Is A 705 Credit Score Good

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Is a 705 Credit Score Good? Unveiling the Nuances of Creditworthiness

Is a 705 credit score truly indicative of excellent financial health, or does it represent a mere stepping stone towards better credit? This comprehensive analysis will delve into the complexities of credit scoring, providing actionable insights into what a 705 score means and how to improve it further.

Editor’s Note: This article on the significance of a 705 credit score was published today, providing readers with up-to-date information and perspectives on creditworthiness in today’s financial landscape.

Why a 705 Credit Score Matters: Navigating the Lending Landscape

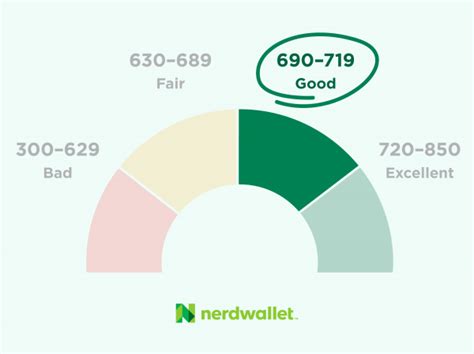

A credit score is a three-digit number that lenders use to assess your creditworthiness. It summarizes your past borrowing and repayment history, offering a snapshot of your financial responsibility. While the specific scoring models vary (most notably FICO and VantageScore), a 705 score generally falls within the "good" to "fair" range. This means you're likely to qualify for many loans and credit cards, but you may not receive the most favorable interest rates or terms available. Understanding where your score sits within the spectrum is crucial for securing optimal financial products and navigating the complexities of borrowing.

Overview: What This Article Covers

This article provides a comprehensive exploration of a 705 credit score. We will delve into:

- The intricacies of credit scoring models and their impact.

- The range of financial products accessible with a 705 score.

- Strategies for improving a 705 score to achieve better interest rates and loan terms.

- The importance of monitoring credit reports and identifying potential errors.

- Addressing common misconceptions surrounding credit scores and their interpretation.

The Research and Effort Behind the Insights

This article draws upon extensive research from reputable sources including Fair Isaac Corporation (FICO), VantageScore, and the Consumer Financial Protection Bureau (CFPB). The analysis incorporates insights from financial experts, case studies demonstrating the practical implications of credit scores, and statistical data illustrating the correlation between credit scores and lending outcomes.

Key Takeaways:

- Credit Score Range: A 705 credit score falls within the "good" range, but improvements can lead to significant benefits.

- Lending Implications: While loans and credit cards are attainable, better rates are possible with higher scores.

- Improvement Strategies: Consistent on-time payments, responsible debt management, and maintaining a low credit utilization ratio are key.

- Credit Report Monitoring: Regular checks help identify and rectify errors that may negatively affect the score.

Smooth Transition to the Core Discussion:

Now that we understand the context of a 705 credit score, let’s delve into the specifics of credit scoring models, the range of financial products accessible, and effective strategies for improvement.

Exploring the Key Aspects of a 705 Credit Score

1. Understanding Credit Scoring Models:

Various credit scoring models exist, each using a different algorithm to generate a score. The most prominent are FICO and VantageScore. While both consider similar factors (payment history, amounts owed, length of credit history, new credit, and credit mix), their weighting and specific calculations differ. A 705 score might translate slightly differently across these models, influencing the specific interest rates and loan terms offered. Understanding this nuance is essential for accurate interpretation.

2. Access to Financial Products:

With a 705 score, individuals typically qualify for most personal loans, credit cards, mortgages (though potentially with higher interest rates), and auto loans. However, the terms will likely be less favorable compared to those offered to individuals with higher scores. Expect higher interest rates, potentially stricter loan-to-value ratios for mortgages, and less lenient eligibility criteria. The difference in interest rates can accumulate over the life of a loan, amounting to substantial savings if a higher credit score could be obtained.

3. Strategies for Improvement:

Improving a 705 credit score involves several key steps:

- Consistent On-Time Payments: This is the single most significant factor influencing credit scores. Late or missed payments severely impact scores, so meticulous attention to payment deadlines is crucial.

- Debt Management: Keeping debt levels low relative to available credit is essential. A high credit utilization ratio (the amount of credit used compared to the total available) negatively affects credit scores. Strategies such as debt consolidation or balance transfers can help manage debt effectively.

