What Is A 650 Credit Score Rating

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding a 650 Credit Score: What It Means and How to Improve It

What does a 650 credit score really tell you, and is it good or bad?

A 650 credit score represents a significant milestone in your financial journey, presenting opportunities while also highlighting areas for potential improvement.

Editor’s Note: This article provides a comprehensive overview of a 650 credit score, offering insights into its implications, how it's calculated, and actionable strategies for improvement. The information is current as of October 26, 2023.

Why a 650 Credit Score Matters:

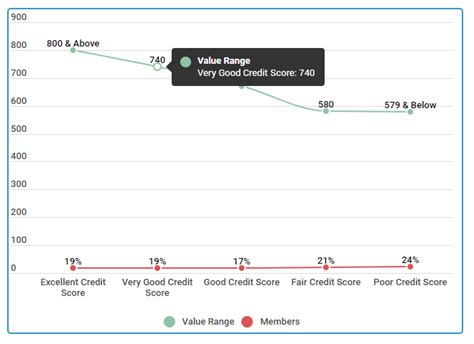

A credit score is a numerical representation of your creditworthiness, summarizing your past borrowing and repayment behavior. Lenders use these scores to assess the risk associated with lending you money. A 650 credit score falls within the "fair" range, according to the widely used FICO scoring system. While it’s not considered excellent, it's not necessarily bad either. It opens some doors but might close others. Understanding its implications is crucial for making informed financial decisions. This score significantly impacts your ability to secure loans, credit cards, insurance, and even rental agreements. A higher score typically translates to better interest rates, lower premiums, and more favorable terms. Conversely, a lower score could lead to higher interest rates, rejected applications, or stricter lending conditions. Improving a 650 score can lead to substantial long-term financial savings.

Overview: What This Article Covers:

This article delves into the intricacies of a 650 credit score. We will explore its position within the broader credit scoring spectrum, examine the factors that contribute to this score, and provide actionable strategies for improvement. Furthermore, we will address common questions and misconceptions surrounding credit scores and offer practical tips for building a stronger financial future.

The Research and Effort Behind the Insights:

The information presented in this article is based on extensive research, drawing upon publicly available data from reputable credit reporting agencies like Experian, Equifax, and TransUnion, as well as insights from financial experts and academic studies on credit scoring models. We have meticulously analyzed various credit scoring methodologies to ensure accuracy and provide readers with a clear and comprehensive understanding of a 650 credit score.

Key Takeaways:

- Understanding the FICO Score Range: A 650 score sits in the "fair" range, meaning it's acceptable but not ideal. There's room for improvement to access better financial opportunities.

- Factors Influencing Credit Scores: Delving into the five key factors: payment history, amounts owed, length of credit history, new credit, and credit mix.

- Improving a 650 Credit Score: Practical steps to raise your score, including addressing negative marks, managing debt, and building a positive credit history.

- The Impact of a 650 Credit Score on Financial Decisions: Examining the implications across various financial areas, including loans, credit cards, and insurance.

Smooth Transition to the Core Discussion:

Now that we understand the significance of a 650 credit score, let’s explore its components and the path toward improvement.

Exploring the Key Aspects of a 650 Credit Score:

1. Definition and Core Concepts:

A credit score is a three-digit number ranging from 300 to 850 (using the FICO scoring system), reflecting your creditworthiness. A 650 score falls within the "fair" range, indicating a moderate level of risk to lenders. While you may qualify for some credit products, the terms and interest rates offered will likely be less favorable than those available to individuals with higher scores. Different scoring models exist, but FICO scores are the most widely used by lenders.

2. Applications Across Industries:

Your credit score impacts various aspects of your financial life. A 650 score might allow you to secure certain loans, such as personal loans or auto loans, but you'll likely face higher interest rates than those with better scores. Credit card applications might be approved, but with higher interest rates and lower credit limits. Renting an apartment might also be challenging, as landlords often use credit scores to assess tenant reliability. Insurance premiums could be higher, as insurers consider credit scores as an indicator of risk.

3. Challenges and Solutions:

The primary challenge with a 650 credit score is the potential for higher interest rates and less favorable loan terms. This can lead to increased borrowing costs over the lifetime of a loan. Solutions involve actively improving your credit score by addressing the contributing factors (discussed below). This might include paying down debt, improving payment history, and diversifying your credit mix.

4. Impact on Innovation:

The credit scoring industry is constantly evolving, with new technologies and analytical techniques being developed. This innovation aims to provide more accurate and comprehensive assessments of creditworthiness. Understanding these advancements can help individuals better manage their credit and improve their scores.

