What Is The Maximum Credit Line For Capital One

adminse

Apr 04, 2025 · 7 min read

Table of Contents

Decoding Capital One Credit Line: Understanding the Maximums and Influencing Factors

What determines the maximum credit line you can get from Capital One? Is there a secret number everyone's chasing?

Securing a high credit line with Capital One hinges on a complex interplay of factors; there's no single magic number, but rather a personalized assessment of your financial profile.

Editor’s Note: This article on Capital One credit line maximums was published [Date]. The information provided is based on publicly available data and current industry understanding. Credit policies are subject to change, so always confirm details directly with Capital One.

Why Your Capital One Credit Line Matters:

A higher credit line with Capital One, or any credit card issuer, offers several advantages. It can improve your credit utilization ratio (the percentage of available credit used), a crucial factor in your credit score. A lower utilization ratio generally results in a higher credit score, making you a more attractive borrower for future loans, mortgages, and even better credit card offers. A larger credit limit can also provide greater financial flexibility, allowing you to handle unexpected expenses without exceeding your credit limit and incurring penalties. It can also be beneficial for building a strong credit history, particularly if you're aiming to obtain larger credit lines from other financial institutions in the future.

What This Article Covers:

This article dives deep into the factors that determine Capital One's credit line offers, exploring the application process, credit scoring models, and the various internal and external elements influencing the final decision. Readers will gain a comprehensive understanding of how to improve their chances of securing a higher credit limit, and learn what to expect from the application process. We'll also address common misconceptions and explore alternative strategies for managing credit effectively.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing from publicly available information on Capital One's credit practices, industry best practices in credit scoring, and analysis of consumer experiences. While specific internal algorithms used by Capital One remain proprietary, the underlying principles guiding credit line decisions are well-established within the financial industry.

Key Takeaways:

- No Fixed Maximum: There's no publicly stated maximum credit line for Capital One cards. The amount offered is entirely personalized.

- Credit Score is King: Your credit score is the most significant determinant of your credit limit.

- Income and Debt Play a Role: Income verification and existing debt levels significantly influence the decision.

- Credit History Matters: Length and stability of credit history are crucial.

- Capital One's Risk Assessment: Capital One uses sophisticated models to assess your risk profile.

Smooth Transition to the Core Discussion:

Having established the importance of understanding your Capital One credit line, let’s delve into the key factors influencing the credit limit assigned to your application.

Exploring the Key Aspects of Capital One Credit Line Determinations:

1. Credit Score: Your credit score, a three-digit numerical representation of your creditworthiness, is paramount. Capital One, like other lenders, uses credit scores (typically FICO scores) to assess your risk. A higher credit score generally signifies a lower risk of default, resulting in a higher credit line offer. The specific credit score needed for a high credit limit is not publicly disclosed, but aiming for a score above 750 generally increases your chances of securing a favorable offer.

2. Income and Debt: Capital One assesses your income to determine your ability to repay the credit. They verify this information through various methods, often involving checking your employment history and income documents. Existing debt, including outstanding loans and credit card balances, impacts your debt-to-income ratio (DTI). A higher DTI indicates a greater financial burden, potentially leading to a lower credit line. Managing your debt effectively and maintaining a low DTI is crucial.

3. Credit History Length and Stability: The length of your credit history demonstrates your experience in managing credit responsibly. A longer history with consistent on-time payments shows lenders that you're reliable. Stability in your credit history, meaning consistent credit behavior without sudden changes or significant delinquencies, is also highly valued. A long, stable credit history significantly improves your odds of receiving a higher credit line.

4. Capital One's Proprietary Algorithms: Capital One uses sophisticated algorithms and models to assess risk. These models consider numerous factors beyond the standard credit score, such as the type of accounts you have, your spending patterns, and the frequency of credit inquiries. These proprietary models are not publicly available and are constantly refined to improve accuracy in predicting risk.

Exploring the Connection Between Application History and Capital One Credit Line:

The number of credit cards you've applied for in the recent past can influence your credit line offer. Multiple recent applications can lead to a decrease in your credit score due to an increase in hard inquiries, which are recorded on your credit report. This signals to lenders that you're potentially seeking a large amount of credit, increasing the perceived risk. Therefore, it is generally recommended to limit credit applications to reduce the impact on your credit score.

Key Factors to Consider:

- Roles and Real-World Examples: A person with a strong credit score of 800, a high income, and a low DTI is significantly more likely to receive a high credit line compared to someone with a 600 credit score, low income, and a high DTI.

- Risks and Mitigations: Applying for multiple credit cards in a short period can negatively impact your credit score, leading to a lower credit line offer. Mitigation involves responsible credit management, limiting applications, and ensuring timely payments.

