Is It Good Or Bad To Only Pay The Minimum Payment On A Credit Card Why

adminse

Apr 05, 2025 · 7 min read

Table of Contents

Is It Good or Bad to Only Pay the Minimum Payment on a Credit Card? Why?

What if consistently paying only the minimum on your credit card could cost you thousands, even tens of thousands, of dollars more than necessary? This seemingly innocuous practice is a financial trap that silently drains your resources and hinders your long-term financial health.

Editor’s Note: This article on the implications of only paying the minimum credit card payment was published today, providing readers with up-to-date information and insights into this crucial aspect of personal finance.

Why Paying Only the Minimum Matters: Relevance, Practical Applications, and Industry Significance

The decision to pay only the minimum due on a credit card is a seemingly small choice with potentially significant repercussions. It affects not only your immediate finances but also your credit score, future borrowing capacity, and overall financial well-being. Understanding the long-term consequences is crucial for responsible credit card management. This understanding helps individuals make informed financial choices and avoid the pitfalls of accumulating unnecessary debt. The impact extends beyond personal finance; it touches upon broader economic trends and the overall health of the consumer credit market.

Overview: What This Article Covers

This article provides a comprehensive analysis of the implications of paying only the minimum due on a credit card. It will delve into the mechanics of credit card interest, the snowball effect of minimum payments, the impact on credit scores, and the long-term financial consequences. Readers will gain valuable insights into responsible credit card management and strategies for avoiding the debt trap.

The Research and Effort Behind the Insights

This article draws upon extensive research, including analysis of credit card agreements, studies on consumer debt, and data from reputable financial institutions. The information presented is based on established financial principles and aims to provide accurate and reliable guidance to readers.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of credit card interest, APR, minimum payment calculations, and how they interact.

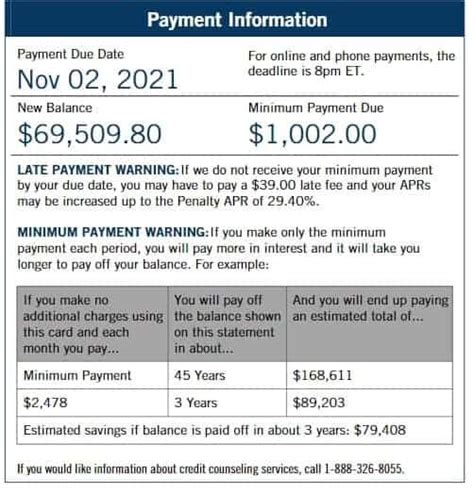

- Practical Applications: Real-world scenarios illustrating the long-term cost of minimum payments versus paying more.

- Challenges and Solutions: Identifying the obstacles that lead to minimum payments and strategies to overcome them.

- Future Implications: The potential impact of consistent minimum payments on future financial goals, such as buying a home or investing.

Smooth Transition to the Core Discussion:

Having established the importance of understanding minimum payment implications, let’s delve into the specifics, exploring the mechanics of interest accrual, the impact on credit scores, and strategic alternatives for managing credit card debt.

Exploring the Key Aspects of Paying Only the Minimum

1. Definition and Core Concepts:

Understanding the mechanics of credit card interest is paramount. The Annual Percentage Rate (APR) is the yearly interest rate charged on outstanding balances. The minimum payment is typically a small percentage (often 2-3%) of your total balance, plus any accrued interest. This means that when you only pay the minimum, a significant portion of your payment goes towards interest, leaving a smaller amount to reduce the principal balance.

2. Applications Across Industries:

The practice of paying only the minimum affects individuals across various income brackets and industries. For low-income individuals, this practice can create a cycle of debt that's incredibly difficult to escape. For higher-income individuals, it can represent a missed opportunity to invest or save that money, resulting in a diminished return on their income over time.

3. Challenges and Solutions:

The biggest challenge associated with paying only the minimum is the compounding effect of high interest rates. Even small balances can balloon significantly over time. Solutions include creating a budget, prioritizing debt repayment, and exploring debt consolidation options.

4. Impact on Innovation:

The financial industry itself has responded to the challenges of minimum payments by creating various financial products like balance transfer cards and debt management programs. However, innovations in financial technology (FinTech) are also emerging that help individuals better track their spending and manage their debt more effectively.

