Statement Date Of Credit Card Means

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding the Statement Date of Your Credit Card: A Comprehensive Guide

What if understanding your credit card statement date unlocks better financial management and avoids costly mistakes? This seemingly simple detail holds significant power in optimizing your credit utilization and overall financial health.

Editor’s Note: This article on credit card statement dates was published today, providing you with the most up-to-date information and practical advice to manage your credit effectively.

Why Your Credit Card Statement Date Matters:

Understanding your credit card statement date is crucial for several reasons. It directly impacts your credit score, helps you track spending, and allows you to optimize your payment strategy to avoid late fees and interest charges. It’s a key component in responsible credit card management, impacting everything from your credit utilization ratio (a major factor in your credit score) to your ability to budget effectively. Ignoring this seemingly minor detail can lead to significant financial repercussions.

Overview: What This Article Covers:

This article provides a comprehensive guide to understanding your credit card statement date. We'll explore its definition, how it differs from your payment due date, its impact on your credit report, strategies for managing your spending around your statement date, and answer frequently asked questions. You’ll gain practical knowledge to enhance your financial literacy and optimize your credit card usage.

The Research and Effort Behind the Insights:

This article is the result of extensive research, incorporating information from leading credit bureaus, financial institutions, and consumer finance experts. We've analyzed various credit card agreements and consulted reputable financial resources to ensure the accuracy and trustworthiness of the information presented.

Key Takeaways:

- Definition and Core Concepts: A clear definition of the statement date and its relationship to other credit card dates.

- Practical Applications: How understanding the statement date impacts budgeting, credit utilization, and payment strategies.

- Challenges and Solutions: Common issues related to statement dates and effective ways to address them.

- Future Implications: The continuing relevance of statement dates in an evolving financial landscape.

Smooth Transition to the Core Discussion:

Now that we understand the importance of the statement date, let's delve into its specifics, exploring its intricacies and practical applications for improved financial management.

Exploring the Key Aspects of Credit Card Statement Dates:

Definition and Core Concepts:

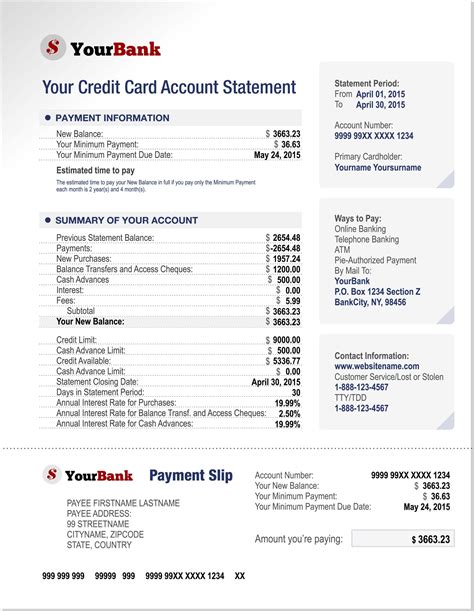

The credit card statement date is the day of the month your credit card issuer generates your monthly statement. This statement summarizes all transactions made during the previous billing cycle, including purchases, payments, fees, and interest charges. It's not the day you receive the statement, but the date the statement is generated by the credit card company. The statement date typically remains consistent from month to month.

The Billing Cycle:

The billing cycle is the period between consecutive statement dates. This cycle typically lasts 28-31 days, although it can vary slightly depending on your credit card issuer. Understanding your billing cycle is crucial because it determines when your transactions are reported to the credit bureaus and when your credit utilization is calculated.

Statement Date vs. Payment Due Date:

It’s vital to differentiate between the statement date and the payment due date. The payment due date is the deadline by which you must make your payment to avoid late fees and potential negative impacts on your credit score. The payment due date usually falls 21-25 days after the statement date. Always check your credit card agreement or your monthly statement for the precise payment due date.

Impact on Your Credit Report:

Your credit utilization ratio—the percentage of your available credit that you're using—is a critical factor in your credit score. This ratio is calculated based on your credit card balance on your statement date. A high credit utilization ratio (generally above 30%) can negatively impact your credit score. Understanding your statement date helps you manage your spending and payments strategically to keep your credit utilization low.

Applications Across Industries:

The concept of a statement date isn't unique to a single industry; it's a standard practice across all credit card issuers. Whether you use a Visa, Mastercard, American Express, or Discover card, the principle remains the same. The statement date is a fundamental aspect of managing your credit card account, regardless of the issuing bank or credit union.

