What Is Finance Charges In Credit Card Bill

adminse

Apr 04, 2025 · 9 min read

Table of Contents

Decoding the Mystery: Understanding Finance Charges on Your Credit Card Bill

What if understanding your credit card finance charges could save you hundreds, even thousands, of dollars over your lifetime? Mastering this crucial aspect of credit card management is essential for responsible financial planning and avoiding crippling debt.

Editor’s Note: This article on credit card finance charges was published today, providing you with the most up-to-date information and strategies for managing your credit card accounts effectively.

Why Finance Charges Matter: Relevance, Practical Applications, and Industry Significance

Finance charges represent the cost of borrowing money from your credit card issuer. Understanding these charges is paramount because they can significantly impact your overall financial health. Ignoring them can lead to a snowball effect of debt, making it increasingly difficult to pay off your balance. This understanding is crucial for budgeting, managing debt effectively, and making informed financial decisions. The implications extend beyond individual finances; understanding finance charges also empowers consumers to negotiate better terms with credit card companies and promotes financial literacy, reducing the vulnerability of individuals to predatory lending practices.

Overview: What This Article Covers

This article provides a comprehensive guide to understanding finance charges on your credit card bill. We will delve into the definition of finance charges, explore the various components that make up these charges, examine how they are calculated, discuss strategies for minimizing them, and answer frequently asked questions. Readers will gain a clear understanding of how finance charges work and learn practical steps to manage their credit card debt effectively.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon information from leading financial institutions, consumer protection agencies, and reputable financial publications. The information presented is based on widely accepted accounting practices and regulatory guidelines. Every effort has been made to ensure the accuracy and clarity of the information presented, enabling readers to make informed decisions regarding their credit card finances.

Key Takeaways:

- Definition and Core Concepts: A detailed explanation of finance charges and their core components.

- Calculation Methods: Understanding the different ways finance charges are calculated, including the impact of APR and daily interest.

- Factors Influencing Finance Charges: Exploring variables that affect the amount you pay, like your credit utilization and payment history.

- Strategies for Minimizing Finance Charges: Practical tips and actionable advice to reduce or eliminate finance charges.

- Dispute Resolution: Understanding how to challenge inaccurate or unfair finance charges.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding finance charges, let's delve into the specifics. We'll begin by defining these charges and then explore the various factors that contribute to their calculation.

Exploring the Key Aspects of Finance Charges

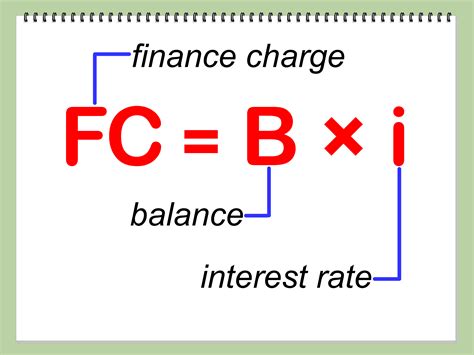

1. Definition and Core Concepts:

Finance charges are the fees you pay for borrowing money using your credit card. These charges are essentially the cost of revolving credit. Unlike debit cards, where you spend only the money you have in your account, credit cards provide a line of credit, allowing you to spend money you don't currently possess. The finance charge compensates the credit card issuer for extending this credit to you.

2. Components of Finance Charges:

Finance charges are usually comprised of several components:

- Interest Charges: This is the most significant component of finance charges. It's the cost of borrowing money, calculated based on your outstanding balance and the Annual Percentage Rate (APR). The APR is the annual interest rate you're charged.

- Fees: Credit card issuers may charge various fees that contribute to your finance charges. These fees can include:

- Late Payment Fees: Charged if you fail to make your minimum payment by the due date.

- Cash Advance Fees: Fees applied when you withdraw cash from an ATM or get a cash advance from a merchant using your credit card. These fees are typically a percentage of the amount withdrawn, plus interest that accrues immediately.

- Balance Transfer Fees: Fees charged for transferring your balance from one credit card to another.

- Over-the-Limit Fees: Charged when your spending exceeds your credit limit.

- Foreign Transaction Fees: Fees charged for transactions made in foreign currencies.

- Annual Fees: Some premium credit cards charge an annual fee for the benefits they offer. While this isn't strictly an interest charge, it contributes to the overall cost of using the card.

3. Calculation Methods:

Finance charges are usually calculated using the following methods:

- Average Daily Balance Method: This is the most common method. Your average daily balance is calculated by adding up your daily balances over the billing cycle and dividing by the number of days in the cycle. The interest is then calculated on this average balance.

- Previous Balance Method: Interest is calculated on the balance you owed at the beginning of the billing cycle, regardless of payments made during the cycle. This method is less common and generally less favorable to the cardholder.

- Adjusted Balance Method: Interest is calculated on the balance after subtracting payments made during the billing cycle. This method is more favorable to cardholders.

4. Factors Influencing Finance Charges:

Several factors impact the amount of finance charges you pay:

- APR: A higher APR results in higher interest charges.

- Outstanding Balance: A larger outstanding balance leads to higher interest charges.

