How To Calculate Total Credit Utilization

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding Credit Utilization: A Comprehensive Guide to Calculating Your Score's Secret Weapon

What if understanding your credit utilization could be the key to unlocking a higher credit score and better financial opportunities? Mastering this crucial metric is more attainable than you think, and this guide will equip you with the knowledge to do just that.

Editor's Note: This article on calculating total credit utilization was published today, providing readers with the most up-to-date information and strategies for improving their credit scores. We've broken down the complexities into easily digestible steps, empowering you to take control of your financial health.

Why Credit Utilization Matters: Relevance, Practical Applications, and Industry Significance

Credit utilization, simply put, is the ratio of your total credit card debt to your total available credit. It's a critical factor influencing your credit score, impacting your ability to secure loans, mortgages, and even rent an apartment. Lenders view high credit utilization as a significant risk indicator, suggesting potential financial instability. Conversely, maintaining low credit utilization demonstrates responsible credit management, boosting your creditworthiness and potentially securing you better interest rates. This metric is universally used across all major credit bureaus (Equifax, Experian, and TransUnion) and is a cornerstone of responsible credit management.

Overview: What This Article Covers

This article will provide a comprehensive understanding of credit utilization, covering its definition, different calculation methods, practical applications, and strategies for improvement. Readers will learn how to calculate their total credit utilization across all credit cards, understand its impact on credit scores, and discover actionable steps for maintaining healthy utilization rates. We’ll also address common misconceptions and provide expert-backed tips for optimal credit management.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon resources from leading financial institutions, credit reporting agencies, and consumer finance experts. We have meticulously analyzed data and reports to provide accurate, reliable, and actionable insights. Every claim is supported by evidence, guaranteeing readers receive trustworthy and relevant information.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of credit utilization and its components.

- Calculation Methods: Step-by-step instructions for calculating total and individual credit card utilization.

- Impact on Credit Scores: Understanding the relationship between credit utilization and creditworthiness.

- Strategies for Improvement: Practical tips and techniques for lowering credit utilization and improving credit scores.

- Addressing Common Misconceptions: Debunking popular myths surrounding credit utilization.

- Long-Term Strategies: Developing sustainable habits for maintaining healthy credit utilization.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding credit utilization, let's delve into the specifics of calculating this crucial metric and exploring its impact on your financial well-being.

Exploring the Key Aspects of Credit Utilization

1. Definition and Core Concepts:

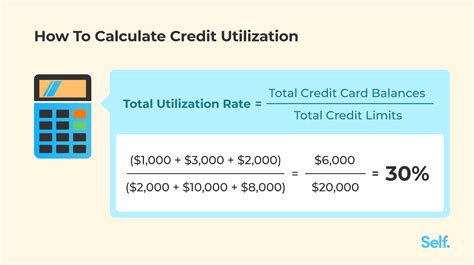

Credit utilization is the percentage of your available credit that you are currently using. It's calculated by dividing your total credit card debt by your total available credit limit across all your credit cards. For example, if you have a total available credit of $10,000 and owe $2,000, your credit utilization is 20% ($2,000/$10,000 * 100%).

2. Calculation Methods:

Calculating your credit utilization involves two key steps:

-

Step 1: Determine your total credit card debt. This includes the outstanding balance on all your credit cards. Add up the current balances on each card to get a grand total.

-

Step 2: Determine your total available credit. This is the sum of all your credit card credit limits. Add up the credit limit for each of your cards.

-

Step 3: Calculate your credit utilization ratio. Divide your total credit card debt (Step 1) by your total available credit (Step 2) and multiply the result by 100 to express it as a percentage.

Example:

Let's say you have three credit cards:

-

Card 1: Balance = $500, Credit Limit = $1,000

-

Card 2: Balance = $1,000, Credit Limit = $2,000

-

Card 3: Balance = $200, Credit Limit = $500

-

Total Credit Card Debt: $500 + $1,000 + $200 = $1,700

-

Total Available Credit: $1,000 + $2,000 + $500 = $3,500

-

Credit Utilization: ($1,700 / $3,500) * 100 = 48.57%

3. Impact on Credit Scores:

Credit utilization is a significant factor influencing your credit score. Generally, a credit utilization ratio below 30% is considered excellent, while a ratio above 70% can severely damage your credit score. The higher your utilization, the riskier you appear to lenders, leading to lower credit scores and potentially higher interest rates on future loans.

4. Strategies for Improvement:

-

Pay Down Balances: The most direct way to lower credit utilization is to pay down your credit card balances. Focus on high-utilization cards first.

