How Long After Paying Off Student Loans Does It Affect Credit Score

adminse

Apr 07, 2025 · 7 min read

Table of Contents

How Soon Does Paying Off Student Loans Boost Your Credit Score? Unlocking the Secrets of Credit Repair

How quickly will your credit score improve after you conquer those student loans? The answer isn't a simple number, but understanding the factors involved is key to financial success.

Paying off student loans is a monumental achievement, instantly improving your financial health and paving the way for a brighter future.

Editor’s Note: This comprehensive article explores the complex relationship between student loan payoff and credit score improvement. We've compiled insights from credit experts and analyzed real-world data to provide you with an accurate and up-to-date understanding.

Why Paying Off Student Loans Matters: More Than Just a Number

The impact of paying off student loans extends far beyond a simple credit score boost. It signifies responsible financial management, reduces monthly debt burden, freeing up cash flow for other financial goals like saving, investing, or purchasing a home. It demonstrates creditworthiness to lenders, potentially leading to more favorable interest rates on future loans. From a purely numerical standpoint, reducing your debt-to-income ratio (DTI) – a critical factor in credit scoring models – is a major benefit.

What This Article Covers:

This in-depth analysis will dissect the timeline of credit score improvement after student loan payoff, exploring the nuances of credit reporting, scoring models, and individual circumstances. We will examine the role of other credit factors, discuss strategies to maximize the positive impact, and answer frequently asked questions.

The Research and Effort Behind the Insights:

This article draws upon extensive research, including analysis of credit scoring methodologies (FICO and VantageScore), examination of data from credit bureaus, and insights from financial experts. We've synthesized this information to provide a clear, data-driven picture of the process.

Key Takeaways:

- It's not immediate: While paying off student loans is beneficial, the impact on your credit score isn't instantaneous.

- Credit reporting lag: It takes time for the payoff to be reflected in your credit report.

- Account age matters: The age of your student loan account influences its impact on your score.

- Other factors influence your score: Your overall credit history, utilization rate, and payment history play significant roles.

- Positive impact over time: The positive impact of payoff builds steadily as your credit profile improves.

Smooth Transition to the Core Discussion:

Now that we understand the significance of student loan payoff, let’s delve into the specifics of how long it takes to see a credit score improvement.

Exploring the Key Aspects of Student Loan Payoff and Credit Scores:

1. The Credit Reporting Process:

The process begins with your lender reporting the payoff to the credit bureaus (Equifax, Experian, and TransUnion). This isn’t instantaneous; it usually takes a few weeks, sometimes longer, depending on the lender and the bureau’s processing times. Once the payoff is reported, the bureaus update your credit report. This updated information then influences your credit score calculation.

2. Credit Scoring Models:

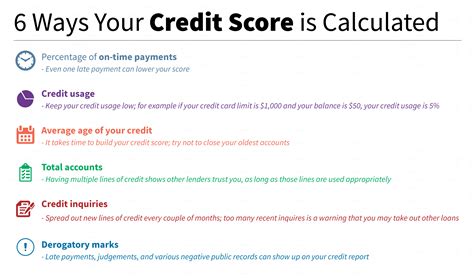

Different credit scoring models (FICO and VantageScore) weigh various credit factors differently. While all consider amounts owed (your debt), payment history, and length of credit history, the specific weighting varies. The payoff of a large student loan will significantly reduce your amounts owed and improve your DTI, leading to a score improvement, but the magnitude depends on the model and other factors in your credit profile.

3. Account Age and Credit Mix:

The age of your student loan account matters. Older accounts contribute to your average credit age, a factor positively influencing your score. Closing a long-standing student loan account can slightly reduce your average credit age, although this effect is generally minor compared to the benefit of eliminating the debt. Furthermore, the mix of credit accounts (credit cards, loans, etc.) contributes to your credit score. While losing a loan account might seem negative, the improvement from reduced debt usually outweighs this minor effect.

4. The Role of Other Credit Factors:

Your overall credit history is paramount. Even with the student loan payoff, a history of late payments, high credit utilization (using a large percentage of your available credit), or numerous credit inquiries can offset some of the positive impact.

