What Is A Student Loan Repayment

adminse

Mar 28, 2025 · 9 min read

Table of Contents

Decoding Student Loan Repayment: A Comprehensive Guide

What if navigating the complexities of student loan repayment didn't have to feel like a daunting maze? Understanding the various repayment options and strategies can empower you to take control of your financial future and achieve long-term financial well-being.

Editor’s Note: This article on student loan repayment was published today, offering readers the most up-to-date information and strategies for managing their student debt effectively. This guide covers a range of repayment plans, strategies, and considerations to help you make informed decisions about your student loans.

Why Student Loan Repayment Matters:

Student loan debt has become a significant financial burden for many individuals. The total amount of student loan debt in many countries is staggering, impacting not only personal finances but also broader economic growth. Understanding student loan repayment is crucial for several reasons:

- Financial Freedom: Repaying student loans effectively is essential to achieving financial freedom. Unmanageable debt can severely restrict your ability to save for a down payment on a house, invest in your future, or even manage unexpected expenses.

- Credit Score Impact: Consistent on-time payments on your student loans significantly boost your credit score, impacting your eligibility for future loans, credit cards, and even rental applications. Conversely, defaulting on your loans can severely damage your credit score for years.

- Future Opportunities: High levels of student loan debt can hinder career progression. The weight of debt can limit your willingness to take risks, such as starting a business or pursuing further education, which might otherwise lead to higher earning potential.

- Mental Well-being: The stress associated with managing substantial student loan debt can negatively impact mental health. Developing a solid repayment plan can alleviate this stress and improve overall well-being.

Overview: What This Article Covers

This article provides a comprehensive overview of student loan repayment. We will explore different repayment plans, discuss strategies for effective repayment, address potential challenges, and delve into the consequences of defaulting on loans. We will also consider the role of income-driven repayment plans, loan forgiveness programs, and refinancing options.

The Research and Effort Behind the Insights:

This article is the result of extensive research, incorporating information from government websites, reputable financial institutions, and non-profit organizations focused on student loan debt. Data on repayment plans, interest rates, and default rates have been analyzed to ensure accuracy and provide readers with trustworthy insights.

Key Takeaways:

- Understanding Loan Types: Differentiating between federal and private student loans, and their respective repayment options.

- Repayment Plan Options: Exploring standard repayment, graduated repayment, extended repayment, and income-driven repayment plans.

- Strategies for Efficient Repayment: Implementing effective budgeting techniques and debt management strategies.

- Consequences of Default: Understanding the severe repercussions of failing to repay student loans.

- Exploring Alternative Options: Examining loan consolidation, refinancing, and loan forgiveness programs.

Smooth Transition to the Core Discussion:

Now that we’ve established the importance of understanding student loan repayment, let's delve into the specifics, beginning with the different types of student loans and their implications for repayment.

Exploring the Key Aspects of Student Loan Repayment

1. Understanding Loan Types:

The first step in navigating student loan repayment is understanding the type of loans you have. This distinction is crucial because federal and private student loans have different repayment options and protections.

- Federal Student Loans: These loans are issued by the government and generally offer more flexible repayment plans and borrower protections. They include subsidized and unsubsidized loans, as well as PLUS loans (for parents and graduate students). Federal loans often have lower interest rates than private loans.

- Private Student Loans: These loans are provided by banks, credit unions, and other private lenders. They typically have less flexible repayment options and fewer borrower protections. Interest rates tend to be higher, and the application process can be more stringent.

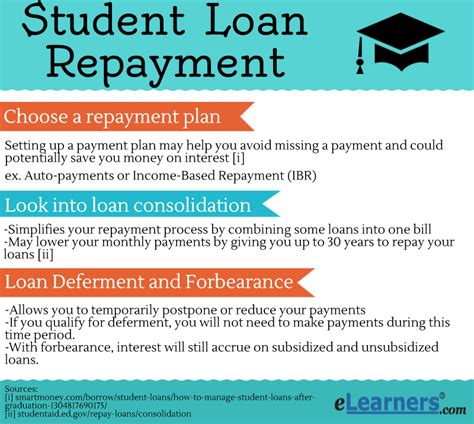

2. Repayment Plan Options:

Once you've graduated or left school, your loan servicer will contact you to discuss repayment options. Several plans are available, each with its own advantages and disadvantages:

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. It's the most straightforward plan but may result in higher monthly payments compared to other options.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. While initial payments are manageable, they become significantly higher in later years.

- Extended Repayment Plan: This plan stretches your repayment period to up to 25 years, leading to lower monthly payments but ultimately higher total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans, available for federal loans, base your monthly payments on your income and family size. Several IDR plans exist, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. These plans often lead to lower monthly payments but can extend the repayment period to 20 or 25 years, resulting in more interest paid over the life of the loan.

3. Strategies for Efficient Repayment:

Effective repayment requires planning and discipline. Here are some key strategies:

- Budgeting: Create a detailed budget to track your income and expenses. Allocate a specific amount towards your student loan payments each month.

- Debt Avalanche or Snowball Method: The debt avalanche method prioritizes paying off loans with the highest interest rates first, while the debt snowball method focuses on paying off the smallest loan balance first to gain momentum and motivation.

