How Is Chase Minimum Payment Calculated

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Decoding the Chase Minimum Payment: A Comprehensive Guide

What if understanding your Chase minimum payment calculation could save you hundreds, even thousands, of dollars in interest? Mastering this seemingly simple calculation is key to effective credit card management and achieving financial freedom.

Editor’s Note: This article on Chase minimum payment calculation was published today, providing readers with the most up-to-date information and strategies for managing their credit card debt effectively.

Why Understanding Your Chase Minimum Payment Matters:

Understanding how Chase calculates your minimum payment is crucial for several reasons. Failing to grasp this calculation can lead to:

- Increased interest charges: Paying only the minimum can significantly prolong your debt repayment, resulting in substantially higher interest payments over time.

- Damaged credit score: Consistent minimum payments, especially when combined with high credit utilization, can negatively impact your credit score, limiting your access to loans and other financial products in the future.

- Difficulty managing finances: A lack of understanding about your minimum payment can make budgeting and financial planning challenging.

- Potential for late payment fees: Miscalculating or missing your minimum payment can lead to late fees, further adding to your debt burden.

This article provides a comprehensive breakdown of the Chase minimum payment calculation, explaining the factors involved and offering actionable strategies for managing your credit card debt more effectively.

Overview: What This Article Covers

This article delves into the intricacies of Chase minimum payment calculations. We’ll explore the different methods Chase might use, examine the factors influencing the minimum payment amount, analyze how to calculate it yourself (with caveats), discuss the consequences of only paying the minimum, and finally, provide practical strategies to accelerate your debt repayment and improve your financial health.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon Chase's official website disclosures, consumer financial education resources, and analysis of common credit card payment structures. The information provided aims to be accurate and up-to-date, though it's crucial to remember that specific details might vary slightly based on your individual account terms and any changes Chase might implement. Always refer to your official cardholder agreement for the most precise information.

Key Takeaways:

- Understanding the Components: Learn the key elements that contribute to your Chase minimum payment calculation.

- Calculating Your Minimum Payment: Understand the general formula and limitations of self-calculation.

- Consequences of Minimum Payments: Recognize the long-term financial implications of only paying the minimum.

- Strategies for Faster Repayment: Discover effective strategies to accelerate debt repayment and reduce interest charges.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding your Chase minimum payment, let's delve into the details.

Exploring the Key Aspects of Chase Minimum Payment Calculation:

1. The Chase Minimum Payment Formula: A General Overview

Unfortunately, Chase doesn't publicly release a single, universally applicable formula for calculating its minimum payment. The calculation is generally based on a percentage of your outstanding balance (usually between 1% and 3%, though this can vary), plus any interest accrued and any fees incurred. Importantly, the minimum payment is never less than a specified minimum dollar amount (often around $25-$35, depending on your card).

2. Factors Influencing the Minimum Payment:

Several factors determine the precise amount of your Chase minimum payment:

- Outstanding Balance: The higher your outstanding balance, the higher your minimum payment will typically be (based on the percentage calculation).

- Accrued Interest: Interest charges are added to your balance, increasing the minimum payment. This is a critical point—the interest accrues daily, compounding over time.

- Fees: Late payment fees, over-limit fees, or other fees charged to your account will increase the minimum payment.

- Promotional Periods (if applicable): During promotional periods (e.g., 0% APR periods), the minimum payment calculation may be different, sometimes focusing solely on the principal balance or a reduced percentage. Be sure to check your statement carefully during these periods.

- Account Type: Different Chase credit cards may have slightly different minimum payment calculation methods.

3. Calculating Your Minimum Payment: A Practical Approach (with Caveats):

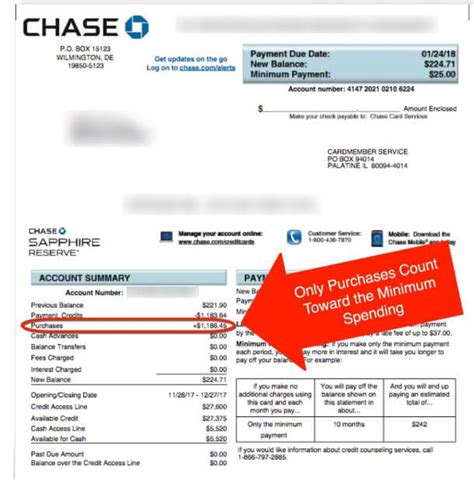

While a precise formula is not publicly available, you can get a reasonable estimate. Review your statement carefully. Look for details such as the "New Balance," the interest charged, and any added fees. Then, estimate using the following:

-

Method 1 (Percentage-Based): Take your outstanding balance and multiply it by a percentage (between 1% and 3%). Add the interest and any fees. This will give you an approximation.

-

Method 2 (Statement-Based): Your statement should explicitly state the minimum payment due. This is the most accurate method.

