Days Payable Outstanding Dpo Defined And How Its Calculated

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Decoding Days Payable Outstanding (DPO): Definition, Calculation, and Strategic Importance

What if a company's financial health was easily assessed by simply understanding its Days Payable Outstanding (DPO)? This crucial metric offers invaluable insights into a company's operational efficiency and cash flow management.

Editor’s Note: This article on Days Payable Outstanding (DPO) provides a comprehensive guide to understanding, calculating, and utilizing this vital financial metric for improved business performance. Updated with the latest best practices, this resource is designed for business owners, financial analysts, and anyone seeking to enhance their understanding of cash flow management.

Why Days Payable Outstanding Matters: Relevance, Practical Applications, and Industry Significance

Days Payable Outstanding (DPO) is a critical financial ratio that measures how efficiently a company pays its suppliers. It represents the average number of days it takes a company to pay its invoices after receiving goods or services. A well-managed DPO signifies responsible financial stewardship, while a high DPO may indicate cash flow problems or strained supplier relationships. This metric is crucial for:

- Creditworthiness: Lenders and investors use DPO to assess a company's creditworthiness and ability to meet its financial obligations.

- Supplier Relationships: Maintaining a healthy DPO fosters strong supplier relationships, ensuring consistent access to goods and services.

- Cash Flow Management: Optimizing DPO is a cornerstone of effective cash flow management, maximizing available capital for other business activities.

- Benchmarking: Comparing DPO to industry averages helps companies identify areas for improvement and gain a competitive edge.

Overview: What This Article Covers

This article will thoroughly explore the concept of DPO, covering its definition, various calculation methods, factors influencing it, and its strategic importance in business decision-making. Readers will gain a practical understanding of how to calculate and interpret DPO, along with strategies for optimizing this key financial metric. We will also delve into the relationship between DPO and other financial ratios, highlighting its interconnectedness within a company's overall financial health.

The Research and Effort Behind the Insights

This article is the culmination of extensive research, drawing upon widely accepted accounting principles, industry best practices, and case studies from diverse business sectors. Data and examples presented are intended to illustrate key concepts and provide a clear, actionable understanding of DPO's practical application. We have avoided overly technical jargon, ensuring accessibility for a broad audience.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of DPO and its foundational principles.

- Calculation Methods: Different approaches to calculating DPO, including their strengths and weaknesses.

- Influencing Factors: Key factors that impact a company's DPO, both internal and external.

- Benchmarking and Interpretation: How to effectively interpret DPO and compare it to industry standards.

- Optimization Strategies: Practical strategies for improving DPO and enhancing cash flow management.

- Relationship with other Financial Metrics: The connection between DPO and other key financial ratios.

Smooth Transition to the Core Discussion

Having established the significance of DPO, let's now delve into the specifics of its definition and calculation. Understanding these fundamentals is crucial for effectively utilizing DPO as a management tool.

Exploring the Key Aspects of Days Payable Outstanding (DPO)

1. Definition and Core Concepts:

Days Payable Outstanding (DPO) represents the average number of days a company takes to pay its suppliers. It reflects the length of time between the invoice date and the payment date. A lower DPO generally indicates better cash flow management and stronger supplier relationships. Conversely, a higher DPO might suggest potential cash flow challenges or strained relationships with suppliers. It's important to note that DPO is not a measure of how long a company takes to pay, but rather the average time taken over a period.

2. Calculation Methods:

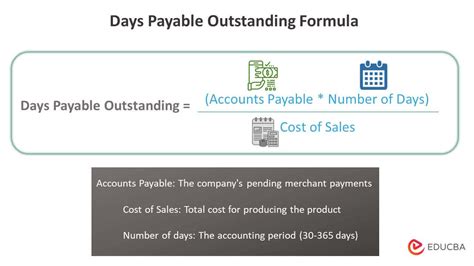

There are several methods for calculating DPO, each with slight variations. The most common method uses the following formula:

DPO = (Average Accounts Payable / Cost of Goods Sold) * Number of Days in the Period

-

Average Accounts Payable: This is the average balance of accounts payable over a specific period (e.g., a quarter or a year). It's calculated by adding the beginning and ending accounts payable balances and dividing by two. A more sophisticated approach might involve averaging accounts payable over multiple periods for a more accurate representation.

-

Cost of Goods Sold (COGS): This represents the direct costs attributable to producing the goods sold by a company. It includes raw materials, direct labor, and manufacturing overhead.

-

Number of Days in the Period: This is the number of days in the period for which the DPO is being calculated (e.g., 90 days for a quarter, 365 days for a year).

Alternative Calculation Method:

Another method, particularly useful when COGS data isn't readily available, is:

DPO = (Average Accounts Payable / Total Purchases) * Number of Days in the Period

- Total Purchases: This represents the total amount spent on purchasing goods and services during the period.

3. Influencing Factors:

Several factors can influence a company's DPO:

- Negotiated Payment Terms: Longer payment terms negotiated with suppliers directly increase DPO.

- Cash Flow: Companies with tight cash flow may delay payments to suppliers, leading to a higher DPO.

- Supplier Relationships: Strong supplier relationships often allow for more flexible payment terms, potentially impacting DPO.

