What Percentage Should I Keep My Credit Card Usage Under

adminse

Apr 07, 2025 · 7 min read

Table of Contents

What's the magic number? Finding the optimal credit card usage percentage.

Maintaining a low credit utilization ratio is crucial for a strong credit score.

Editor’s Note: This article on credit card utilization rates was published today, providing up-to-date insights and best practices for managing your credit responsibly. We've consulted numerous financial experts and analyzed current credit scoring models to deliver accurate and actionable advice.

Why Your Credit Card Usage Percentage Matters:

Understanding your credit utilization ratio is paramount for building and maintaining a healthy credit score. This ratio, expressed as a percentage, represents the amount of available credit you're using compared to your total credit limit. Lenders closely scrutinize this metric because it reflects your ability to manage debt responsibly. A high utilization ratio signals potential financial strain, increasing the perceived risk associated with lending to you. Conversely, a low utilization ratio demonstrates responsible credit management and improves your creditworthiness. This impacts not only your ability to secure loans but also the interest rates offered on those loans. A better credit score can translate into lower interest rates on mortgages, auto loans, and even credit cards themselves, saving you thousands of dollars over time.

Overview: What This Article Covers:

This comprehensive guide dives deep into the optimal credit card usage percentage, exploring the impact of various utilization rates on your credit score, the factors influencing the ideal percentage, and strategies for maintaining a healthy credit profile. We will examine the intricacies of credit scoring models, discuss the role of different types of credit, and offer practical tips for improving your credit utilization ratio. The article will also address common misconceptions and answer frequently asked questions.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing on data from major credit bureaus like Experian, Equifax, and TransUnion, along with insights from financial experts and analyses of numerous published studies on credit scoring. We have meticulously reviewed and synthesized information to provide readers with accurate, up-to-date, and actionable advice.

Key Takeaways:

- Ideal Credit Utilization Ratio: Aim for a credit utilization ratio of 30% or less across all credit cards. Ideally, strive for under 10%.

- Impact on Credit Score: High credit utilization significantly negatively impacts your credit score.

- Importance of Total Credit Limit: Managing multiple cards effectively contributes to a lower overall utilization ratio.

- Strategies for Improvement: Paying down balances, requesting credit limit increases, and closing unnecessary accounts can improve your utilization ratio.

- Long-Term Benefits: Maintaining a low utilization ratio builds a strong credit history, leading to better loan terms and lower interest rates.

Smooth Transition to the Core Discussion:

Now that we understand the significance of credit utilization, let's explore the optimal percentage and strategies to achieve it.

Exploring the Key Aspects of Credit Card Usage Percentage:

1. The 30% Rule (and Why It's a Guideline, Not a Law):

The widely accepted guideline suggests keeping your credit utilization below 30%. This means that if your total credit limit across all your cards is $10,000, you should aim to keep your outstanding balance below $3,000. However, this is just a guideline. While exceeding 30% will almost certainly negatively impact your score, the severity depends on other factors in your credit report.

2. The Power of Under 10%:

While 30% is a commonly cited threshold, aiming for a utilization rate of under 10% is significantly better. Many credit scoring models place greater emphasis on keeping balances low. A utilization rate under 10% demonstrates exceptional financial responsibility and can contribute to a higher credit score. Consider this your "ideal" target.

3. The Importance of Total Credit Limit:

Your total available credit is a critical factor. Someone with a $1,000 credit limit and a $300 balance has a 30% utilization rate, while someone with a $10,000 credit limit and a $3,000 balance has the same percentage, yet the latter is less likely to impact their credit score as significantly, due to the much larger available credit line. This highlights the benefit of increasing your credit limit responsibly.

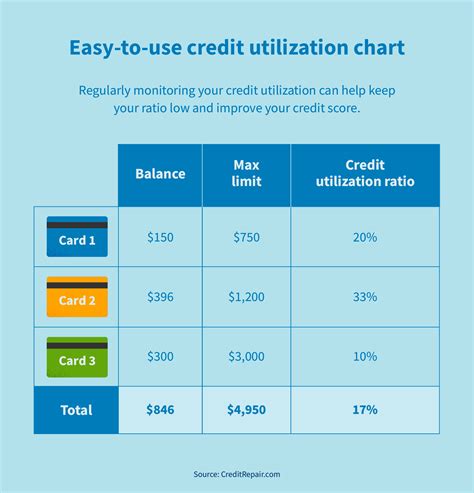

4. The Impact of Multiple Credit Cards:

Managing multiple credit cards effectively is key. Instead of concentrating debt on one card, strategically utilizing several cards with low balances can reduce your overall utilization ratio. For example, using multiple cards with small balances will keep utilization down, even if each card's percentage is higher individually.

