustworthiness of the insights provided.

Key Takeaways:

- Diverse Activity Formats: Exploring various activity formats to cater to diverse learning styles and preferences.

- Practical Application: Highlighting real-world applications and scenarios to enhance learning effectiveness.

- Addressing Challenges: Identifying and addressing potential challenges in group facilitation and engagement.

- Measuring Success: Defining metrics to assess the effectiveness of the implemented activities.

Smooth Transition to the Core Discussion:

Having established the importance of money management group activities, let's now explore the diverse spectrum of activities that can be implemented to enhance financial literacy effectively.

Exploring the Key Aspects of Money Management Group Activities

1. Definition and Core Concepts:

Money management group activities encompass a wide variety of interactive exercises, discussions, simulations, and games designed to foster collaborative learning about financial topics. The core concepts include budgeting, saving, investing, debt management, and financial planning. The activities should be tailored to the participants' age, financial literacy level, and specific needs.

2. Applications Across Industries:

The applications of money management group activities are extensive, extending beyond personal finance to encompass various sectors. For instance:

- Schools and Universities: Incorporating financial literacy into school curricula through interactive workshops, role-playing exercises, and peer-to-peer learning.

- Community Centers and Non-profits: Offering free financial literacy programs for low-income communities and vulnerable populations.

- Workplace Training: Developing employee financial wellness programs to enhance productivity and reduce stress.

- Financial Institutions: Providing engaging workshops and seminars for customers to improve their financial understanding.

3. Challenges and Solutions:

Implementing successful money management group activities requires careful planning and consideration of potential challenges:

- Diverse Skill Levels: Addressing the varying levels of financial literacy among participants through differentiated instruction and personalized support.

- Group Dynamics: Facilitating effective group discussions and ensuring that all participants have an opportunity to contribute.

- Time Constraints: Designing activities that can be completed within a reasonable timeframe.

- Engagement Levels: Maintaining participant engagement through a variety of interactive methods.

4. Impact on Innovation:

Money management group activities contribute to innovation in financial literacy by fostering creative problem-solving, collaborative learning, and the development of new pedagogical approaches. The innovative use of technology, such as online simulations and gamification, further enhances the learning experience.

Closing Insights: Summarizing the Core Discussion

Effective money management group activities are crucial in addressing widespread financial illiteracy. By utilizing a diverse range of methodologies, catering to various learning styles, and addressing potential challenges proactively, these activities can significantly improve financial literacy and empower individuals to achieve their financial goals.

Exploring the Connection Between Gamification and Money Management Group Activities

Gamification, the application of game-design elements and game principles in non-game contexts, significantly enhances the engagement and effectiveness of money management group activities. It transforms learning into an enjoyable and rewarding experience, promoting active participation and knowledge retention.

Key Factors to Consider:

- Roles and Real-World Examples: Gamified activities can simulate real-world financial scenarios, enabling participants to apply their knowledge in a risk-free environment. For instance, a budgeting simulation game can challenge participants to manage their virtual income and expenses, learning from their successes and mistakes.

- Risks and Mitigations: While gamification can be highly engaging, it's crucial to avoid overly simplistic or unrealistic scenarios. The design should balance fun with accurate representation of financial realities. Clear instructions and supportive facilitation are essential to mitigate potential frustration or confusion.

- Impact and Implications: Successful gamification can lead to improved knowledge retention, increased engagement, and positive behavioral changes related to money management. It can also foster a more collaborative and enjoyable learning environment, promoting peer-to-peer learning and support.

Conclusion: Reinforcing the Connection

The integration of gamification significantly enhances the impact of money management group activities. By creating engaging and interactive experiences, gamification transforms learning into a positive and rewarding process, promoting knowledge retention and positive behavioral changes.

Further Analysis: Examining Budgeting Simulations in Greater Detail

Budgeting simulations are a powerful tool within money management group activities. They allow participants to experience the consequences of their financial decisions in a safe and controlled environment. These simulations can range from simple spreadsheet exercises to complex online games incorporating various financial factors.

For example, a simulation might present participants with a hypothetical income, expenses, and unexpected events (like car repairs or medical bills). They then need to make choices about spending, saving, and debt management, observing the impact of their decisions on their virtual financial situation.

This hands-on experience provides valuable insights into the importance of budgeting, saving, and prioritizing expenses. It allows participants to learn from their mistakes without incurring real-world financial consequences, making it a highly effective learning tool.

FAQ Section: Answering Common Questions About Money Management Group Activities

-

Q: What is the best way to start a money management group?

- A: Begin by identifying your target audience and their specific needs. Then, select appropriate activities aligned with their level of financial literacy and interests. Recruit experienced facilitators and ensure access to suitable resources.

-

Q: How can I make money management group activities more engaging?

- A: Incorporate gamification elements, use real-world examples, encourage peer-to-peer learning, and provide opportunities for participants to share their experiences.

-

Q: How can I measure the effectiveness of money management group activities?

- A: Use pre- and post-assessments to gauge changes in knowledge and attitudes. Track participant engagement and feedback. Monitor the long-term impact on participants' financial behavior.

Practical Tips: Maximizing the Benefits of Money Management Group Activities

- Clearly Define Objectives: Establish clear learning goals and objectives before designing the activities.

- Choose Appropriate Activities: Select activities that are relevant, engaging, and appropriate for the participants' level of financial literacy.

- Create a Supportive Environment: Foster a safe and inclusive environment where participants feel comfortable sharing their experiences and asking questions.

- Provide Feedback and Support: Offer constructive feedback and personalized support to help participants improve their financial skills.

- Evaluate and Improve: Regularly evaluate the effectiveness of the activities and make adjustments as needed.

Final Conclusion: Wrapping Up with Lasting Insights

Money management group activities offer a powerful approach to addressing financial illiteracy and fostering financial well-being. Through engaging activities, collaborative learning, and thoughtful facilitation, these groups empower individuals to take control of their finances, improving their overall quality of life. By implementing these strategies and continually innovating, we can create a more financially literate and empowered society.

Latest Posts

Latest Posts

-

How Many Countries Use Credit Score

Apr 08, 2025

-

How Many Countries Have Credit

Apr 08, 2025

-

Do Any Other Countries Have Credit Scores

Apr 08, 2025

-

Which Countries Have Credit Scores

Apr 08, 2025

-

How Many Countries Use A Credit Score System

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Money Management Group Activities . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.