How Long Do Paid Medical Collections Stay On Credit Report

adminse

Apr 07, 2025 · 7 min read

Table of Contents

How Long Do Paid Medical Collections Stay on Your Credit Report?

How long does a stain on your credit report linger, even after you've paid a medical debt? The answer is more nuanced than you might think.

Editor’s Note: This article on how long paid medical collections stay on your credit report was published today, [Date]. We’ve compiled the latest information to help you understand this crucial aspect of your credit health.

Why Medical Collection Accounts Matter:

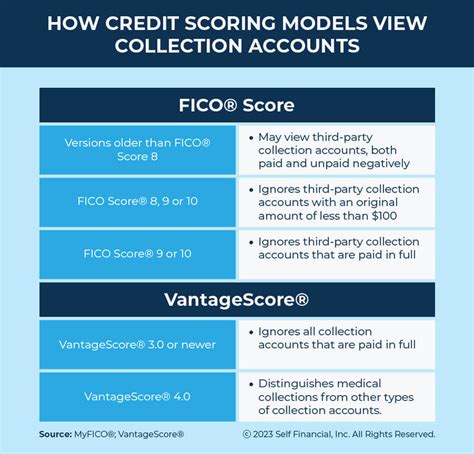

Medical debt is a significant contributor to negative credit reports in the United States. Many individuals face unexpected high medical bills, leading to difficulties in timely payment. Even after diligent efforts to resolve the debt, the lingering impact on credit scores can be substantial. Understanding how long these entries remain on your credit report is vital for financial planning and recovery.

Overview: What This Article Covers:

This comprehensive guide delves into the lifespan of paid medical collections on your credit report. We will examine the relevant laws, the differences between paid and unpaid collections, the impact on your credit score, and strategies for mitigating the negative effects. We will also discuss the role of credit reporting agencies and the steps you can take to improve your credit health after resolving medical debt.

The Research and Effort Behind the Insights:

This article is based on extensive research, drawing from the Fair Credit Reporting Act (FCRA), guidelines from the three major credit bureaus (Equifax, Experian, and TransUnion), consumer finance websites, and legal precedents related to medical debt collection. Our aim is to provide accurate and up-to-date information to help you navigate this complex issue.

Key Takeaways:

- Generally, paid medical collections remain on your credit report for seven years from the date of the first delinquency. This applies to most negative information, including charge-offs and collections accounts.

- The date of first delinquency is crucial, not the date of payment or the date the account was sent to collections.

- After seven years, the negative information must be removed. Credit bureaus are legally obligated to remove this data after this period.

- There are exceptions: Some states have different regulations affecting the reporting period. Additionally, certain types of medical debt might have shorter reporting periods.

- Paying the debt does not immediately remove the entry. While payment is essential, it does not automatically erase the record.

- Dispute inaccurate information. If you identify errors in the reporting, you have the right to dispute the accuracy of the information with the credit bureaus.

Smooth Transition to the Core Discussion:

Now that we've established the basics, let's explore the nuances of how paid medical collections affect your credit report and how long they stay.

Exploring the Key Aspects of Paid Medical Collections on Credit Reports:

1. Definition and Core Concepts:

A medical collection account arises when a medical provider sends a debt to a collections agency because the original bill hasn't been paid. Once the debt is sent to collections, it is reported to the credit bureaus, impacting your credit score. Even if you subsequently pay the debt in full, the entry remains on your report for a defined period.

2. Applications Across Industries:

Understanding how long paid medical collections remain on your credit report is crucial for various life decisions. It affects your ability to obtain loans (mortgages, auto loans, personal loans), secure credit cards, rent an apartment, and even land certain jobs.

3. Challenges and Solutions:

The primary challenge is the persistent negative impact on credit scores, even after paying the debt. The solution lies in understanding the timeline, actively monitoring your credit reports, and proactively addressing inaccuracies.

4. Impact on Innovation (Future Implications):

The increasing prevalence of medical debt and its impact on credit scores highlights the need for innovative solutions in the healthcare finance system. This includes transparent billing practices, better financial assistance programs, and improved debt resolution mechanisms.

