What Credit Card Can I Get With A 600 Credit Score Reddit

adminse

Apr 07, 2025 · 9 min read

Table of Contents

What Credit Card Can I Get with a 600 Credit Score? Reddit's Insights and Beyond

What if securing a credit card with a 600 credit score is easier than you think? A strategic approach, informed by real-world experiences and expert advice, can unlock access to valuable financial tools.

Editor's Note: This article on obtaining a credit card with a 600 credit score was published [Date]. We understand the challenges of building credit and aim to provide you with the most up-to-date and accurate information available. We've consulted various resources, including Reddit discussions, to provide a comprehensive overview.

Why a Credit Card with a 600 Credit Score Matters:

A credit score of 600 sits in the "fair" range. While not ideal, it's not a dead end. Securing a credit card at this score is crucial for several reasons: It allows you to begin rebuilding your credit, demonstrating responsible credit use to lenders, and accessing convenient financial tools like rewards programs and purchase protection. Building a positive credit history is essential for future loans, mortgages, and even renting an apartment. A credit card can serve as a stepping stone toward a brighter financial future. This is particularly relevant in today's digital economy where many transactions are conducted electronically.

Overview: What This Article Covers:

This article will delve into the strategies for obtaining a credit card with a 600 credit score. We will examine various card types, discuss factors influencing approval, explore resources beyond Reddit, and offer practical advice for maximizing your chances of success. We will also address common concerns and misconceptions based on Reddit user experiences and provide a comprehensive FAQ section.

The Research and Effort Behind the Insights:

This article incorporates insights from extensive research, including analysis of numerous Reddit threads related to credit card applications with fair credit scores, comparisons of various credit card offers from reputable issuers, and review of financial advice from reputable sources. The information provided is intended to be factual and unbiased, offering actionable strategies for readers.

Key Takeaways:

- Understanding Credit Card Types: Different cards cater to different credit profiles.

- Improving Your Chances of Approval: Proactive steps to enhance your application.

- Secured vs. Unsecured Cards: The pros and cons of each option.

- Building Credit Responsibly: Strategies for improving your credit score over time.

- Reading the Fine Print: Avoiding hidden fees and unfavorable terms.

Smooth Transition to the Core Discussion:

With a solid understanding of the importance of securing a credit card, let's explore the practical steps involved and the various options available to individuals with a 600 credit score.

Exploring the Key Aspects of Obtaining a Credit Card with a 600 Credit Score:

1. Understanding Credit Card Types:

Several types of credit cards cater to different credit profiles. The most common categories relevant to individuals with a 600 credit score are:

-

Secured Credit Cards: These cards require a security deposit, which typically serves as your credit limit. This reduces the risk to the issuer, making approval more likely. The deposit is usually returned after a period of responsible use. Many secured cards report to the credit bureaus, helping to build your credit history.

-

Credit Builder Cards: These cards are specifically designed to help individuals build credit. They often have lower credit limits and may charge annual fees, but they report payment activity to the credit bureaus, positively impacting your credit score over time.

-

Student Credit Cards: If you're a student, you might qualify for a student credit card even with a 600 credit score. These cards often have lower credit limits and may require a co-signer.

-

Store Credit Cards: Retail stores sometimes offer their own credit cards. While these cards can be useful for earning rewards within that specific store, they generally have high interest rates. Approvals for store cards are often more lenient compared to major credit card issuers. However, make sure to understand their terms as they can be less favorable.

2. Improving Your Chances of Approval:

Several factors can impact your chances of approval for a credit card with a 600 credit score:

-

Check Your Credit Report: Before applying, review your credit report for errors. Correcting any inaccuracies can positively influence your score.

-

Reduce Your Credit Utilization: Keep your credit utilization (the amount of credit you're using compared to your available credit) low. Aim for under 30%, ideally closer to 10%.

-

Pay Bills On Time: Consistent on-time payments demonstrate financial responsibility.

-

Limit New Credit Applications: Applying for multiple cards in a short period can negatively impact your credit score.

-

Choose the Right Card: Select a card tailored to your credit profile and financial goals.

3. Secured vs. Unsecured Cards:

The choice between a secured and unsecured card depends on your risk tolerance and financial situation.

-

Secured Cards: Offer a guaranteed approval but require a security deposit. They're ideal for building credit from scratch or repairing a damaged credit history.

-

Unsecured Cards: Don't require a security deposit, but approval is contingent upon your creditworthiness. They offer more flexibility but may be harder to obtain with a 600 credit score.

4. Building Credit Responsibly:

Once you secure a credit card, responsible use is paramount:

-

Pay Your Balance in Full and On Time: This is the single most important factor in improving your credit score.

-

Keep Your Credit Utilization Low: Avoid maxing out your card.

-

Monitor Your Credit Report Regularly: Stay informed about your credit history.

5. Reading the Fine Print:

Carefully review the terms and conditions of any credit card before accepting it. Pay close attention to:

-

Annual Fees: Some cards charge annual fees, which can eat into your rewards.

-

Interest Rates (APR): High APRs can quickly accumulate debt if you don't pay your balance in full.

-

Late Payment Fees: Understand the penalties for missed payments.