- Impact and Implications: A higher credit line can improve your credit utilization ratio, boosting your credit score, which can positively affect future financial decisions like securing loans or mortgages at favorable interest rates.

Conclusion: Reinforcing the Connection:

The relationship between application history and your Capital One credit line is significant. Responsible credit behavior, including avoiding excessive applications and maintaining a healthy credit score, are crucial for maximizing your chances of securing a higher credit limit.

Further Analysis: Examining Credit Utilization in Greater Detail:

Credit utilization, the percentage of your available credit you're using, is a crucial factor in credit scoring. Keeping your credit utilization low, ideally below 30%, demonstrates responsible credit management and improves your credit score. This contributes to a higher credit limit approval and helps secure better financial offers in the future.

FAQ Section: Answering Common Questions About Capital One Credit Lines:

- Q: What is the average Capital One credit line? A: There's no publicly available average. It varies drastically depending on individual credit profiles.

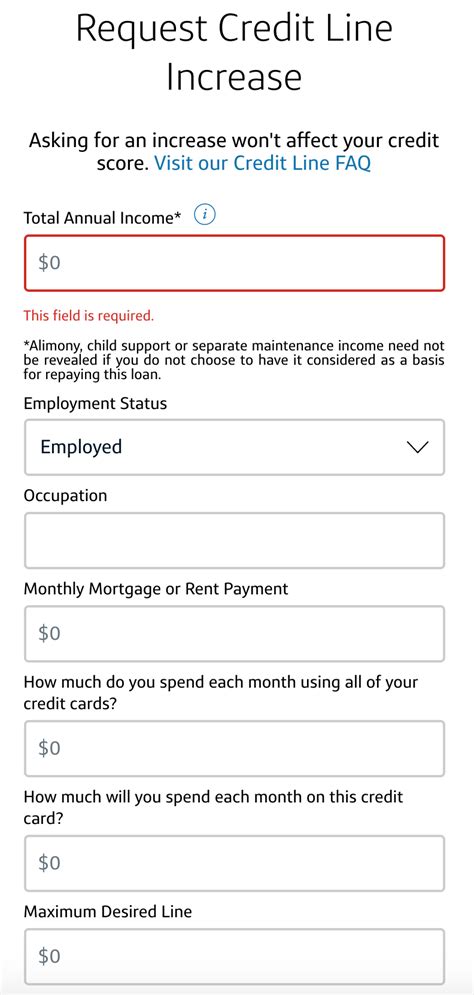

- Q: Can I increase my Capital One credit line? A: Yes, you can request a credit limit increase after maintaining your account in good standing for a certain period.

- Q: How long does it take to get a credit limit increase? A: The timeframe varies, typically ranging from a few weeks to several months.

- Q: What happens if I'm denied a credit line increase? A: You'll receive notification from Capital One. Consider improving your credit score and reapplying later.

- Q: Can my credit score affect my credit limit? A: Absolutely. A higher credit score significantly increases your chances of a higher credit limit.

Practical Tips: Maximizing the Benefits of Your Capital One Credit Line:

- 1. Maintain a High Credit Score: Prioritize timely payments and responsible credit management.

- 2. Keep Credit Utilization Low: Avoid maxing out your credit cards.

- 3. Monitor Your Credit Report Regularly: Check for errors and address them promptly.

- 4. Request a Credit Limit Increase Periodically: After establishing a positive credit history with Capital One, request increases strategically.

- 5. Consider Alternative Credit-Building Strategies: If your credit score is low, explore options like secured credit cards or credit-builder loans.

Final Conclusion: Wrapping Up with Lasting Insights:

Securing a high credit line with Capital One, or any lender, requires strategic planning and proactive credit management. Understanding the factors that influence credit line decisions, including your credit score, income, debt, and application history, is crucial. By focusing on responsible credit behavior and actively improving your financial profile, you'll significantly increase your chances of securing a favorable credit line offer. Remember, there is no guaranteed maximum, but by following these tips, you can optimize your chances of accessing the credit limit that best suits your needs.

Latest Posts

Latest Posts

-

What Is The Minimum Payment On A 1000 Credit Card Chase

Apr 05, 2025

-

What Is The Minimum Payment On A 300 Credit Card Chase

Apr 05, 2025

-

What Is The Minimum Payment On A 1500 Credit Card Chase

Apr 05, 2025

-

What Is The Minimum Payment On A 3000 Credit Card Chase

Apr 05, 2025

-

What Is The Minimum Payment On Chase Credit Card

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is The Maximum Credit Line For Capital One . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.