Closing Insights: Summarizing the Core Discussion:

The length of time paid medical collections stay on your credit report is a significant factor impacting your financial health. The seven-year rule is the general guideline, but individual circumstances can vary. Proactive monitoring and addressing inaccuracies are crucial steps in mitigating the long-term effects.

Exploring the Connection Between the Fair Credit Reporting Act (FCRA) and Paid Medical Collections:

The FCRA is the cornerstone of consumer credit protection in the U.S. It dictates how credit information is collected, used, and disclosed. The FCRA mandates that negative information, including paid medical collections, generally remains on a credit report for seven years from the date of first delinquency. This date is not when you paid the debt but when the account was first reported as past due.

Key Factors to Consider:

- Roles and Real-World Examples: Imagine a person who paid a medical collection after a year of delinquency. The entry will remain on their credit report for six more years, even though the debt is settled.

- Risks and Mitigations: The risk is a lower credit score, making it harder to access credit. Mitigation involves early payment, proactive credit monitoring, and disputing inaccuracies.

- Impact and Implications: The long-term impact can restrict financial opportunities and potentially affect various aspects of daily life.

Conclusion: Reinforcing the Connection:

The FCRA's guidelines provide a framework, but practical application requires diligence and awareness. Understanding the nuances of the FCRA’s stipulations regarding paid medical collections is key to protecting your financial future.

Further Analysis: Examining the Role of Credit Reporting Agencies in Greater Detail:

The three major credit bureaus—Equifax, Experian, and TransUnion—play a central role in maintaining and distributing credit reports. They collect data from various sources, including medical collection agencies. Understanding how these agencies handle and report paid medical collections is essential. Consumers have rights under the FCRA to access and dispute the accuracy of the information on their reports.

FAQ Section: Answering Common Questions About Paid Medical Collections:

- Q: What is a "date of first delinquency"? A: This is the date the account was first reported as past due to the credit bureaus.

- Q: Does paying a medical collection immediately remove it from my credit report? A: No, it remains on your report for seven years from the date of first delinquency.

- Q: What if my medical collection was reported inaccurately? A: You have the right to dispute the information with the credit bureaus.

- Q: Can I negotiate the amount owed on a medical collection? A: Often, yes. Contact the collection agency to explore options like settlement for a lower amount.

- Q: Are there any state-specific laws that might affect how long a paid medical collection stays on my report? A: Yes, some states have laws that might impact the reporting period, so it's important to check your state's specific regulations.

- Q: What is the impact of a paid medical collection on my credit score? A: It will negatively impact your credit score, although the impact will lessen over time. Paying the debt shows positive repayment behavior, but the entry itself still remains on the report.

Practical Tips: Maximizing the Benefits of Credit Repair After Medical Debt:

- Understand the Basics: Familiarize yourself with the FCRA and the process of credit reporting.

- Obtain Your Credit Reports: Review your credit reports from all three bureaus for accuracy.

- Dispute Inaccuracies: If you find errors, immediately file a dispute with the relevant credit bureaus.

- Pay Medical Bills Promptly: Make every effort to pay medical bills on time to avoid collections.

- Negotiate with Collection Agencies: If you are unable to pay the full amount, attempt to negotiate a settlement.

- Monitor Your Credit Regularly: Track your credit scores and reports to ensure accuracy.

- Consider Credit Repair Services: If dealing with multiple collections, consider professional help.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how long paid medical collections stay on your credit report is crucial for maintaining good financial health. While the seven-year rule is the general guideline, individual circumstances can vary. By understanding your rights under the FCRA and proactively addressing any inaccuracies or outstanding debt, you can take control of your credit situation and minimize the long-term impact. Remember, paying the debt is essential, but it’s only one step in a longer process of credit recovery. Consistent monitoring, responsible financial habits, and accurate reporting are vital components of building and maintaining a positive credit profile.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How Long Do Paid Medical Collections Stay On Credit Report . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.