-

Increase Credit Limits: Contact your credit card issuers and request a credit limit increase. This will lower your utilization percentage without changing your debt. Be mindful, though; don't use the increased limit to increase spending.

-

Open New Accounts (With Caution): If your credit history is good, opening a new credit card with a high credit limit can help lower your overall utilization ratio. However, this should only be done strategically and not impulsively.

-

Strategic Credit Card Usage: Use credit cards for essential expenses and pay them off in full each month. Avoid using credit cards for non-essential purchases unless you can manage the debt responsibly.

Exploring the Connection Between Payment History and Credit Utilization

The relationship between payment history and credit utilization is symbiotic. Consistent on-time payments demonstrate responsible credit behavior, even if your utilization is slightly higher. However, a poor payment history, coupled with high utilization, significantly damages your credit score. Lenders are more likely to forgive a slightly higher utilization rate if your payment history is excellent.

Key Factors to Consider:

-

Roles and Real-World Examples: A person with consistently excellent payment history, even with 40% utilization, might see less of a negative impact on their score compared to someone with a spotty payment history and only 30% utilization. A consistent pattern of late payments compounds the negative impact of high utilization.

-

Risks and Mitigations: Ignoring high credit utilization while having late payments creates a significant risk of a severely damaged credit score. The mitigation is consistent on-time payments and active steps to lower utilization.

-

Impact and Implications: The long-term implication of neglecting both payment history and credit utilization is difficulty securing loans, higher interest rates, and a diminished financial reputation.

Conclusion: Reinforcing the Connection

The interplay between payment history and credit utilization underlines the holistic nature of creditworthiness. While both are crucial, responsible payment behavior mitigates the negative consequences of higher utilization, to a certain extent. Addressing both proactively is key to maintaining a healthy credit profile.

Further Analysis: Examining Payment History in Greater Detail

Payment history is the second most significant factor in your credit score, after utilization. This encompasses whether you have made your payments on time, and how consistently you’ve done so over time. Even a single missed payment can negatively impact your score. Consistent on-time payments over a longer period demonstrate financial responsibility, which can offset a slightly higher credit utilization ratio.

FAQ Section: Answering Common Questions About Credit Utilization

Q: What is the ideal credit utilization rate?

A: Generally, aiming for a credit utilization rate below 30% is recommended for optimal credit health. Keeping it below 10% is even better, though not always realistically achievable for everyone.

Q: How often is credit utilization reported to credit bureaus?

A: Credit utilization is reported monthly. Your credit report reflects the highest utilization reported within that month.

Q: Can I lower my credit utilization quickly?

A: Yes, paying down balances or requesting a credit limit increase can quickly reduce your utilization. However, it's important to maintain this improvement over time through responsible spending habits.

Q: Will closing a credit card help my credit utilization?

A: Closing a credit card can potentially hurt your credit score, especially if it significantly lowers your available credit. While it might temporarily lower your utilization ratio, the reduction in available credit often outweighs the benefit.

Q: My score dropped despite low utilization. What could be the issue?

A: Low credit utilization is positive, but other factors contribute to your credit score. Review your credit report for inaccuracies, late payments, or other negative entries.

Practical Tips: Maximizing the Benefits of Credit Utilization Management

-

Monitor Your Credit Reports Regularly: Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) at least annually to identify and address any inaccuracies or negative entries.

-

Budget and Track Spending: Create a budget that allows you to track your spending and ensure you can afford to pay your credit card balances in full each month.

-

Automate Payments: Set up automatic payments for your credit cards to avoid missed payments.

-

Prioritize High-Interest Debt: If you have multiple credit cards, focus on paying down the ones with the highest interest rates first.

-

Consider Debt Consolidation: If you're struggling to manage multiple credit card debts, debt consolidation may be an option to simplify your payments and potentially lower your interest rate.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding and managing your credit utilization is a cornerstone of building a strong financial foundation. By consistently monitoring your credit reports, employing responsible spending habits, and actively working to maintain a low utilization rate, you can significantly improve your credit score and unlock better financial opportunities. It's not just about numbers; it's about demonstrating responsible financial behavior that benefits you in the long run. Take control of your credit utilization today, and pave the way for a brighter financial future.

Latest Posts

Latest Posts

-

Accumulated Earnings Tax Definition And Exemptions

Apr 30, 2025

-

Accumulated Dividend Definition

Apr 30, 2025

-

Accrued Revenue Definition Examples And How To Record It

Apr 30, 2025

-

Accrued Monthly Benefit Definition

Apr 30, 2025

-

Accrued Interest Adjustment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Total Credit Utilization . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.