How To Get A Copy Of Credit Report On Credit Karma

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Unlocking Your Credit Report on Credit Karma: A Comprehensive Guide

What if accessing your credit report was simpler than you think? Credit Karma offers a straightforward path to understanding your financial health, empowering you to make informed decisions.

Editor’s Note: This article provides up-to-date information on obtaining your credit report through Credit Karma. Credit reporting laws and processes can change, so always verify information directly with the source.

Why Your Credit Report Matters:

Your credit report is a detailed history of your financial behavior, including loan applications, payment history, and outstanding debts. It’s the cornerstone of your credit score, a crucial factor in securing loans, mortgages, insurance, and even some employment opportunities. Regularly reviewing your credit report is essential for identifying errors, monitoring your credit health, and protecting yourself from identity theft. This report, unlike your credit score, is provided for free annually thanks to the Fair Credit Reporting Act. Understanding how to access it, especially through readily available platforms like Credit Karma, is key to financial wellness.

Overview: What This Article Covers

This article walks you through the process of obtaining your credit report copy from Credit Karma, explaining what to expect, addressing common concerns, and offering tips for interpreting the information. We'll cover account creation, report access, understanding the information presented, potential limitations, and alternative methods should Credit Karma not meet your needs.

The Research and Effort Behind the Insights

This guide draws upon extensive research of Credit Karma's official website, user reviews, and relevant financial regulations. The information is presented accurately and objectively to provide readers with a reliable and actionable resource.

Key Takeaways:

- Free Access: Credit Karma provides free access to your TransUnion and Equifax credit reports.

- Regular Monitoring: Utilize the platform to track your credit health regularly.

- Easy Navigation: The Credit Karma interface is designed for user-friendly access to your credit information.

- Score & Report Differences: Understand the distinctions between your credit score and your comprehensive credit report.

- Additional Resources: Learn about other avenues for obtaining your credit report if needed.

Smooth Transition to the Core Discussion:

Now that we understand the significance of accessing your credit report, let's delve into the specific steps involved in retrieving your credit report using Credit Karma.

Exploring the Key Aspects of Accessing Your Credit Report on Credit Karma:

1. Account Creation:

To access your credit report on Credit Karma, you'll need to create a free account. This involves providing basic personal information, including your name, email address, date of birth, and Social Security number (SSN). Credit Karma uses this information to securely link your credit file with your account. It's crucial to provide accurate information to avoid any delays or complications in accessing your report. Remember, Credit Karma uses robust security measures to protect your data.

2. Verification Process:

After submitting your information, Credit Karma will initiate a verification process. This usually involves verifying your identity using information from your credit report. This process ensures that only you can access your own credit information. Expect a brief delay while the system matches your information to your credit file.

3. Accessing Your Credit Report:

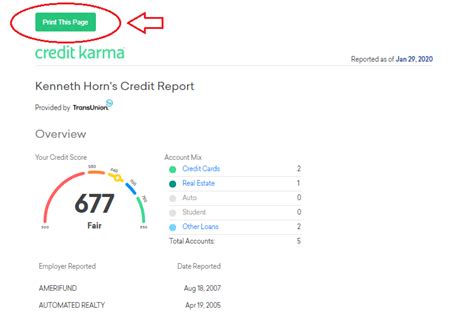

Once your account is verified, your TransUnion and Equifax credit reports will be available for viewing within the Credit Karma dashboard. These reports typically display your credit history, including:

- Personal Information: Your name, address, and date of birth.

- Accounts: A list of your credit accounts, including credit cards, loans, and mortgages.

- Payment History: Your payment history for each account, showing whether you made payments on time.

- Inquiries: Recent credit inquiries from lenders.

- Public Records: Bankruptcies, foreclosures, and tax liens.

4. Understanding Your Credit Report:

Credit reports are presented in a structured format, typically separated into sections for easier understanding. Look for any inaccuracies and immediately dispute them with the relevant credit bureaus. The information presented directly impacts your credit score, so paying attention to details such as late payments or missed payments is crucial.

