How To Get My Full Credit Report On Credit Karma

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding Credit Karma: How to Access Your Full Credit Report

What if unlocking your financial future hinges on understanding your credit report, and Credit Karma holds the key? This comprehensive guide empowers you to navigate Credit Karma and access the complete picture of your creditworthiness.

Editor’s Note: This article on accessing your full credit report via Credit Karma was updated today, offering the latest insights and steps for navigating the platform effectively.

Why Your Full Credit Report Matters:

Understanding your credit report is paramount to financial well-being. It’s a detailed snapshot of your credit history, influencing loan approvals, interest rates, and even insurance premiums. A thorough understanding allows you to identify errors, track progress, and make informed financial decisions. Credit Karma provides a valuable service in this regard, though it's crucial to understand its limitations and how to access the complete picture of your credit data.

Overview: What This Article Covers:

This article comprehensively explains how to get your full credit report from Credit Karma, addressing common misconceptions and providing a step-by-step guide. We'll explore the difference between Credit Karma's VantageScore and the full credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion). We'll also delve into the importance of regular monitoring and dispute resolution processes.

The Research and Effort Behind the Insights:

This article is the culmination of extensive research, incorporating information directly from Credit Karma’s website, consumer finance resources, and expert opinions on credit reporting and score management. All information presented here is intended to be accurate and up-to-date, but it is always recommended to consult official sources for the most current details.

Key Takeaways:

- Understanding VantageScore vs. FICO: Credit Karma primarily uses VantageScore, a different scoring model than the FICO scores used by many lenders.

- Accessing Full Reports: Credit Karma doesn't directly provide full credit reports from all three bureaus; it offers a summary and encourages users to access the full reports via AnnualCreditReport.com.

- The Importance of Regular Monitoring: Consistently checking your credit report helps identify errors and potential fraud early on.

- Dispute Resolution: Knowing how to dispute inaccurate information is crucial for maintaining a healthy credit score.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding your credit report, let's delve into the specifics of using Credit Karma to gain access to the information you need to manage your credit effectively.

Exploring the Key Aspects of Credit Karma and Full Credit Reports:

1. Understanding Credit Karma's Credit Score and Report:

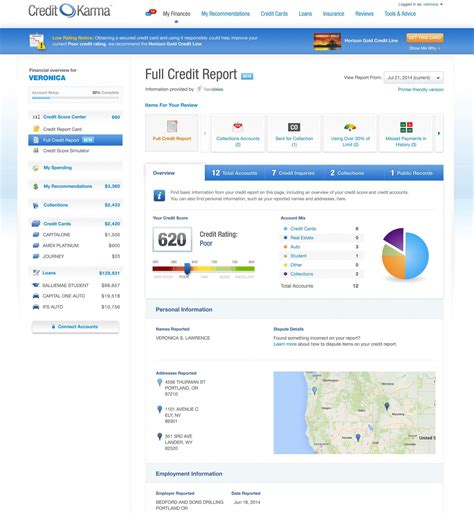

Credit Karma offers a free credit monitoring service that includes a VantageScore and a simplified credit report summary. This summary provides a general overview of your credit information, including:

- Credit Score: A numerical representation of your creditworthiness based on the VantageScore 3.0 model.

- Credit Utilization: The percentage of your available credit that you're currently using.

- Payment History: A summary of your on-time and late payments.

- Credit Age: The length of your credit history.

- Number of Accounts: The total number of credit accounts you hold.

- Types of Accounts: The mix of credit accounts you have (credit cards, loans, etc.).

However, this is not a full credit report. A full credit report contains significantly more detail, including specific account information, public records, and inquiries.

2. The Difference Between VantageScore and FICO:

It's essential to understand that the VantageScore provided by Credit Karma is different from the FICO scores used by most lenders. While both are credit scoring models, they use different algorithms and weighting factors. This means your VantageScore on Credit Karma may not precisely reflect the FICO score a lender uses to evaluate your creditworthiness.

3. Accessing Your Full Credit Reports from the Credit Bureaus:

To obtain your full credit reports from Equifax, Experian, and TransUnion, you must use AnnualCreditReport.com, the only authorized website for free annual credit reports from all three major credit bureaus. Credit Karma doesn't directly provide these full reports. However, Credit Karma can help you monitor your score and identify potential discrepancies which you can then investigate further through AnnualCreditReport.com.

4. Step-by-Step Guide to Accessing Your Full Credit Reports:

- Visit AnnualCreditReport.com: This is the only legitimate website for accessing your free annual credit reports. Be wary of websites that claim to offer free credit reports but require payment or personal information beyond what's required at AnnualCreditReport.com.

- Verify Your Identity: You’ll need to provide personal information to verify your identity. This is a crucial security measure to protect your credit data.

- Request Your Reports: You can request reports from all three bureaus simultaneously or individually.

