How To Increase My Secured Credit Card Limit Capital One

adminse

Apr 07, 2025 · 8 min read

Table of Contents

How to Increase Your Capital One Secured Credit Card Limit: A Comprehensive Guide

What if unlocking a higher credit limit on your Capital One secured credit card could unlock a brighter financial future? This achievable goal can significantly improve your credit score and expand your financial opportunities.

Editor's Note: This article on increasing your Capital One secured credit card limit was published today and provides up-to-date information and strategies. We've consulted Capital One's official resources and analyzed best practices for credit limit increases to ensure accuracy and relevance.

Why Increasing Your Capital One Secured Credit Card Limit Matters:

A secured credit card is a crucial stepping stone towards building credit. However, the initial low credit limit can be a constraint. Increasing your limit demonstrates responsible credit management and opens doors to better financial products, including unsecured credit cards, loans, and potentially even lower interest rates. A higher limit also provides more financial flexibility for unexpected expenses without exceeding your credit utilization ratio, a key factor in credit scoring.

Overview: What This Article Covers:

This article provides a detailed roadmap for increasing your Capital One secured credit card limit. We will explore the factors influencing Capital One's decisions, outline strategies to improve your chances of approval, and address frequently asked questions. You’ll learn how to navigate the application process, understand the importance of responsible credit usage, and discover additional tips for credit building.

The Research and Effort Behind the Insights:

This guide is based on extensive research, including Capital One's official website, credit reporting agency information, and financial expert analysis. We've meticulously reviewed various strategies and case studies to provide readers with accurate, actionable advice.

Key Takeaways:

- Understanding Capital One's Criteria: Learn the factors Capital One considers when evaluating credit limit increase requests.

- Improving Your Creditworthiness: Discover strategies to enhance your credit profile and increase your approval odds.

- Navigating the Application Process: Understand the steps involved in requesting a credit limit increase.

- Responsible Credit Management: Learn the importance of maintaining a healthy credit utilization ratio.

- Alternative Strategies: Explore alternative options if your limit increase request is declined.

Smooth Transition to the Core Discussion:

Now that we understand the importance of a higher credit limit, let's delve into the specific steps and strategies you can employ to successfully increase your Capital One secured credit card limit.

Exploring the Key Aspects of Increasing Your Capital One Secured Credit Card Limit:

1. Understanding Capital One's Criteria:

Capital One, like other credit card issuers, uses a multifaceted approach to assess credit limit increase requests. Key factors include:

- Payment History: Consistent on-time payments are paramount. Even a single missed payment can significantly harm your chances.

- Credit Utilization Ratio: This is the percentage of your available credit you're using. Keeping it below 30%, ideally closer to 10%, demonstrates responsible credit management.

- Credit Age: The length of your credit history influences your credit score. A longer history, even with a secured card, shows a track record of responsible credit usage.

- Credit Score: Your credit score is a crucial indicator of your creditworthiness. A higher score significantly increases your chances of approval.

- Income: Your income demonstrates your ability to repay your debts. A stable income is viewed favorably.

- Account Age: The length of time you've held your Capital One secured card also matters. Demonstrating consistent responsible use over time strengthens your application.

2. Improving Your Creditworthiness:

Before requesting a credit limit increase, focus on improving your credit profile:

- Pay Bills On Time: This is the single most important factor influencing your credit score. Set up automatic payments to avoid accidental late payments.

- Keep Your Credit Utilization Low: Monitor your spending and strive to keep your credit utilization well below 30%.

- Check Your Credit Report: Review your credit report regularly for errors. Dispute any inaccuracies with the credit bureaus.

- Consider a Credit-Building Loan: Small, short-term loans that are paid off on time can boost your credit score.

- Become an Authorized User: If a friend or family member has good credit, ask to be added as an authorized user on their account. Their positive payment history can positively impact your score.

3. Navigating the Application Process:

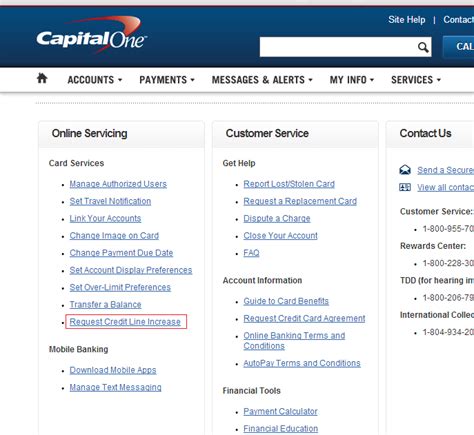

Capital One typically allows you to request a credit limit increase through your online account. The process usually involves:

- Logging into Your Account: Access your Capital One account online.

- Locating the Credit Limit Increase Option: Look for a section dedicated to credit limit increases or account management.

