What Is Financial Charges In Credit Card

adminse

Apr 04, 2025 · 7 min read

Table of Contents

Decoding the Fine Print: A Comprehensive Guide to Credit Card Financial Charges

What if understanding your credit card financial charges is the key to unlocking better financial health? These often-overlooked fees can significantly impact your budget and credit score, making this knowledge crucial for responsible credit management.

Editor’s Note: This article on credit card financial charges was published today and provides up-to-date information on common fees and strategies to minimize their impact on your finances. We've consulted multiple sources, including consumer protection agencies and leading financial institutions, to ensure accuracy and clarity.

Why Credit Card Financial Charges Matter:

Credit card financial charges are more than just numbers on your statement; they are significant factors affecting your overall financial well-being. Understanding these charges allows you to make informed decisions, avoid unnecessary fees, and ultimately manage your finances more effectively. Ignoring these fees can lead to spiraling debt, damage your credit score, and hinder your long-term financial goals. These charges impact personal budgeting, debt management strategies, and overall creditworthiness. Understanding them is vital for both consumers with good credit and those looking to improve their credit standing.

Overview: What This Article Covers:

This article provides a comprehensive overview of various credit card financial charges. We will explore common fee types, delve into the calculation methods, and offer practical strategies for minimizing or avoiding these charges. We will also examine the impact of these fees on your credit report and provide actionable advice for responsible credit card usage. Finally, we will address frequently asked questions and offer practical tips for maximizing your financial well-being.

The Research and Effort Behind the Insights:

This in-depth analysis draws upon extensive research from reputable sources, including the Consumer Financial Protection Bureau (CFPB), leading financial institutions' websites, and academic studies on consumer finance. The information presented is based on widely accepted practices and legal frameworks surrounding credit card fees. Every effort has been made to ensure accuracy and clarity, enabling readers to gain a thorough understanding of the complexities associated with credit card charges.

Key Takeaways:

- Definition and Core Concepts: A detailed explanation of various financial charges associated with credit cards.

- Types of Fees: A comprehensive list and explanation of common and less common fees.

- Calculation Methods: Understanding how these fees are calculated and applied to your account.

- Avoiding and Minimizing Charges: Practical strategies and tips to reduce or eliminate unnecessary fees.

- Impact on Credit Score: How these charges can affect your credit report and overall creditworthiness.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding credit card financial charges, let's delve into the specifics. We'll examine the different types of fees, how they're calculated, and how to navigate them effectively.

Exploring the Key Aspects of Credit Card Financial Charges:

1. Definition and Core Concepts:

Credit card financial charges are fees levied by credit card issuers for various services or actions related to your account. These fees can significantly impact your monthly payments and overall financial health if not managed carefully. Understanding the different types of fees and their implications is crucial for responsible credit card usage.

2. Types of Fees:

Several types of credit card fees exist, and understanding them is crucial for responsible credit card usage. These include:

- Annual Fee: A yearly charge for possessing the credit card, often associated with premium cards offering benefits like travel insurance or rewards programs.

- Late Payment Fee: Charged when a minimum payment is not received by the due date. The amount varies depending on the issuer.

- Over-the-Limit Fee: Incurred when your spending exceeds your credit limit.

- Cash Advance Fee: A percentage-based fee charged for withdrawing cash from an ATM using your credit card. This fee is typically higher than other transaction fees.

- Foreign Transaction Fee: A percentage-based fee added to transactions made in foreign currencies.

- Returned Payment Fee: Charged if a payment is returned due to insufficient funds.

- Balance Transfer Fee: A percentage fee charged when transferring your balance from another credit card to your current one.

- Penalty APR: A significantly higher interest rate applied if you violate the terms of your credit card agreement, such as making late payments or exceeding your credit limit.

