How To Create A Fund Management Company

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Launching Your Fund Management Company: A Comprehensive Guide

What if the future of your financial success hinges on understanding the intricacies of establishing a fund management company? This complex yet rewarding endeavor requires meticulous planning, rigorous regulatory compliance, and a deep understanding of the financial markets.

Editor’s Note: This comprehensive guide on establishing a fund management company has been meticulously researched and compiled to provide aspiring entrepreneurs with the most up-to-date information and practical advice. The information presented here is for informational purposes only and does not constitute financial or legal advice. Consult with qualified professionals before making any decisions.

Why Starting a Fund Management Company Matters:

The asset management industry is a vast and dynamic landscape, offering significant opportunities for skilled professionals and innovative investment strategies. Launching a fund management company allows entrepreneurs to capitalize on market trends, build a successful business, and potentially generate substantial returns. This sector plays a crucial role in channeling capital towards businesses and projects, driving economic growth and contributing to global financial stability. Furthermore, a well-managed fund can offer investors a diversified portfolio and potentially higher returns compared to traditional investments. The industry's significance extends to its influence on investment choices, impacting global economic trends and market direction. Understanding the regulatory landscape and navigating the complexities of fund structuring are critical for success in this competitive field.

Overview: What This Article Covers:

This article will serve as a practical roadmap for launching your own fund management company. We will delve into the key aspects of business planning, regulatory compliance, investment strategy, marketing, and operational efficiency. We'll explore the challenges involved and offer solutions to overcome them, equipping you with the knowledge necessary to navigate this challenging yet rewarding entrepreneurial journey. The article will also address essential considerations, such as selecting the appropriate legal structure, securing funding, and building a robust team.

The Research and Effort Behind the Insights:

This guide is the culmination of extensive research, incorporating insights from regulatory documents, industry experts, case studies, and successful fund management companies. Every aspect has been carefully considered to ensure accuracy and provide readers with a comprehensive understanding of the process. We’ve examined various fund structures, regulatory requirements across different jurisdictions, and best practices for operational excellence.

Key Takeaways:

- Business Planning: Developing a comprehensive business plan outlining your investment strategy, target market, and financial projections.

- Legal and Regulatory Compliance: Navigating the complex legal and regulatory environment, obtaining necessary licenses and registrations.

- Investment Strategy: Defining your investment philosophy, asset allocation, and risk management approach.

- Fund Structure: Choosing the appropriate legal structure for your fund (e.g., hedge fund, mutual fund, private equity fund).

- Team Building: Assembling a team of experienced professionals with expertise in finance, law, and operations.

- Marketing and Sales: Developing a marketing strategy to attract investors and build a strong brand.

- Operational Efficiency: Establishing robust operational processes and technology infrastructure.

- Risk Management: Implementing comprehensive risk management procedures to mitigate potential losses.

Smooth Transition to the Core Discussion:

With a solid grasp of why establishing a fund management company presents a compelling opportunity, let's delve into the critical steps involved in bringing this ambitious vision to fruition.

Exploring the Key Aspects of Establishing a Fund Management Company:

1. Business Planning:

Before embarking on this journey, a detailed business plan is paramount. This plan should include:

- Executive Summary: A concise overview of your company, investment strategy, and financial projections.

- Company Description: A detailed description of your fund management company, its mission, and its unique selling proposition.

- Market Analysis: A comprehensive analysis of the target market, competitive landscape, and potential opportunities.

- Investment Strategy: A clear articulation of your investment philosophy, asset allocation, and risk management approach. This section will detail the types of assets you'll invest in (equities, bonds, real estate, etc.), your investment horizon, and your risk tolerance.

- Management Team: Information on the key personnel, their qualifications, and their experience in the financial industry.

- Financial Projections: Detailed financial statements, including projected income statements, balance sheets, and cash flow statements.

- Funding Request (if applicable): If seeking external funding, this section should outline the amount of funding required, its intended use, and the proposed return on investment.

2. Legal and Regulatory Compliance:

Navigating the regulatory landscape is a critical aspect of starting a fund management company. Requirements vary significantly by jurisdiction, but generally include:

- Legal Structure: Choosing the appropriate legal structure (e.g., limited partnership, limited liability company, corporation).

- Registration and Licensing: Obtaining the necessary licenses and registrations from relevant regulatory authorities (e.g., the SEC in the US, the FCA in the UK). This often involves meeting stringent capital requirements and demonstrating a high level of competence and integrity.

- Compliance with Regulatory Requirements: Adhering to all relevant regulations, including those related to investor protection, anti-money laundering (AML), and know your customer (KYC) regulations.

- Legal Counsel: Engaging experienced legal counsel specializing in financial regulation to ensure compliance throughout the process.

3. Investment Strategy and Fund Structure:

Defining your investment strategy and choosing the appropriate fund structure are interconnected decisions:

- Investment Philosophy: Articulating your investment philosophy – value investing, growth investing, quantitative investing, etc. – is critical to guide your investment decisions.

- Asset Allocation: Determining the optimal allocation of assets across different asset classes to achieve your investment goals while managing risk.

- Risk Management: Establishing robust risk management procedures to identify, assess, and mitigate potential risks.

