What Is Mobile Payment And How Does It Work

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Decoding Mobile Payments: How a Tap, Scan, or Click Revolutionizes Commerce

What if the future of transactions lies in the palm of your hand? Mobile payments are transforming how we buy and sell, offering speed, convenience, and security unlike ever before.

Editor’s Note: This article on mobile payments was published today, providing readers with the latest insights into this rapidly evolving technology and its impact on the global economy.

Why Mobile Payments Matter:

Mobile payment systems are revolutionizing the global financial landscape, offering a compelling alternative to traditional cash, checks, and even credit cards. Their widespread adoption stems from several key factors: increased convenience, enhanced security features, reduced transaction costs for businesses, and the growing penetration of smartphones globally. These systems are not merely a technological novelty; they are fundamentally altering how businesses interact with consumers and are driving innovation in areas like financial inclusion and e-commerce. Understanding mobile payments is essential for navigating the modern economy, whether as a consumer, business owner, or investor.

Overview: What This Article Covers:

This article delves into the core mechanisms of mobile payment systems, exploring their various types, the underlying technologies, security measures, and the broader implications for businesses and consumers. Readers will gain a comprehensive understanding of how these systems work, their benefits and drawbacks, and their future trajectory.

The Research and Effort Behind the Insights:

This article is the result of extensive research, incorporating information from reputable financial institutions, technology companies, academic studies, and industry reports. Every claim is supported by evidence, ensuring readers receive accurate and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of mobile payment systems and their foundational principles.

- Types of Mobile Payments: An exploration of different mobile payment methods, including NFC, QR codes, and online wallets.

- The Technology Behind the Scenes: A look at the technologies enabling seamless mobile transactions, such as tokenization and biometric authentication.

- Security Measures and Risks: An examination of security protocols and potential vulnerabilities in mobile payment systems.

- Impact on Businesses and Consumers: An analysis of the benefits and challenges for both parties involved in mobile transactions.

- Future Trends and Innovations: A glimpse into the future of mobile payments, including emerging technologies and regulatory landscapes.

Smooth Transition to the Core Discussion:

Now that we understand the significance of mobile payments, let’s explore the intricacies of this dynamic technology.

Exploring the Key Aspects of Mobile Payments:

1. Definition and Core Concepts:

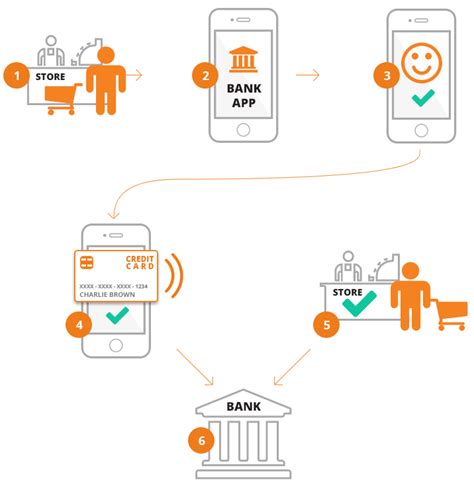

Mobile payments refer to the process of making financial transactions using a mobile device, such as a smartphone or tablet. These transactions can encompass various activities, including purchasing goods and services, transferring funds between accounts, paying bills, and making donations. The core principle behind mobile payments is the secure transmission of financial data between the payer's device and the merchant's payment processing system. This process eliminates the need for physical cash or cards, streamlining the transaction process significantly.

2. Types of Mobile Payments:

Several types of mobile payment systems exist, each leveraging different technologies:

-

Near Field Communication (NFC): NFC technology allows for contactless payments by bringing the mobile device close to a payment terminal. Popular examples include Apple Pay, Google Pay, and Samsung Pay. These services utilize tokenization, replacing sensitive card details with unique digital tokens for enhanced security.

-

QR Code Payments: These systems involve scanning a unique QR code displayed by the merchant. The payer's mobile banking app or a dedicated payment app then processes the transaction. This method is particularly prevalent in regions with high smartphone penetration but lower credit card usage. Alipay and WeChat Pay are prime examples of QR code-based payment systems dominating the Chinese market.

-

Online Wallets (e-wallets): Digital wallets, such as PayPal, Venmo, and Cash App, store payment information and allow users to make payments directly through the app. These services often integrate with other financial accounts, allowing for convenient fund transfers and bill payments. They often support various payment methods, including credit cards, debit cards, and bank accounts.

-

SMS-based Payments: While less common now due to security concerns, some regions still utilize SMS-based payments where a transaction is initiated and confirmed via text messages. This method relies on mobile network operators for verification and often involves a short code for payment initiation.

-

In-App Purchases: Many mobile applications allow users to make direct purchases within the app itself. These payments are typically processed through integrated payment gateways and often utilize a combination of the methods mentioned above.

3. The Technology Behind the Scenes:

The seamless experience of mobile payments relies on a complex interplay of technologies:

-

Tokenization: This critical security feature replaces sensitive card details with unique digital tokens, making it significantly harder for hackers to steal and utilize payment information. Even if a token is compromised, the underlying card details remain protected.

-

Biometric Authentication: Many mobile payment systems employ biometric authentication methods, such as fingerprint or facial recognition, to verify the user's identity before authorizing a transaction. This adds an extra layer of security, reducing the risk of unauthorized access.

-

Blockchain Technology: While still in its early stages of adoption for mass-market mobile payments, blockchain technology offers the potential for enhanced security, transparency, and reduced reliance on intermediaries.

