Which European Country Has No Income Tax

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Which European Country Has No Income Tax? Uncovering the Myths and Realities of Tax Havens

Is it truly possible to live in Europe without paying income tax? The allure of a tax-free existence is powerful, but the reality is far more nuanced. This article will delve into the complexities of European taxation, debunking common myths and exploring the countries often mistakenly associated with zero income tax.

Editor’s Note: This article on European countries and their income tax systems has been compiled using the most up-to-date information available. Tax laws are subject to change, so readers are encouraged to consult official government sources for the most current regulations.

Why the Search for No Income Tax Matters:

The quest for a low- or no-income-tax haven reflects a desire for greater financial freedom and control. For individuals and businesses alike, minimizing tax burdens can significantly impact disposable income, investment opportunities, and overall financial well-being. Understanding the intricacies of European tax systems is crucial for making informed decisions about residency, investment, and business operations.

Overview: What This Article Covers:

This in-depth analysis explores the common misconceptions surrounding income tax in Europe. We'll examine specific countries often cited as potential tax havens, critically analyzing their tax structures and highlighting the often-overlooked complexities. We'll also discuss the ethical and practical considerations of choosing a country based solely on its tax regime. The article concludes with a realistic assessment of the possibilities and limitations of minimizing tax burdens within the European Union.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable sources, including official government websites, international tax organizations (like the OECD), academic publications, and leading financial news outlets. The information provided is based on factual data and analysis, aiming to provide readers with a clear and unbiased understanding of the subject.

Key Takeaways:

- Mythbusting: No European country currently offers a complete exemption from income tax for all residents.

- Tax Structures: European tax systems are diverse, with varying rates and rules.

- Residency Requirements: Tax residency, not just citizenship, is the determining factor for tax obligations.

- Hidden Costs: Low tax rates may be offset by higher costs of living, indirect taxes, or other regulations.

- Ethical Considerations: Tax avoidance strategies should be evaluated ethically and legally.

Smooth Transition to the Core Discussion:

While the dream of a completely tax-free European life is largely a myth, understanding the variations in tax systems across the continent is vital for anyone considering relocation or international investment. Let's explore the countries most frequently associated with low income tax burdens and analyze the realities of their tax landscapes.

Exploring the Key Aspects of European Income Tax Systems:

The European Union boasts a wide spectrum of tax systems, reflecting the diverse economic and social policies of its member states. There's no single "European" income tax; each country sets its own rates and rules. Many countries utilize progressive tax systems, where higher earners pay a larger percentage of their income in taxes.

Countries Often Misunderstood:

Several European countries are often mistakenly identified as having no income tax or extremely low rates. These misconceptions often stem from a misunderstanding of tax residency, the complexities of tax treaties, or a focus on a single aspect of the tax system (e.g., corporation tax) while ignoring others (like VAT or property tax).

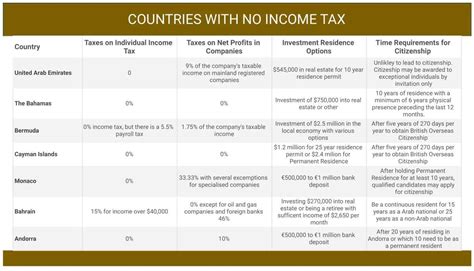

Monaco: Often cited as a tax haven, Monaco doesn't levy income tax on its residents. However, residency requirements are strict, and obtaining residency is challenging. Moreover, Monaco compensates for its lack of income tax through high property taxes, sales taxes, and other indirect taxes. The cost of living in Monaco is exceptionally high, negating any significant financial advantage for many.

Andorra: Similar to Monaco, Andorra has no income tax. However, similar caveats apply. Residency requirements are demanding, and other taxes, like VAT and property taxes, can be substantial. The cost of living, while potentially lower than Monaco, is still relatively high compared to many other European nations.

San Marino: San Marino also has a unique tax system with no income tax for its residents. However, this is balanced by other taxes and fees, and the requirements for residency are stringent. It's important to note that the economic opportunities and infrastructure in San Marino are comparatively limited compared to larger European economies.

Liechtenstein: While Liechtenstein has a relatively low income tax rate compared to many other European countries, it's not a tax-free haven. The tax burden is still present and is influenced by factors such as income level and residency status.