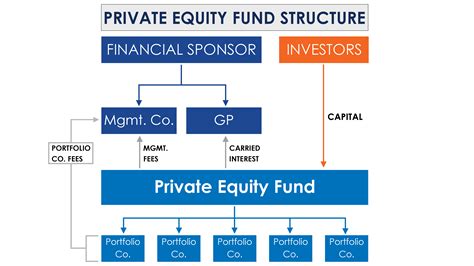

- Fund Structure: Selecting the appropriate fund structure (e.g., hedge fund, mutual fund, private equity fund) based on your investment strategy, investor base, and regulatory requirements. Each structure has its own legal and regulatory implications.

4. Team Building:

Building a strong team is crucial for success:

- Investment Professionals: Recruiting experienced investment professionals with proven track records in your chosen investment strategy.

- Legal and Compliance: Employing experienced legal and compliance professionals to ensure adherence to all regulatory requirements.

- Operations: Hiring skilled operational personnel to manage the day-to-day operations of the fund.

5. Marketing and Sales:

Attracting investors requires a well-defined marketing strategy:

- Investor Relations: Building relationships with potential investors, including high-net-worth individuals, institutional investors, and family offices.

- Marketing Materials: Developing compelling marketing materials, including a fund prospectus, fact sheets, and presentations.

- Networking: Actively networking within the financial industry to build relationships and generate leads.

6. Operational Efficiency:

Efficient operations are critical for managing a fund effectively:

- Technology Infrastructure: Investing in robust technology infrastructure to manage investments, track performance, and comply with regulatory requirements.

- Administrative Processes: Establishing efficient administrative processes for investor onboarding, fund accounting, and reporting.

7. Risk Management:

Implementing a comprehensive risk management framework is crucial:

- Risk Identification: Identifying potential risks, including market risk, credit risk, liquidity risk, and operational risk.

- Risk Assessment: Assessing the likelihood and potential impact of each identified risk.

- Risk Mitigation: Implementing strategies to mitigate or reduce the impact of identified risks.

Exploring the Connection Between Regulatory Compliance and Operational Efficiency:

The relationship between regulatory compliance and operational efficiency is symbiotic. Robust operational processes are essential for ensuring compliance with regulations. Efficient systems streamline the reporting and record-keeping processes required for regulatory compliance. Conversely, a strong compliance framework helps prevent operational errors and ensures the smooth functioning of the fund.

Key Factors to Consider:

- Roles and Real-World Examples: The role of compliance officers, for instance, is critical in ensuring adherence to regulations. Examples of operational failures leading to regulatory penalties highlight the importance of efficiency.

- Risks and Mitigations: Failure to comply with regulations can result in significant penalties, reputational damage, and even business closure. Mitigations include investing in compliance technology and training staff.

- Impact and Implications: Non-compliance can severely impact investor confidence and lead to significant financial losses. The long-term implications include reputational damage and potential legal action.

Conclusion: Reinforcing the Connection:

The intricate interplay between regulatory compliance and operational efficiency underlines the need for a holistic approach. By prioritizing both, fund management companies can foster investor trust, achieve sustainable growth, and navigate the complexities of the industry effectively.

Further Analysis: Examining Regulatory Compliance in Greater Detail:

A deeper dive into regulatory compliance reveals the multifaceted nature of this crucial aspect. It involves understanding various regulations related to investor protection, anti-money laundering, and market conduct. These regulations are dynamic, constantly evolving to adapt to market changes and technological advancements.

FAQ Section: Answering Common Questions About Establishing a Fund Management Company:

- What is the minimum capital required to start a fund management company? This varies greatly depending on the jurisdiction and the type of fund.

- What licenses and registrations are required? The specific requirements vary by location and fund type; consult relevant regulatory bodies.

- How long does it take to establish a fund management company? The process can take several months to a year or more.

- What are the ongoing costs of operating a fund management company? Ongoing costs include regulatory fees, legal fees, operational expenses, and technology costs.

Practical Tips: Maximizing the Benefits of Establishing a Fund Management Company:

- Thorough Due Diligence: Conduct thorough due diligence on all aspects of the business before launching.

- Expert Advice: Seek expert advice from legal, financial, and regulatory professionals.

- Strategic Planning: Develop a clear and comprehensive business plan and investment strategy.

- Strong Team: Assemble a strong and experienced team.

- Compliance Focus: Prioritize regulatory compliance throughout the process.

Final Conclusion: Wrapping Up with Lasting Insights:

Establishing a fund management company is a complex but potentially highly rewarding undertaking. Success hinges on meticulous planning, unwavering adherence to regulatory requirements, a robust investment strategy, and a strong operational framework. By carefully considering all aspects outlined in this guide, aspiring entrepreneurs can increase their chances of building a successful and sustainable fund management business. The potential rewards are substantial, but the challenges are equally significant. Thorough preparation and a commitment to excellence are essential for navigating this competitive and demanding industry.

Latest Posts

Latest Posts

-

How Fast Will A Car Loan Raise My Credit Score Reddit

Apr 08, 2025

-

How Fast Will A Car Loan Raise My Credit Score

Apr 08, 2025

-

How Much Does A Car Payment Affect Your Credit Score

Apr 08, 2025

-

How Much Will A Late Car Payment Affect My Credit Score

Apr 08, 2025

-

How Much Does A Car Loan Affect Your Credit Score

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Create A Fund Management Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.