Can You Request A Credit Line Increase With Credit One Bank

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Can You Request a Credit Line Increase with Credit One Bank? Unlocking Higher Credit Limits

Is maximizing your Credit One Bank credit limit crucial for achieving your financial goals? This comprehensive guide unveils the process, strategies, and considerations for successfully requesting a credit line increase with Credit One Bank.

Editor’s Note: This article on requesting a credit line increase with Credit One Bank was published today, providing you with the most up-to-date information and strategies.

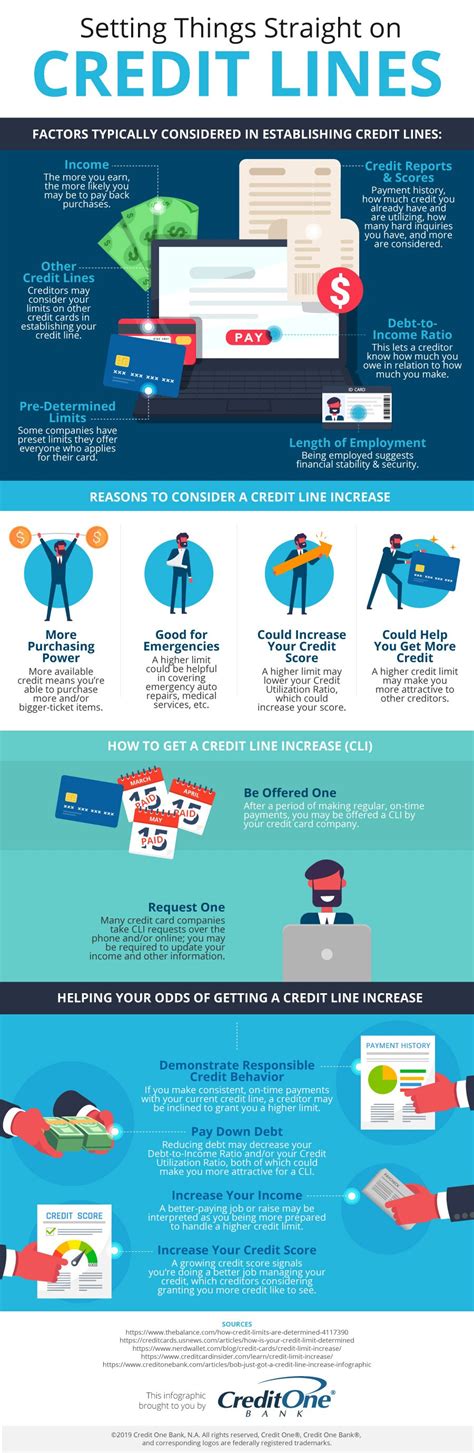

Why a Credit One Bank Credit Line Increase Matters:

Credit line increases are more than just numbers; they significantly impact your financial well-being. A higher credit limit can improve your credit utilization ratio – a key factor in your credit score. A lower credit utilization ratio (the percentage of your available credit you're using) demonstrates responsible credit management and can lead to a better credit score. This, in turn, can unlock access to better interest rates on loans, credit cards, and even insurance. Furthermore, a higher credit limit provides more financial flexibility, offering a safety net for unexpected expenses. For businesses using Credit One Bank cards, increased credit lines can facilitate smoother operations and larger purchases.

Overview: What This Article Covers:

This article provides a detailed exploration of how to successfully request a credit line increase with Credit One Bank. We will cover eligibility requirements, the application process, factors influencing approval, alternative options, and frequently asked questions. Readers will gain actionable insights and strategies to improve their chances of a successful application.

The Research and Effort Behind the Insights:

This article is based on extensive research, including an analysis of Credit One Bank's official website, credit utilization best practices, and expert opinions from financial advisors. We have reviewed numerous customer experiences and reports to offer readers realistic expectations and practical advice.

Key Takeaways:

- Understanding Credit One Bank's Requirements: Learn about the criteria Credit One Bank uses to evaluate credit line increase requests.

- Strategic Timing: Discover when is the best time to apply for a higher credit limit.

- Improving Your Credit Profile: Understand how to strengthen your creditworthiness before applying.

- Navigating the Application Process: A step-by-step guide to submitting your request.

- Handling Rejection: Strategies for dealing with a denied application.

- Alternatives to Credit Line Increases: Exploring other options to improve your financial flexibility.

Smooth Transition to the Core Discussion:

Now that we understand the importance of a credit line increase, let’s delve into the specifics of requesting one from Credit One Bank.

Exploring the Key Aspects of Requesting a Credit Line Increase with Credit One Bank:

1. Understanding Credit One Bank's Requirements:

Credit One Bank, like other credit card issuers, assesses applicants based on several factors before approving a credit limit increase. These typically include:

- Credit History: A longer history of responsible credit management is favorable. Credit One Bank will examine your payment history, looking for consistent on-time payments. Late payments or defaults can negatively impact your chances.

- Credit Score: A higher credit score generally signifies lower risk, increasing the likelihood of approval. Credit One Bank likely uses various credit scoring models to evaluate your creditworthiness.

- Income: A stable income demonstrates your ability to repay any increased debt. Providing documentation of your income can strengthen your application.

- Credit Utilization: Keeping your credit utilization low (ideally below 30%) demonstrates responsible credit management. A high credit utilization ratio suggests you may be struggling to manage your existing debt.

