What Percentage Of Credit Usage Is Good

adminse

Apr 07, 2025 · 7 min read

Table of Contents

What percentage of credit utilization is ideal, and how can I manage it effectively?

Maintaining a low credit utilization ratio is crucial for achieving a high credit score and securing favorable financial terms.

Editor’s Note: This article on credit utilization percentages was published today, [Date]. This comprehensive guide provides up-to-date information and actionable strategies for managing your credit effectively. It’s designed to help consumers of all credit backgrounds understand and improve their credit utilization ratios.

Why Credit Utilization Matters: Relevance, Practical Applications, and Industry Significance

Your credit utilization ratio—the percentage of your available credit you're currently using—is a significant factor influencing your credit score. Lenders view it as an indicator of your debt management capabilities. A high utilization ratio suggests you're heavily reliant on credit, increasing the perceived risk of default. Conversely, a low utilization ratio signifies responsible credit management and reduces lender risk. This directly impacts interest rates on loans, credit card approvals, and even insurance premiums. Understanding and managing your credit utilization is essential for securing favorable financial terms and achieving your financial goals. It’s not just about a number; it's about demonstrating financial responsibility.

Overview: What This Article Covers

This article dives deep into the optimal credit utilization percentage, exploring its impact on your credit score, the nuances of different credit card types and their impact on utilization calculations, and practical strategies for managing your credit effectively. You'll learn how to interpret your credit reports, identify potential pitfalls, and develop a plan to maintain a healthy credit utilization ratio.

The Research and Effort Behind the Insights

This article is the product of extensive research, drawing upon data from major credit bureaus like Experian, Equifax, and TransUnion, and incorporating insights from financial experts and industry reports. The analysis considers various credit scoring models and their weighting of credit utilization to ensure accuracy and provide readers with actionable, reliable information.

Key Takeaways: Summarize the Most Essential Insights

- Ideal Credit Utilization: Aim for under 30%, ideally under 10%.

- Credit Mix Matters: The impact of utilization varies slightly depending on the types of credit you use.

- Regular Monitoring: Track your credit utilization regularly using your credit reports and card statements.

- Strategic Payment Planning: Pay down balances strategically to minimize utilization.

- Credit Limit Increases: Request credit limit increases judiciously to lower your utilization.

Smooth Transition to the Core Discussion

With a solid understanding of why credit utilization is paramount, let’s delve into the specifics of what constitutes a “good” percentage and how to achieve it.

Exploring the Key Aspects of Credit Utilization

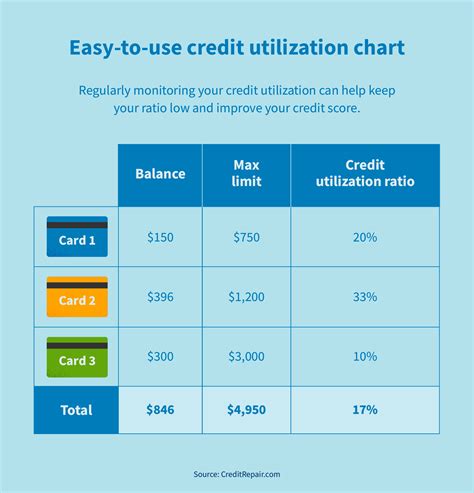

Definition and Core Concepts: Credit utilization is calculated by dividing your total credit card balances by your total available credit across all your accounts. For example, if you have $1,000 in credit card debt and $5,000 in available credit, your utilization ratio is 20% ($1,000 / $5,000).

Optimal Percentage: While there's no universally agreed-upon "magic number," experts generally recommend keeping your credit utilization below 30%. An even more favorable range is below 10%. Staying below this threshold significantly minimizes risk in the eyes of lenders and boosts your credit score potential.

Applications Across Industries: The concept of credit utilization is relevant across various financial industries, affecting your access to credit cards, loans (mortgages, auto loans, personal loans), and even insurance rates. Lenders use this metric as a key factor in assessing your creditworthiness.

Challenges and Solutions: Many face challenges maintaining a low utilization ratio, particularly during unexpected expenses or periods of financial strain. Strategies include budgeting diligently, prioritizing debt payments, and exploring options like balance transfers or debt consolidation.

