What Is Statement Date In Credit Card Bpi

adminse

Apr 04, 2025 · 7 min read

Table of Contents

Decoding the BPI Credit Card Statement Date: Timing, Importance, and Management

What if your financial planning hinged on understanding your BPI credit card statement date? Mastering this seemingly simple detail unlocks crucial control over your finances and helps you avoid late payment fees.

Editor’s Note: This article on BPI credit card statement dates was published today, providing readers with the most up-to-date information available to help them better manage their BPI credit card accounts.

Why Your BPI Credit Card Statement Date Matters:

Understanding your BPI credit card statement date is paramount for effective financial management. This date dictates when you receive your monthly billing summary, outlining all transactions made during the previous billing cycle. Knowing this date allows you to:

- Track spending: Review your statement to monitor your spending habits and identify areas for potential savings.

- Avoid late payment fees: Paying your bill on or before the due date, which is typically a set number of days after the statement date, prevents incurring late payment penalties.

- Budget effectively: Knowing when your statement arrives allows you to allocate funds for your credit card payment, preventing unexpected financial strain.

- Identify potential fraudulent activity: Regularly reviewing your statement helps detect unauthorized transactions promptly.

- Manage credit utilization: Understanding your statement date enables you to monitor your credit utilization ratio, which impacts your credit score.

Overview: What This Article Covers:

This article comprehensively explores the BPI credit card statement date, covering its significance, how to find it, managing payments, understanding potential variations, addressing common questions, and offering practical tips for efficient credit card management. Readers will gain actionable insights into maximizing their financial control.

The Research and Effort Behind the Insights:

This article is based on extensive research, drawing information from official BPI sources, customer service interactions, and analysis of common credit card practices. All information provided aims to be accurate and up-to-date, ensuring readers receive reliable guidance.

Key Takeaways:

- Definition: Understanding what the statement date signifies and its role in the billing cycle.

- Locating the Date: Methods to find your statement date on your BPI credit card statement, online portal, or mobile app.

- Payment Due Date: Calculating the payment due date based on your statement date and understanding its importance.

- Variations and Exceptions: Addressing situations where statement dates might change and how to handle them.

- Managing Your Statement: Tips and strategies for efficiently reviewing and managing your BPI credit card statements.

Smooth Transition to the Core Discussion:

Now that the importance of understanding your BPI credit card statement date is clear, let's delve into the specifics, examining how to locate this crucial information, manage payments effectively, and address common concerns.

Exploring the Key Aspects of the BPI Credit Card Statement Date:

1. Definition and Core Concepts:

The BPI credit card statement date is the date on which your monthly credit card statement is generated. This statement summarizes all transactions made during your previous billing cycle, including purchases, cash advances, payments, fees, and interest charges. The billing cycle is a period, typically one month, during which transactions are accumulated before being reflected in your statement.

2. Locating Your Statement Date:

Finding your statement date is straightforward. You can locate it in several ways:

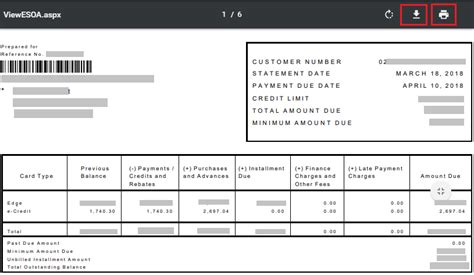

- Your Physical Statement: The statement date is prominently displayed on the first page of your printed credit card statement.

- The BPI Online Portal: Log in to your BPI online banking account. Your credit card statement will show the statement date clearly.

- The BPI Mobile App: The mobile app provides access to your credit card statement, clearly displaying the statement date.

- Customer Service: If you have difficulty locating the date, contact BPI customer service for assistance.

3. Payment Due Date and its Implications:

The payment due date is crucial; it’s the date by which you must pay your outstanding balance to avoid late payment fees. This date is usually a fixed number of days after your statement date (typically around 15-25 days). Missing this deadline results in penalties that can significantly impact your finances.