5. Regular Monitoring:

Credit Karma facilitates regular monitoring of your credit report, allowing you to track any changes over time. This is critical for early detection of potential issues such as fraudulent activity or errors in your report.

Closing Insights: Summarizing the Core Discussion:

Credit Karma provides a user-friendly platform for accessing your credit reports, empowering individuals to monitor and manage their financial health. By following the simple steps outlined, users can gain valuable insights into their credit history and proactively address any potential concerns.

Exploring the Connection Between Data Security and Credit Karma:

Data security is paramount when dealing with sensitive personal and financial information. Credit Karma employs robust security measures to protect user data, including encryption and multi-factor authentication. Understanding the security protocols in place ensures that users can confidently utilize the platform without compromising their personal information.

Key Factors to Consider:

- Data Encryption: Credit Karma uses encryption to protect data transmitted between users' devices and their servers.

- Multi-Factor Authentication: This additional security layer enhances account protection by requiring multiple forms of verification to access your account.

- Fraud Monitoring: Credit Karma actively monitors for any suspicious activity on user accounts and promptly notifies users of any potential security breaches.

- Data Privacy Policies: Regularly reviewing Credit Karma's data privacy policies is essential to stay informed about how your personal information is handled.

Risks and Mitigations:

While Credit Karma takes security seriously, it’s essential to practice safe online habits:

- Strong Passwords: Use strong, unique passwords for your Credit Karma account.

- Beware of Phishing: Avoid clicking on suspicious links or responding to emails that request personal information.

- Regularly Monitor Your Account: Check your account activity regularly for any unusual transactions.

Impact and Implications:

By employing robust security measures and educating users on safe online practices, Credit Karma aims to minimize security risks and safeguard user data. This fosters trust and encourages the responsible use of credit monitoring services.

Conclusion: Reinforcing the Connection:

The security measures implemented by Credit Karma are vital for ensuring the privacy and security of user data. By combining advanced security protocols with user awareness, Credit Karma contributes to a secure and transparent environment for managing your credit information.

Further Analysis: Examining Data Privacy in Greater Detail:

Credit Karma's data privacy policy outlines how they collect, use, and protect user data. Understanding this policy is crucial for informed consent and managing your privacy settings within the platform. It's essential to read and understand the policy to ensure alignment with your personal privacy preferences.

FAQ Section: Answering Common Questions About Credit Karma Credit Reports:

Q: Is Credit Karma completely free?

A: Yes, accessing your TransUnion and Equifax credit reports and your VantageScore 3.0 is free on Credit Karma.

Q: How often can I get my credit report through Credit Karma?

A: You can access your credit reports as often as you want through Credit Karma. However, the report content generally only updates once a month.

Q: What if there's an error on my credit report?

A: If you find an error on your report, Credit Karma provides tools and resources to dispute it with the relevant credit bureaus.

Q: Can I get my Experian credit report through Credit Karma?

A: No. Credit Karma currently offers TransUnion and Equifax credit reports only. For your Experian report, you'll need to utilize another resource such as AnnualCreditReport.com.

Q: How does Credit Karma make money if their service is free?

A: Credit Karma generates revenue through targeted advertising and by partnering with financial institutions to offer credit products to their users.

Practical Tips: Maximizing the Benefits of Credit Karma:

- Set up alerts: Enable email or text alerts to notify you of any changes to your credit report, such as new inquiries or accounts.

- Compare your scores: Track your VantageScore 3.0 over time and monitor your progress toward improving your creditworthiness.

- Use educational resources: Credit Karma provides valuable resources to educate users on understanding and improving their credit scores.

- Understand your credit utilization: Keep an eye on your credit utilization ratio to ensure it's within a healthy range.

Final Conclusion: Wrapping Up with Lasting Insights:

Credit Karma provides a valuable service, offering free and easy access to crucial credit information. By understanding how to utilize the platform and employing safe online practices, individuals can effectively monitor their credit health, detect potential issues, and make informed financial decisions. Regularly checking your credit report is a proactive measure to safeguard your financial future. Remember to supplement Credit Karma with other resources to get a complete picture of your credit, and always be aware of your digital security.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Get A Copy Of Credit Report On Credit Karma . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.