Important Caveat: These are estimates. The actual minimum payment may differ slightly due to internal Chase algorithms or specific account parameters. Always rely on the official minimum payment figure shown on your statement or online account.

4. Consequences of Paying Only the Minimum Payment:

Paying only the minimum payment, while seemingly convenient, carries significant long-term financial consequences:

- High Interest Costs: You'll pay significantly more in interest over the life of your debt.

- Lengthened Repayment: It will take much longer to pay off your balance, potentially for years or even decades.

- Debt Accumulation: Minimum payments often do not cover the accrued interest, leading to a snowball effect where your debt actually increases over time.

5. Strategies for Faster Repayment:

To avoid the pitfalls of minimum payments, consider the following:

- Increase Your Payments: Make payments significantly larger than the minimum to reduce your principal balance more quickly.

- Debt Snowball/Avalanche Method: Prioritize paying off your high-interest debt first (Avalanche method) or your smallest debt first to build momentum (Snowball method).

- Budgeting and Financial Planning: Create a realistic budget to ensure you have enough funds available for larger credit card payments.

- Balance Transfers: Consider transferring your balance to a card offering a lower APR for a limited time, but be aware of balance transfer fees.

- Debt Consolidation: Consolidate multiple debts into a single loan with a lower interest rate.

Exploring the Connection Between Interest Rates and Chase Minimum Payment:

The connection between your interest rate and your Chase minimum payment is crucial. A higher interest rate will significantly increase the portion of your minimum payment allocated to interest, making it harder to reduce your principal balance. Conversely, a lower interest rate will allow a larger portion of your minimum payment to go toward the principal. This emphasizes the importance of negotiating for lower interest rates or seeking options like balance transfers to manage your debt efficiently.

Key Factors to Consider:

-

Roles and Real-World Examples: High-interest rates often lead to situations where the minimum payment barely covers the interest accrued, essentially trapping you in a cycle of debt. Conversely, lower rates allow more of the minimum payment to reduce principal.

-

Risks and Mitigations: The risk of high-interest rates is prolonged debt and increased financial burden. Mitigations include balance transfers, debt consolidation, and proactive budgeting to increase payments.

-

Impact and Implications: The long-term implications of ignoring high-interest rates are detrimental to financial health, delaying other financial goals and potentially damaging credit scores.

Conclusion: Reinforcing the Connection:

The relationship between interest rates and Chase minimum payments is undeniable. Understanding this dynamic is paramount for managing credit card debt effectively. By actively addressing high interest rates and strategically increasing payments, consumers can break free from the cycle of minimum payments and achieve financial well-being.

Further Analysis: Examining Interest Rates in Greater Detail:

Interest rates are determined by several factors, including your credit score, the credit card's APR (Annual Percentage Rate), and current market conditions. A higher credit score typically translates to lower interest rates, while market fluctuations can impact APRs offered by credit card companies.

FAQ Section: Answering Common Questions About Chase Minimum Payment Calculation

Q: What if I can't afford the minimum payment? A: Contact Chase immediately. They may offer hardship programs or payment arrangements. Failing to make payments can severely damage your credit score.

Q: Does Chase ever change the minimum payment calculation method? A: While the core principles remain consistent, Chase reserves the right to modify its calculation methods, usually described in your cardholder agreement. Regularly review your statement and agreements.

Q: Can I negotiate a lower minimum payment? A: While not always guaranteed, contacting Chase directly to explain your financial situation might lead to a temporary arrangement.

Q: How often is the minimum payment recalculated? A: Typically, the minimum payment is recalculated monthly based on your outstanding balance, interest accrued, and any fees.

Practical Tips: Maximizing the Benefits of Understanding Your Minimum Payment

- Track Your Spending: Monitor your spending closely to avoid exceeding your credit limit and accumulating high balances.

- Pay More Than the Minimum: Always aim to pay more than the minimum payment to reduce your debt faster and save on interest.

- Set Up Automatic Payments: Automate your payments to avoid missing deadlines and incurring late fees.

- Review Your Statement Regularly: Carefully review your statements to understand how your minimum payment is calculated and identify any discrepancies.

- Seek Professional Advice: If you're struggling to manage your credit card debt, consult a financial advisor for personalized guidance.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how Chase calculates your minimum payment is not just a matter of numbers; it's a crucial step toward financial literacy and responsible credit card management. By mastering this calculation and implementing the strategies discussed, you can effectively manage your debt, minimize interest charges, and build a stronger financial future. Don't let the seemingly simple minimum payment calculation control your financial destiny – take charge and make informed decisions.

Latest Posts

Latest Posts

-

When Is The Statement Date Of Bdo Credit Card

Apr 07, 2025

-

When Is The Statement Date Of Unionbank Credit Card

Apr 07, 2025

-

How To Raise Your Credit Score Using A Credit Card

Apr 07, 2025

-

How To Build My Credit Score With A Credit Card

Apr 07, 2025

-

How To Raise Your Credit Score With A Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How Is Chase Minimum Payment Calculated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.