How To Make Financial Management

adminse

Apr 06, 2025 · 6 min read

Table of Contents

Mastering the Art of Financial Management: A Comprehensive Guide

What if your financial future wasn't a source of stress, but a path paved with confidence and opportunity? Effective financial management is the key, unlocking a life of stability and prosperity.

Editor's Note: This comprehensive guide to financial management was written to provide readers with actionable strategies and up-to-date information to improve their financial well-being. We've drawn from reputable sources and expert advice to ensure accuracy and relevance.

Why Financial Management Matters:

In today's complex economic landscape, strong financial management isn't a luxury; it's a necessity. Whether you're aiming for financial independence, a comfortable retirement, or simply peace of mind, understanding and implementing sound financial principles is crucial. Poor financial management can lead to debt accumulation, missed opportunities, and significant stress. Effective management, conversely, empowers you to achieve your goals, weather financial storms, and build a secure future. It encompasses budgeting, saving, investing, debt management, and planning for the future. This applies to individuals, families, and even businesses. Understanding your financial situation allows for informed decision-making across all aspects of life.

Overview: What This Article Covers

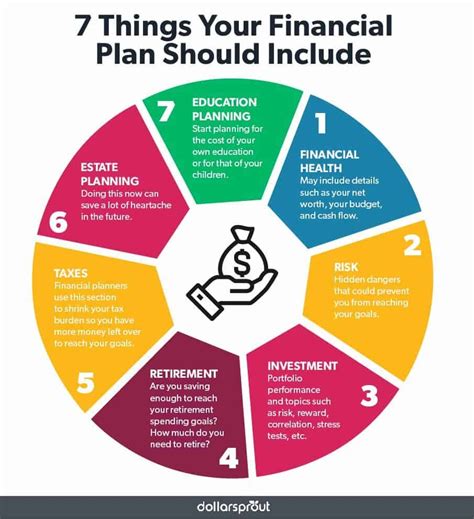

This in-depth guide provides a holistic approach to financial management. We'll explore fundamental concepts like budgeting and saving, delve into strategies for investing and managing debt, and finally, discuss long-term financial planning, including retirement and estate planning. We'll also examine the crucial role of understanding your credit score and protecting yourself from financial fraud.

The Research and Effort Behind the Insights

This article is the culmination of extensive research, drawing upon reputable sources such as the Financial Planning Association, the Consumer Financial Protection Bureau, and numerous peer-reviewed academic studies. We've integrated best practices from financial experts and case studies to provide readers with actionable and reliable insights.

Key Takeaways:

- Creating a Realistic Budget: Understanding where your money goes is the first step to controlling it.

- Building an Emergency Fund: A safety net protects you from unexpected expenses.

- Strategic Debt Management: Developing a plan to pay down high-interest debt.

- Investing for the Future: Growing your wealth through diversified investments.

- Long-Term Financial Planning: Setting financial goals and creating a roadmap to achieve them.

Smooth Transition to the Core Discussion:

Now that we've established the importance of financial management, let's explore its key components in detail.

Exploring the Key Aspects of Financial Management:

1. Budgeting: The cornerstone of financial management is creating and sticking to a budget. This involves tracking your income and expenses to understand your cash flow. There are numerous budgeting methods, including the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), the zero-based budget (allocating every dollar), and envelope budgeting (cash allocated to specific categories). Use budgeting apps or spreadsheets to simplify the process. Regularly review and adjust your budget as needed to reflect changes in your income or expenses.

2. Saving and Emergency Funds: Building an emergency fund is paramount. Aim for 3-6 months' worth of living expenses in a readily accessible savings account. This cushion protects you from unexpected job loss, medical emergencies, or home repairs. Once the emergency fund is established, focus on saving for other goals, such as a down payment on a house, a new car, or retirement.

3. Debt Management: High-interest debt can significantly hinder your financial progress. Develop a strategy to manage and pay down debt, prioritizing high-interest debts first (like credit cards). Consider debt consolidation or balance transfer options to lower interest rates. Avoid accumulating new debt whenever possible.

4. Investing: Investing your savings allows your money to grow over time. Diversify your investments across different asset classes (stocks, bonds, real estate) to mitigate risk. Consider your risk tolerance and investment timeline when choosing investments. Consult with a financial advisor to develop a personalized investment strategy. Start early to take advantage of compounding returns.

5. Long-Term Financial Planning: This involves setting long-term financial goals, such as retirement, education funding, or buying a home. Create a roadmap to achieve these goals, considering factors like inflation and potential life changes. Regularly review and adjust your plan as needed.

Exploring the Connection Between Credit Scores and Financial Management:

A strong credit score is crucial for securing loans, mortgages, and credit cards at favorable interest rates. It reflects your responsible use of credit. Understanding your credit score and actively managing it is a vital aspect of financial management. Pay bills on time, maintain low credit utilization, and avoid opening multiple credit accounts simultaneously. Regularly monitor your credit report for errors.

Key Factors to Consider:

- Roles and Real-World Examples: A good credit score allows for lower interest rates on loans, saving thousands of dollars over the life of the loan. Conversely, a poor credit score can lead to higher interest rates or even loan denial.

- Risks and Mitigations: Failing to manage credit responsibly can lead to debt accumulation, impacting your ability to achieve financial goals. Regular monitoring and responsible credit use are crucial mitigations.

- Impact and Implications: A high credit score opens doors to better financial opportunities, while a low score limits them. This can significantly affect long-term financial stability.

Conclusion: Reinforcing the Connection

The relationship between credit scores and financial management is undeniable. Responsible credit management is a crucial component of overall financial health and success.

Further Analysis: Examining Retirement Planning in Greater Detail

Retirement planning is a crucial aspect of long-term financial management. It involves saving and investing consistently over your working years to ensure a comfortable retirement. Consider factors such as your desired retirement lifestyle, expected life expectancy, and potential healthcare costs. Maximize contributions to retirement accounts (401(k), IRA) to take advantage of tax benefits and employer matching. Regularly review and adjust your retirement plan as needed.

FAQ Section: Answering Common Questions About Financial Management:

Q: What is the best budgeting method?

A: The best budgeting method depends on your individual needs and preferences. Experiment with different methods to find one that suits you.

Q: How much should I save for retirement?

A: A general rule of thumb is to aim to save at least 15% of your pre-tax income for retirement.

Q: What are the risks of investing?

A: Investing always involves some level of risk. Diversification and a long-term investment strategy can help mitigate risk.

Q: How can I improve my credit score?

A: Pay bills on time, keep credit utilization low, and avoid opening many new accounts at once.

Practical Tips: Maximizing the Benefits of Financial Management:

- Set clear financial goals: Define short-term and long-term goals to provide direction.

- Track your spending: Monitor your expenses to identify areas for improvement.

- Automate savings: Set up automatic transfers to your savings and investment accounts.

- Seek professional advice: Consult with a financial advisor for personalized guidance.

- Stay informed: Keep up-to-date on financial news and trends.

Final Conclusion: Wrapping Up with Lasting Insights

Effective financial management is a journey, not a destination. By consistently implementing sound financial principles and adapting to changing circumstances, you can build a secure financial future and achieve your financial dreams. Remember, proactive planning and responsible decision-making are the cornerstones of long-term financial success. Embrace the power of knowledge and take control of your financial destiny today.

Latest Posts

Latest Posts

-

When Does Indigo Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Amazon Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Destiny Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Self Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Discover Credit Card Report To Credit Bureau

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Make Financial Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.