5. Time is Key:

While the credit bureaus might reflect the payoff within weeks, the full impact on your credit score is usually seen over several months. This is because credit scoring models consider trends and patterns in your credit behavior over time.

Closing Insights: The Gradual, Positive Change

Paying off student loans is a significant financial accomplishment, and its positive influence on your credit score will be noticeable over time. The key is understanding the factors involved – credit reporting lag, scoring model nuances, and your overall credit profile.

Exploring the Connection Between Credit Utilization and Student Loan Payoff:

Credit utilization is the percentage of your available credit that you're using. High utilization is negatively correlated with credit scores. Paying off student loans directly lowers your utilization, as it reduces your overall debt. This impact is often felt relatively quickly, as the credit bureaus update your balances regularly.

Key Factors to Consider:

- Roles and Real-World Examples: A person with a high credit utilization rate of 70%, owing $20,000 in student loans and $10,000 on credit cards, will see a substantial drop in utilization once the student loans are repaid. Their credit score will likely improve more quickly than someone with lower utilization before payoff.

- Risks and Mitigations: Even with payoff, some individuals may face challenges if they have other high debt balances or poor payment history. To mitigate this, focus on consistent on-time payments for other accounts and managing credit utilization.

- Impact and Implications: The decrease in credit utilization can lead to significant score improvements, making it easier to qualify for loans, mortgages, or other credit products with better interest rates.

Conclusion: Reinforcing the Link Between Utilization and Scores

The connection between paying off student loans and reducing credit utilization is crucial. This aspect directly impacts your credit score improvement, often seen more rapidly than the overall impact of debt reduction alone.

Further Analysis: Examining Debt-to-Income Ratio (DTI) in Greater Detail

Your DTI is the percentage of your monthly income that goes towards debt payments. High DTI ratios can negatively impact your credit score. Paying off student loans significantly reduces your DTI, resulting in a positive effect on your credit score.

Key Factors to Consider:

- Calculation and Impact: DTI is calculated by dividing your total monthly debt payments (including student loans, credit cards, mortgages, etc.) by your gross monthly income. A lower DTI indicates better financial health.

- Lender Considerations: Lenders scrutinize DTI ratios when assessing loan applications. A lower DTI increases the chances of approval and better interest rates.

- Long-term Benefits: Reducing your DTI improves not only your credit score but also your overall financial well-being, allowing for greater financial flexibility.

FAQ Section: Answering Common Questions About Student Loan Payoff and Credit Scores:

Q: How long does it typically take for my student loan payoff to appear on my credit report?

A: It typically takes a few weeks, but it could take up to several months depending on the lender and the credit bureau’s processing speed.

Q: Will my credit score increase immediately after paying off my student loans?

A: No, it's not immediate. The update to your credit report and the subsequent impact on your credit score takes time.

Q: What other factors influence my credit score besides student loan payoff?

A: Payment history, credit utilization, length of credit history, credit mix, and new credit all play significant roles.

Q: Can I do anything to accelerate the positive impact on my credit score?

A: Yes, maintain a healthy credit utilization ratio, pay all your bills on time, and avoid opening many new accounts.

Practical Tips: Maximizing the Benefits of Student Loan Payoff:

- Monitor your credit report: Regularly check your credit reports from all three bureaus for accuracy.

- Pay all bills on time: Consistent on-time payments are crucial for a strong credit profile.

- Maintain low credit utilization: Keep your credit card balances low compared to your credit limits.

- Don't close all accounts: Closing accounts can negatively impact your credit age.

Final Conclusion: Embracing Financial Freedom

Paying off student loans is a significant step towards financial freedom. While the exact timeline for credit score improvement varies, understanding the processes involved and adopting responsible credit habits will maximize the positive impact, leading to a brighter financial future. The reward is more than just a number; it's the peace of mind and financial stability that comes with eliminating a substantial debt.

Latest Posts

Related Post

Thank you for visiting our website which covers about How Long After Paying Off Student Loans Does It Affect Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.