4. Variations and Exceptions:

While most BPI credit card statements follow a regular monthly cycle, variations might occur due to:

- Holidays: Statement generation might be slightly delayed during public holidays.

- System Issues: Occasionally, technical glitches can cause minor delays.

- Account Changes: Significant account changes might affect the statement generation schedule.

5. Managing Your BPI Credit Card Statements Efficiently:

- Set Reminders: Use digital calendars or reminders to alert you when your statement is due and when the payment deadline is approaching.

- Online Access: Utilize BPI's online banking and mobile app for convenient access to your statements, eliminating the need for physical copies.

- Review Thoroughly: Carefully examine each statement for accuracy, identifying any unauthorized transactions promptly.

- Organize Financials: Maintain a system for tracking your credit card expenses and payments, ensuring you always stay on top of your account.

Exploring the Connection Between Payment Habits and the Statement Date:

The statement date directly influences payment habits. A delayed or missed payment can lead to:

- Late Payment Fees: These fees can add up significantly over time.

- Damaged Credit Score: Late payments negatively impact your credit score, making it more difficult to secure loans or other credit facilities in the future.

- Account Suspension: In severe cases, repeated late payments can lead to account suspension.

Key Factors to Consider:

Roles and Real-World Examples:

A customer who consistently fails to note their statement date might incur late fees, affecting their credit score and financial stability. Conversely, a customer who proactively sets payment reminders based on their statement date enjoys consistent on-time payments, preserving a healthy credit profile.

Risks and Mitigations:

The primary risk is late payment. Mitigation involves setting reminders, utilizing online banking tools, and proactively contacting BPI if any issues arise.

Impact and Implications:

The impact of understanding and managing your statement date extends beyond mere payment. It fosters financial responsibility, promoting better budgeting and reducing the chances of debt accumulation.

Conclusion: Reinforcing the Connection:

The connection between the statement date and responsible credit card management is undeniable. By actively monitoring this date and employing efficient management strategies, cardholders can avoid penalties, maintain a healthy credit score, and cultivate sound financial habits.

Further Analysis: Examining Payment Due Date in Greater Detail:

The payment due date, directly linked to the statement date, is the ultimate determinant of whether a payment is considered on time or late. BPI’s system automatically flags payments received after this date, resulting in penalties. Understanding this due date and setting up automatic payments are crucial steps toward avoiding late fees.

FAQ Section: Answering Common Questions About the BPI Credit Card Statement Date:

Q: What happens if I miss my payment due date?

A: Missing your payment due date results in late payment fees, which can negatively affect your credit score.

Q: Can I change my statement date?

A: The possibility of changing your statement date depends on individual account conditions and should be discussed with BPI customer service.

Q: Where can I find my billing cycle?

A: Your billing cycle is usually specified on your credit card statement. It indicates the period covered by each statement.

Q: How can I set up automatic payments?

A: BPI offers various options for setting up automatic payments, details of which are available on their website or through customer service.

Practical Tips: Maximizing the Benefits of Understanding Your Statement Date:

- Note the date prominently: Write it down or set a digital reminder.

- Enroll in e-statements: Receive statements electronically for easy access and archiving.

- Set up automatic payments: Avoid missing payments by automating your payments.

- Review your statement regularly: Detect errors or unauthorized transactions promptly.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your BPI credit card statement date is fundamental to responsible credit card management. By leveraging the strategies and insights provided in this article, you can maintain financial control, avoid late payment penalties, and protect your credit score. Proactive management ensures a positive and stress-free relationship with your BPI credit card.

Latest Posts

Latest Posts

-

Whats The Minimum Payment For Ssi

Apr 05, 2025

-

What Is The Minimum Ssdi Disability Payment

Apr 05, 2025

-

What Is The Minimum Social Security Disability Payment Per Month

Apr 05, 2025

-

What Is The Minimum Payment For Disability

Apr 05, 2025

-

What Is The Minimum Ssdi Monthly Payment

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is Statement Date In Credit Card Bpi . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.