How To Calculate Your Credit Utilization

adminse

Apr 07, 2025 · 6 min read

Table of Contents

Decoding Credit Utilization: A Comprehensive Guide to Calculating and Managing Your Score

What if your credit score hinges on a single, easily misunderstood metric? Understanding and managing your credit utilization is crucial for achieving a healthy financial standing.

Editor’s Note: This article on calculating credit utilization was published today, providing you with the most up-to-date information and strategies to improve your credit health.

Why Credit Utilization Matters:

Credit utilization, simply put, is the ratio of your outstanding credit card debt to your total available credit. It's one of the most significant factors influencing your credit score, far outweighing the impact of individual payment histories in many scoring models. Lenders view high credit utilization as a sign of potential financial instability, increasing your perceived risk. Conversely, low credit utilization demonstrates responsible credit management and can significantly boost your credit score. This article will provide you with the tools and knowledge to master this crucial aspect of your financial well-being.

Overview: What This Article Covers

This article will guide you through the process of calculating your credit utilization, explaining different methods and providing actionable strategies for improving your score. We'll examine the impact of various credit card types, explore the nuances of different credit scoring models, and address common misconceptions surrounding credit utilization. You'll leave with a comprehensive understanding and practical tools for optimizing your credit utilization ratio.

The Research and Effort Behind the Insights

This comprehensive guide draws upon research from reputable sources, including leading credit reporting agencies like Experian, Equifax, and TransUnion, along with insights from financial experts and extensive analysis of credit scoring methodologies. Each calculation method and strategy presented is supported by factual evidence to ensure accuracy and reliability.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of credit utilization and its components.

- Calculation Methods: Several approaches to calculating your credit utilization, including individual card calculations and total credit utilization.

- Impact on Credit Scores: How credit utilization affects your creditworthiness and scoring models.

- Strategies for Improvement: Practical steps to lower your credit utilization and improve your credit score.

- Addressing Common Misconceptions: Clarification on frequently misunderstood aspects of credit utilization.

Smooth Transition to the Core Discussion:

Now that we've established the importance of credit utilization, let's delve into the specifics of calculating and managing this critical metric.

Exploring the Key Aspects of Credit Utilization

1. Definition and Core Concepts:

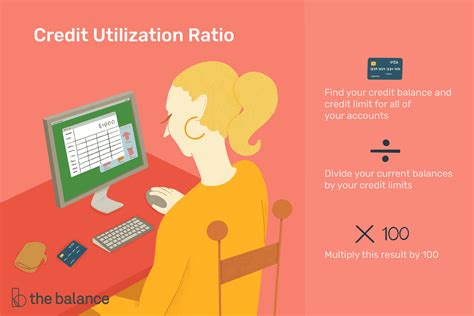

Credit utilization is expressed as a percentage and represents the proportion of your available credit that you are currently using. For example, if you have a total available credit of $10,000 and an outstanding balance of $2,000, your credit utilization is 20% ($2,000/$10,000 x 100%). This percentage is calculated separately for each credit card and then often combined to determine your overall credit utilization ratio.

2. Calculation Methods:

-

Individual Card Utilization: Calculate the utilization for each credit card separately. This helps you identify which cards are contributing most to your overall high utilization. The formula remains the same: (Outstanding balance / Credit limit) x 100%.

-

Total Credit Utilization: This is the sum of all your outstanding balances divided by the sum of all your credit limits. This gives you an overall picture of your credit usage across all your cards. For example: Total outstanding balance = $5,000; Total credit limit = $20,000; Total credit utilization = 25%.

-

Utilizing Credit Reports: Your credit report provides this information, usually presented as a percentage for each card and your overall utilization. However, manually calculating it ensures you understand the process and helps you monitor changes more effectively.

3. Impact on Credit Scores:

Different credit scoring models weigh credit utilization differently, but it's consistently a significant factor. Generally, keeping your credit utilization below 30% is crucial, ideally aiming for below 10%. High utilization significantly hurts your score, signaling increased risk to lenders. Low utilization demonstrates responsible credit management, contributing positively to your score.

4. Strategies for Improvement:

-

Pay Down Balances: The most direct method is to reduce your outstanding balances on your credit cards. Even small payments can make a difference over time.

-

Increase Credit Limits: If you have a good credit history, consider requesting a credit limit increase from your card issuers. This increases your available credit, thus lowering your utilization ratio even if your balance remains the same. However, be cautious; only request an increase if you can manage your spending responsibly.

-

Open New Accounts: This strategy should be used cautiously and only if you have a good credit history. Opening a new credit card with a high credit limit can lower your overall credit utilization ratio, but it increases the number of accounts you manage.

-

Strategic Card Usage: Prioritize paying down cards with the highest utilization rate first.

Exploring the Connection Between Payment History and Credit Utilization

While credit utilization is a key factor, it doesn’t exist in isolation. Your payment history strongly influences your credit score. Even with low credit utilization, consistently late or missed payments will negatively impact your score.

Key Factors to Consider:

-

Roles and Real-World Examples: A person with excellent payment history but consistently high credit utilization (above 50%) will have a significantly lower credit score than someone with a few minor late payments but consistently low utilization (below 10%).

-

Risks and Mitigations: Over-reliance on increasing credit limits without responsible spending can lead to accumulating debt. Regularly monitoring your spending and diligently paying down balances mitigates this risk.

-

Impact and Implications: A poor credit score due to high credit utilization can severely impact loan approvals, interest rates, and even your ability to rent an apartment.

Conclusion: Reinforcing the Connection

The interplay between payment history and credit utilization underscores the holistic nature of creditworthiness. While low credit utilization is crucial, it's only one piece of the puzzle. Maintaining a consistent payment history is equally essential for building a strong credit profile.

Further Analysis: Examining Payment History in Greater Detail

Consistent on-time payments demonstrate responsible financial behavior. Even a single missed payment can negatively impact your score, lingering on your report for years. Building a strong payment history takes time and discipline, but it’s a cornerstone of excellent credit.

FAQ Section: Answering Common Questions About Credit Utilization

-

What is the ideal credit utilization rate? Ideally, aim for below 10%, but anything under 30% is generally considered good.

-

How often is credit utilization calculated? Credit scoring models typically use your credit utilization at the time your credit report is pulled. Your utilization fluctuates throughout the month.

-

Does closing a credit card affect my utilization? Closing a card reduces your total available credit, potentially increasing your utilization percentage. This is especially true if you have outstanding balances on other cards.

-

Can I improve my credit utilization overnight? While you can't change your credit score instantly, paying down balances will improve your utilization immediately, though the impact on your credit score may take time.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

-

Set a Budget: Track your spending and ensure you're not exceeding your means.

-

Automate Payments: Set up automatic payments to avoid late fees and maintain a positive payment history.

-

Monitor Your Credit Report: Regularly check your credit reports for accuracy and identify any potential issues.

-

Use Credit Cards Wisely: Only charge what you can afford to pay off in full each month.

Final Conclusion: Wrapping Up with Lasting Insights

Credit utilization is a pivotal aspect of your financial health. By understanding how to calculate it, manage it, and integrate it with responsible spending habits, you can significantly improve your credit score and secure a better financial future. Remember, consistent effort and mindful financial decisions are key to long-term credit success.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Your Credit Utilization . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.