Impact on Innovation: The increasing focus on credit scoring and financial technology (FinTech) leads to more sophisticated credit scoring models that are even more sensitive to credit utilization ratios. Understanding these models is crucial for managing credit effectively in today's financial landscape.

Closing Insights: Summarizing the Core Discussion

Maintaining a low credit utilization ratio is fundamental to good credit health. It's a simple yet powerful tool to improve your credit score and access better financial opportunities. By understanding its implications and employing effective strategies, individuals can proactively manage their finances and secure a more favorable financial future.

Exploring the Connection Between Payment History and Credit Utilization

A strong payment history is inextricably linked to credit utilization. Consistent on-time payments demonstrate responsible credit management and offset the impact of even a slightly higher utilization ratio. Conversely, missed payments, even with low utilization, can significantly damage your credit score.

Key Factors to Consider

Roles and Real-World Examples: Consider someone with a $10,000 credit limit and a $3,000 balance (30% utilization). This individual might still face higher interest rates than someone with the same balance but a $20,000 limit (15% utilization), even with perfect payment history.

Risks and Mitigations: High utilization increases the risk of exceeding credit limits, incurring late payment fees, and ultimately damaging your credit score. Mitigation strategies include budgeting carefully, setting payment reminders, and considering debt management solutions if necessary.

Impact and Implications: The long-term impact of high utilization can include higher interest rates on loans, reduced approval chances for new credit, and potentially higher insurance premiums. Conversely, consistently low utilization significantly improves your creditworthiness.

Conclusion: Reinforcing the Connection

The relationship between payment history and credit utilization is symbiotic. While consistent on-time payments help mitigate the negative impact of higher utilization, maintaining low utilization significantly reduces the risk of late payments and strengthens your overall credit profile.

Further Analysis: Examining Payment History in Greater Detail

Payment history encompasses more than just timely payments; it also includes the length of your credit history, the types of credit accounts you have, and the number of inquiries on your credit report. Each of these elements contributes to your overall credit score, further emphasizing the importance of responsible credit management. Analyzing your credit reports regularly to identify any negative marks and address them proactively is crucial for maintaining a healthy credit profile.

FAQ Section: Answering Common Questions About Credit Utilization

What is a good credit utilization percentage? Aim for under 30%, ideally under 10%.

How is credit utilization calculated? It's calculated by dividing your total credit card balances by your total available credit.

Does credit utilization affect all credit scores equally? Different credit scoring models might weigh credit utilization differently, but it's consistently a significant factor.

What happens if my credit utilization is too high? Lenders perceive higher risk, potentially leading to higher interest rates, loan denials, or reduced credit card limits.

How can I lower my credit utilization? Pay down balances, request credit limit increases (if qualified), and avoid opening new credit accounts unnecessarily.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

-

Track Your Spending: Monitor your credit card spending regularly to avoid exceeding your budget.

-

Pay More Than the Minimum: Paying more than the minimum payment each month significantly reduces your balance and improves your utilization ratio.

-

Automate Payments: Set up automatic payments to ensure on-time payments and avoid late fees.

-

Review Your Credit Report Regularly: Check your credit reports from all three major bureaus (Experian, Equifax, and TransUnion) annually to identify any errors or inconsistencies.

-

Consider a Balance Transfer: If you have high-interest debt, a balance transfer to a card with a lower interest rate can help you pay down your debt faster.

Final Conclusion: Wrapping Up with Lasting Insights

Credit utilization is a fundamental aspect of personal finance. By understanding its importance and implementing the strategies outlined in this article, individuals can effectively manage their credit, improve their credit scores, and secure more favorable financial terms. Consistent monitoring, responsible spending, and proactive debt management are key to maintaining a healthy and beneficial credit utilization ratio. Remember, it’s not just about a number; it's about demonstrating financial responsibility and building a strong foundation for long-term financial success.

Latest Posts

Latest Posts

-

What Credit Score Do I Need For Tj Maxx

Apr 08, 2025

-

Is It Hard To Get Approved For A Tj Maxx Credit Card

Apr 08, 2025

-

What Credit Score Do You Need For A Tjmaxx Credit Card

Apr 08, 2025

-

What Credit Score Do I Need To Get A Tj Maxx Credit Card

Apr 08, 2025

-

What Credit Score Do You Need To Get A Tj Maxx Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Percentage Of Credit Usage Is Good . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.