Why Does Higher Credit Utilization Increase Your Credit Score

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Does higher credit utilization actually increase your credit score?

The common belief that higher credit utilization boosts your credit score is a myth; in reality, it significantly harms it.

Editor’s Note: This article on credit utilization and its impact on credit scores was published today, [Date]. We've compiled information from reputable sources to provide up-to-date insights into this crucial aspect of personal finance. This information should help you understand how to manage your credit responsibly and improve your credit score.

Why Credit Utilization Matters: A Foundation of Financial Health

Credit utilization is the ratio of your outstanding credit card balances to your total available credit. It's a critical factor influencing your credit score because it reflects your ability to manage debt. Lenders see high utilization as a sign of potential financial instability, increasing the risk of default. Conversely, low utilization demonstrates responsible credit management. This impacts not only your credit score but also your ability to secure loans with favorable interest rates and terms.

Overview: What This Article Covers

This article will dissect the misconception surrounding higher credit utilization and credit scores. We will explore the mechanics of credit scoring, the detrimental effects of high utilization, strategies to maintain a healthy utilization ratio, and address common questions regarding credit utilization and score improvement. You will gain a comprehensive understanding of how to manage your credit effectively and build a strong credit profile.

The Research and Effort Behind the Insights

This article draws on extensive research from reputable sources, including credit bureaus like Experian, Equifax, and TransUnion, as well as financial experts and publications. Data-driven analysis and real-world examples are used to illustrate the points discussed. The goal is to provide readers with accurate and actionable information supported by credible evidence.

Key Takeaways:

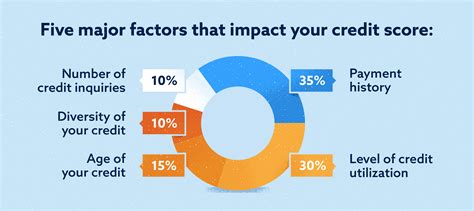

- Credit utilization is a significant factor in credit scoring. It represents a large percentage of your overall credit score.

- Higher credit utilization negatively impacts credit scores. It signals increased financial risk to lenders.

- Maintaining a low credit utilization ratio is crucial for a good credit score. Aiming for under 30% is generally recommended.

- Several strategies exist to lower credit utilization and improve your credit score. These include paying down balances, increasing credit limits, and using alternative credit products.

Smooth Transition to the Core Discussion:

The widespread misunderstanding surrounding credit utilization necessitates a deeper dive into its mechanics and impact on credit scoring models. Let’s debunk the myth and explore effective strategies for responsible credit management.

Exploring the Key Aspects of Credit Utilization and Credit Scores

1. Definition and Core Concepts:

Credit utilization is calculated by dividing your total outstanding credit card balances by your total available credit. For example, if you have $1,000 in outstanding balances across all your credit cards and a total credit limit of $5,000, your utilization rate is 20% ($1,000/$5,000). Credit scoring models, like FICO and VantageScore, heavily weigh this ratio, considering it a strong indicator of creditworthiness.

2. Applications Across Industries:

The impact of credit utilization transcends personal finance. Businesses also face scrutiny regarding their credit utilization, impacting their ability to secure loans and lines of credit for expansion or operational needs. High utilization can signal financial distress, making lenders hesitant to extend further credit.

3. Challenges and Solutions:

Many individuals struggle to maintain a low credit utilization ratio, often due to unexpected expenses, lifestyle changes, or poor budgeting habits. However, proactive planning and responsible spending habits can mitigate these challenges. Solutions involve creating a realistic budget, prioritizing debt repayment, and actively monitoring credit utilization.

4. Impact on Innovation:

The emphasis on credit utilization has led to innovative financial products and services. Credit monitoring tools and budgeting apps help individuals track their spending and manage their credit effectively. This increased focus on financial literacy promotes responsible borrowing and improves overall financial health.

Closing Insights: Summarizing the Core Discussion

High credit utilization is detrimental to credit scores, contrary to popular misconception. Responsible credit management requires careful monitoring and proactive strategies to keep utilization low. Understanding this relationship is crucial for building and maintaining a strong credit profile.

Exploring the Connection Between Payment History and Credit Utilization

Payment history is another significant factor in credit scoring, alongside utilization. While they are distinct elements, they are interconnected. A consistent history of on-time payments demonstrates responsible credit behavior. However, even with a perfect payment history, high credit utilization can negatively impact your score. Conversely, even with low utilization, missed payments severely damage your creditworthiness.

Key Factors to Consider:

Roles and Real-World Examples:

Imagine two individuals with identical credit histories except for their credit utilization. One maintains a utilization ratio below 30%, while the other consistently exceeds 70%. The individual with lower utilization will likely have a significantly higher credit score, even with identical payment histories. This highlights the independent yet intertwined nature of these credit scoring factors.

Risks and Mitigations:

High credit utilization increases the risk of debt accumulation and potential default. Mitigating this risk involves proactive budgeting, disciplined spending habits, and regular monitoring of credit reports. Setting up automatic payments can prevent late payments, further bolstering your credit profile.

Impact and Implications:

The long-term implications of high credit utilization are substantial. It can affect your ability to secure loans, mortgages, and even rental agreements at favorable rates. It can also lead to higher interest rates on future borrowing, increasing the overall cost of credit.

Conclusion: Reinforcing the Connection

The interplay between payment history and credit utilization emphasizes the holistic nature of credit scoring. Maintaining a clean payment history is essential, but it's not sufficient. Low credit utilization, ideally below 30%, is equally crucial for a robust and favorable credit score.

Further Analysis: Examining Payment History in Greater Detail

Payment history reflects your consistency in meeting your financial obligations. Each missed or late payment negatively impacts your credit score. The severity of the impact depends on the frequency and length of delinquency. Factors like the number of missed payments and the amount of overdue debt are also considered by credit scoring algorithms.

FAQ Section: Answering Common Questions About Credit Utilization

What is the ideal credit utilization ratio? The generally recommended ratio is below 30%, ideally below 10%.

How does credit utilization affect my interest rates? High utilization signals higher risk to lenders, leading to higher interest rates on loans and credit cards.

Can I improve my credit score by lowering my credit utilization? Yes, significantly lowering your credit utilization can lead to a noticeable improvement in your credit score within a few months.

What if I have a limited credit history? Focus on building a history of responsible credit use. Start with a secured credit card and gradually increase your credit limit as your creditworthiness improves.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

- Pay down your balances regularly: Make more than the minimum payments whenever possible.

- Request a credit limit increase: A higher credit limit lowers your utilization ratio, even if your balance remains the same.

- Use multiple credit cards strategically: Distribute your spending across multiple cards to avoid maxing out any single card.

- Monitor your credit reports regularly: Check for errors and ensure the information is accurate.

- Avoid applying for new credit frequently: Multiple applications within a short time frame can lower your score.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding and managing credit utilization is paramount to achieving and maintaining a strong credit score. By adopting responsible spending habits, regularly paying down balances, and strategically managing your credit, you can significantly improve your financial health and access better financial opportunities. The common misconception that higher utilization benefits your score is false; low utilization is key to a higher credit score. Remember, your credit score is a reflection of your financial responsibility; prioritizing responsible credit management will yield lasting positive benefits.

Latest Posts

Related Post

Thank you for visiting our website which covers about Why Does Higher Credit Utilization Increase Your Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.