- Review Your Reports Thoroughly: Carefully examine each report for inaccuracies, inconsistencies, or fraudulent activity.

5. Regular Credit Monitoring and Dispute Resolution:

Once you've accessed your full credit reports, it’s crucial to monitor them regularly (at least annually, if not more frequently). Regular monitoring allows you to:

- Identify and correct errors: Inaccuracies on your credit report can negatively impact your credit score.

- Detect fraudulent activity: Early detection of fraudulent accounts or transactions can help prevent significant financial damage.

- Track your progress: Monitoring your credit report shows how your financial habits are impacting your credit score over time.

If you discover any errors or inconsistencies, you have the right to dispute them with the respective credit bureau. Each bureau has its own dispute process, usually involving submitting a dispute form with supporting documentation.

Exploring the Connection Between Credit Karma and AnnualCreditReport.com:

Credit Karma and AnnualCreditReport.com are complementary services. Credit Karma provides a convenient tool for monitoring your VantageScore and getting a simplified credit report summary. However, it's crucial to remember that for the complete credit picture, you need the full reports from all three bureaus available only through AnnualCreditReport.com. This means Credit Karma acts as a useful preliminary tool, prompting users to seek the complete data from the official source.

Key Factors to Consider:

- Roles: Credit Karma offers a free service for credit score monitoring and a simplified credit report. AnnualCreditReport.com provides the official, legally mandated, full credit reports.

- Real-World Examples: A user might see a sudden drop in their VantageScore on Credit Karma and then use AnnualCreditReport.com to investigate the specific account causing the issue, potentially finding an error to dispute.

- Risks and Mitigations: Relying solely on Credit Karma without accessing full reports from AnnualCreditReport.com risks missing crucial information, potentially leading to financial setbacks. Mitigation involves regularly accessing full reports to get a comprehensive view.

- Impact and Implications: Using both services together provides a powerful combination for managing your credit effectively, promoting better financial health and decisions.

Conclusion: Reinforcing the Connection:

The interplay between Credit Karma and AnnualCreditReport.com highlights the importance of utilizing multiple resources to ensure a holistic understanding of your credit. While Credit Karma provides a useful monitoring tool, obtaining and regularly reviewing your full credit reports from AnnualCreditReport.com remains essential for maintaining good credit health.

Further Analysis: Examining AnnualCreditReport.com in Greater Detail:

AnnualCreditReport.com is not just a website; it’s a consumer’s right. The Fair Credit Reporting Act (FCRA) mandates that each of the three major credit bureaus provide consumers with a free credit report annually. This right is vital for protecting against identity theft and ensuring the accuracy of your credit information. Understanding how to use this resource effectively is key to responsible credit management.

FAQ Section: Answering Common Questions About Credit Reports and Credit Karma:

-

Q: What is a credit report?

- A: A credit report is a detailed record of your credit history, including payment history, credit utilization, and public records.

-

Q: How often can I get a free credit report?

- A: You are entitled to one free credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) every 12 months via AnnualCreditReport.com.

-

Q: Does Credit Karma provide my full credit report?

- A: No, Credit Karma provides a summary and a VantageScore but not the full credit report from all three bureaus. For full reports, you need to go to AnnualCreditReport.com.

-

Q: What should I do if I find an error on my credit report?

- A: Immediately contact the credit bureau that reported the error and file a dispute, providing supporting documentation.

-

Q: Is it safe to use AnnualCreditReport.com?

- A: Yes, AnnualCreditReport.com is the only authorized website for accessing free annual credit reports from all three major credit bureaus, making it a secure source.

Practical Tips: Maximizing the Benefits of Credit Monitoring:

- Set reminders: Schedule annual reminders to access your free credit reports from AnnualCreditReport.com.

- Compare scores: Compare your VantageScore from Credit Karma with any FICO scores you receive from lenders to understand the potential differences.

- Review regularly: Review your credit reports and scores regularly for any unusual activity or errors.

- Dispute promptly: Don't delay in disputing any inaccuracies or fraudulent activity.

- Maintain good credit habits: Consistent on-time payments, low credit utilization, and responsible credit management are crucial for a healthy credit score.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your credit report is essential for financial well-being. While Credit Karma offers a valuable tool for credit monitoring and score tracking, it's not a substitute for obtaining and regularly reviewing your full credit reports from AnnualCreditReport.com. By effectively utilizing both services and practicing responsible credit management, individuals can protect their financial future and achieve long-term financial success. Remember, your credit report is a valuable asset; treat it as such.

Latest Posts

Latest Posts

-

Acceleration Principle Definition And How It Works In Economics

Apr 30, 2025

-

Accelerated Option Definition

Apr 30, 2025

-

Accelerated Bookbuild Definition How The Process Works

Apr 30, 2025

-

Absorbed Cost Definition Examples Importance

Apr 30, 2025

-

Absolute Return Index Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Get My Full Credit Report On Credit Karma . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.