How To Calculate Credit Utilisation Ratio

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Unlocking the Secrets of Credit Utilization Ratio: A Comprehensive Guide

What if your credit score hinges on a single, easily misunderstood number? Mastering your credit utilization ratio is the key to unlocking better credit and financial freedom.

Editor’s Note: This article on calculating credit utilization ratio was published today, providing you with the most up-to-date information and strategies to improve your credit health.

Why Credit Utilization Ratio Matters:

Your credit utilization ratio (CUR) is a critical factor influencing your credit score. It represents the percentage of your available credit you're currently using. Lenders closely monitor this ratio because it reflects your debt management habits. A high CUR signals potential financial instability, while a low CUR suggests responsible credit management. This translates directly into better interest rates on loans, credit cards, and other financial products. Understanding and managing your CUR can significantly impact your financial well-being. It's a cornerstone of responsible credit management and a pathway to better financial opportunities.

Overview: What This Article Covers:

This comprehensive guide delves into the intricacies of calculating and managing your credit utilization ratio. We'll explore the definition, calculation methods, the impact on your credit score, strategies for improvement, and address frequently asked questions. You'll gain actionable insights backed by practical examples and clear explanations.

The Research and Effort Behind the Insights:

This article is the culmination of extensive research, incorporating insights from leading credit bureaus, financial experts, and analysis of various credit scoring models. Every calculation and recommendation is supported by reliable data and established financial principles, ensuring you receive accurate and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: A precise definition of credit utilization ratio and its underlying principles.

- Calculation Methods: Step-by-step instructions and examples illustrating different calculation scenarios.

- Impact on Credit Scores: A detailed examination of how CUR affects your creditworthiness.

- Strategies for Improvement: Practical and effective methods for lowering your CUR and boosting your credit score.

- Addressing Common Misconceptions: Clarification of prevalent misunderstandings regarding CUR.

Smooth Transition to the Core Discussion:

Now that we understand the significance of credit utilization ratio, let's delve into the specifics of calculating it and strategies for optimal management.

Exploring the Key Aspects of Credit Utilization Ratio:

1. Definition and Core Concepts:

Credit utilization ratio is the percentage of your total available credit that you're currently using. It's calculated separately for each credit account (credit cards, personal lines of credit, etc.) and then often considered as an overall average across all accounts. Lenders use this ratio to assess your risk profile; a lower ratio indicates better financial responsibility.

2. Calculation Methods:

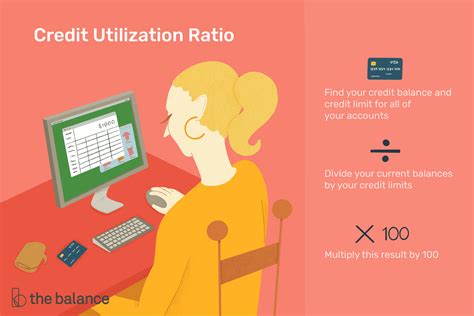

The formula for calculating your credit utilization ratio is straightforward:

(Credit Balance / Credit Limit) x 100 = Credit Utilization Ratio (%)

Let's illustrate with examples:

-

Example 1: You have a credit card with a $1,000 credit limit and a current balance of $200. Your credit utilization ratio is ($200 / $1,000) x 100 = 20%.

-

Example 2: You have two credit cards. Card A has a $500 limit and a $100 balance. Card B has a $1,000 limit and a $500 balance. The individual CURs are:

- Card A: ($100 / $500) x 100 = 20%

- Card B: ($500 / $1,000) x 100 = 50%

To calculate your overall CUR, you need to sum your total balances and your total credit limits:

* Total Balance: $100 + $500 = $600

* Total Credit Limit: $500 + $1,000 = $1,500

* Overall CUR: ($600 / $1,500) x 100 = 40%

3. Impact on Credit Scores:

Credit scoring models like FICO and VantageScore heavily weigh credit utilization. While the exact impact varies depending on the specific model and other factors, generally:

- Low CUR (under 30%): This is considered excellent and significantly boosts your credit score.

- Moderate CUR (30-50%): This is still acceptable, but your score might be slightly lower than with a lower ratio.

