What Are The Requirements For A Private Student Loan

adminse

Mar 28, 2025 · 7 min read

Table of Contents

Navigating the Maze: A Comprehensive Guide to Private Student Loan Requirements

What if securing the funding for your education hinges on understanding the intricate requirements of private student loans? These loans, while offering flexibility, demand careful consideration of eligibility criteria and associated responsibilities.

Editor’s Note: This article on private student loan requirements was published today, offering readers up-to-date information and insights to navigate the complexities of securing private student financing.

Why Private Student Loans Matter:

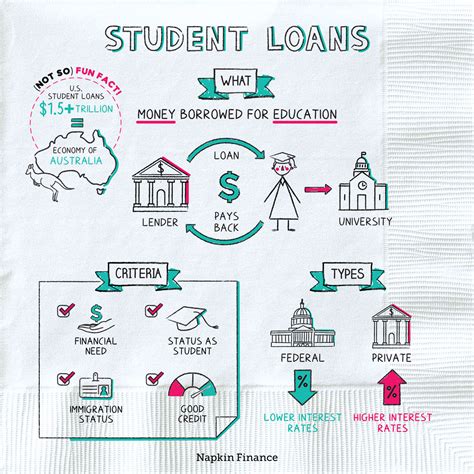

Private student loans supplement federal student aid, offering crucial funding for higher education expenses not fully covered by grants, scholarships, or federal loans. They provide flexibility for students who may not qualify for or need the full amount available through federal programs. However, it's vital to understand that private loans often come with higher interest rates and less favorable repayment terms than federal loans. Understanding the requirements is crucial to making informed borrowing decisions and avoiding financial pitfalls. This understanding is vital for students, parents, and co-signers alike. The implications of choosing private student loans extend beyond the immediate need for funding and impact long-term financial health. Careful consideration of the terms and conditions is paramount to responsible borrowing.

Overview: What This Article Covers:

This article delves into the core aspects of private student loan requirements, exploring eligibility criteria, application processes, and crucial factors to consider before borrowing. Readers will gain actionable insights backed by research and real-world examples, enabling them to navigate the private student loan landscape confidently.

The Research and Effort Behind the Insights:

This comprehensive guide is the result of extensive research, drawing upon information from reputable sources including government websites, financial institutions, and consumer advocacy groups. Data on interest rates, repayment options, and eligibility criteria have been carefully analyzed to provide accurate and up-to-date information for prospective borrowers. The aim is to offer readers clear, unbiased advice to aid in informed decision-making.

Key Takeaways:

- Creditworthiness: A strong credit score and history are often paramount.

- Income Verification: Lenders typically assess the borrower's or co-signer's income stability.

- Enrollment Verification: Proof of enrollment in an eligible educational program is required.

- Co-Signer Requirements: Understanding the role and responsibility of a co-signer is vital.

- Loan Terms and Fees: Carefully reviewing interest rates, fees, and repayment options is crucial.

Smooth Transition to the Core Discussion:

Having established the significance of private student loans and the research underpinning this guide, let's examine the key aspects of their requirements in detail.

Exploring the Key Aspects of Private Student Loan Requirements:

1. Creditworthiness: This is often the most significant hurdle for prospective borrowers. Most private lenders require applicants to have established credit history, ideally with a good credit score (generally above 670). A strong credit history demonstrates responsible financial management, increasing the lender's confidence in the borrower's ability to repay the loan. Individuals with limited or poor credit history may find it difficult to secure a loan without a co-signer.

2. Income Verification: Lenders assess the borrower's or co-signer's income to determine their ability to repay the loan. They usually require proof of income, such as pay stubs, tax returns, or employment verification letters. Consistent income streams and stable employment history are crucial factors in loan approval. The required income level varies depending on the lender and the loan amount.

3. Enrollment Verification: Private lenders need verification that the borrower is enrolled in, or accepted into, an eligible educational program at an accredited institution. This usually involves providing documentation such as an acceptance letter, enrollment confirmation, or transcript. The program must be recognized by the lender; some lenders may have specific limitations on the types of programs they fund.

