How Much Will A Late Car Payment Affect My Credit Score

adminse

Apr 08, 2025 · 7 min read

Table of Contents

How Much Will a Late Car Payment Affect My Credit Score? The Definitive Guide

What if a single missed car payment could significantly derail your financial future? A late car payment's impact on your credit score is far more substantial than many realize, potentially leading to higher interest rates and limited financial opportunities.

Editor’s Note: This article on the impact of late car payments on credit scores was published today, providing up-to-date information and insights to help you manage your finances effectively.

Why Late Car Payments Matter: Relevance, Practical Applications, and Industry Significance

A seemingly minor oversight—a late car payment—can have profound consequences. Your credit score, a three-digit number that reflects your creditworthiness, is a crucial factor in numerous financial decisions. Lenders use it to assess your risk, influencing interest rates on loans (mortgages, auto loans, personal loans), credit card approvals, and even insurance premiums. A dinged credit score due to late payments can translate into thousands of dollars in extra interest over the life of a loan. Furthermore, late payments can affect your ability to rent an apartment, secure a job (in some industries), or even qualify for certain types of insurance.

Overview: What This Article Covers

This article provides a comprehensive analysis of how late car payments impact your credit score. We'll explore the mechanics of credit scoring, the severity of the impact based on various factors, strategies for mitigating damage, and steps to rebuild your credit after a late payment. Readers will gain actionable insights to protect and improve their financial health.

The Research and Effort Behind the Insights

This article draws upon extensive research from reputable sources, including the Fair Isaac Corporation (FICO), the major credit bureaus (Experian, Equifax, and TransUnion), and financial experts. We analyze data on credit scoring models, payment history's weight in those models, and the real-world consequences of late payments. Every claim is supported by evidence to ensure accuracy and trustworthiness.

Key Takeaways:

- Severity Varies: The impact of a late payment depends on factors like payment history, credit utilization, and the length of delinquency.

- Significant Weight: Payment history is the most significant factor in credit scoring models.

- Multiple Impacts: Late payments not only lower your score but can also lead to higher interest rates and reduced borrowing power.

- Rebuilding is Possible: While a late payment is damaging, consistent on-time payments afterward can gradually rebuild your credit score.

- Proactive Strategies: Prevention is key. Setting up automatic payments and monitoring your account diligently are crucial.

Smooth Transition to the Core Discussion

Now that we understand the importance of credit scores and the potential consequences of late payments, let's delve into the specifics of how a late car payment affects your credit score and what steps you can take.

Exploring the Key Aspects of Late Car Payment Impact

1. Definition and Core Concepts:

Your credit score is calculated using various factors, primarily your payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). The FICO scoring model is the most widely used. A late payment is any payment received after the due date, even by a single day. The severity of the impact is determined by several factors.

2. Applications Across Industries:

The consequences of a late car payment extend beyond your auto loan. A lower credit score can result in:

- Higher interest rates on future loans: This can significantly increase the total cost of borrowing for mortgages, personal loans, and even credit cards.

- Loan application rejection: Lenders may reject your application if your credit score is too low.

- Increased insurance premiums: Insurance companies often use credit scores to assess risk, and a lower score can lead to higher premiums.

- Difficulty renting an apartment: Landlords frequently check credit reports as part of the application process.

- Job application challenges: While less common, some employers, particularly in finance-related fields, may check credit reports.

3. Challenges and Solutions:

The primary challenge is the significant negative impact on your credit score. Solutions include:

- Automatic Payments: Setting up automatic payments eliminates the risk of forgetting to pay on time.

- Payment Reminders: Use calendar reminders or banking apps to receive notifications before due dates.

- Budgeting: Develop a budget to ensure you have sufficient funds for all your bills.

- Contacting Your Lender: If facing financial difficulties, contact your lender immediately to explore options like payment plans or hardship programs.

4. Impact on Innovation:

The credit scoring system itself is constantly evolving, aiming for more accurate assessments of risk. Innovations in fintech are making it easier to monitor credit scores and manage finances, potentially mitigating the impact of late payments through better financial literacy and proactive strategies.

Closing Insights: Summarizing the Core Discussion

A late car payment can significantly damage your credit score, leading to substantial financial consequences. Proactive measures like automatic payments, budgeting, and diligent account monitoring are vital for protecting your credit health.

