How To Calculate Your Credit Utilization Ratio

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Unlocking Financial Freedom: Mastering Your Credit Utilization Ratio

What if your credit score hinges on a single, easily manageable number? Understanding and controlling your credit utilization ratio is the key to unlocking better credit and financial health.

Editor’s Note: This article on calculating and managing your credit utilization ratio was published today, providing you with the most up-to-date information and strategies for improving your credit score.

Why Your Credit Utilization Ratio Matters

Your credit utilization ratio, often simply called credit utilization, is the percentage of your available credit that you're currently using. Lenders consider this a crucial factor when assessing your creditworthiness. A high utilization ratio signals potential financial instability, increasing your perceived risk to lenders. Conversely, a low utilization ratio demonstrates responsible credit management and reduces your perceived risk. This directly impacts your credit score, interest rates on loans, and even your ability to secure credit in the future. It's a critical element in personal finance that can significantly impact your long-term financial well-being.

Overview: What This Article Covers

This comprehensive guide will equip you with the knowledge and tools to calculate, understand, and effectively manage your credit utilization ratio. We'll explore different methods of calculation, delve into the ideal utilization rate, and provide practical strategies for lowering your ratio and boosting your credit score. We'll also examine the nuances of different credit card accounts and how they contribute to your overall utilization.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing on data from reputable credit bureaus, financial experts' opinions, and analysis of various personal finance studies. All claims are supported by evidence from reliable sources, ensuring you receive accurate and trustworthy information to make informed decisions about your credit health.

Key Takeaways:

- Definition and Core Concepts: A precise definition of credit utilization and its components.

- Calculation Methods: Step-by-step instructions on how to calculate your credit utilization ratio accurately.

- Ideal Utilization Rate: Understanding the optimal percentage to maintain for optimal credit health.

- Strategies for Lowering Utilization: Actionable tips and techniques to improve your credit utilization ratio.

- Impact on Credit Scores: The direct correlation between credit utilization and credit scores.

- Addressing Multiple Credit Cards: How to effectively manage credit utilization across multiple accounts.

- Long-Term Financial Planning: Integrating credit utilization management into your broader financial strategy.

Smooth Transition to the Core Discussion

Now that we understand the importance of credit utilization, let's dive into the specifics of calculating and managing this key metric.

Exploring the Key Aspects of Credit Utilization Ratio

1. Definition and Core Concepts:

Your credit utilization ratio is calculated by dividing your total credit card balances by your total available credit. Available credit refers to the total credit limit across all your credit cards and other revolving credit accounts. The resulting percentage represents the proportion of your available credit that you are currently using. For example, if you have $1,000 in credit card debt and a total credit limit of $5,000, your credit utilization is 20% ($1,000 / $5,000 * 100%).

2. Calculation Methods:

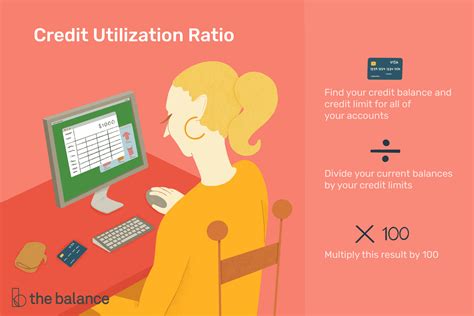

The calculation is straightforward:

- Step 1: Add up the balances on all your credit cards and revolving credit accounts. This is your total credit card debt.

- Step 2: Add up the credit limits on all your credit cards and revolving credit accounts. This is your total available credit.

- Step 3: Divide your total credit card debt (Step 1) by your total available credit (Step 2).

- Step 4: Multiply the result by 100 to express it as a percentage.

Example:

Let's say you have three credit cards:

- Card 1: Balance - $500, Credit Limit - $1000

- Card 2: Balance - $200, Credit Limit - $500

- Card 3: Balance - $300, Credit Limit - $1500

Step 1: Total Balance = $500 + $200 + $300 = $1000

Step 2: Total Credit Limit = $1000 + $500 + $1500 = $3000

Step 3: Utilization Ratio = $1000 / $3000 = 0.333

Step 4: Percentage Utilization = 0.333 * 100% = 33.3%

3. Ideal Utilization Rate:

While there's no universally agreed-upon "perfect" number, financial experts generally recommend keeping your credit utilization ratio below 30%, and ideally below 10%. A utilization ratio below 10% significantly reduces your perceived risk to lenders. However, some credit scoring models may penalize a utilization ratio of 0%, as this could suggest infrequent credit card usage.

