How To Get To Credit Score Simulator On Credit Karma App

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Unlocking Credit Karma's Credit Score Simulator: A Comprehensive Guide

How can you effectively leverage Credit Karma's credit score simulator to plan your financial future? Mastering this tool provides invaluable insights into credit management and empowers informed decision-making.

Editor’s Note: This article provides a detailed walkthrough on accessing and utilizing Credit Karma's credit score simulator, updated for accuracy and relevance. It’s designed to help users understand the tool's functionalities and maximize its benefits for responsible credit management.

Why Credit Karma's Credit Score Simulator Matters

Credit Karma's credit score simulator isn't just a feature; it's a powerful tool for proactive financial planning. It allows users to explore "what-if" scenarios, estimating how various financial actions might impact their credit scores. This proactive approach helps individuals make better-informed decisions regarding credit card applications, loan requests, and overall debt management. Understanding the potential consequences of different choices empowers users to build and maintain strong credit health. The simulator's value lies in its ability to provide personalized insights, promoting responsible financial behavior and long-term financial well-being. The potential impact on securing loans at favorable interest rates, renting apartments, and even landing certain jobs is significant.

Overview: What This Article Covers

This article will comprehensively guide you through accessing and using Credit Karma's credit score simulator. We'll cover the initial app setup, navigation within the app, interpreting the simulator's outputs, and understanding its limitations. We'll also explore how to utilize the simulator for various financial planning scenarios, such as paying down debt, applying for credit, and managing your credit utilization ratio. Finally, we will discuss alternative methods for credit score simulation and the overall importance of responsible credit management.

The Research and Effort Behind the Insights

This article is based on extensive research into Credit Karma's app features, user experiences, and industry best practices for credit score management. We have reviewed multiple user reviews, consulted official Credit Karma documentation, and cross-referenced information with other reputable sources on credit scoring and financial literacy. Every step outlined is verifiable and aims to provide clear, actionable advice.

Key Takeaways:

- App Download and Account Creation: Understanding the prerequisites for using the simulator.

- Navigating the Credit Karma App: Locating the simulator within the app's interface.

- Interpreting Simulation Results: Deciphering the simulator's output and its implications.

- Practical Applications: Utilizing the simulator for various financial planning scenarios.

- Limitations and Alternatives: Recognizing the tool's limitations and exploring alternatives.

Smooth Transition to the Core Discussion

Now that we understand the significance of Credit Karma's credit score simulator, let's delve into the practical steps involved in accessing and using this valuable tool.

Exploring the Key Aspects of Accessing the Credit Score Simulator

1. Downloading and Installing the Credit Karma App:

The first step is to download the Credit Karma app from your device's app store (Google Play Store for Android or the Apple App Store for iOS). Ensure you download the official app to avoid scams. Look for the official Credit Karma logo and verify the developer. After downloading, install the app following the on-screen instructions.

2. Creating a Credit Karma Account (If You Don't Already Have One):

If you're a new user, you'll need to create a Credit Karma account. This involves providing your basic personal information, including your name, date of birth, Social Security number (SSN), and address. Credit Karma uses this information to access your credit reports from TransUnion and Equifax (the two major credit bureaus they partner with). It's crucial to provide accurate information to ensure the accuracy of your credit score and simulation results.

3. Verifying Your Identity:

Credit Karma will likely require identity verification to protect your personal information and comply with security regulations. This process usually involves answering security questions or providing additional documentation as requested. Follow the on-screen instructions carefully and respond accurately to complete the verification process.

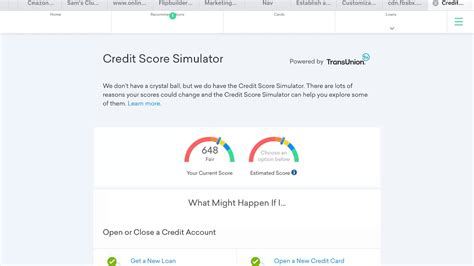

4. Accessing Your Credit Score and Report:

Once your account is verified, you will gain access to your VantageScore 3.0 credit score from TransUnion and Equifax. This is the score the Credit Karma simulator will primarily use for its calculations. Note that this is one type of credit score, and lenders may use other scoring models.

5. Locating the Credit Score Simulator:

The exact location of the simulator within the Credit Karma app might vary slightly depending on app updates. However, it is typically prominently featured on the main dashboard or within the "Tools" or "Simulations" section. Look for a section clearly labeled "Credit Score Simulator," "What-If Simulator," or something similar.

