What Is A Statement Period For Credit Card

adminse

Apr 04, 2025 · 8 min read

Table of Contents

What's the Secret to Understanding Your Credit Card Bill? Decoding the Statement Period!

Mastering your credit card statement period is key to financial freedom and avoiding costly mistakes.

Editor’s Note: This article on credit card statement periods was published today, providing readers with the most up-to-date information and actionable insights to manage their credit card accounts effectively.

Why Understanding Your Credit Card Statement Period Matters:

Understanding your credit card statement period is crucial for several reasons. It directly impacts your ability to:

- Track spending: Knowing the exact period covered by your statement allows you to meticulously monitor your expenses and identify areas for potential savings.

- Avoid late fees: Understanding the statement period's closing date ensures you make timely payments and prevent incurring late payment penalties, which can significantly impact your credit score.

- Manage credit utilization: By knowing when your statement closes, you can optimize your credit utilization ratio – the percentage of your available credit that you're using. Keeping this ratio low (ideally below 30%) is vital for maintaining a healthy credit score.

- Budget effectively: Accurate tracking of your spending within the statement period enables effective budgeting and helps you plan for upcoming expenses.

- Dispute charges accurately: If you need to dispute a fraudulent or erroneous charge, understanding your statement period helps you pinpoint the transaction and initiate the dispute process efficiently.

Overview: What This Article Covers

This comprehensive guide delves into the intricacies of credit card statement periods. We’ll explore:

- The definition and significance of a statement period.

- How statement periods are determined and what factors influence them.

- The impact of statement periods on credit utilization and interest calculations.

- Common misconceptions surrounding statement periods.

- Practical tips for effectively managing your credit card statement period.

- Strategies to avoid late payment fees and optimize credit utilization.

- A detailed FAQ section addressing frequently asked questions about credit card statement periods.

The Research and Effort Behind the Insights

This article draws upon extensive research, including analysis of credit card agreements from major issuers, examination of financial industry best practices, and consultation of relevant legal and regulatory information. The information presented is intended to be accurate and informative, helping readers navigate the complexities of credit card billing cycles.

Key Takeaways:

- Definition: A credit card statement period is the timeframe during which your credit card transactions are recorded before they appear on your monthly statement.

- Impact: The statement period directly affects your credit utilization, interest accrual, and payment due dates.

- Management: Proactive management of spending within the statement period is key to maintaining a healthy credit score and avoiding unnecessary fees.

- Actionable steps: Specific strategies are provided to help manage your spending, optimize credit utilization, and avoid late payments.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding your credit card statement period, let's delve into the specifics of this crucial aspect of credit card management.

Exploring the Key Aspects of Credit Card Statement Periods:

Definition and Core Concepts:

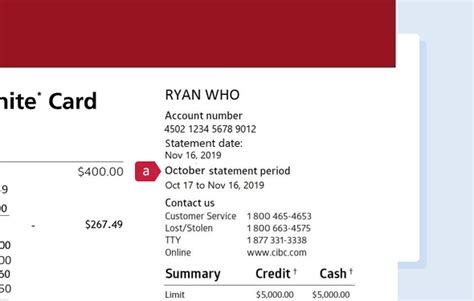

A credit card statement period is a specific timeframe, typically 25 to 35 days, during which your credit card issuer records all your transactions. This period begins on a specific date (the statement start date) and ends on another specific date (the statement closing date or statement end date). At the end of the statement period, the issuer generates a statement summarizing all transactions, payments made, and outstanding balances during that period.

Statement Period Length and Variation:

While the standard length is typically between 25 and 35 days, the exact length can vary depending on your issuer and even the specific card you hold. Some issuers may offer different statement period lengths for various products within their portfolio.

The Role of the Closing Date:

The statement closing date is the most critical element of your statement period. This is the date on which your credit card issuer takes a snapshot of your account activity, calculating your balance and generating your statement. The date the statement arrives in the mail or is available online is separate from the closing date. The closing date is essential because it determines when your payment is due.

Applications Across Industries:

The concept of a statement period isn't unique to credit cards. Similar billing cycles are used for various financial products, such as store credit cards, personal loans, and even some utility bills. Understanding the principles of statement periods across different financial products can help you manage your overall finances more efficiently.

Challenges and Solutions:

One of the primary challenges is keeping track of the closing date. Forgetting this date can lead to late payment fees. Solutions include setting reminders on your calendar or using budgeting apps that automatically track your statement cycles. Another challenge lies in managing spending within the statement period to optimize credit utilization. Utilizing budgeting tools and tracking expenses regularly can help alleviate this.

