Fafsa Without Student Loan

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Navigating FAFSA Without Student Loans: Maximizing Grants and Scholarships

Can you afford college without taking on crippling student loan debt? The answer may be a resounding "yes," if you strategically navigate the FAFSA process.

Editor’s Note: This article provides up-to-date information on utilizing the Free Application for Federal Student Aid (FAFSA) to maximize grant funding and scholarships, thereby minimizing or eliminating the need for student loans. The information is current as of the date of publication but may be subject to change; always refer to official government websites for the most current details.

Why FAFSA Without Student Loans Matters:

The rising cost of higher education is a significant concern for many families. Student loan debt has reached crisis levels, impacting graduates' financial futures for years after graduation. However, many students mistakenly believe that FAFSA is solely about securing loans. The truth is, FAFSA is the gateway to a wide range of federal and institutional grants and scholarships that can significantly reduce or even eliminate the need for borrowing. Understanding how to leverage FAFSA without relying on loans is crucial for achieving a debt-free college experience.

Overview: What This Article Covers:

This article will guide you through the process of completing the FAFSA form strategically to maximize your chances of receiving grants and scholarships. We'll explore various funding sources, discuss eligibility criteria, provide tips for strengthening your application, and offer advice on managing financial aid offers.

The Research and Effort Behind the Insights:

This article is based on extensive research, incorporating information from the U.S. Department of Education, official FAFSA resources, and expert opinions from financial aid professionals. We've analyzed data on grant availability, scholarship opportunities, and successful strategies for securing financial aid without loans.

Key Takeaways:

- Understanding FAFSA's Purpose: FAFSA is more than just a loan application; it’s the key to unlocking numerous grant and scholarship opportunities.

- Maximizing Grant Eligibility: Learn strategies to improve your chances of receiving federal and institutional grants.

- Exploring Scholarship Opportunities: Discover various scholarship sources and effective application techniques.

- Strategic Financial Aid Management: Learn how to effectively compare and accept financial aid offers to minimize or avoid loans.

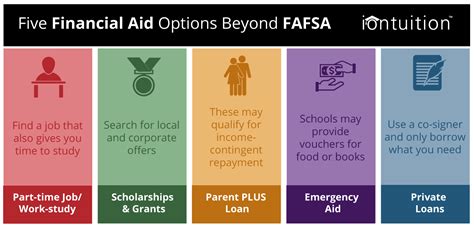

- Beyond FAFSA: Explore additional funding options beyond the federal aid system.

Smooth Transition to the Core Discussion:

Now that we've established the importance of navigating FAFSA for grant and scholarship funding, let's delve into the specifics of maximizing your financial aid without relying on student loans.

Exploring the Key Aspects of FAFSA Without Student Loans:

1. Understanding FAFSA and its Components:

The FAFSA (Free Application for Federal Student Aid) is a crucial form that determines your eligibility for federal student aid, including grants, loans, and work-study programs. While many associate FAFSA with loans, the primary goal should be to secure as much grant funding as possible. Grants are essentially free money that doesn't need to be repaid. Completing the FAFSA accurately and thoroughly is paramount. The information requested includes family income, tax information, assets, and the number of family members in college. Be prepared to gather all necessary documents before starting the application.

2. Maximizing Grant Eligibility:

Several factors influence your eligibility for federal grants like the Pell Grant, the largest federal grant program for undergraduate students. These factors include:

- Expected Family Contribution (EFC): Your EFC is a measure of your family's ability to pay for college. A lower EFC increases your chances of receiving a larger Pell Grant. Accurate reporting of your family's financial information is crucial for an accurate EFC calculation.

- Demonstrated Financial Need: The FAFSA determines your financial need based on the EFC and the cost of attendance at your chosen institution. If your financial need is high, you are more likely to qualify for grants.

- Enrollment Status: Full-time students generally receive more grant funding than part-time students.

- Academic Performance: While not always a direct eligibility factor for federal grants, strong academic performance can increase your chances of securing merit-based scholarships which can often be used in conjunction with grants.

3. Exploring Scholarship Opportunities:

Beyond federal grants, numerous scholarships are available to students with various backgrounds and interests. These scholarships can significantly offset college costs. To locate suitable scholarship opportunities, consider the following resources:

- Institutional Scholarships: Colleges and universities often offer merit-based and need-based scholarships to their enrolled students. These scholarships are usually awarded automatically based on your FAFSA information or through a separate application process.

- External Scholarships: Many private organizations, corporations, and foundations offer scholarships based on academic achievement, extracurricular activities, community involvement, or specific demographics.