- Existing Credit Lines: Credit One Bank will consider the number of other credit accounts you hold and your overall debt load. Having too many open accounts or high levels of debt could negatively affect your application.

- Account Age: The age of your Credit One Bank account is a factor; a longer account history with positive payment behavior strengthens your application.

2. Strategic Timing:

The timing of your application can influence its success. It's generally recommended to apply after you've had your Credit One Bank account for at least six months to a year and have demonstrated a consistent history of on-time payments. Avoid applying immediately after a major life event, such as a job change or a large purchase, as these could negatively impact your credit profile.

3. Improving Your Credit Profile:

Before applying for a credit line increase, take steps to improve your creditworthiness. This might involve:

- Paying down existing debt: Lowering your credit utilization ratio is crucial.

- Paying bills on time: Consistent on-time payments are essential for building a strong credit history.

- Disputing any errors on your credit report: Incorrect information can negatively impact your credit score.

- Limiting new credit applications: Applying for too much new credit in a short period can hurt your credit score.

4. Navigating the Application Process:

The application process for a credit line increase with Credit One Bank typically involves:

- Online Application: Most credit card issuers allow credit limit increase requests through their online account portals. Log in to your Credit One Bank account and look for the option to request a credit line increase.

- Phone Call: You can also contact Credit One Bank's customer service directly to request a credit line increase. Be prepared to answer questions about your financial situation.

- Written Request: While less common, some institutions accept written requests. Check Credit One Bank's website for their preferred method.

- Providing Supporting Documentation: You may need to provide supporting documentation, such as proof of income or recent bank statements.

5. Handling Rejection:

If your application is rejected, don't be discouraged. Review the reasons given for the rejection and address any issues identified. Improving your credit score and reducing your debt load will significantly increase your chances of success in future applications.

6. Alternatives to Credit Line Increases:

If a credit line increase is denied, consider these alternatives:

- Balance Transfer: Transferring your balance to a card with a lower interest rate can save money on interest payments.

- Debt Consolidation Loan: Consolidating your debts into a single loan can simplify repayment and potentially lower your monthly payments.

- Applying for a new credit card: Applying for a new credit card with a higher credit limit may be an option, but this should be done strategically to avoid impacting your credit score.

Exploring the Connection Between Credit Score and Credit Line Increases:

The relationship between your credit score and your ability to obtain a credit line increase is paramount. A higher credit score signals lower risk to Credit One Bank, significantly improving your chances of approval. A low credit score, however, indicates a higher risk, leading to rejection or a smaller increase than requested.

Key Factors to Consider:

- Roles and Real-World Examples: A customer with a high credit score and low credit utilization consistently receives approval for credit line increases. Conversely, a customer with a low credit score and high credit utilization is more likely to be rejected.

- Risks and Mitigations: The risk of rejection can be mitigated by improving your credit score and lowering your credit utilization before applying.

- Impact and Implications: A successful credit line increase positively impacts your credit score and provides financial flexibility, while a rejection can hinder your financial goals.

Conclusion: Reinforcing the Connection:

The connection between your credit score and your success in requesting a credit line increase is undeniable. By proactively improving your creditworthiness, you can greatly enhance your chances of securing a higher credit limit with Credit One Bank.

Further Analysis: Examining Credit Utilization in Greater Detail:

Credit utilization is the percentage of your available credit you're currently using. Keeping this percentage low (below 30%) is critical for maintaining a healthy credit score. High credit utilization suggests overreliance on credit and is a red flag to lenders. Actively managing your credit utilization is crucial in demonstrating responsible credit management.

FAQ Section: Answering Common Questions About Credit Line Increases with Credit One Bank:

- Q: How often can I request a credit line increase? A: Credit One Bank may have limitations on how frequently you can apply. Check their website or contact customer service for details.

- Q: What happens if my request is denied? A: You'll receive a notification explaining the reason for denial. Address any identified issues and reapply later.

- Q: Will a credit line increase affect my credit score? A: A credit line increase inquiry will have a minor temporary impact on your credit score, but responsible credit management after the increase can offset this.

- Q: How long does it take to process a credit line increase request? A: The processing time varies, but it typically takes several weeks.

- Q: What documentation might Credit One Bank require? A: Credit One Bank may request proof of income, bank statements, or other financial documentation.

Practical Tips: Maximizing the Benefits of a Credit Line Increase:

- Understand the Basics: Before applying, understand Credit One Bank’s requirements and factors impacting approval.

- Improve Your Credit Profile: Take steps to improve your credit score and lower your credit utilization.

- Time Your Application Strategically: Apply after a period of consistent on-time payments.

- Follow the Application Process Carefully: Complete the application thoroughly and provide any necessary documentation.

- Manage Your Credit Responsibly: After receiving the increase, continue to manage your credit responsibly to maintain a healthy credit score.

Final Conclusion: Wrapping Up with Lasting Insights:

Securing a credit line increase with Credit One Bank requires strategic planning and responsible credit management. By understanding the requirements, improving your credit profile, and following the application process carefully, you can significantly improve your chances of success. A higher credit limit can provide valuable financial flexibility and contribute to a healthier credit score, opening doors to future financial opportunities.

Latest Posts

Related Post

Thank you for visiting our website which covers about Can You Request A Credit Line Increase With Credit One Bank . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.