What Is A 600 Credit Score Considered

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What is a 600 Credit Score Considered? Navigating the World of Fair Credit

What does a 600 credit score really mean, and what are its implications?

A 600 credit score signifies a level of creditworthiness that presents both opportunities and challenges, requiring careful financial management and strategic planning.

Editor’s Note: This article on 600 credit scores was published today, providing up-to-date insights into the complexities of credit scoring and its impact on financial decisions. We aim to offer a clear and comprehensive understanding of what a 600 credit score represents and how individuals can navigate this stage of their credit journey.

Why a 600 Credit Score Matters: Relevance, Practical Applications, and Industry Significance

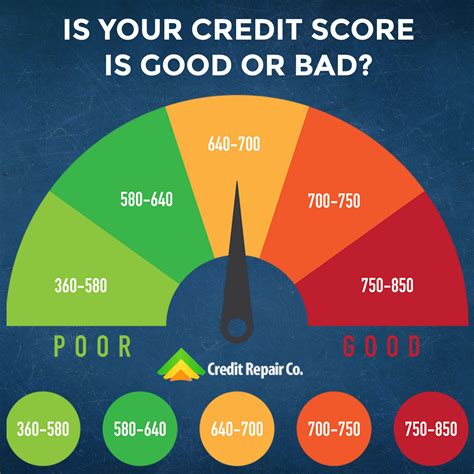

A credit score is a numerical representation of an individual's creditworthiness, calculated using a statistical model that considers various factors from your credit history. A score of 600 falls within the "fair" range, generally considered below average. Understanding its implications is crucial for accessing credit, securing loans, renting an apartment, and even obtaining certain jobs. Lenders and other businesses use credit scores to assess risk; a 600 score may limit access to favorable loan terms and interest rates. Moreover, it can influence insurance premiums and employment opportunities in some sectors. Improving a 600 credit score is a key step towards achieving better financial health and unlocking more opportunities.

Overview: What This Article Covers

This article provides a detailed exploration of a 600 credit score. We will examine its placement within the credit scoring spectrum, analyze the factors contributing to such a score, explore the challenges it presents in obtaining credit, and discuss strategies for improvement. Readers will gain a clear understanding of the implications of a 600 score and actionable steps to enhance their creditworthiness.

The Research and Effort Behind the Insights

This article draws upon extensive research, incorporating data from reputable credit bureaus like Equifax, Experian, and TransUnion, alongside insights from financial experts and analysis of relevant industry reports. The information presented is designed to provide an accurate and comprehensive understanding of the topic, empowering readers with knowledge to make informed financial decisions.

Key Takeaways:

- Definition and Core Concepts: A 600 credit score falls within the "fair" range, indicating a level of credit risk that may limit access to favorable financial products.

- Practical Applications: Understanding the real-world implications of a 600 credit score in securing loans, renting, and obtaining employment.

- Challenges and Solutions: Identifying the common obstacles faced with a 600 score and effective strategies to overcome them.

- Future Implications: Exploring the long-term impact of a 600 score and the potential for improvement through responsible financial behavior.

Smooth Transition to the Core Discussion:

Now that we understand the significance of credit scores, let's delve into a detailed analysis of a 600 score, examining its components, implications, and pathways to improvement.

Exploring the Key Aspects of a 600 Credit Score

Definition and Core Concepts: A credit score is a three-digit number generated by credit bureaus based on your credit history. FICO scores (Fair Isaac Corporation) and VantageScores are the most common models. A score of 600 falls within the "fair" range, typically ranging from 600 to 660. While not considered "bad," it suggests a higher level of risk to lenders compared to scores in the "good" or "excellent" categories. This higher risk translates to less favorable terms and higher interest rates when applying for credit.

Applications Across Industries: A 600 credit score significantly impacts access to various financial products and services. Securing a mortgage or auto loan with a 600 score may be challenging, potentially resulting in higher interest rates or loan denials. Landlords often use credit scores to assess tenant reliability, and a 600 score might make it difficult to secure an apartment, particularly in competitive rental markets. Some employers also consider credit scores during the hiring process, particularly for positions handling finances. Furthermore, insurance companies might use credit scores to determine premiums, potentially resulting in higher costs.

Challenges and Solutions: The primary challenge associated with a 600 credit score is limited access to favorable financial products and services. Lenders view individuals with fair credit scores as higher-risk borrowers, leading to higher interest rates, stricter lending criteria, and potential loan denials. This can create a cycle of financial hardship if not addressed proactively. Solutions involve improving credit scores through responsible financial practices, such as consistently paying bills on time, reducing outstanding debt, and diversifying credit usage.

