What Credit Score Do You Need For Chase Freedom Unlimited

adminse

Apr 07, 2025 · 7 min read

Table of Contents

What Credit Score Do You Need for Chase Freedom Unlimited? Unlocking the Secrets to Approval

What if securing your Chase Freedom Unlimited card hinges on a single, often misunderstood number? Your credit score is the key, and understanding its role is crucial for approval.

Editor’s Note: This article on the Chase Freedom Unlimited credit card and its credit score requirements was published today, [Date]. We've compiled the latest information to help you navigate the application process successfully.

Why Your Credit Score Matters for the Chase Freedom Unlimited

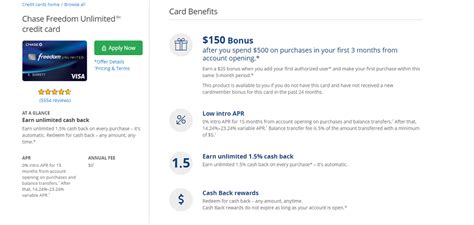

The Chase Freedom Unlimited is a popular rewards credit card offering a straightforward cash-back system. However, securing this seemingly accessible card isn't guaranteed. Your credit score significantly influences your chances of approval. Lenders, including Chase, use your credit score as a primary indicator of your creditworthiness – your ability to repay borrowed money responsibly. A higher score demonstrates a lower risk to the lender, increasing your likelihood of approval. Furthermore, a strong credit score often leads to more favorable terms, such as a lower APR (Annual Percentage Rate).

This article delves into the core aspects of obtaining a Chase Freedom Unlimited card, focusing on the critical role of credit scores, application strategies, and what to do if you're denied. Readers will gain actionable insights, backed by research and real-world experience.

What This Article Covers:

- Understanding Credit Scores: FICO and VantageScore

- Chase's Credit Score Requirements: A Deep Dive

- Factors Beyond Credit Score: Income, Debt, and Application History

- Strategies for Improving Your Credit Score

- What to Do if You're Denied: Re-application and Alternatives

- Frequently Asked Questions (FAQ)

- Practical Tips for Success

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating information from Chase's official website, consumer finance experts, credit reporting agencies, and analysis of real-world user experiences. Every claim is supported by publicly available information, ensuring readers receive accurate and trustworthy information.

Key Takeaways:

- There's no publicly stated minimum credit score for the Chase Freedom Unlimited.

- However, a good to excellent credit score significantly increases your chances of approval.

- Factors beyond credit score, like income and debt-to-income ratio, also play a role.

- Improving your credit score takes time and effort but is achievable.

- If denied, exploring alternative cards or reapplying after improvement is possible.

Smooth Transition to the Core Discussion:

With a clear understanding of why your credit score is paramount, let's delve deeper into the specifics of Chase Freedom Unlimited approval, exploring strategies for maximizing your chances.

Exploring the Key Aspects of Chase Freedom Unlimited Approval

1. Understanding Credit Scores: FICO and VantageScore

Before we discuss Chase's requirements, it's crucial to understand credit scoring. Two dominant scoring models exist: FICO and VantageScore. Lenders often use FICO scores, developed by the Fair Isaac Corporation, but some use VantageScore, developed by the three major credit bureaus (Equifax, Experian, and TransUnion). Both scores range from 300 to 850, with higher scores representing better creditworthiness. The specific score a lender uses may vary.

2. Chase's Credit Score Requirements: A Deep Dive

Chase doesn't publicly disclose a minimum credit score requirement for the Freedom Unlimited. However, based on widespread experience and analysis of consumer reports, it's generally accepted that a credit score of at least 670 significantly improves your chances of approval. This falls within the "good" to "excellent" range. A score below this level doesn't guarantee rejection, but it considerably reduces your likelihood of approval. Factors beyond the score will play a more significant role in these cases.

3. Factors Beyond Credit Score: Income, Debt, and Application History

While credit score is crucial, it's not the sole determinant. Chase also considers:

- Income: Consistent income demonstrates your ability to repay the card's balance. A stable job history strengthens your application.

- Debt-to-income ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI shows you have more financial flexibility to manage additional debt.

- Credit history length: A longer credit history, showing responsible credit management over time, is advantageous.