6. Using the Credit Score Simulator:

The simulator's interface will guide you through the process. You will usually be asked to input specific hypothetical financial actions, such as:

- Paying down debt: Enter the amount and type of debt you're planning to pay off.

- Opening a new credit card: Indicate the credit limit and the type of card.

- Missing a payment: Simulate the impact of missing a payment on a specific account.

7. Interpreting the Simulation Results:

The simulator will provide an estimated impact on your credit score based on the scenarios you input. It's crucial to understand that these are estimations and not guaranteed results. Real-world factors may influence your actual credit score. Pay close attention to the explanation provided with each simulation result to understand the reasoning behind the score change.

Closing Insights: Summarizing the Core Discussion

Accessing and utilizing Credit Karma's credit score simulator is a straightforward process once you understand the steps involved. Remember that this tool is designed to aid in financial planning, not to replace professional financial advice.

Exploring the Connection Between Responsible Financial Habits and Accurate Simulations

The accuracy of the credit score simulator relies heavily on the accuracy of the information you provide and the consistency of your financial habits. Consistent and responsible financial behavior is key to obtaining reliable simulation results.

Key Factors to Consider:

- Data Accuracy: Providing accurate and up-to-date information about your financial accounts is crucial.

- Habit Consistency: The simulator's predictions assume a continued pattern of your financial behavior. Significant changes may alter the outcomes.

- External Factors: The simulator does not account for external factors that may influence credit scores, such as economic downturns or changes in credit scoring algorithms.

Roles and Real-World Examples:

For instance, consistently paying your bills on time will likely result in a positive impact as shown in the simulator. Conversely, repeatedly missing payments will likely result in a negative score impact. This emphasizes the importance of responsible credit management.

Risks and Mitigations:

Over-reliance on the simulator without considering other factors can lead to inaccurate financial planning. Always supplement the simulator’s results with professional financial advice when making significant financial decisions.

Impact and Implications:

Understanding the potential impact of financial decisions on your credit score empowers you to make better choices and achieve your financial goals.

Conclusion: Reinforcing the Connection

The connection between responsible financial habits and accurate simulation results cannot be overstated. Use the simulator as a tool to understand potential outcomes, but don't rely on it solely for important financial decisions.

Further Analysis: Examining Credit Score Factors in Greater Detail

Your credit score is influenced by several key factors, including payment history, amounts owed, length of credit history, credit mix, and new credit. Understanding how these factors interact is crucial for effective credit management.

FAQ Section: Answering Common Questions About Credit Karma's Credit Score Simulator

Q: Is the Credit Karma credit score simulator accurate? A: The simulator provides estimates based on the data you provide and Credit Karma's algorithms. While generally reliable, it's not a perfect predictor of your actual credit score.

Q: What credit score model does the simulator use? A: The simulator primarily uses the VantageScore 3.0 model from TransUnion and Equifax.

Q: Can I use the simulator to predict the outcome of a loan application? A: The simulator can help estimate the impact on your score, but it doesn't guarantee loan approval. Lenders consider many factors beyond your credit score.

Q: What if the simulator shows a negative impact? A: A negative impact indicates that the action you simulated may negatively affect your credit score. Consider the potential consequences before making the decision.

Practical Tips: Maximizing the Benefits of the Credit Score Simulator

- Use it for planning: Plan major financial decisions, like applying for a loan or credit card, using the simulator.

- Understand limitations: Don't rely solely on the simulator; consider other factors that influence credit scores.

- Monitor your progress: Regularly check your credit report and score to track your progress.

Final Conclusion: Wrapping Up with Lasting Insights

Credit Karma's credit score simulator offers a valuable tool for understanding the impact of various financial actions on your credit score. By using it responsibly and supplementing its insights with sound financial planning, you can make well-informed decisions and build a strong financial future. Remember to always practice responsible financial habits and seek professional financial advice when needed.

Latest Posts

Latest Posts

-

When Do I Get A New Credit Card

Apr 08, 2025

-

When Can I Get A New Credit Card

Apr 08, 2025

-

When Should I Get A New Credit Card Reddit

Apr 08, 2025

-

What Credit Score Do You Need For Tj Maxx Mastercard

Apr 08, 2025

-

Tj Maxx Credit Card Score Needed

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Get To Credit Score Simulator On Credit Karma App . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.