- Payment History: Consistently paying your balance in full avoids interest charges altogether.

- Credit Utilization: Keeping your credit utilization (the amount you owe compared to your credit limit) low can positively impact your credit score and potentially influence the APR offered by some lenders.

- Credit Score: A higher credit score often qualifies you for a lower APR.

5. Strategies for Minimizing Finance Charges:

- Pay Your Balance in Full and On Time: This is the most effective way to avoid finance charges.

- Negotiate a Lower APR: Contact your credit card issuer and request a lower APR, especially if your credit score has improved.

- Transfer Your Balance: Consider transferring your balance to a credit card with a lower APR (be mindful of balance transfer fees).

- Use a Balance Transfer Credit Card: Look for cards specifically designed for balance transfers, often offering introductory 0% APR periods.

- Budget Effectively: Track your spending and create a budget to control your credit card usage and avoid accumulating large balances.

- Avoid Cash Advances: Cash advances often come with high fees and interest rates that accrue immediately.

- Understand Your Billing Cycle: Paying attention to your billing cycle helps you to manage your payments effectively and avoid late fees.

6. Dispute Resolution:

If you believe you've been charged an inaccurate or unfair finance charge, contact your credit card issuer immediately to dispute the charge. Keep detailed records of your transactions and payments.

Closing Insights: Summarizing the Core Discussion

Understanding finance charges is crucial for responsible credit card management. By understanding how these charges are calculated and implementing effective strategies for minimizing them, you can significantly reduce your overall credit card costs and improve your financial well-being.

Exploring the Connection Between Credit Score and Finance Charges

The relationship between your credit score and finance charges is significant. Your credit score is a numerical representation of your creditworthiness. A higher credit score indicates a lower risk to lenders, making you more attractive for favorable credit terms, including lower APRs. Conversely, a lower credit score often leads to higher APRs and, consequently, higher finance charges.

Key Factors to Consider:

Roles and Real-World Examples: A person with an excellent credit score might qualify for a credit card with an APR of 12%, resulting in significantly lower finance charges compared to someone with a poor credit score who might face an APR of 25% or higher on the same outstanding balance.

Risks and Mitigations: Ignoring your credit score can lead to higher finance charges and difficulty obtaining favorable credit terms in the future. Regularly checking your credit report and addressing any negative marks can help improve your score and reduce your finance charges.

Impact and Implications: Your credit score influences not only your credit card APR but also your ability to secure loans, mortgages, and insurance at competitive rates. A strong credit score translates to long-term financial savings.

Conclusion: Reinforcing the Connection

The link between your credit score and finance charges is undeniable. By actively managing your credit and working towards a higher credit score, you can significantly reduce your finance charges and enjoy better financial health.

Further Analysis: Examining Credit Utilization in Greater Detail

Credit utilization, the percentage of your available credit you're currently using, is a critical factor affecting your credit score and subsequently your finance charges. Keeping your credit utilization low (ideally below 30%) demonstrates responsible credit management and signals to lenders that you're not overextending yourself financially. High credit utilization, conversely, can negatively impact your credit score and result in higher APRs and increased finance charges.

FAQ Section: Answering Common Questions About Finance Charges

Q: What is the difference between APR and interest rate?

A: APR (Annual Percentage Rate) is the annual interest rate, including any fees. The interest rate is the base rate before fees are added.

Q: How often are finance charges calculated?

A: Finance charges are typically calculated daily on the average daily balance, but they appear on your monthly statement.

Q: Can I negotiate my finance charges?

A: It's worth trying to negotiate a lower APR or a payment plan with your credit card issuer, but success depends on your credit history and the issuer's policies.

Q: What happens if I can't pay my finance charges?

A: Failing to pay your finance charges will lead to increased debt, negatively impacting your credit score and potentially leading to collection efforts from the credit card issuer.

Practical Tips: Maximizing the Benefits of Understanding Finance Charges

- Monitor Your Statements Closely: Carefully review your monthly statements to identify any discrepancies or unexpected charges.

- Pay Attention to Due Dates: Make your payments on time to avoid late fees.

- Use Budgeting Tools: Employ budgeting apps or spreadsheets to track your spending and ensure you stay within your credit limit.

- Consider Debt Consolidation: If you're struggling with multiple credit card debts, explore debt consolidation options to simplify payments and potentially reduce interest rates.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding finance charges is a cornerstone of responsible credit card management. By actively monitoring your accounts, employing effective strategies, and maintaining a healthy credit score, you can navigate the complexities of credit card debt effectively and build a strong financial future. The information presented here empowers you to take control of your finances and avoid the pitfalls of high interest rates and excessive debt. Remember, informed financial decisions are the key to long-term financial success.

Latest Posts

Latest Posts

-

Tjx Rewards Card Worth It

Apr 05, 2025

-

How To Find My Minimum Payment

Apr 05, 2025

-

Minimum Payment On Federal Student Loans

Apr 05, 2025

-

How To Find The Monthly Payment Of A Loan

Apr 05, 2025

-

How To Calculate Minimum Payment On Loan

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is Finance Charges In Credit Card Bill . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.