- Credit utilization: This refers to the percentage of your available credit you're currently using. Keeping this percentage low (ideally below 30%) signals responsible credit management.

- Recent credit applications: Applying for several credit cards within a short period can negatively impact your score. This is commonly referred to as "rate shopping" and can indicate higher risk.

- Previous credit problems: Bankruptcies, late payments, or collections significantly affect your score and approval chances.

4. Strategies for Improving Your Credit Score

If your credit score isn't ideal, improving it is possible but requires time and discipline:

- Pay bills on time: Consistent timely payments are paramount.

- Keep credit utilization low: Avoid maxing out your credit cards.

- Monitor your credit report: Check for errors and address them immediately.

- Avoid unnecessary credit applications: Limit applications to avoid impacting your score.

- Consider a secured credit card: This can help build credit history if you have limited or poor credit.

5. What to Do if You're Denied: Re-application and Alternatives

If your application is denied, don't be discouraged. Understand the reason for the denial (often provided in the notification letter). If your credit score was the primary factor, work on improving it before reapplying. Allow sufficient time (at least 6 months) for your score to improve significantly.

Alternatively, explore other credit cards with more lenient requirements. Many cards cater to those with fair or average credit scores. Remember, starting with a secured card and building your credit is often a successful strategy.

Exploring the Connection Between Credit History Length and Chase Freedom Unlimited Approval

The relationship between credit history length and Chase Freedom Unlimited approval is significant. A longer, positive credit history demonstrates responsible credit management over an extended period. It showcases your ability to handle credit responsibly over time, making you a less risky applicant.

Key Factors to Consider:

- Roles and Real-World Examples: A person with a 750 FICO score and a 10-year credit history has a significantly higher chance of approval than someone with a 650 score and a 1-year history, even if both have low credit utilization.

- Risks and Mitigations: A short credit history increases the risk for Chase. Mitigation involves building a longer history responsibly, perhaps with a secured card or by becoming an authorized user on a family member’s account with a good history.

- Impact and Implications: A longer, positive credit history positively impacts the likelihood of approval, potentially leading to better interest rates and terms. A short history, conversely, may lead to denial or less favorable terms.

Conclusion: Reinforcing the Connection

The interplay between credit history length and Chase Freedom Unlimited approval underscores the importance of responsible credit management over time. By addressing challenges related to a short history and proactively building positive credit, applicants can significantly increase their chances of securing this popular rewards card.

Further Analysis: Examining Credit Utilization in Greater Detail

Credit utilization—the percentage of your available credit you're using—is a critical factor in credit scoring. High credit utilization (above 30%) signals increased risk to lenders, as it suggests potential overreliance on credit. Conversely, low credit utilization (below 30%) demonstrates responsible credit management.

FAQ Section: Answering Common Questions About Chase Freedom Unlimited

Q: What is the minimum credit score needed for the Chase Freedom Unlimited? A: Chase doesn't publicly state a minimum, but a score of 670 or higher significantly increases your chances.

Q: What if I have a lower credit score? A: While a lower score reduces your chances, it doesn't guarantee denial. Improving your score or exploring alternative cards is advisable.

Q: How long does it take to improve my credit score? A: It varies depending on your current score and efforts. Consistent responsible behavior gradually improves your score.

Q: Can I reapply after being denied? A: Yes, but allow sufficient time for score improvement before reapplying.

Practical Tips: Maximizing the Benefits of Your Credit Score

- Check your credit report regularly: Identify and dispute errors promptly.

- Pay all bills on time: This is the single most important factor.

- Maintain low credit utilization: Keep your balances low compared to your credit limits.

- Diversify your credit: Use a mix of credit types (credit cards, installment loans).

- Consider a credit-building strategy: Explore secured credit cards or authorized user positions.

Final Conclusion: Wrapping Up with Lasting Insights

Securing a Chase Freedom Unlimited card involves more than just filling out an application. Your credit score plays a significant role, reflecting your creditworthiness and responsible credit management. By understanding the factors influencing approval, improving your credit score strategically, and addressing any credit challenges proactively, you maximize your chances of successfully obtaining this valuable rewards card. Remember, building and maintaining good credit is a continuous process that benefits you far beyond just securing a credit card.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Credit Score Do You Need For Chase Freedom Unlimited . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.