4. Co-Signer Requirements: If a borrower lacks sufficient credit history or income, a co-signer is often necessary. A co-signer is an individual with good credit who agrees to be jointly responsible for repaying the loan if the borrower defaults. Lenders view co-signers as a way to mitigate risk, increasing the likelihood of loan repayment. The requirements for co-signers are similar to those for primary borrowers, emphasizing creditworthiness and income stability. The co-signer should carefully consider the implications before agreeing to this significant financial responsibility.

5. Loan Terms and Fees: Private student loans vary significantly in their terms and fees. Interest rates are typically higher than those for federal student loans, and they can be variable or fixed. Borrowers should compare rates from multiple lenders to find the most favorable terms. It's important to understand all associated fees, such as origination fees, late payment fees, and prepayment penalties. Understanding the repayment schedule, including the length of the repayment period and the monthly payment amount, is crucial for budgeting and responsible repayment.

Exploring the Connection Between Credit Score and Private Student Loan Approval:

The relationship between a credit score and private student loan approval is paramount. A higher credit score significantly improves the chances of loan approval and often leads to more favorable interest rates. Individuals with excellent credit scores may be offered lower interest rates and more favorable loan terms compared to those with lower scores.

Key Factors to Consider:

- Roles and Real-World Examples: A borrower with a 750 credit score is far more likely to secure a loan with a competitive interest rate than someone with a 600 score. A co-signer with excellent credit can help a borrower with limited credit history secure a loan.

- Risks and Mitigations: A low credit score may result in loan denial or higher interest rates. Building credit history before applying for a loan can mitigate this risk.

- Impact and Implications: A higher interest rate increases the total cost of the loan, extending the repayment period and increasing the overall debt burden.

Conclusion: Reinforcing the Connection:

The impact of credit score on private student loan approval cannot be overstated. Building and maintaining a strong credit score is crucial for obtaining favorable loan terms and securing the necessary funding for higher education.

Further Analysis: Examining Credit Building in Greater Detail:

Building credit responsibly takes time and effort. Strategies include paying bills on time, maintaining low credit utilization, and applying for credit cautiously. Utilizing credit-builder tools and monitoring credit reports are also vital steps.

FAQ Section: Answering Common Questions About Private Student Loan Requirements:

Q: What is a co-signer, and why is one needed?

A: A co-signer is an individual with good credit who agrees to be responsible for loan repayment if the borrower defaults. They are often required for borrowers with limited credit history or low credit scores.

Q: How can I improve my chances of getting a private student loan?

A: Improve your credit score, maintain a stable income, ensure enrollment in an eligible program, and consider applying with a co-signer if necessary.

Q: What are the typical fees associated with private student loans?

A: Fees may include origination fees, late payment fees, and prepayment penalties. These vary by lender.

Q: How do interest rates work on private student loans?

A: Interest rates can be fixed or variable and are influenced by creditworthiness and market conditions.

Practical Tips: Maximizing the Benefits of Private Student Loans:

- Shop Around: Compare offers from multiple lenders to find the best interest rates and terms.

- Understand the Terms: Carefully review all loan documents before signing.

- Budget Wisely: Create a realistic budget that accounts for loan repayment.

- Explore Alternatives: Consider scholarships, grants, and federal loans before turning to private loans.

Final Conclusion: Wrapping Up with Lasting Insights:

Navigating the world of private student loans requires careful planning and thorough understanding of the requirements. By understanding creditworthiness, income verification, and the role of co-signers, prospective borrowers can make informed decisions and secure the necessary funding for their educational goals. However, the responsible use of private student loans and the importance of planning for repayment cannot be overemphasized. Borrowing responsibly is vital for long-term financial well-being.

Latest Posts

Latest Posts

-

Where Can I Make A Money Order With Credit Card

Apr 07, 2025

-

Where Can I Get A Money Order With A Credit Card Near Me

Apr 07, 2025

-

How Long Does Paid Off Debt Stay On Credit Report

Apr 07, 2025

-

How Long Does Paid Collections Stay On Your Credit Report

Apr 07, 2025

-

How Long Do Paid Medical Collections Stay On Credit Report

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Are The Requirements For A Private Student Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.