Impact on Innovation: While not directly related to technological innovation, a 600 credit score highlights the need for innovative financial solutions. Fintech companies are developing tools and resources to improve financial literacy and access to credit for individuals with lower scores. These innovations can help individuals navigate the challenges associated with fair credit scores and build a stronger financial future.

Closing Insights: Summarizing the Core Discussion

A 600 credit score represents a critical juncture in an individual's financial journey. It's a signal that requires attention and proactive steps to improve. While it doesn't necessarily preclude access to credit entirely, it significantly impacts the terms and conditions offered. Understanding the underlying factors contributing to the score and taking decisive action to address them is essential for long-term financial well-being.

Exploring the Connection Between Debt Management and a 600 Credit Score

The relationship between debt management and a 600 credit score is highly significant. High levels of debt, particularly credit card debt with high utilization rates, are major contributors to lower credit scores. Poor debt management practices, such as missing payments or exceeding credit limits, negatively impact creditworthiness.

Key Factors to Consider:

-

Roles and Real-World Examples: Individuals with a 600 credit score often carry significant debt, perhaps from credit cards, medical bills, or personal loans. This debt burden limits their ability to obtain new credit at favorable interest rates. For example, someone trying to buy a car might face significantly higher monthly payments or even loan denial.

-

Risks and Mitigations: The primary risk is the accumulation of more debt due to higher interest rates and limited access to favorable lending options. Mitigation strategies involve creating a realistic budget, prioritizing debt repayment, and exploring debt consolidation options.

-

Impact and Implications: Poor debt management perpetuates the cycle of low credit scores, hindering long-term financial goals such as homeownership or retirement planning. Conversely, effective debt management can significantly improve credit scores over time.

Conclusion: Reinforcing the Connection

The connection between debt management and a 600 credit score is undeniable. Addressing outstanding debt, improving payment history, and practicing responsible credit usage are crucial for improving the credit score.

Further Analysis: Examining Debt Consolidation in Greater Detail

Debt consolidation involves combining multiple debts into a single loan or payment. This strategy can simplify debt management, potentially lowering monthly payments and reducing interest rates. However, it's crucial to carefully evaluate the terms of any consolidation loan to ensure it's a financially sound decision. For those with a 600 credit score, debt consolidation might offer a pathway to better credit health, but only if undertaken with a well-defined plan.

FAQ Section: Answering Common Questions About a 600 Credit Score

Q: What is a 600 credit score?

A: A 600 credit score falls within the "fair" range, indicating a higher risk to lenders than higher scores. It may limit access to favorable loan terms and financial products.

Q: How can I improve my 600 credit score?

A: Focus on paying bills on time, reducing outstanding debt, and maintaining low credit utilization ratios. Monitor your credit reports regularly for errors and dispute inaccuracies.

Q: What are the consequences of a 600 credit score?

A: Higher interest rates on loans, potential loan denials, difficulties securing apartments, and possible impact on employment opportunities.

Q: How long does it take to improve a credit score?

A: The time required depends on individual circumstances and the actions taken. Consistent positive changes can lead to noticeable improvements within several months, but significant improvements may take longer.

Practical Tips: Maximizing the Benefits of Credit Score Improvement

-

Track Your Credit Reports: Regularly monitor your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify and dispute any inaccuracies.

-

Pay Bills On Time: Punctual payments are critical. Even small delays can negatively impact your score. Set up automatic payments to ensure timely remittances.

-

Reduce Credit Card Debt: Strive to keep your credit utilization ratio below 30% (the amount of credit used compared to your total available credit). Pay down high-balance credit cards aggressively.

-

Explore Debt Consolidation: If appropriate, consolidate high-interest debts into a single, lower-interest loan.

-

Don't Open Too Many New Accounts: Opening multiple credit accounts in a short period can lower your score.

Final Conclusion: Wrapping Up with Lasting Insights

A 600 credit score is not a life sentence; it’s a challenge that can be overcome. By understanding the factors that influence your credit score, taking proactive steps to improve your financial habits, and utilizing available resources, you can significantly enhance your creditworthiness and unlock a brighter financial future. Remember, consistent effort and responsible financial management are key to achieving lasting credit score improvement.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is A 600 Credit Score Considered . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.