How To Increase Limit On Secured Credit Card Bank Of America

adminse

Apr 07, 2025 · 9 min read

Table of Contents

How Can I Increase My Bank of America Secured Credit Card Limit?

Unlocking Higher Credit Limits: A Strategic Guide to Maximizing Your Secured Credit Card with Bank of America

Editor’s Note: This article on increasing your Bank of America secured credit card limit was published today and provides up-to-date information and strategies. We've compiled expert advice and real-world examples to help you navigate the process effectively.

Why Increasing Your Secured Credit Card Limit Matters

A secured credit card, unlike a traditional credit card, requires a security deposit that serves as your credit limit. For many, it's a crucial first step in building credit. However, a low credit limit can hinder your credit-building journey. Increasing your limit demonstrates responsible credit management and can significantly improve your credit score over time. A higher limit provides more financial flexibility, allowing for larger purchases and improved credit utilization, a key factor in your creditworthiness. This article will guide you through the steps to successfully request a credit limit increase on your Bank of America secured credit card.

Overview: What This Article Covers

This article provides a comprehensive guide to increasing your Bank of America secured credit card limit. We will explore the eligibility requirements, the application process, alternative strategies if your request is denied, and frequently asked questions. Readers will gain actionable insights and practical advice to improve their chances of success.

The Research and Effort Behind the Insights

This article is based on extensive research, incorporating information directly from Bank of America's official website, analysis of consumer experiences, and best practices in credit management. We have meticulously examined the factors influencing credit limit increases to provide accurate and reliable information.

Key Takeaways:

- Understanding Eligibility: Factors influencing Bank of America's decision to increase your credit limit.

- The Application Process: Step-by-step guide on how to request a credit limit increase.

- Alternative Strategies: Actions to take if your initial request is denied.

- Maintaining a Positive Credit History: Crucial steps to ensure continued creditworthiness.

- Long-Term Credit Building: Strategies for maximizing your credit potential.

Smooth Transition to the Core Discussion

Now that we understand the importance of increasing your secured credit card limit, let's delve into the specifics of how to approach this with Bank of America.

Exploring the Key Aspects of Increasing Your Bank of America Secured Credit Card Limit

1. Understanding Eligibility Criteria:

Bank of America, like most financial institutions, assesses several factors before approving a credit limit increase. These include:

- Payment History: A consistent history of on-time payments is paramount. Even a single missed payment can significantly impact your chances.

- Credit Utilization: This refers to the percentage of your available credit that you are currently using. Keeping your utilization low (ideally below 30%) demonstrates responsible credit management.

- Account Age: The longer you've held your secured credit card, the more likely you are to qualify for an increase. Demonstrates responsible long-term account management.

- Income: While not always explicitly stated, your income level can indirectly influence the decision. Higher income generally suggests a greater ability to manage debt.

- Credit Score: While Bank of America may not explicitly require a specific credit score, an improving credit score significantly increases your chances of approval.

- New Credit: Opening multiple new credit accounts in a short period can negatively impact your credit score and your chances for a limit increase.

2. The Application Process:

Typically, there are two main ways to request a credit limit increase on your Bank of America secured credit card:

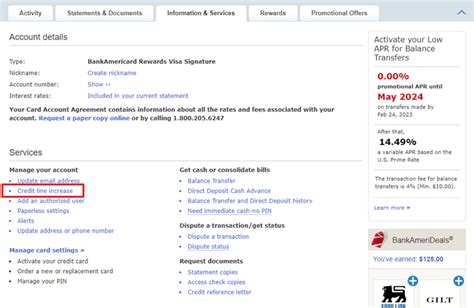

- Online: Log in to your Bank of America online banking account. Navigate to your credit card account. Look for an option to "Increase Credit Limit" or a similar phrasing. Follow the on-screen instructions. This is usually the fastest and most convenient method.

- By Phone: Call Bank of America's customer service line. Be prepared to provide your account information and answer questions about your financial situation. This method can be helpful if you have questions or require assistance during the process.

Regardless of the method, you'll likely need to provide some personal information for verification purposes. Be prepared to answer questions about your employment, income, and address.

3. What Happens After You Apply?

After submitting your request, Bank of America will review your application based on the eligibility criteria mentioned earlier. The review process can take a few days or weeks. You'll typically receive notification via email or mail about the decision.

4. Dealing with a Denied Request:

If your request is denied, don’t despair. Understanding why your request was denied is the first step. Bank of America might provide a reason in their notification. Common reasons include:

- Poor Payment History: Address any late payments immediately. Consistent on-time payments are crucial for future applications.

- High Credit Utilization: Pay down your balance to reduce your credit utilization ratio. Aim for below 30% for optimal credit health.

- Recent Credit Applications: Avoid opening multiple new credit accounts for a while. This can negatively impact your credit score.

- Insufficient Account Age: Continue to use your secured credit card responsibly until you have a longer history of positive credit behavior.