- High CUR (over 50%): This is a major negative factor and can severely damage your credit score. A CUR above 70% is exceptionally detrimental.

4. Strategies for Improvement:

Lowering your CUR is crucial for improving your credit score. Here are some effective strategies:

-

Pay Down Balances: The most direct way to reduce your CUR is to pay down your credit card balances. Even small payments can make a difference.

-

Increase Credit Limits: If you have a good payment history, consider requesting a credit limit increase from your credit card issuer. This increases your available credit, thereby lowering your CUR. However, be mindful not to overspend after an increase.

-

Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and lower your overall debt.

-

Open New Accounts Strategically: Opening a new credit card with a high credit limit can improve your CUR, especially if you keep balances low. However, avoid opening multiple accounts simultaneously, as this can also negatively impact your credit score.

-

Monitor Your Spending: Track your spending habits to prevent accumulating high balances on your credit cards. Budgeting and financial planning are essential tools for responsible credit management.

Exploring the Connection Between Payment History and Credit Utilization Ratio:

While credit utilization is a vital factor, it’s crucial to understand its interplay with payment history. A stellar payment history can somewhat mitigate the negative impact of a slightly higher CUR. However, a high CUR combined with late payments is a recipe for significant credit score damage.

Key Factors to Consider:

-

Roles and Real-World Examples: A consistent history of on-time payments can offset a slightly elevated CUR (e.g., someone with a 45% CUR and a flawless payment history will likely have a better score than someone with a 35% CUR and multiple late payments).

-

Risks and Mitigations: Ignoring a high CUR, especially when coupled with late payments, creates significant risks to your creditworthiness. Mitigation strategies involve aggressively paying down debt and consistently making timely payments.

-

Impact and Implications: The combined impact of a high CUR and poor payment history can result in higher interest rates on loans, difficulty securing credit, and even denial of applications for mortgages or auto loans.

Conclusion: Reinforcing the Connection:

The relationship between payment history and credit utilization ratio underscores the holistic nature of credit scoring. While a low CUR is paramount, responsible credit management extends to consistent on-time payments. Neglecting either aspect jeopardizes your credit health.

Further Analysis: Examining Payment History in Greater Detail:

Beyond simply making on-time payments, maintaining a positive payment history involves understanding how different payment behaviors affect your credit score. Factors like the length of your credit history, the number of accounts, and the mix of credit types also play crucial roles. Diligent monitoring and responsible financial behavior are keys to building a strong credit profile.

FAQ Section: Answering Common Questions About Credit Utilization Ratio:

Q: What is the ideal credit utilization ratio?

A: The ideal CUR is generally considered to be below 30%, and aiming for under 10% is even better.

Q: Does closing a credit card affect my credit utilization ratio?

A: Closing a credit card can negatively impact your credit score, even if it lowers your CUR temporarily, because it decreases your available credit. It's generally better to keep accounts open, especially those with a long history, while diligently managing your balances.

Q: How often should I check my credit utilization ratio?

A: Regularly monitoring your CUR, ideally monthly, allows for proactive management of your credit health. You can access this information through your credit card statements and credit reports.

Q: My CUR is high; what's the quickest way to improve it?

A: The quickest and most effective way to improve a high CUR is to aggressively pay down your credit card balances.

Practical Tips: Maximizing the Benefits of Credit Utilization Management:

-

Track Your Spending: Use budgeting apps or spreadsheets to monitor your expenses and ensure you're not exceeding your credit limits.

-

Set Payment Reminders: Utilize automated payment systems or set reminders to ensure on-time payments every month.

-

Review Credit Reports Regularly: Check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) annually to identify any errors and monitor your credit utilization ratio.

-

Communicate with Creditors: If facing financial difficulties, contact your creditors to explore options like payment plans to prevent further damage to your credit score.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding and managing your credit utilization ratio is paramount for achieving strong credit health. By implementing the strategies outlined in this article and maintaining responsible financial habits, you can significantly improve your credit score, unlock better financial opportunities, and build a secure financial future. Remember that responsible credit management is an ongoing process, requiring consistent vigilance and proactive strategies.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Credit Utilisation Ratio . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.