Exploring the Connection Between Reddit and Credit Card Applications:

Reddit offers a valuable platform for sharing experiences and insights on credit card applications. Subreddits like r/CreditCards and r/personalfinance provide a wealth of information from users who have navigated similar situations. However, it's crucial to remember that anecdotal evidence is not a substitute for professional financial advice. The experiences shared on Reddit can be informative but may not be universally applicable.

Key Factors to Consider (Based on Reddit Insights):

-

Pre-qualification Tools: Many issuers offer pre-qualification tools that allow you to check your chances of approval without impacting your credit score. Reddit users frequently discuss the usefulness of these tools.

-

Building Credit Gradually: Reddit users often emphasize the importance of starting with a secured card and gradually working towards unsecured cards as their credit scores improve.

-

Importance of Responsible Use: The consensus across Reddit is clear: responsible credit card use is essential for building a strong credit history.

Roles and Real-World Examples:

Reddit users frequently share their success stories (and sometimes failures) with specific credit cards. These narratives illustrate the importance of understanding your credit profile and choosing a card that aligns with your financial situation. For instance, some users report success with secured cards from Capital One or Discover, while others found success with credit builder cards from specific banks or credit unions. However, it is vital to understand that personal experiences can vary greatly.

Risks and Mitigations:

The primary risk is applying for cards you are unlikely to get approved for, which can negatively impact your credit score. Mitigation involves using pre-qualification tools, carefully reviewing eligibility requirements, and understanding your credit report before applying.

Impact and Implications:

Reddit discussions highlight the importance of strategic credit card management. Successfully navigating this process can lead to better financial opportunities in the future, including access to loans with better interest rates and greater borrowing power.

Conclusion: Reinforcing the Connection:

Reddit discussions provide a valuable source of user experiences related to obtaining credit cards with a 600 credit score, highlighting the importance of understanding your credit profile, choosing the right card, and utilizing responsible credit practices. While helpful, it’s vital to supplement Reddit information with professional financial guidance.

Further Analysis: Examining Credit Score Improvement in Greater Detail:

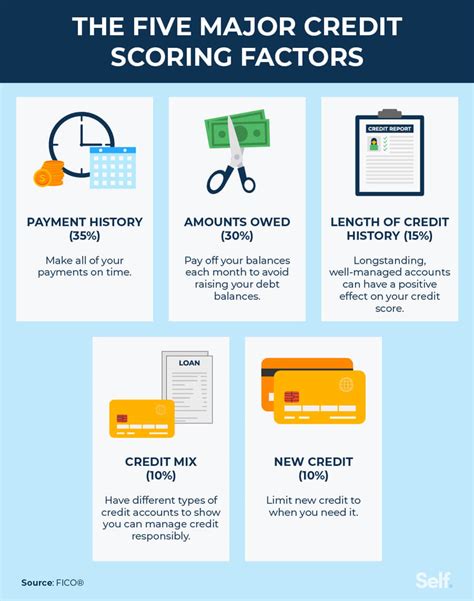

Improving your credit score beyond 600 requires consistent effort and discipline. Key strategies include:

-

Paying Bills On Time: This is the most significant factor influencing your credit score.

-

Maintaining Low Credit Utilization: Keeping your credit usage below 30% of your available credit is crucial.

-

Diversifying Your Credit Mix: Having a mix of credit accounts (e.g., credit cards, installment loans) can positively impact your score.

-

Dispute Errors on Your Credit Report: Incorrect information on your credit report can negatively affect your score.

-

Monitoring Your Credit Score: Regularly checking your credit score can help you track your progress.

FAQ Section: Answering Common Questions About Credit Cards and 600 Credit Scores:

Q: What are the best credit cards for a 600 credit score?

A: There's no single "best" card. The best option depends on your individual circumstances. Secured credit cards and credit builder cards are often the most accessible options for those with a 600 credit score. Research cards from issuers like Capital One, Discover, and smaller credit unions.

Q: Can I get an unsecured credit card with a 600 credit score?

A: It's possible, but less likely than getting approved for a secured card. Your chances increase with a strong income, low debt-to-income ratio, and a history of on-time payments on other credit accounts.

Q: How long does it take to improve my credit score?

A: The time it takes to improve your credit score varies depending on your starting point and the steps you take. Consistent responsible credit behavior can lead to noticeable improvements within six months to a year.

Q: What happens if I miss a credit card payment?

A: Missing a payment can negatively impact your credit score and lead to late payment fees. It's crucial to make every effort to pay on time.

Practical Tips: Maximizing the Benefits of Credit Card Ownership:

-

Choose a Card Wisely: Select a card that aligns with your financial goals and credit profile.

-

Set Up Automatic Payments: Avoid missed payments by automating your payments.

-

Track Your Spending: Monitor your credit card usage to stay within your budget.

-

Pay Your Balance in Full Each Month: Avoid accruing interest charges.

-

Review Your Credit Report Regularly: Stay informed about your credit health.

Final Conclusion: Wrapping Up with Lasting Insights:

Securing a credit card with a 600 credit score is achievable with a strategic approach. By understanding the different card types, taking proactive steps to improve your credit profile, and using credit responsibly, you can gain access to valuable financial tools and pave the way for a brighter financial future. Remember, Reddit offers a valuable resource, but professional financial advice is always recommended.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Credit Card Can I Get With A 600 Credit Score Reddit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.