- Length of Credit History: A longer credit history demonstrates consistent financial responsibility. Avoid unnecessarily closing old credit accounts, as doing so reduces the average age of accounts, potentially affecting the score.

- New Credit: Applying for multiple new credit accounts in a short period can negatively affect the score. Refrain from excessive credit applications unless absolutely necessary.

- Credit Mix: A diversified credit portfolio – including credit cards, installment loans, and mortgages (where applicable) – can positively influence credit scores. This demonstrates the ability to manage various credit types responsibly.

4. Monitoring Credit Reports:

Regularly checking credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) is vital. This allows for the identification of errors or inaccuracies that can negatively impact credit scores. Disputing inaccurate information with the credit bureaus can lead to score improvements.

Exploring the Connection Between Debt Management and a 705 Credit Score

The relationship between effective debt management and a 705 credit score is paramount. High debt levels and poor debt management practices significantly impact credit scores. A 705 score might suggest the presence of some debt, but successful management of that debt is key to improvement.

Key Factors to Consider:

-

Roles and Real-World Examples: Individuals with a 705 score might have manageable credit card debt, perhaps an auto loan or student loan. Effective management, such as consistently paying more than the minimum amount due, can significantly improve the score. Conversely, someone with a similar score but struggling with multiple high-interest debts will find it harder to improve.

-

Risks and Mitigations: The risks associated with poor debt management include higher interest rates, difficulty securing new credit, and potentially even debt collection actions. Mitigation strategies include creating a realistic budget, prioritizing debt repayment based on interest rates, and seeking professional financial advice if needed.

-

Impact and Implications: Sustained poor debt management leads to a lower credit score, restricting access to favorable financial products and potentially increasing financial stress. Conversely, responsible debt management leads to a higher credit score, opening up opportunities for better interest rates, lower monthly payments, and greater financial flexibility.

Conclusion: Reinforcing the Debt Management Connection

The interplay between effective debt management and a 705 credit score is undeniable. By diligently addressing debt, individuals can improve their creditworthiness and secure better financial opportunities.

Further Analysis: Examining Credit Utilization in Greater Detail

Credit utilization, the percentage of available credit used, is a critical factor influencing credit scores. High credit utilization ratios negatively impact scores, signaling potential over-reliance on credit. Even with a 705 score, optimizing credit utilization is crucial for improvement. For instance, keeping utilization consistently below 30% and ideally below 10% demonstrates responsible credit management.

FAQ Section: Answering Common Questions About a 705 Credit Score

Q: What is considered a good credit score?

A: Generally, a credit score above 700 is considered good, while scores above 800 are excellent. However, the specific thresholds vary based on the lender and the type of credit product sought.

Q: How can I improve my 705 credit score quickly?

A: There's no quick fix. Sustainable improvement requires consistent on-time payments, responsible debt management, and monitoring credit reports. The speed of improvement depends on individual circumstances and the actions taken.

Q: Will a 705 credit score affect my ability to buy a house?

A: A 705 score might qualify you for a mortgage, but you may face higher interest rates compared to someone with a higher score. Lenders assess several factors, including income, debt-to-income ratio, and down payment, in addition to credit scores.

Q: What are the consequences of a low credit score?

A: A low credit score limits access to favorable financial products, leading to higher interest rates, stricter loan terms, and potentially higher insurance premiums.

Practical Tips: Maximizing the Benefits of a 705 Credit Score

- Pay Bills on Time: Set up automatic payments to ensure timely payments.

- Lower Credit Utilization: Pay down high-balance credit cards to reduce utilization ratios.

- Monitor Credit Reports Regularly: Dispute any inaccuracies found on credit reports.

- Avoid Excessive Credit Applications: Apply for new credit only when necessary.

- Consider Debt Consolidation: Consolidate high-interest debts to simplify repayment and potentially lower monthly payments.

Final Conclusion: Wrapping Up with Lasting Insights

A 705 credit score represents a good foundation but presents opportunities for improvement. By understanding the factors influencing credit scores, employing effective debt management strategies, and maintaining responsible credit habits, individuals can enhance their creditworthiness, opening doors to better financial opportunities and a more secure financial future. Consistent effort and a commitment to responsible financial behavior are key to unlocking the full potential of one's credit score.

Latest Posts

Related Post

Thank you for visiting our website which covers about Is A 705 Credit Score Good . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.