How Long Does Paid Off Debt Stay On Credit Report

adminse

Apr 07, 2025 · 8 min read

Table of Contents

How Long Does Paid-Off Debt Stay on Your Credit Report? Uncovering the Truth and Protecting Your Credit Score

What if the longevity of a paid debt on your credit report significantly impacts your future financial opportunities? Understanding this timeline is crucial for building and maintaining excellent credit.

Editor's Note: This article on how long paid-off debt remains on credit reports was published [Date]. We've compiled the latest information from reputable sources to provide you with an accurate and up-to-date understanding of this important credit topic.

Why Knowing the Lifespan of Paid Debt Matters:

Your credit report is a detailed record of your borrowing and repayment history. It serves as the foundation for lenders to assess your creditworthiness. Knowing how long positive and negative information remains on your report is vital for several reasons:

- Mortgage Applications: Lenders scrutinize your credit history when you apply for a mortgage. The length of time positive payment history remains can significantly influence your approval odds and interest rate.

- Loan Approvals: Similar to mortgages, loan applications are heavily reliant on credit scores. A longer track record of responsible repayment, even after debt is paid, benefits your score.

- Credit Card Applications: Credit card companies use credit reports to determine credit limits and interest rates. A clean, detailed history showcasing responsible debt management can secure you favorable terms.

- Rental Applications: Increasingly, landlords use credit reports to assess tenant reliability. A strong credit history, even with paid debts, can improve your chances of securing a rental property.

- Insurance Rates: Some insurance companies factor credit history into premium calculations. A positive credit report can potentially lead to lower insurance costs.

Overview: What This Article Covers:

This article provides a comprehensive exploration of how long various types of paid-off debt remain on your credit report. We will examine the different reporting agencies, the nuances of different debt types, and strategies to manage your credit report effectively. You will gain actionable insights to understand your credit history and proactively protect your financial future.

The Research and Effort Behind the Insights:

This article draws on extensive research from reputable sources, including the Fair Credit Reporting Act (FCRA), guidance from the three major credit bureaus (Equifax, Experian, and TransUnion), and insights from financial experts. We aim to deliver accurate, unbiased information to empower informed decision-making.

Key Takeaways:

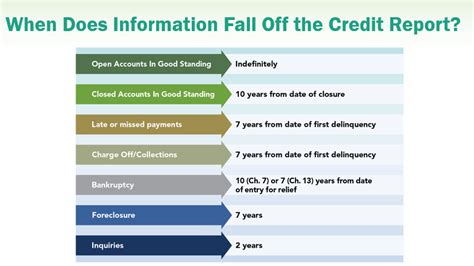

- Most paid-off accounts remain on your credit report for seven years. This includes accounts like installment loans (auto loans, personal loans) and most credit cards.

- Bankruptcies stay on your report for 10 years. This is a significant negative mark and requires careful management of your credit afterward.

- Collection accounts also remain for seven years from the date of the first delinquency. This emphasizes the importance of prompt debt resolution.

- Credit inquiries typically fall off after two years. While they don't impact your score as much as negative marks, minimizing unnecessary inquiries is good practice.

- Positive payment history is valuable. The longer your history of responsible payments, the better it impacts your creditworthiness.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding the lifespan of paid-off debt, let's delve into the specifics, exploring different debt types and their impact on your credit report.

Exploring the Key Aspects of Paid-Off Debt on Your Credit Report:

1. The Seven-Year Rule:

The most common timeframe for paid-off accounts is seven years from the date of the first missed payment (delinquency). This applies to most types of credit accounts, including:

- Credit Cards: Once you've paid off your credit card balance in full, the account will remain on your report for seven years from the date of any missed payments. If you maintained a good payment history on the card, this is a positive entry.

- Installment Loans: These include car loans, personal loans, and mortgages. Similar to credit cards, the paid-off status will remain for seven years from the date of the last delinquency.

- Medical Debt: If the medical debt has been sent to collections, it follows the seven-year rule from the date of first delinquency. If you've paid it directly to the provider and it hasn't been sent to collections, it might not appear on your report at all.

2. Exceptions to the Seven-Year Rule:

- Bankruptcy: Bankruptcies remain on your credit report for a significantly longer period—ten years from the filing date. This is a serious negative mark that can severely impact your credit score. However, responsible credit behavior after bankruptcy can help mitigate its effects over time.

