What Are The Requirements For A Subsidized Student Loan

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Unlocking Educational Dreams: A Comprehensive Guide to Subsidized Student Loan Requirements

What if access to higher education depended solely on financial resources? Subsidized student loans are a crucial safety net, leveling the playing field and enabling countless individuals to pursue their academic aspirations.

Editor’s Note: This article provides up-to-date information on the requirements for subsidized student loans in the United States. Loan programs and requirements can change, so it’s always best to verify details with the appropriate federal agencies (like the Federal Student Aid website) and your chosen educational institution’s financial aid office.

Why Subsidized Student Loans Matter:

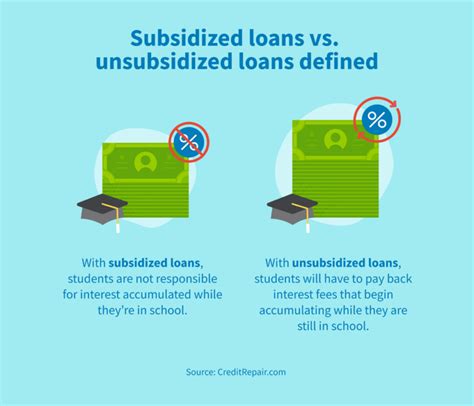

Subsidized student loans represent a significant commitment from the government to ensure accessibility to higher education. Unlike unsubsidized loans, the government pays the interest on subsidized loans while the student is enrolled at least half-time and during grace periods (the period between graduation and when repayment begins). This reduces the overall cost of borrowing and makes higher education attainable for students from lower-income backgrounds. The importance extends beyond individual benefits; a more educated populace contributes to a stronger economy and a more informed society. Subsidized loans are instrumental in fueling this progress.

Overview: What This Article Covers:

This article provides a detailed exploration of the requirements for obtaining subsidized federal student loans. We will delve into eligibility criteria, the application process, loan limits, repayment plans, and potential pitfalls to avoid. Readers will gain a comprehensive understanding of the process and be better equipped to navigate the complexities of student loan financing.

The Research and Effort Behind the Insights:

This article draws upon extensive research from official government sources, including the Federal Student Aid website, and incorporates insights from financial aid experts and published studies on student loan programs. Information is presented accurately and transparently, allowing readers to make informed decisions about their educational financing.

Key Takeaways:

- Eligibility Criteria: A thorough understanding of the factors determining eligibility for subsidized loans.

- Application Process: A step-by-step guide to navigating the FAFSA and loan application.

- Loan Limits: Clarification on annual and aggregate loan limits.

- Repayment Options: An overview of available repayment plans and their implications.

- Potential Challenges: Identification of common obstacles and strategies for overcoming them.

Smooth Transition to the Core Discussion:

Now that we've established the significance of subsidized student loans, let's explore the specific requirements needed to secure this valuable form of financial assistance.

Exploring the Key Aspects of Subsidized Student Loan Requirements:

1. Demonstrating Financial Need:

The cornerstone of subsidized loan eligibility is demonstrated financial need. This isn't simply about having a low income; it's a calculated determination based on the information provided in the Free Application for Federal Student Aid (FAFSA). The FAFSA considers factors such as:

- Parental Income (if dependent): For dependent students, parental income and assets play a significant role in the need analysis. Independent students' financial situations are assessed based solely on their own income and assets.

- Family Size: The number of people in the household influences the expected family contribution (EFC). Larger families often have higher EFCs.

- Number of Students in College: If multiple family members are pursuing higher education simultaneously, the need analysis reflects this increased financial burden.

- Assets: Both liquid (cash, savings) and non-liquid (real estate, investments) assets are considered, although the weight given to different asset types can vary.

The FAFSA uses a complex formula to calculate the student's Expected Family Contribution (EFC). A lower EFC generally translates to a greater need for financial aid, increasing the likelihood of receiving subsidized loans.

2. Enrolment Status:

To qualify for subsidized loans, students must be enrolled at least half-time in a degree or certificate program at an eligible institution. This generally means taking a minimum number of credit hours per term, as defined by the institution. Maintaining this enrollment status is crucial; failure to do so may result in the loss of subsidized benefits.

3. US Citizenship or Eligibility:

Applicants must be US citizens or eligible non-citizens to qualify for federal student aid, including subsidized loans. Specific documentation demonstrating eligibility may be required.

4. High School Diploma or GED:

Most federal student aid programs require applicants to have a high school diploma or its equivalent (GED). This serves as a baseline indicator of readiness for post-secondary education.

