What Is The Difference Between Installment Vs Revolving Credit

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Installment vs. Revolving Credit: Understanding the Key Differences

What if your financial success hinged on understanding the nuances between installment and revolving credit? Mastering these two fundamental credit types unlocks financial freedom and empowers strategic borrowing.

Editor’s Note: This article on installment vs. revolving credit was published today, providing readers with up-to-date information and insights to make informed financial decisions.

Why Understanding Installment and Revolving Credit Matters:

Navigating the world of personal finance requires a solid grasp of credit. Understanding the distinctions between installment and revolving credit is crucial for responsible borrowing, debt management, and achieving long-term financial goals. These credit types affect interest rates, repayment schedules, and overall creditworthiness. Ignoring these differences can lead to missed payments, accumulating debt, and damaging your credit score. The information presented here empowers individuals and businesses to make informed borrowing decisions, optimizing their financial strategies.

Overview: What This Article Covers:

This article provides a comprehensive comparison of installment and revolving credit. We will delve into their definitions, core features, advantages, disadvantages, examples, and implications for credit scores. Readers will gain a clear understanding of the differences and learn how to choose the appropriate credit type based on their financial needs and circumstances.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable financial institutions, government agencies, and academic publications. Data from consumer credit bureaus and industry reports have been meticulously analyzed to ensure accuracy and objectivity. The information presented is designed to be clear, concise, and accessible to a broad audience.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of installment and revolving credit and their underlying principles.

- Practical Applications: Real-world examples illustrating the use of each credit type in various financial scenarios.

- Comparison of Features: A side-by-side comparison highlighting the key differences between installment and revolving credit.

- Impact on Credit Scores: How the responsible use (or misuse) of each credit type affects your creditworthiness.

- Strategic Use of Both Credit Types: Strategies for effectively managing both installment and revolving credit to maximize financial benefits.

Smooth Transition to the Core Discussion:

Having established the importance of understanding these credit types, let's delve into the specific details of installment and revolving credit, exploring their unique characteristics and practical implications.

Exploring the Key Aspects of Installment and Revolving Credit:

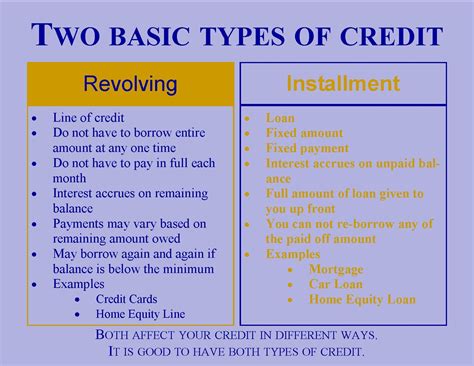

1. Installment Credit:

Installment credit is a type of loan where you borrow a specific amount of money and repay it in fixed monthly installments over a predetermined period. Each payment includes a portion of the principal amount borrowed and the interest charged. The loan amount, interest rate, and repayment term are agreed upon at the outset. Once the loan is fully repaid, the credit line is closed.

-

Definition and Core Concepts: The core principle of installment credit is the fixed payment schedule. It's structured to be predictable and manageable for the borrower, allowing them to budget effectively for repayment. Failure to make timely payments can result in late fees and negatively impact credit scores.

-

Applications Across Industries: Installment credit is widely used for various purposes, including:

- Auto Loans: Financing the purchase of a vehicle with regular monthly payments.

- Mortgages: Securing a loan to purchase a home with monthly mortgage payments spread over many years.

- Personal Loans: Borrowing money for personal expenses, debt consolidation, or home improvements, repaid in scheduled installments.

- Student Loans: Funding education expenses through loans with repayment schedules beginning after graduation.

-

Challenges and Solutions: The main challenge with installment credit is the commitment to fixed monthly payments. Unexpected financial difficulties can make it difficult to keep up with payments. Solutions include budgeting carefully, exploring options for payment deferral or modification if facing hardship, and building an emergency fund to cover unexpected expenses.

-

Impact on Innovation: The standardization of installment credit has enabled easier access to larger purchases, fostering economic growth and consumer spending. Technological advancements have streamlined the application and management processes, making it more accessible to a wider range of borrowers.

2. Revolving Credit:

Revolving credit is a type of credit that allows you to borrow money repeatedly up to a certain limit, known as your credit limit. You can borrow, repay, and borrow again within this limit. Interest is typically charged on the outstanding balance, and you only need to make a minimum payment each month. The amount you owe will fluctuate depending on your spending and repayments.

-

Definition and Core Concepts: The defining feature of revolving credit is its flexibility. It provides a readily available source of funds for unexpected expenses or ongoing purchases, as long as you stay within the credit limit. However, this flexibility also carries risks if not managed properly.

-

Applications Across Industries: Common examples of revolving credit include:

- Credit Cards: The most prevalent form of revolving credit, allowing for various purchases and cash advances.