- Foreclosure: Similar to bankruptcy, foreclosures also impact your credit report for seven years from the date of the foreclosure.

- Collections: When debts are sent to collections agencies, the account remains on your credit report for seven years from the date of the first delinquency.

3. Understanding Your Credit Report:

It's crucial to regularly review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). You can access free credit reports annually from AnnualCreditReport.com. Look for any inaccuracies and dispute them with the appropriate bureau if needed.

4. The Impact of Positive Payment History:

While negative marks remain for a set period, positive payment history continues to be beneficial. Lengthy records of consistent on-time payments demonstrate responsible financial behavior and contribute positively to your credit score. Even after an account is paid off, the history of responsible payment remains a valuable asset.

Exploring the Connection Between Payment History and Credit Score:

The length of your positive payment history significantly influences your credit score. Lenders consider consistency and duration when evaluating your creditworthiness. A long history of timely payments demonstrates reliability and reduces the perceived risk associated with lending to you.

Key Factors to Consider:

- Length of positive payment history: A longer history significantly boosts your credit score.

- Consistency of payments: Missed payments negatively impact your score, even if you eventually pay the debt.

- Credit utilization: Keeping your credit utilization low (the percentage of available credit you're using) contributes to a higher score.

Roles and Real-World Examples:

Consider two individuals: Alice and Bob. Both paid off a credit card a year ago. Alice had a perfect payment history for five years before paying it off, while Bob had several late payments during that same five-year period. Even though the card is paid off, Alice will have a substantially higher credit score than Bob due to her superior payment history.

Risks and Mitigations:

The primary risk is that old, negative marks can linger on your report, potentially affecting your ability to secure loans or credit at favorable terms. Regular monitoring of your credit report, disputing inaccuracies, and maintaining excellent credit behavior are crucial mitigations.

Impact and Implications:

The length of time negative and positive information remains on your credit report has far-reaching implications, affecting your ability to secure loans, rent property, and even obtain insurance at competitive rates.

Conclusion: Reinforcing the Connection:

The connection between your payment history, the duration of information on your credit report, and your credit score is undeniable. By understanding these timelines and actively managing your credit, you can positively influence your financial future.

Further Analysis: Examining Credit Repair Strategies:

If you have negative marks on your credit report, exploring credit repair options might be beneficial. Reputable credit repair companies can help you dispute inaccuracies and potentially negotiate with creditors to improve your credit profile. However, proceed with caution and thoroughly research any company before engaging their services.

FAQ Section: Answering Common Questions About Paid-Off Debt:

Q: What if I paid off a debt but it’s still showing on my report as delinquent? A: Contact the credit bureau immediately and dispute the inaccuracy. Provide documentation proving the debt is paid.

Q: Does closing a credit card after paying it off affect my credit score? A: Closing a credit card can slightly decrease your credit score, especially if it lowers your overall credit history length and available credit. Consider keeping the card open but inactive if you wish to maintain a positive history.

Q: How can I improve my credit score after a bankruptcy? A: Focus on responsible credit behavior: pay all bills on time, maintain low credit utilization, and gradually rebuild your credit history with secured cards or loans.

Q: Is it worth paying off old debts that are already past the seven-year reporting period? A: While it won't directly improve your credit score, paying off old debts can provide peace of mind and potentially prevent future collection efforts.

Practical Tips: Maximizing the Benefits of Good Credit:

- Monitor your credit reports regularly: Check for errors and inconsistencies.

- Pay all bills on time: Consistent on-time payments are crucial for building good credit.

- Maintain low credit utilization: Keep your credit card balances low compared to your credit limit.

- Diversify your credit mix: Having a mix of credit accounts (credit cards, installment loans) can be beneficial.

- Avoid unnecessary credit inquiries: Only apply for credit when necessary.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how long paid-off debt stays on your credit report is essential for financial success. By diligently managing your credit and understanding the nuances of credit reporting, you can build a strong credit history that opens doors to financial opportunities. Remember, good credit is a valuable asset that pays dividends over the long term. Take proactive steps to safeguard your financial future.

Latest Posts

Related Post

Thank you for visiting our website which covers about How Long Does Paid Off Debt Stay On Credit Report . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.