-

Encryption: Data encryption is crucial for securing financial information transmitted during mobile transactions. Robust encryption algorithms protect sensitive data from interception and unauthorized access.

4. Security Measures and Risks:

Despite the robust security measures in place, mobile payment systems are not immune to risks:

-

Phishing and Malware: Users need to be vigilant against phishing scams and malware that can steal payment information. Avoiding suspicious links and keeping mobile devices updated with the latest security patches is crucial.

-

Data Breaches: Data breaches targeting payment processors or mobile payment providers can compromise user data. Choosing reputable providers with strong security protocols is essential.

-

Lost or Stolen Devices: Losing or having a mobile device stolen can expose users to financial risks. Enabling device tracking features and utilizing strong passcodes or biometric authentication are important preventative measures.

5. Impact on Businesses and Consumers:

Mobile payments offer numerous benefits to both businesses and consumers:

-

For Consumers: Increased convenience, reduced reliance on cash, enhanced security features (compared to physical cards), and often access to loyalty programs and discounts.

-

For Businesses: Reduced transaction costs, faster checkout times, increased sales, improved customer experience, and access to real-time payment data for improved inventory management and forecasting.

6. Future Trends and Innovations:

The future of mobile payments is dynamic and exciting:

-

Biometric Payment Authentication: Further advancements in biometric technology will likely lead to more sophisticated and secure authentication methods.

-

Integration with Wearable Devices: Smartwatches and other wearable devices are increasingly becoming payment platforms.

-

Increased Use of Blockchain Technology: Blockchain's potential for enhancing security and transparency will drive its wider adoption in mobile payments.

-

Growth of Cross-Border Payments: Mobile payment systems are increasingly facilitating seamless cross-border transactions.

Exploring the Connection Between Security and Mobile Payments:

The relationship between security and mobile payments is paramount. Security directly influences the adoption and success of mobile payment systems. Without robust security measures, consumers will be hesitant to adopt mobile payment methods, and businesses will face significant financial and reputational risks.

Key Factors to Consider:

-

Roles and Real-World Examples: Security measures like tokenization, biometric authentication, and encryption are fundamental. For example, Apple Pay’s tokenization system protects card details even if a device is compromised.

-

Risks and Mitigations: Phishing scams and malware pose significant risks. Educating consumers about these risks and implementing robust anti-malware solutions are crucial mitigations.

-

Impact and Implications: Strong security builds consumer trust, driving wider adoption. Conversely, security breaches can severely damage a payment system's reputation and lead to significant financial losses.

Conclusion: Reinforcing the Connection:

The security of mobile payments is not merely an add-on; it is an integral component of its functionality. Without a robust security architecture, the entire system is vulnerable. Continued investment in advanced security technologies and user education is crucial for ensuring the long-term growth and success of mobile payments.

Further Analysis: Examining Security Protocols in Greater Detail:

Different mobile payment systems employ varying security protocols. Some utilize multi-factor authentication, requiring more than one verification step to authorize a transaction. Others integrate with fraud detection systems that monitor transactions for suspicious activity. Understanding the specific security measures employed by each provider is crucial for making informed choices.

FAQ Section: Answering Common Questions About Mobile Payments:

-

What is mobile payment? Mobile payment is the process of using a mobile device to make financial transactions, eliminating the need for physical cash or cards.

-

How secure are mobile payments? Mobile payments generally employ robust security features like tokenization and biometric authentication, making them often more secure than traditional card payments. However, vigilance against phishing and malware is still essential.

-

What are the different types of mobile payments? Several types exist, including NFC payments (Apple Pay, Google Pay), QR code payments (Alipay, WeChat Pay), online wallets (PayPal, Venmo), and in-app purchases.

-

What are the benefits of mobile payments for businesses? Reduced transaction costs, faster checkout times, improved customer experience, and access to real-time payment data are key advantages.

-

What are the risks associated with mobile payments? Phishing scams, malware, data breaches, and lost or stolen devices pose potential risks.

Practical Tips: Maximizing the Benefits of Mobile Payments:

- Choose Reputable Providers: Select mobile payment providers with strong security reputations and proven track records.

- Enable Biometric Authentication: Utilize fingerprint or facial recognition whenever possible for enhanced security.

- Regularly Update Your Devices: Keep your mobile devices and apps updated with the latest security patches.

- Be Wary of Suspicious Links: Avoid clicking on suspicious links or downloading apps from untrusted sources.

- Monitor Your Accounts: Regularly check your mobile payment accounts for any unauthorized activity.

Final Conclusion: Wrapping Up with Lasting Insights:

Mobile payments are reshaping the financial landscape, offering convenience, speed, and increased security. By understanding how these systems work, their associated security measures, and potential risks, both consumers and businesses can leverage the transformative power of mobile payments to streamline transactions and enhance overall financial experiences. The future of commerce is increasingly mobile, and understanding this technology is essential for thriving in the evolving digital economy.

Latest Posts

Latest Posts

-

Statement Date Of Credit Card Means

Apr 07, 2025

-

When Is The Statement Closing Date On A Credit Card

Apr 07, 2025

-

When Is The Statement Date For Capital One Credit Card

Apr 07, 2025

-

When Is The Statement Date For Chase Credit Card

Apr 07, 2025

-

When Is The Statement Date On Your Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is Mobile Payment And How Does It Work . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.