- Extra Payments: Whenever possible, make extra payments towards your principal balance. This reduces the total interest paid and shortens the repayment period.

- Refinancing: Consider refinancing your student loans, particularly if you have a strong credit score and can secure a lower interest rate. This can significantly reduce the total interest paid over the life of the loan. However, be aware of the implications of refinancing federal loans into private loans.

4. Consequences of Default:

Defaulting on your student loans has severe consequences:

- Damaged Credit Score: A default will significantly damage your credit score, making it difficult to obtain credit in the future.

- Wage Garnishment: The government can garnish your wages to recover the debt.

- Tax Refund Offset: Your tax refund can be seized to repay the loan.

- Collection Agencies: Your debt will be sent to collection agencies, which will aggressively pursue repayment.

5. Exploring Alternative Options:

Several options can assist with student loan repayment:

- Loan Consolidation: Combining multiple federal loans into a single loan with a potentially lower interest rate or a more manageable repayment schedule.

- Loan Forgiveness Programs: Some programs, such as the Public Service Loan Forgiveness (PSLF) program, may forgive remaining loan balances after a certain period of qualifying employment.

- Deferment and Forbearance: These options temporarily suspend or reduce your payments during periods of financial hardship, but interest usually continues to accrue.

Exploring the Connection Between Financial Literacy and Student Loan Repayment

Financial literacy plays a pivotal role in successful student loan repayment. A lack of understanding about budgeting, interest rates, and repayment options can lead to financial difficulties.

Key Factors to Consider:

- Roles and Real-World Examples: Individuals with strong financial literacy skills are better equipped to choose appropriate repayment plans, manage their budgets effectively, and avoid default. Conversely, those lacking financial literacy may struggle to understand their loan terms, leading to missed payments and debt accumulation.

- Risks and Mitigations: The primary risk associated with poor financial literacy is the inability to manage student loan debt, resulting in default and significant financial hardship. Mitigating this risk involves investing in financial education, seeking guidance from financial advisors, and utilizing online resources to improve understanding.

- Impact and Implications: The long-term impact of poor financial literacy on student loan repayment can be devastating, leading to damaged credit, wage garnishment, and significant financial strain. Conversely, strong financial literacy empowers individuals to manage their debt effectively, achieve financial stability, and unlock future opportunities.

Conclusion: Reinforcing the Connection

The relationship between financial literacy and student loan repayment is undeniably crucial. By equipping themselves with the knowledge and skills to manage their finances effectively, individuals can navigate the complexities of student loan repayment, avoid default, and build a strong financial foundation for the future.

Further Analysis: Examining Financial Literacy Programs in Greater Detail

Many organizations offer financial literacy programs designed to help individuals understand and manage their finances effectively. These programs typically cover budgeting, debt management, credit scores, and investing. Accessing and participating in such programs can significantly improve an individual's ability to handle student loan debt responsibly.

FAQ Section: Answering Common Questions About Student Loan Repayment

- What is a student loan servicer? A student loan servicer is the company responsible for processing your payments, answering your questions, and providing customer service related to your student loans.

- Can I refinance my federal student loans? While possible, refinancing federal loans into private loans can eliminate certain borrower protections, so carefully weigh the pros and cons before proceeding.

- What happens if I miss a student loan payment? Missing payments will negatively impact your credit score and may lead to late fees and ultimately default.

- What are income-driven repayment plans? These plans adjust your monthly payments based on your income and family size, making them more affordable for borrowers with lower incomes.

- How do I contact my student loan servicer? Contact information for your servicer can typically be found on your loan documents or the National Student Loan Data System (NSLDS) website.

Practical Tips: Maximizing the Benefits of Effective Student Loan Repayment

- Understand your loan terms: Carefully review your loan documents to understand the interest rates, repayment periods, and any associated fees.

- Create a realistic budget: Track your income and expenses to determine how much you can comfortably allocate towards your student loan payments.

- Explore all repayment options: Research the different repayment plans available to find one that best suits your financial situation.

- Prioritize payments: Make timely payments to avoid late fees and negative impacts on your credit score.

- Seek professional help: If you're struggling to manage your student loan debt, consider seeking guidance from a financial advisor or credit counselor.

Final Conclusion: Wrapping Up with Lasting Insights

Student loan repayment is a significant financial undertaking, but with careful planning, informed decision-making, and a commitment to responsible financial management, you can successfully navigate this process and achieve financial well-being. Understanding your loan types, exploring repayment options, and prioritizing financial literacy are essential steps towards achieving long-term financial success. Remember, taking proactive steps towards managing your student loan debt will contribute significantly to your overall financial health and peace of mind.

Latest Posts

Latest Posts

-

Instamine Definition

Apr 24, 2025

-

Installment Sale Definition And How Its Used In Accounting

Apr 24, 2025

-

Insolvencies Definition How It Works And Contributing Factors

Apr 24, 2025

-

Insider Definition Types Trading Laws Examples

Apr 24, 2025

-

Insider Trading Sanctions Act Of 1984 Definition

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about What Is A Student Loan Repayment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.