Closing Insights: Summarizing the Core Discussion

Paying only the minimum on a credit card is a financially detrimental strategy in almost all circumstances. The high interest rates and compounding effect lead to substantially higher overall costs and prolonged debt burdens. It's a cycle that is often very difficult to break out of without significant changes in spending habits and repayment strategies.

Exploring the Connection Between Interest Rates and Paying Only the Minimum

The relationship between interest rates and minimum payments is fundamentally intertwined. High interest rates significantly increase the cost of only paying the minimum. A larger portion of the minimum payment goes toward interest, leaving less to reduce the principal balance. This leads to a slower repayment process, resulting in more interest charges over the life of the debt.

Key Factors to Consider:

-

Roles and Real-World Examples: Consider a credit card balance of $1,000 with a 18% APR. The minimum payment might be $25. The majority of this payment goes to interest, and the principal reduction is minimal. Over time, the interest accumulates rapidly, and the balance remains high.

-

Risks and Mitigations: The primary risk is the accumulation of significant debt and damage to credit scores. Mitigations include creating a budget, prioritizing debt repayment, and exploring options such as debt consolidation or balance transfers.

-

Impact and Implications: The long-term impact can severely limit financial opportunities such as buying a house, investing, or securing loans. It can also significantly impact creditworthiness and financial stability.

Conclusion: Reinforcing the Connection

The connection between high interest rates and minimum payments reinforces the critical importance of strategic debt management. Understanding this dynamic is crucial for making informed decisions and avoiding the debt trap. Paying more than the minimum is always the fiscally responsible choice.

Further Analysis: Examining Compounding Interest in Greater Detail

Compounding interest is the interest earned not only on the principal but also on accumulated interest. This effect dramatically accelerates the growth of debt when only minimum payments are made. Let's illustrate with an example:

Imagine a $1,000 balance with a 20% APR. The minimum payment might be around $25. Month one, a substantial portion of that $25 goes to interest, leaving only a small amount applied to the principal. Month two, the interest is calculated on the slightly smaller principal. This pattern repeats, and the interest continues to compound, making it difficult to reduce the principal balance significantly.

FAQ Section: Answering Common Questions About Minimum Credit Card Payments

Q: What is the impact of consistently paying only the minimum on my credit score?

A: Consistently paying only the minimum can negatively impact your credit score. Lenders view this as a sign of financial instability and increased risk. A lower credit score can lead to higher interest rates on future loans and limit your access to credit.

Q: How can I get out of the cycle of minimum payments?

A: Develop a realistic budget to understand your spending and income. Prioritize debt repayment by allocating extra funds to the credit card balance. Consider debt consolidation or balance transfer options to lower interest rates and simplify repayment. Seek professional financial advice if needed.

Q: What is the best strategy for paying off credit card debt?

A: The best strategy depends on your individual circumstances and financial goals. Common approaches include the avalanche method (paying off the highest interest debt first) and the snowball method (paying off the smallest debt first for motivational purposes). The key is consistency and dedication to the repayment plan.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Use

-

Track your spending meticulously: Use budgeting apps or spreadsheets to monitor your expenses and ensure you stay within your means.

-

Pay more than the minimum: Make extra payments whenever possible to accelerate debt repayment and minimize interest charges.

-

Negotiate lower interest rates: Contact your credit card company to see if they can lower your APR.

-

Explore debt consolidation options: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate.

-

Build an emergency fund: Having an emergency fund can prevent you from relying on credit cards during unexpected expenses.

Final Conclusion: Wrapping Up with Lasting Insights

The decision to pay only the minimum payment on a credit card is a seemingly small choice with potentially devastating long-term financial consequences. Understanding the mechanics of interest, the impact on credit scores, and the availability of debt management strategies is crucial for responsible financial management. Prioritizing debt repayment and adopting proactive strategies significantly increases your chances of achieving long-term financial security and avoiding the pitfalls of accumulating unnecessary debt. The consistent practice of paying more than the minimum, combined with careful budgeting and financial planning, is paramount for a secure and prosperous financial future.

Latest Posts

Latest Posts

-

How Do You Add Tradelines To Your Credit

Apr 07, 2025

-

How Can I Add Tradelines To My Credit Report

Apr 07, 2025

-

How To Add Primary Tradelines To Your Credit Report

Apr 07, 2025

-

How To Add Tradelines To Your Credit Report Yourself

Apr 07, 2025

-

What Does Your Credit Score Need To Be For Chase Sapphire Reserve

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Is It Good Or Bad To Only Pay The Minimum Payment On A Credit Card Why . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.