5. Credit Scoring Models and Their Sensitivity:

Different credit scoring models (FICO, VantageScore, etc.) have different algorithms, but they all consider credit utilization a crucial factor. While the precise weight given to utilization may vary, a high percentage will consistently lead to a lower score. The models are constantly updated, and minimizing your utilization remains a constant best practice.

Closing Insights: Summarizing the Core Discussion:

Maintaining a low credit utilization ratio is not merely a suggestion; it's a cornerstone of responsible credit management. By aiming for under 10% and never exceeding 30%, individuals can significantly improve their credit scores, unlocking access to better loan terms and lower interest rates. This translates to substantial long-term financial benefits.

Exploring the Connection Between Payment History and Credit Utilization:

Payment history is another major factor in credit scoring. Even with low utilization, consistently late payments can severely damage your score. The connection is simple: low utilization shows responsible credit management, but consistently missing payments negates this positive signal.

Key Factors to Consider:

- Roles and Real-World Examples: A person with a low utilization rate but a history of late payments will likely have a lower score than someone with a slightly higher utilization rate but a perfect payment history.

- Risks and Mitigations: The risk of a high utilization ratio is a lower credit score, impacting loan approval and interest rates. Mitigation involves paying down balances, requesting credit limit increases, and responsible credit card usage.

- Impact and Implications: Ignoring the relationship between payment history and utilization can lead to significant financial setbacks, including higher interest rates and difficulty securing credit.

Conclusion: Reinforcing the Connection:

Payment history and credit utilization are interdependent factors. Both need to be managed effectively to build a strong credit profile. Consistent on-time payments, combined with a low credit utilization ratio, are essential for optimal credit health.

Further Analysis: Examining Payment History in Greater Detail:

Consistent on-time payments demonstrate financial responsibility and reliability, outweighing even a slightly higher utilization rate. Conversely, even with a low utilization rate, late or missed payments indicate a higher risk to lenders. Building a history of consistent on-time payments takes time, emphasizing the importance of responsible credit management from the beginning.

FAQ Section: Answering Common Questions About Credit Card Utilization:

Q: What happens if my credit utilization exceeds 30%?

A: Exceeding 30% negatively impacts your credit score. The severity depends on how much you exceed it and other factors in your credit report.

Q: Can I request a credit limit increase?

A: Yes, you can contact your credit card issuer and request a credit limit increase. This can help lower your utilization ratio.

Q: How often should I check my credit report?

A: It's recommended to check your credit report at least annually, ideally more frequently, to monitor your credit utilization and identify any potential issues.

Q: What if I only have one credit card?

A: Even with one card, strive to keep your utilization below 30%, preferably under 10%.

Practical Tips: Maximizing the Benefits of Low Credit Utilization:

-

Track Your Spending: Use budgeting apps or spreadsheets to monitor your credit card spending closely.

-

Pay More Than the Minimum: Pay down your balance as quickly as possible to reduce your utilization ratio.

-

Request Credit Limit Increases: If you've been a responsible cardholder, consider requesting a credit limit increase from your issuer.

-

Set Payment Reminders: Use calendar reminders or automatic payments to ensure you always pay your bills on time.

-

Monitor Your Credit Report: Regularly check your credit report for accuracy and to track your credit utilization.

Final Conclusion: Wrapping Up with Lasting Insights:

Maintaining a low credit card utilization ratio is a critical step towards building a strong financial foundation. By understanding the importance of this metric, implementing responsible spending habits, and diligently monitoring your credit report, you can significantly improve your credit score and secure better financial opportunities. Remember, responsible credit management is a long-term endeavor, but the rewards are substantial. Aim for that sub-10% utilization rate – it’s the key to unlocking better financial health.

Latest Posts

Latest Posts

-

Additional Child Tax Credit Actc Definition And Who Qualifies

Apr 30, 2025

-

Adding To A Loser Definition And Example

Apr 30, 2025

-

What Is An Addendum Definition How It Works And Examples

Apr 30, 2025

-

Add On Interest Definition Formula Cost Vs Simple Interest

Apr 30, 2025

-

Add On Factor Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Percentage Should I Keep My Credit Card Usage Under . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.