5. Alternative Strategies:

If your request is denied, consider these alternative strategies:

- Wait and Reapply: After addressing any issues highlighted in the denial, wait a few months and reapply. Show improved credit behavior before trying again.

- Increase Your Security Deposit: By increasing your security deposit, you effectively increase your credit limit. This is a guaranteed way to raise your limit, though it requires additional funds.

- Graduate to an Unsecured Card: After demonstrating responsible credit use for an extended period, consider applying for an unsecured credit card from Bank of America or another institution. This shows creditworthiness and can lead to higher credit limits.

6. Maintaining a Positive Credit History:

Continuously maintaining a positive credit history is essential for future credit limit increases and overall financial health. Key practices include:

- Paying Bills on Time: Always pay your credit card bills on time and in full. This is the single most important factor in maintaining a good credit score.

- Keeping Utilization Low: Aim for a credit utilization ratio below 30%. Paying down your balances regularly helps achieve this.

- Monitoring Your Credit Report: Regularly check your credit report for errors and to track your credit score's progress. You can obtain your free credit reports from AnnualCreditReport.com.

- Avoiding New Credit: Minimize applications for new credit accounts to avoid impacting your credit score negatively.

Exploring the Connection Between Responsible Credit Use and Increasing Your Credit Limit

Responsible credit use is intrinsically linked to the possibility of increasing your credit limit. Bank of America's decision hinges on your demonstrated ability to manage credit responsibly.

Key Factors to Consider:

- Roles and Real-World Examples: A consistent history of on-time payments, low credit utilization, and responsible account management significantly increases the likelihood of approval. For example, someone with a consistently low credit utilization ratio and a history of on-time payments is far more likely to get an increase than someone with a high utilization ratio and late payments.

- Risks and Mitigations: Failing to pay bills on time or maintaining high credit utilization significantly increases the risk of denial. Mitigating these risks involves consistently paying bills on time and actively reducing credit utilization.

- Impact and Implications: Successfully increasing your credit limit demonstrates responsible credit management, improves your credit score, and provides greater financial flexibility. Conversely, repeated denials can negatively impact your credit score and financial prospects.

Conclusion: Reinforcing the Connection

The connection between responsible credit use and increasing your Bank of America secured credit card limit is undeniable. By demonstrating responsible financial behavior, you significantly improve your chances of securing a higher credit limit, ultimately enhancing your financial health and creditworthiness.

Further Analysis: Examining Payment History in Greater Detail

Payment history is arguably the most significant factor influencing credit limit increases. Even a single missed payment can significantly impact your chances. Consistently paying your bills on time demonstrates reliability and responsible credit management. Conversely, late payments signal to lenders a potential risk of default, making them less likely to grant a credit limit increase. This aspect of your credit report weighs heavily on Bank of America's decision-making process. Building a pristine payment history is the cornerstone of securing a higher credit limit.

FAQ Section: Answering Common Questions About Increasing Your Bank of America Secured Credit Card Limit

Q: How often can I request a credit limit increase?

A: Bank of America doesn't specify a timeframe, but it's generally recommended to wait at least a few months between requests. Repeated requests in a short period may negatively impact your application.

Q: What if my credit limit increase request is denied?

A: If denied, review your credit report, address any negative factors (late payments, high utilization), and wait a few months before reapplying. Alternatively, you can increase your security deposit to directly increase your credit limit.

Q: How long does the review process take?

A: The review process typically takes a few days to a few weeks. You'll receive notification via email or mail once a decision is made.

Q: Can I increase my limit without a credit check?

A: Increasing your security deposit is the only way to increase your limit without a formal credit check review. However, Bank of America will still review your account activity.

Practical Tips: Maximizing the Benefits of a Higher Credit Limit

- Start Small: Don't jump to a large increase immediately. Start with a reasonable request and gradually increase your limit as your creditworthiness improves.

- Maintain Low Utilization: Keep your credit utilization consistently low even with a higher limit. This continues to demonstrate responsible spending habits.

- Monitor Your Spending: With a larger limit, track your spending carefully to avoid accumulating high balances.

- Pay on Time, Always: Prioritize paying your credit card balance on time and in full each month.

Final Conclusion: Wrapping Up with Lasting Insights

Increasing your Bank of America secured credit card limit is achievable with responsible credit management and a strategic approach. By understanding the eligibility criteria, following the application process, and addressing any potential challenges, you can significantly improve your chances of success. Remember, consistent, responsible credit behavior is the key to unlocking higher credit limits and building a strong credit foundation for your financial future.

Latest Posts

Latest Posts

-

Activity Based Management Abm Definition And Examples

Apr 30, 2025

-

Activity Based Costing Abc Method And Advantages Defined With Example

Apr 30, 2025

-

Activity Quota Definition

Apr 30, 2025

-

Activity Cost Driver Definition And Examples

Apr 30, 2025

-

Activities Interests And Opinions Aio Definition Example

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Increase Limit On Secured Credit Card Bank Of America . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.