- Home Equity Lines of Credit (HELOCs): Borrowing against the equity in your home, offering flexibility for various needs.

- Business Credit Cards: Similar to personal credit cards but designed for business expenses.

-

Challenges and Solutions: The primary challenge is the potential to accumulate high-interest debt if balances are not paid down regularly. High interest rates can quickly make the debt unmanageable. Solutions include paying more than the minimum payment each month, aiming for zero balance whenever possible, and diligently tracking spending to avoid exceeding the credit limit.

-

Impact on Innovation: Revolving credit has fueled consumer spending and economic activity. The introduction of digital payment systems and online banking has further expanded the accessibility and usage of revolving credit.

Closing Insights: Summarizing the Core Discussion:

Both installment and revolving credit serve important financial purposes, but their characteristics differ significantly. Installment credit offers predictable payments and is suitable for large, one-time purchases, while revolving credit provides flexibility but carries the risk of accumulating high-interest debt if not managed responsibly. Understanding these differences is paramount for effective financial planning and avoiding debt traps.

Exploring the Connection Between Interest Rates and Installment/Revolving Credit:

The interest rate applied to both installment and revolving credit significantly impacts the overall cost of borrowing. Installment loans typically have fixed interest rates determined at the outset, while revolving credit often has variable interest rates that can fluctuate based on market conditions and the borrower's creditworthiness. The difference in interest rates can lead to substantial variations in the total amount repaid over the loan term.

Key Factors to Consider:

-

Roles and Real-World Examples: A fixed interest rate on an installment loan provides predictability, allowing borrowers to budget accurately. Conversely, variable interest rates on revolving credit can lead to unexpected increases in monthly payments if the rate rises.

-

Risks and Mitigations: The risk with installment credit is primarily missed payments, which can damage credit scores. With revolving credit, the risk is accumulating high-interest debt due to unpaid balances. Mitigation strategies include budgeting, emergency funds, and mindful spending habits.

-

Impact and Implications: High-interest rates on revolving credit can significantly increase the total cost of borrowing, potentially leading to debt cycles. Conversely, responsible management of both credit types can contribute positively to credit scores and overall financial health.

Conclusion: Reinforcing the Connection:

The connection between interest rates and the choice between installment and revolving credit is crucial. Understanding how interest rates work in each scenario enables borrowers to make informed decisions that align with their financial goals and risk tolerance.

Further Analysis: Examining Credit Scores in Greater Detail:

Credit scores are significantly influenced by how both installment and revolving credit are managed. On-time payments on installment loans demonstrate responsible borrowing habits, positively impacting credit scores. With revolving credit, maintaining a low credit utilization ratio (the percentage of available credit used) and making consistent, timely payments are critical for a favorable credit score. High credit utilization and missed payments negatively affect scores, potentially limiting access to future credit.

FAQ Section: Answering Common Questions About Installment vs. Revolving Credit:

Q: What is the best type of credit for a large purchase like a car?

A: An installment loan is generally better for large purchases like a car because it offers a fixed payment schedule and a predetermined repayment period.

Q: Can I use revolving credit to pay off an installment loan?

A: While you can use revolving credit to pay off an installment loan, it's crucial to be mindful of interest rates and avoid accumulating high-interest debt on the credit card.

Q: What happens if I miss payments on installment or revolving credit?

A: Missed payments negatively impact your credit score and may lead to late fees, collection actions, and even legal consequences.

Q: How can I improve my credit score using both credit types?

A: Consistently making on-time payments on both installment and revolving credit, maintaining a low credit utilization ratio on revolving credit, and using credit responsibly are key to building a strong credit history.

Practical Tips: Maximizing the Benefits of Installment and Revolving Credit:

-

Budgeting: Create a realistic budget to ensure you can comfortably afford monthly payments on both installment and revolving credit.

-

Prioritize Payments: Prioritize paying down high-interest revolving credit debt to minimize interest charges.

-

Monitor Credit Reports: Regularly review your credit reports to identify any errors and ensure accuracy.

-

Emergency Fund: Build an emergency fund to cover unexpected expenses and avoid relying solely on credit.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the difference between installment and revolving credit is fundamental for responsible financial management. By carefully considering your financial needs, managing your debt effectively, and utilizing each credit type appropriately, you can achieve your financial goals and build a strong credit history. The key takeaway is that both credit types can be valuable tools, but their proper use depends on a thorough understanding of their features and implications. Armed with this knowledge, individuals can confidently navigate the world of credit and achieve financial success.

Latest Posts

Latest Posts

-

Active Trust Definition

Apr 30, 2025

-

Active Stocks Definition

Apr 30, 2025

-

Active Retention Definition

Apr 30, 2025

-

Active Management Definition Investment Strategies Pros Cons

Apr 30, 2025

-

Active Index Fund Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is The Difference Between Installment Vs Revolving Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.