- Completing the Application: Provide any required information, which may include your income and employment details.

- Review and Submit: Carefully review the application before submitting it.

- Waiting for a Decision: Capital One will review your application and notify you of their decision.

4. Responsible Credit Management:

Even after securing a credit limit increase, responsible credit management remains crucial:

- Track Your Spending: Monitor your expenses to avoid exceeding your credit limit.

- Pay Your Bills on Time: Continue to make on-time payments to maintain a positive payment history.

- Keep Your Credit Utilization Low: Avoid using more than 30% of your available credit.

5. Alternative Strategies if Your Request is Declined:

If your credit limit increase request is denied, don't despair. Consider these alternatives:

- Wait and Reapply: Wait a few months and reapply, demonstrating improved creditworthiness in the meantime.

- Contact Capital One: Contact Capital One customer service to understand the reason for the denial and discuss potential solutions.

- Consider a Different Card: Explore other secured credit card options with potentially more favorable terms.

- Focus on Building Credit: Continue to focus on responsible credit management to improve your credit score over time.

Exploring the Connection Between Responsible Credit Usage and Capital One Credit Limit Increases:

Responsible credit usage is inextricably linked to successful credit limit increase requests. Consistent on-time payments and low credit utilization demonstrate your ability to manage credit responsibly, significantly improving your chances of approval.

Key Factors to Consider:

- Roles and Real-World Examples: Individuals with consistent on-time payment histories and low credit utilization ratios have a much higher success rate in obtaining credit limit increases. For example, someone who consistently pays their balance in full and maintains a credit utilization ratio below 10% is far more likely to be approved than someone with a history of late payments and high credit utilization.

- Risks and Mitigations: The primary risk is that a credit limit increase request may be denied. To mitigate this, focus on improving your credit score and maintaining a low credit utilization ratio before applying.

- Impact and Implications: Successfully increasing your credit limit can significantly improve your credit score, unlocking access to better financial products and lower interest rates. Conversely, a denial can indicate a need to improve credit management practices.

Conclusion: Reinforcing the Connection:

The connection between responsible credit usage and a successful credit limit increase with Capital One is undeniable. By diligently managing your credit and demonstrating consistent responsible behavior, you significantly enhance your chances of securing a higher credit limit.

Further Analysis: Examining Responsible Credit Management in Greater Detail:

Responsible credit management encompasses more than just paying bills on time. It involves actively monitoring your credit report, understanding your credit utilization ratio, and proactively managing your debt. Regularly checking your credit report helps identify and correct errors, while understanding your credit utilization ratio enables you to make informed spending decisions. Proactive debt management involves creating a budget and developing a plan to pay down existing debt.

FAQ Section: Answering Common Questions About Increasing Your Capital One Secured Credit Card Limit:

Q: How often can I request a credit limit increase?

A: Capital One doesn't specify a timeframe, but it's generally advisable to wait at least six months between requests. Repeated requests in short succession may negatively impact your application.

Q: What if my credit limit increase request is denied?

A: Contact Capital One customer service to understand the reason for the denial. Address any underlying credit issues and reapply after improving your credit profile.

Q: How long does it take to process a credit limit increase request?

A: Processing times vary, but typically you'll receive a decision within a few weeks.

Q: Can I increase my credit limit if I have a secured credit card?

A: Yes, you can request a credit limit increase on a secured credit card, but the approval depends on your creditworthiness.

Q: Does a higher credit limit always mean a better credit score?

A: Not necessarily. A higher credit limit can improve your credit score if you manage it responsibly. However, it's the responsible management of your credit that truly matters.

Practical Tips: Maximizing the Benefits of a Higher Credit Limit:

- Understand the Basics: Thoroughly understand the factors influencing credit limit increases.

- Improve Your Credit Score: Focus on improving your payment history, credit utilization ratio, and overall creditworthiness.

- Time Your Request: Wait until you have a solid track record of responsible credit usage before applying.

- Monitor Your Spending: Track your expenses closely to avoid exceeding your new credit limit.

Final Conclusion: Wrapping Up with Lasting Insights:

Increasing your Capital One secured credit card limit is an achievable goal that can significantly benefit your financial well-being. By understanding the factors influencing Capital One's decisions, improving your creditworthiness, and managing your credit responsibly, you can successfully navigate the process and unlock a brighter financial future. Remember, consistent responsible credit management is the cornerstone of building strong credit and accessing a wider range of financial opportunities.

Latest Posts

Latest Posts

-

Activity Cost Driver Definition And Examples

Apr 30, 2025

-

Activities Interests And Opinions Aio Definition Example

Apr 30, 2025

-

Active Trust Definition

Apr 30, 2025

-

Active Stocks Definition

Apr 30, 2025

-

Active Retention Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Increase My Secured Credit Card Limit Capital One . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.