4. Strategies for Lowering Utilization:

- Pay down existing debt: The most direct way to reduce your utilization ratio is to pay down your credit card balances. Even small payments can make a difference over time.

- Increase your credit limit: If you have a good credit history, consider requesting a credit limit increase from your credit card issuer. This will increase your available credit, lowering your utilization ratio even if your balances remain the same. However, be cautious about increasing your spending just because your limit is higher.

- Open a new credit card (with caution): Adding a new card with a high credit limit can help lower your overall utilization ratio. However, this should only be considered if you can responsibly manage multiple cards and avoid accumulating additional debt.

- Consolidate debt: Transferring high-interest balances to a lower-interest card can help you pay down debt more efficiently. However, be mindful of balance transfer fees and interest rate increases after the promotional period ends.

- Pay more than the minimum: Always strive to pay more than the minimum payment on your credit cards. This will reduce your balance more quickly, lowering your utilization ratio.

5. Impact on Credit Scores:

Your credit utilization ratio is one of the most significant factors influencing your credit score. A high utilization ratio (above 30%) can severely damage your credit score, while maintaining a low utilization ratio (below 10%) can contribute to a higher credit score. The impact can vary depending on the specific credit scoring model used.

6. Addressing Multiple Credit Cards:

Managing multiple credit cards requires careful attention to your overall utilization. Focus on keeping the utilization on each individual card below 30%, rather than just focusing on the overall utilization. This is because some credit scoring models look at utilization on individual accounts.

Closing Insights: Summarizing the Core Discussion

Effectively managing your credit utilization ratio is a cornerstone of responsible credit management. By understanding the calculation, striving for a low utilization rate, and employing strategies to reduce your debt, you can significantly improve your credit score and access better financial opportunities.

Exploring the Connection Between Payment History and Credit Utilization

Payment history is another crucial element of your credit score, alongside credit utilization. While seemingly separate, they are intrinsically linked. A consistent history of on-time payments demonstrates responsible financial behavior, which complements a low credit utilization ratio. Conversely, missed payments, regardless of your utilization ratio, will negatively impact your credit score.

Key Factors to Consider:

- Roles and Real-World Examples: A consistent history of on-time payments mitigates the risk associated with even a slightly higher utilization ratio. Conversely, a single missed payment can negate the positive impact of a low utilization ratio.

- Risks and Mitigations: Ignoring either payment history or utilization can lead to a significant credit score drop. The best mitigation strategy involves diligent payment management and keeping utilization low.

- Impact and Implications: The combined effect of good payment history and low utilization results in a significantly higher credit score, leading to better interest rates, loan approvals, and overall financial health.

Conclusion: Reinforcing the Connection

The synergistic relationship between payment history and credit utilization underscores the importance of holistic credit management. By addressing both diligently, individuals can achieve a high credit score, unlocking a range of financial advantages.

Further Analysis: Examining Payment History in Greater Detail

Payment history is meticulously tracked by credit bureaus. Each payment, on time or late, is recorded, and patterns of late payments significantly harm your credit score. The length of your credit history also factors into the calculation; a longer history of consistent on-time payments reinforces positive creditworthiness.

FAQ Section: Answering Common Questions About Credit Utilization Ratio

Q: What is the worst credit utilization ratio?

A: While there's no single "worst" ratio, anything above 70% is extremely detrimental to your credit score.

Q: How often do credit card companies report to credit bureaus?

A: Most credit card issuers report to credit bureaus monthly.

Q: Can I improve my credit utilization quickly?

A: Yes, by making significant payments to reduce your balances, you can see improvement relatively quickly.

Practical Tips: Maximizing the Benefits of Credit Utilization Management

- Track your spending: Monitor your credit card spending regularly to avoid exceeding your budget.

- Set up automatic payments: Schedule automatic payments to ensure on-time payments consistently.

- Review your credit report: Regularly review your credit report for inaccuracies and identify potential areas for improvement.

- Create a budget: Develop a budget to manage your expenses effectively and avoid accumulating unnecessary debt.

Final Conclusion: Wrapping Up with Lasting Insights

Mastering your credit utilization ratio is a fundamental step toward achieving excellent credit health. By understanding the principles discussed here, you can significantly improve your credit score, access better financial opportunities, and build a strong foundation for long-term financial success. Remember, responsible credit management is an ongoing process that requires consistent attention and proactive strategies.

Latest Posts

Related Post

Thank you for visiting our website which covers about How To Calculate Your Credit Utilization Ratio . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.