- Inventory Management: Efficient inventory management can reduce the need for frequent purchases and thus affect payment frequency.

- Discounts for Early Payment: The availability of early payment discounts can incentivize faster payments, leading to a lower DPO.

- Seasonal Variations: Businesses with seasonal fluctuations in sales may experience variations in their DPO.

- Economic Conditions: Economic downturns can impact a company's ability to pay suppliers promptly, resulting in a higher DPO.

4. Benchmarking and Interpretation:

Interpreting DPO requires comparing it to industry averages and the company's historical performance. A DPO significantly higher than industry benchmarks may indicate potential cash flow issues or inefficient payment processes. Conversely, a consistently low DPO, while seemingly positive, might signal overly aggressive payment practices that could strain supplier relationships. Benchmarking is crucial for informed decision-making.

5. Optimization Strategies:

Optimizing DPO involves a multifaceted approach:

- Negotiate Favorable Payment Terms: Seek longer payment terms with reliable suppliers while maintaining strong relationships.

- Improve Cash Flow Management: Implement effective cash flow forecasting and management techniques.

- Automate Payment Processes: Utilize automated payment systems to streamline invoice processing and payment.

- Centralize Accounts Payable: Centralize accounts payable functions for better oversight and control.

- Take Advantage of Early Payment Discounts: Evaluate the cost-benefit of taking early payment discounts to improve cash flow.

- Improve Forecasting: Accurate forecasting allows for better planning of payments.

Exploring the Connection Between Credit Score and DPO

A company's credit score and DPO are intrinsically linked. Lenders and credit rating agencies use DPO as a key indicator of a company's financial health and creditworthiness. A consistently high DPO can negatively impact a company's credit score, making it more difficult to secure financing at favorable rates. Conversely, a healthy DPO demonstrates responsible financial management, potentially leading to better credit ratings and improved access to credit.

Key Factors to Consider:

-

Roles and Real-World Examples: Companies with poor credit scores often exhibit high DPOs, reflecting difficulties in meeting their financial obligations. Conversely, companies with strong credit scores typically maintain healthy DPOs, indicating robust cash flow management.

-

Risks and Mitigations: High DPO can lead to damaged supplier relationships, impacting access to goods and services. Mitigating this risk involves proactively managing cash flow and negotiating favorable payment terms.

-

Impact and Implications: A consistently high DPO can signal financial distress, affecting a company's ability to secure loans, attract investors, and maintain competitive advantage.

Conclusion: Reinforcing the Connection

The relationship between credit score and DPO is undeniable. Maintaining a healthy DPO is not merely a matter of efficient payment practices; it's a cornerstone of building a strong credit profile, fostering positive supplier relationships, and ensuring the long-term financial health and stability of a company.

Further Analysis: Examining Credit Rating Agencies and DPO in Greater Detail

Credit rating agencies like Moody's, Standard & Poor's, and Fitch Ratings incorporate DPO into their assessment models. These agencies analyze a company's financial statements, including its accounts payable and payment history, to gauge its creditworthiness. A high DPO, coupled with other negative financial indicators, can lead to a lower credit rating, potentially impacting access to capital and increasing borrowing costs.

FAQ Section: Answering Common Questions About DPO

Q: What is the ideal DPO? A: There's no single ideal DPO. The optimal level varies significantly by industry, company size, and payment terms negotiated with suppliers. Benchmarking against industry averages is crucial.

Q: How often should DPO be calculated? A: DPO should be calculated regularly, ideally monthly or quarterly, to monitor trends and identify potential problems early on.

Q: What are the implications of a consistently high DPO? A: A consistently high DPO can indicate cash flow problems, strained supplier relationships, and potential financial distress. It can also negatively impact a company's credit rating.

Q: How can I improve my company's DPO? A: Implementing strategies like negotiating better payment terms, improving cash flow management, automating payment processes, and taking advantage of early payment discounts can help improve DPO.

Practical Tips: Maximizing the Benefits of DPO Analysis

- Track DPO Regularly: Monitor DPO trends over time to identify patterns and potential issues.

- Benchmark Against Competitors: Compare your DPO to industry averages to assess your performance relative to competitors.

- Analyze Payment Terms: Negotiate payment terms that balance maintaining good supplier relationships with optimizing cash flow.

- Improve Cash Flow Forecasting: Accurate forecasting enables better planning and management of payments to suppliers.

- Implement Technology: Utilize technology to automate payment processes and improve efficiency.

Final Conclusion: Wrapping Up with Lasting Insights

Days Payable Outstanding is a powerful metric providing critical insights into a company's financial health and operational efficiency. By understanding its definition, calculation, influencing factors, and strategic implications, businesses can leverage DPO to improve cash flow management, strengthen supplier relationships, and enhance overall financial performance. Proactive monitoring and optimization of DPO are crucial for long-term success and sustainable growth. The insights gained from DPO analysis contribute to informed decision-making, leading to a stronger financial position and enhanced competitiveness in today's dynamic business environment.

Latest Posts

Related Post

Thank you for visiting our website which covers about Days Payable Outstanding Dpo Defined And How Its Calculated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.