- Scholarship Search Engines: Several online resources like Fastweb, Scholarships.com, and Peterson's can help you find scholarships that match your criteria. Be cautious of scam websites and ensure the scholarship is legitimate.

4. Strategic Financial Aid Management:

Once you receive financial aid offers, compare the offers carefully to ensure you understand the terms and conditions. This includes understanding the difference between grants, loans, and scholarships. Prioritize grants and scholarships to minimize borrowing. If you need to take out loans, try to borrow only what's absolutely necessary. Federal student loans generally offer better interest rates than private loans.

5. Beyond FAFSA:

Beyond FAFSA, several additional funding options exist:

- State Grants: Many states offer grants to residents attending colleges within the state. Eligibility criteria vary by state.

- Employer Tuition Reimbursement: If your employer offers tuition assistance, this can significantly reduce your educational expenses.

- Military Benefits: Students with military service backgrounds may be eligible for educational benefits.

- Work-Study: This federal program provides part-time employment opportunities to students who demonstrate financial need.

Exploring the Connection Between "Early Planning" and "FAFSA Without Student Loans"

Early planning is crucial for maximizing your chances of obtaining financial aid without loans. This involves:

Roles and Real-World Examples:

Proactive planning allows for adequate time to research scholarship opportunities, improve academic performance to boost eligibility, and develop a strong financial aid application. For example, students who begin researching scholarships during their junior year of high school are more likely to secure multiple awards than those who start the search later.

Risks and Mitigations:

Delaying the FAFSA application or neglecting to research scholarship opportunities increases the risk of relying heavily on loans. Mitigation strategies include setting reminders, creating a scholarship search timeline, and seeking guidance from school counselors or financial aid professionals.

Impact and Implications:

Early planning significantly impacts the financial health of students, reducing the burden of student loan debt and allowing graduates to pursue their career goals without financial constraints.

Conclusion: Reinforcing the Connection

The connection between early planning and securing financial aid without student loans is undeniable. Proactive students who dedicate time and effort to the FAFSA process and scholarship research are significantly more likely to attain a debt-free college education.

Further Analysis: Examining "Financial Literacy" in Greater Detail

Financial literacy plays a significant role in navigating the FAFSA process effectively. It empowers students and their families to make informed decisions about college financing. This includes understanding:

- Budgeting and Savings: Saving money for college is crucial in reducing the reliance on loans. Students should develop budgeting habits and save consistently throughout high school.

- Understanding Credit Scores: A good credit score is important if students need to take out private student loans. Maintaining a good credit history is a long-term strategy.

- Debt Management: Understanding the implications of student loans is critical to avoid over-borrowing and long-term financial strain.

FAQ Section: Answering Common Questions About FAFSA Without Student Loans:

- Q: What if my EFC is high? Can I still get grants? A: While a higher EFC reduces your chances of receiving federal grants, you can still explore institutional grants and various scholarships.

- Q: When should I complete the FAFSA? A: The FAFSA opens every October 1st for the upcoming academic year. Completing it as early as possible is recommended to secure aid promptly.

- Q: How can I increase my chances of winning a scholarship? A: Focus on strong academic performance, engage in extracurricular activities, participate in community service, and craft compelling scholarship essays.

- Q: What if I don't qualify for federal grants? A: Explore state grants, institutional scholarships, and external scholarship opportunities.

Practical Tips: Maximizing the Benefits of FAFSA Without Student Loans:

- Complete the FAFSA early: This allows you to secure funding before it runs out.

- Create a scholarship search strategy: Use online resources and target specific scholarships relevant to your background and interests.

- Network and seek advice: Talk to school counselors, teachers, and family members about potential scholarship opportunities.

- Develop a strong application: Submit high-quality applications that highlight your achievements and aspirations.

- Explore alternative funding options: Investigate state grants, employer tuition assistance, and military benefits if applicable.

Final Conclusion: Wrapping Up with Lasting Insights:

Securing a college education without crippling student loan debt is achievable through strategic planning and a thorough understanding of the FAFSA process. By focusing on maximizing grants and scholarships, students can significantly reduce or eliminate the need to borrow. This approach requires proactive planning, thorough research, and a dedicated commitment to securing financial aid. Remember that college is a significant investment; by navigating the FAFSA process intelligently, you can make that investment more manageable and pave the way for a brighter financial future.

Latest Posts

Latest Posts

-

Investment Advisers Act Of 1940 Definition Overview

Apr 24, 2025

-

Investment Adviser Association Iaa Definition

Apr 24, 2025

-

How Much Is Insurance For A Camaro

Apr 24, 2025

-

Who Owns Valley Forge Insurance Company

Apr 24, 2025

-

How To Get Eyelid Surgery Covered By Insurance

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about Fafsa Without Student Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.