Exploring the Connection Between Delinquency Length and Credit Score Impact

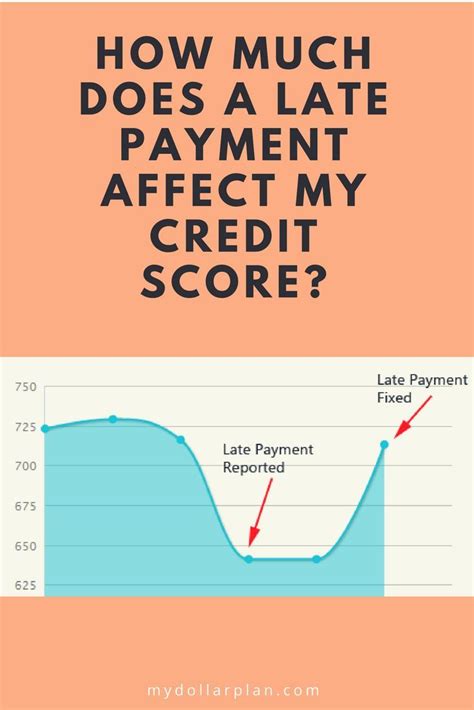

The length of delinquency directly influences the impact on your credit score. A single 30-day late payment will generally have a less severe impact than a 60-day or 90-day late payment, which are reported as increasingly serious delinquencies. A payment that remains delinquent for more than 90 days can severely damage your credit score and significantly impact your ability to obtain future credit.

Key Factors to Consider:

- Roles and Real-World Examples: A 30-day late payment might result in a score drop of 30-50 points, while a 90-day late payment could lead to a drop of 100 points or more. These numbers are estimates and can vary based on individual credit profiles.

- Risks and Mitigations: The risk increases exponentially with each subsequent late payment. Mitigations involve prompt payment once the delinquency is noticed and proactive measures to prevent future late payments.

- Impact and Implications: The longer a payment remains delinquent, the longer the negative impact remains on your credit report. It can take several years for the negative mark to fall off, though its impact diminishes over time.

Conclusion: Reinforcing the Connection

The duration of a delinquency plays a crucial role in determining the extent of its impact on your credit score. The longer the delinquency, the more significant and lasting the negative effects. Preventing late payments is critical, and prompt action to remedy any delinquency is essential.

Further Analysis: Examining Payment History in Greater Detail

Payment history is the most important factor in credit scoring. It reflects your reliability in meeting your financial obligations. A single late payment can disrupt an otherwise perfect payment history, signaling a potential increase in risk to lenders. Consistent on-time payments are crucial for maintaining a high credit score.

FAQ Section: Answering Common Questions About Late Car Payments

Q: What is the average impact of a single late car payment on my credit score?

A: The average impact varies greatly depending on individual credit history, but it can range from a 30-point decrease to over 100 points for more serious delinquencies.

Q: How long will a late car payment stay on my credit report?

A: Generally, late payments remain on your credit report for seven years from the date of delinquency.

Q: Can I remove a late car payment from my credit report?

A: You can't remove a legitimate late payment, but you can dispute inaccurate information reported by the credit bureaus.

Q: What if I can't afford my car payment?

A: Contact your lender immediately to discuss options like payment plans or forbearance. Ignoring the issue will only worsen the situation.

Practical Tips: Maximizing the Benefits of On-Time Payments

- Automate Payments: Set up automatic payments to ensure on-time payments every month.

- Budget Effectively: Create a realistic budget to ensure you have enough money for your car payment and other essential expenses.

- Set Reminders: Use calendar reminders, banking app alerts, or other tools to remind you of your payment due date.

- Monitor Your Account: Regularly check your account balance and payment status to catch any errors or potential issues promptly.

- Build an Emergency Fund: Having an emergency fund can help you cover unexpected expenses and avoid late payments.

Final Conclusion: Wrapping Up with Lasting Insights

A late car payment can have a significant and lasting impact on your credit score. By understanding the risks involved and implementing proactive strategies, you can protect your credit health and maintain a strong financial standing. Consistent on-time payments are the cornerstone of good credit. Prioritize responsible financial habits to ensure a secure financial future.

Latest Posts

Latest Posts

-

What Does Total Available Credit Mean On A Credit Card

Apr 08, 2025

-

Does A Car Loan Build Credit Reddit

Apr 08, 2025

-

How Long Should I Keep A Car Loan To Build Credit After

Apr 08, 2025

-

How Long Should I Keep A Car Loan To Build Credit

Apr 08, 2025

-

How Much Does A Car Loan Build Credit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Much Will A Late Car Payment Affect My Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.