5. Maintaining Satisfactory Academic Progress (SAP):

Federal student aid is contingent upon maintaining satisfactory academic progress (SAP). This usually involves meeting minimum grade point average (GPA) requirements and completing a minimum percentage of required coursework within a specific timeframe. Institutions set their own SAP standards, which are communicated to students. Failure to meet SAP requirements can lead to the loss of eligibility for future aid, including subsidized loans.

6. Selected School Eligibility:

The school you choose must participate in the federal student aid program. Most accredited colleges and universities participate, but it’s crucial to verify this with the prospective institution before applying.

7. Credit History (Generally Not a Factor):

Unlike private student loans, federal subsidized loans do not typically require a credit check or a co-signer. This makes them more accessible to students with limited or no credit history.

8. Completion of the FAFSA:

The FAFSA is the central application for federal student aid. Completing the FAFSA accurately and on time is essential for determining eligibility and receiving the maximum amount of financial aid available.

Exploring the Connection Between Financial Literacy and Subsidized Student Loans:

Understanding the nuances of subsidized student loans requires a level of financial literacy. This includes:

- Roles and Real-World Examples: Knowing how to accurately complete the FAFSA, understanding the implications of different repayment plans, and budgeting effectively while in school are critical skills. For example, a student who understands the implications of accumulating debt can make more informed decisions about borrowing and repayment strategies.

- Risks and Mitigations: Failing to understand the terms of a loan agreement can lead to late payments and accrued interest, while proper financial planning can mitigate these risks.

- Impact and Implications: Long-term financial health is directly impacted by how student loans are managed. Proper financial literacy promotes responsible borrowing and repayment behaviors.

Key Factors to Consider:

- Loan Limits: Federal subsidized loans have annual and aggregate loan limits. These limits vary depending on the student's year in school (freshman, sophomore, etc.) and their dependency status. Exceeding these limits necessitates exploring alternative funding sources, such as unsubsidized loans or private loans.

- Interest Rates: While the government covers interest during certain periods, the interest rate on subsidized loans is set annually. Understanding the interest rate is crucial for projecting total loan costs.

- Repayment Plans: Several repayment plans are available after graduation, including standard, extended, graduated, and income-driven repayment plans. Choosing the appropriate plan significantly impacts monthly payments and overall repayment time.

- Default: Failing to repay student loans can lead to serious consequences, including damage to credit scores, wage garnishment, and even tax refund offset.

Conclusion: Reinforcing the Connection

The connection between financial literacy and effectively navigating the subsidized student loan process cannot be overstated. Students equipped with financial knowledge can make informed decisions, reducing the risk of financial hardship later.

Further Analysis: Examining Financial Literacy Programs in Greater Detail

Many institutions offer financial literacy programs and workshops to help students understand the complexities of student loans and personal finance. These programs can be invaluable resources, providing practical guidance and empowering students to manage their finances responsibly.

FAQ Section: Answering Common Questions About Subsidized Student Loans:

Q: What is a subsidized student loan? A: A subsidized student loan is a federal loan where the government pays the interest while the student is enrolled at least half-time and during grace periods.

Q: How do I apply for a subsidized student loan? A: The application process begins with completing the FAFSA. Once the FAFSA is processed, the student's eligibility for federal aid, including subsidized loans, will be determined.

Q: What happens if I don't maintain satisfactory academic progress? A: Failure to maintain SAP can result in the loss of eligibility for federal student aid, including subsidized loans.

Q: What are the repayment options for subsidized loans? A: Several repayment plans are available after graduation, each with different terms and conditions.

Practical Tips: Maximizing the Benefits of Subsidized Student Loans:

- Complete the FAFSA accurately and on time: This is the first step in the process.

- Understand your eligibility criteria: Ensure you meet all the requirements.

- Shop around for the best repayment plan: Compare options to find the one that best fits your budget and repayment goals.

- Budget carefully: Plan your finances to manage loan repayments effectively.

- Seek professional advice if needed: Consult with a financial aid advisor or counselor for personalized guidance.

Final Conclusion: Wrapping Up with Lasting Insights

Subsidized student loans are a vital tool for making higher education accessible to a broader range of students. However, obtaining and managing these loans responsibly requires understanding the eligibility criteria, application process, and repayment options. By educating themselves and making informed decisions, students can leverage the benefits of subsidized student loans to achieve their academic goals without incurring undue financial burden. The path to higher education is paved with careful planning and informed choices.

Latest Posts

Latest Posts

-

Insurance Premium Defined How Its Calculated And Types

Apr 24, 2025

-

Insurance Regulatory Information System Iris Definition

Apr 24, 2025

-

Insurance Industry Etf Definition

Apr 24, 2025

-

Insurance Grace Period Definition How It Works Example

Apr 24, 2025

-

Insurance Cutoff Definition

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about What Are The Requirements For A Subsidized Student Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.