Impact on Innovation:

The shift towards digital banking and financial technology has introduced new ways to manage statement periods. Many credit card issuers offer mobile apps and online portals that allow you to monitor your spending in real-time, track your closing date, and make payments easily. This increased transparency and accessibility help users maintain control over their accounts and minimize the risk of late payments.

Closing Insights: Summarizing the Core Discussion

Understanding your credit card statement period is fundamental to sound financial management. By closely monitoring your spending within this period, and adhering to the payment due date, you can avoid late payment fees, optimize your credit utilization, and maintain a healthy credit score.

Exploring the Connection Between Payment Due Date and Statement Period

The payment due date is intrinsically linked to the statement period's closing date. Typically, you have a grace period of 21-25 days after the statement closing date to pay your balance in full to avoid interest charges. This grace period ensures you have enough time to review your statement and make your payment before incurring interest.

Key Factors to Consider:

- Grace Period: This is the crucial time between the statement closing date and the payment due date.

- Late Payment Fees: Failure to pay by the due date results in late fees and negatively impacts your credit score.

- Interest Accrual: If you don't pay your balance in full by the due date, interest begins to accrue on the outstanding balance.

Roles and Real-World Examples:

Let's say your statement closing date is the 15th of the month. Your grace period might be 21 days, meaning your payment due date would be the 5th or 6th of the following month. Failing to make a payment by this date will result in a late fee and interest charges on your outstanding balance. This is a real-world example of how the interplay between the closing date and the payment due date significantly impacts your finances.

Risks and Mitigations:

The biggest risk is failing to pay on time, resulting in late payment fees and impacting your credit score. Mitigation involves setting up automatic payments or calendar reminders to avoid this. Another risk is misunderstanding the statement period's length and consequently overspending. Careful budgeting and expense tracking within the statement period can mitigate this risk.

Impact and Implications:

Failing to understand your statement period's implications can lead to financial strain due to accumulating interest and late fees. This can negatively affect your credit score, making it harder to secure loans or credit in the future. Conversely, understanding and effectively managing your statement period allows you to maintain a healthy credit score and avoid unnecessary expenses.

Conclusion: Reinforcing the Connection

The connection between the statement period and the payment due date is crucial. Understanding this relationship allows for proactive financial management, preventing late payments and their associated penalties. Consistent monitoring of your spending during the statement period is key to making timely payments and maintaining a healthy credit score.

Further Analysis: Examining Grace Period in Greater Detail

The grace period is the time given after your statement closing date to pay your balance in full without incurring interest. This period varies among issuers, so reviewing your credit card agreement is vital. The grace period doesn't apply if you carry a balance from the previous month.

FAQ Section: Answering Common Questions About Credit Card Statement Periods

What is a credit card statement period? A credit card statement period is the timeframe during which your credit card transactions are recorded before they appear on your monthly statement.

How long is a typical statement period? Typical statement periods range from 25 to 35 days.

How is my credit utilization calculated? Your credit utilization is calculated by dividing your statement balance by your credit limit.

What happens if I don't pay my balance by the due date? You'll be charged a late payment fee, and interest will accrue on your outstanding balance.

How can I track my statement period? Use your credit card's online portal or mobile app, set reminders, or use budgeting apps.

What if I have a dispute on a charge within the statement period? Contact your credit card issuer immediately to initiate a dispute.

Practical Tips: Maximizing the Benefits of Understanding Your Statement Period

- Set reminders: Use digital calendars or reminder apps to stay informed about your statement closing and payment due dates.

- Track your spending: Use budgeting apps or spreadsheets to monitor your expenses within the statement period.

- Pay on time: Set up automatic payments or pay manually before the due date to avoid late payment fees.

- Review your statement: Carefully review your statement each month to identify any errors or fraudulent transactions.

- Maintain a low credit utilization: Try to keep your credit utilization below 30% to positively influence your credit score.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding your credit card statement period is a foundational aspect of responsible credit card management. By taking proactive steps to track your spending, make timely payments, and understand the implications of your billing cycle, you can effectively control your finances, maintain a healthy credit score, and avoid unnecessary fees and interest charges. Mastering your statement period empowers you to take charge of your financial well-being.

Latest Posts

Latest Posts

-

How To Make A T Mobile Payment Over The Phone

Apr 06, 2025

-

How To Pay T Mobile Prepaid

Apr 06, 2025

-

Setup T Mobile Payment Arrangement

Apr 06, 2025

-

How To Pay T Mobile By Phone

Apr 06, 2025

-

How To Setup T Mobile Account

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about What Is A Statement Period For Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.