Challenges and Solutions:

One common challenge is forgetting the statement date, leading to inaccurate budget tracking and potentially higher credit utilization. To mitigate this, set reminders on your calendar or use budgeting apps that automatically track your credit card spending and alert you to approaching statement dates.

Another challenge is understanding the impact of the statement date on your credit score. Many cardholders are unaware that their credit utilization is based on their balance on the statement date, not their average balance throughout the month. This knowledge empowers you to strategically pay down your balance before the statement date to lower your credit utilization ratio.

Impact on Innovation:

The financial technology (FinTech) industry is constantly evolving. Many apps and platforms integrate with credit cards, providing real-time transaction updates and insights into spending habits. These advancements enhance the understanding of statement dates, helping users manage their finances more effectively and avoid potential credit score pitfalls.

Closing Insights: Summarizing the Core Discussion:

The credit card statement date isn't merely a date on your calendar; it's a pivotal point in your monthly financial cycle. Understanding its significance allows for proactive management of your credit utilization, leading to a healthier credit score and better financial control. By consciously managing your spending and payments around your statement date, you can positively influence your creditworthiness.

Exploring the Connection Between Credit Utilization and Statement Dates:

Credit utilization is the percentage of your available credit that you are using at any given time. It is a crucial factor that credit scoring models heavily consider. The connection to the statement date is direct: your credit utilization is calculated based on your outstanding balance on your statement date.

Key Factors to Consider:

-

Roles and Real-World Examples: If your statement date is the 15th and you have a large purchase on the 10th, you may want to make an extra payment before the 15th to lower your credit utilization. Conversely, if your statement date is the 1st and your paycheck arrives on the 25th of the previous month, you might have a higher balance on the 1st, which could negatively impact your credit utilization.

-

Risks and Mitigations: High credit utilization significantly damages your credit score. To mitigate this risk, pay down your balance before the statement date. Consider utilizing budgeting apps or setting reminders to proactively manage spending and payments.

-

Impact and Implications: A consistently high credit utilization ratio can make it harder to qualify for loans, mortgages, or even certain rental agreements, increasing interest rates and hindering your financial opportunities.

Conclusion: Reinforcing the Connection:

The strong correlation between credit utilization and the statement date cannot be overstated. By understanding this connection and utilizing strategies to manage your spending and payments effectively, you can positively influence your credit score and achieve better financial health.

Further Analysis: Examining Payment Due Dates in Greater Detail:

While the statement date is crucial, the payment due date is equally important. The payment due date is the date by which you must submit your payment to avoid late fees and a negative impact on your credit report. Late payments are reported to credit bureaus and severely impact your credit score. This date is usually clearly indicated on your statement and in your credit card agreement. Always be sure to pay on time or even early to avoid such issues.

FAQ Section: Answering Common Questions About Credit Card Statement Dates:

-

What is a credit card statement date? The statement date is the date your credit card issuer generates your monthly statement summarizing your transactions from the previous billing cycle.

-

How is the statement date determined? It's set by your credit card issuer and typically remains consistent from month to month.

-

How does the statement date affect my credit score? Your credit utilization ratio, a major credit score factor, is calculated based on your balance on the statement date.

-

What if I miss my payment due date? Missing your payment due date will result in late fees and negatively impact your credit score.

-

How can I find my statement date? Your statement date is clearly stated on your monthly credit card statement and in your credit card agreement.

Practical Tips: Maximizing the Benefits of Understanding Your Statement Date:

-

Mark your calendar: Note your statement date and payment due date on your calendar or in a digital planner.

-

Monitor your spending: Regularly check your online account to track your spending and anticipate your balance on the statement date.

-

Plan ahead: If you anticipate high spending before your statement date, consider making extra payments to reduce your credit utilization ratio.

-

Set up automatic payments: Avoid late fees by setting up automatic payments for your credit card bill.

-

Use budgeting apps: Many budgeting apps track your spending and offer insights into your spending habits, enabling better control over your credit utilization.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your credit card statement date is a cornerstone of responsible credit card management. By proactively managing your spending and payments around this key date, you can maintain a healthy credit utilization ratio, avoiding the negative repercussions of high debt and safeguarding your credit score. The knowledge gained from understanding this seemingly small detail can lead to significant long-term financial benefits. Take control of your finances; understand your statement date.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about Statement Date Of Credit Card Means . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.