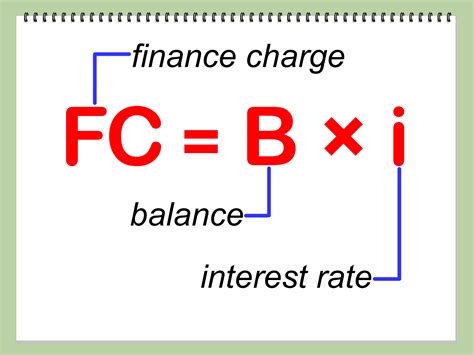

3. Calculation Methods:

The calculation methods vary depending on the type of fee. Annual fees are straightforward, while others are calculated as a percentage of the transaction amount or a fixed dollar amount. For example, a cash advance fee might be 3% of the amount withdrawn plus a fixed fee, while a late payment fee is usually a flat fee. Penalty APR is applied to your outstanding balance, increasing the interest you accrue.

4. Impact on Innovation:

The rise of fintech and digital banking has led to increased transparency in some areas, but complexities remain. New technologies are slowly addressing some of these issues, but the fundamental principles of responsible credit card usage remain unchanged.

Closing Insights: Summarizing the Core Discussion:

Understanding credit card financial charges is paramount for effective personal finance management. The various fees, their calculation methods, and their impact on your credit score necessitate careful attention. By understanding the details, consumers can make informed decisions to minimize these costs.

Exploring the Connection Between Credit Score and Credit Card Charges:

The relationship between your credit score and credit card charges is significant. Late payments, exceeding your credit limit, and accruing high balances due to unpaid fees all negatively affect your credit score. These negative marks can impact your ability to secure loans, rent an apartment, or even get a job.

Key Factors to Consider:

- Roles and Real-World Examples: A missed payment, resulting in a late payment fee, will immediately impact your credit score.

- Risks and Mitigations: Setting up automatic payments can prevent late payment fees and maintain a positive credit history.

- Impact and Implications: A consistently poor credit score, stemming from multiple missed payments and unpaid fees, limits future financial opportunities.

Conclusion: Reinforcing the Connection:

Managing credit card charges proactively safeguards your credit score and overall financial health. By understanding the interplay between these fees and your creditworthiness, you can take steps to maintain a strong credit profile.

Further Analysis: Examining Late Payment Fees in Greater Detail:

Late payment fees are among the most common and impactful credit card charges. These fees are applied when the minimum payment is not received by the due date, significantly impacting your account balance. Understanding how these fees are applied and how to prevent them is vital. The impact of a single late payment can linger on your credit report for years, underscoring the importance of timely payments.

FAQ Section: Answering Common Questions About Credit Card Financial Charges:

Q: What is the average late payment fee?

A: The average late payment fee ranges from $25 to $35, but it can vary significantly depending on the credit card issuer and the terms of your agreement.

Q: Can I negotiate a late payment fee?

A: While not always guaranteed, contacting your credit card issuer and explaining your situation might lead to a fee waiver or reduction. Be polite and persistent.

Q: How do foreign transaction fees work?

A: Foreign transaction fees are usually a percentage (often 1-3%) of the transaction amount made in a foreign currency. They are added to the conversion cost.

Q: What is a penalty APR?

A: A penalty APR is a significantly higher interest rate imposed when you violate the terms of your credit card agreement. This can dramatically increase the cost of borrowing.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Usage:

- Budgeting: Create a realistic budget to track your spending and ensure you can afford your credit card payments.

- Automatic Payments: Set up automatic payments to avoid late payment fees.

- Credit Limit Awareness: Stay well below your credit limit to avoid over-the-limit fees.

- Understanding Your Agreement: Read your credit card agreement carefully to understand all fees and terms.

- Monitoring Your Account: Regularly monitor your credit card statement for any unauthorized charges or errors.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding and managing credit card financial charges is an essential aspect of responsible financial management. By understanding the various fees, their implications, and the strategies to avoid them, you can effectively protect your credit score and maintain sound financial health. Proactive management of your credit card account and a commitment to responsible spending are key to long-term financial success. Remember, proactive planning and informed decision-making empower you to control your credit card costs and build a strong financial future.

Latest Posts

Latest Posts

-

Whats The Average Monthly Payment For Student Loans

Apr 05, 2025

-

Average Monthly Student Loan Payment

Apr 05, 2025

-

Average Minimum Student Loan Payment

Apr 05, 2025

-

What Is The Minimum Payment For Student Loans

Apr 05, 2025

-

Payment Target Meaning

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is Financial Charges In Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.