Exploring the Connection Between Payment History and a 650 Credit Score:

Payment history is the most significant factor influencing your credit score, accounting for approximately 35% of your FICO score. A 650 score suggests some inconsistencies in your payment history, perhaps including some late payments or defaults. Even a few missed payments can negatively impact your score.

Key Factors to Consider:

- Roles and Real-World Examples: A single missed payment can significantly lower your score. Consistent late payments or defaults on loans or credit cards will severely damage your credit.

- Risks and Mitigations: The risk of higher interest rates and difficulty securing credit is substantial. Mitigation involves establishing a consistent record of on-time payments.

- Impact and Implications: A poor payment history can follow you for years, impacting your ability to obtain loans, rent an apartment, or even secure certain jobs.

Conclusion: Reinforcing the Connection:

Payment history is paramount in determining your credit score. A 650 score signals that improvements are needed in this area to achieve better financial outcomes.

Further Analysis: Examining Amounts Owed in Greater Detail:

Amounts owed, representing the second most significant factor (approximately 30% of your FICO score), refers to your credit utilization ratio—the percentage of your available credit you're currently using. A 650 score may indicate a high credit utilization ratio, suggesting you’re utilizing a large portion of your available credit.

Key Factors to Consider:

- Roles and Real-World Examples: Using more than 30% of your available credit can negatively impact your score. Maxing out credit cards is particularly damaging.

- Risks and Mitigations: High credit utilization signals higher risk to lenders. Mitigation involves paying down debt to reduce your credit utilization ratio.

- Impact and Implications: High credit utilization can result in higher interest rates and reduced chances of credit approval.

Conclusion: Reinforcing the Connection:

Managing your debt and keeping your credit utilization ratio low is crucial for improving your score.

Further Analysis: Examining Length of Credit History, New Credit, and Credit Mix:

The remaining factors—length of credit history (15%), new credit (10%), and credit mix (10%)—also contribute to your score. A 650 score might indicate a relatively shorter credit history, recent credit applications, or a lack of credit diversity.

Key Factors to Consider:

- Length of Credit History: A longer history demonstrates consistent responsible credit management.

- New Credit: Applying for multiple credit accounts in a short period can signal increased risk.

- Credit Mix: Having a variety of credit accounts (credit cards, installment loans) demonstrates responsible credit management.

Conclusion: Reinforcing the Connection:

Building a longer credit history, avoiding excessive new credit applications, and diversifying your credit accounts all contribute to improving your credit score.

FAQ Section: Answering Common Questions About a 650 Credit Score:

Q: What is a 650 credit score considered?

A: A 650 credit score is generally considered "fair." While it allows for some credit access, it’s not ideal and often comes with less favorable terms.

Q: How can I improve my 650 credit score?

A: Focus on paying down debt, paying bills on time, keeping your credit utilization low, and avoiding excessive new credit applications.

Q: How long does it take to improve my credit score?

A: The timeframe varies depending on the severity of negative marks and the consistency of positive credit behavior. Consistent positive changes can lead to improvements within several months.

Practical Tips: Maximizing the Benefits of a Credit Score Improvement:

- Monitor your credit reports regularly: Check your reports for errors and identify areas for improvement.

- Pay bills on time, every time: This single action has the most significant impact.

- Keep your credit utilization low: Aim for under 30% of your available credit.

- Avoid opening too many new accounts: Limit applications to only what's necessary.

- Consider a secured credit card: If you struggle to obtain credit, this can help build your history.

- Pay down high-interest debt: Prioritize reducing debt with the highest interest rates.

Final Conclusion: Wrapping Up with Lasting Insights:

A 650 credit score is a starting point, not a destination. By understanding the factors that influence your score and actively working to improve them, you can build a stronger financial future, gaining access to better interest rates, more favorable loan terms, and improved overall financial health. Remember, consistent positive credit behavior is key to long-term success. The effort you put into improving your score will significantly pay off in the long run.

Latest Posts

Latest Posts

-

Accredited Investor Defined Understand The Requirements

Apr 30, 2025

-

Accredited Automated Clearing House Professional Aap Definition

Apr 30, 2025

-

Accounts Receivable Subsidiary Ledger Definition And Purpose

Apr 30, 2025

-

What Is Accounts Receivable Financing Definition And Structuring

Apr 30, 2025

-

Accounts Payable Turnover Ratio Definition Formula Examples

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is A 650 Credit Score Rating . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.