Challenges and Solutions in Navigating European Tax Systems:

Navigating European tax systems requires careful consideration of several key factors:

- Tax Residency: Establishing residency in a particular country triggers tax obligations in that country, regardless of citizenship. Residency criteria vary significantly across Europe.

- Tax Treaties: Double taxation treaties between countries aim to prevent individuals and businesses from being taxed twice on the same income. Understanding these treaties is essential for international tax planning.

- Indirect Taxes: Value-added tax (VAT), sales taxes, and other indirect taxes can significantly impact overall tax burden. These taxes are often levied on goods and services regardless of income level.

- Professional Advice: Seeking expert advice from a qualified tax advisor familiar with international tax law is crucial for accurate tax planning and compliance.

Impact on Innovation and the Future of European Taxation:

The ongoing evolution of European tax systems is driven by factors such as economic competitiveness, social welfare programs, and international tax harmonization efforts. Changes in tax policies can influence investment decisions, business location choices, and individual mobility within the European Union.

Exploring the Connection Between Residency and Tax Obligations:

The connection between residency and tax obligations is paramount. Simply having citizenship in a low-tax country doesn't guarantee tax-free status. To avoid paying income tax, one must usually satisfy the requirements for tax residency, which often involve criteria like physical presence, family ties, and economic connections to the country in question. These requirements are rigorously enforced.

Key Factors to Consider:

- Physical Presence: Spending a significant portion of the year in a country typically establishes residency.

- Center of Vital Interests: Maintaining family ties, business operations, or other significant aspects of life within a country can establish residency.

- Habitual Abode: Demonstrating an established pattern of living in a particular country can meet residency criteria.

- Tax Compliance: Non-compliance with tax laws in any country can have significant legal and financial consequences.

Real-World Examples:

An individual might hold citizenship in a low-tax country but maintain their primary residence and economic activities in a high-tax country, resulting in tax obligations in the high-tax jurisdiction. Likewise, a business operating primarily in a high-tax country but registered in a low-tax jurisdiction is still likely to face tax obligations in the country where the bulk of its business takes place.

Risks and Mitigations:

Ignoring residency requirements or attempting to inappropriately exploit tax loopholes can lead to severe penalties, including financial fines and legal repercussions. Working with experienced tax professionals is crucial to minimize risks and ensure legal compliance.

Impact and Implications:

Understanding the interplay between residency and tax obligations is fundamental for making informed decisions regarding international relocation and business operations. Failure to accurately assess and comply with tax requirements can have significant financial and legal consequences.

Conclusion: Reinforcing the Connection

The relationship between residency and taxation is the cornerstone of understanding European tax systems. Ignoring this connection can lead to costly errors. The absence of income tax in some European microstates is often offset by other levies and stringent residency criteria, making the overall financial picture significantly more complex than initially perceived.

Further Analysis: Examining Residency Requirements in Greater Detail:

Residency requirements vary greatly between European countries. Factors such as the length of stay, nature of accommodation, and purpose of visit all contribute to determining residency status. This complexity highlights the need for careful consideration and expert advice when making decisions based on tax considerations.

FAQ Section: Answering Common Questions About European Income Tax:

Q: Is it possible to completely avoid paying income tax in Europe?

A: No. While some countries have lower income tax rates or specific exemptions, no European country offers complete exemption from all taxes for residents. Other forms of taxation, such as property tax, VAT, or wealth tax, are likely to apply.

Q: What is the difference between citizenship and tax residency?

A: Citizenship refers to legal membership in a country, while tax residency denotes the legal obligation to pay taxes in a specific country based on one's place of residence and economic ties. One can be a citizen of one country and a tax resident of another.

Q: How can I determine my tax residency status?

A: The determination of tax residency is complex and depends on specific rules of each country. Consulting with a tax professional or reviewing the relevant tax authority's guidelines in the country in question is crucial.

Practical Tips: Maximizing the Benefits of Informed Tax Planning:

- Seek Professional Advice: Engage a qualified tax advisor familiar with international tax law to tailor a tax plan to your specific circumstances.

- Understand Residency Rules: Carefully review the residency requirements of any country you are considering.

- Plan Ahead: Engage in tax planning proactively, rather than reactively, to avoid potential penalties and maximize tax efficiency.

Final Conclusion: Wrapping Up with Lasting Insights:

The search for a European country with no income tax is often driven by a desire for financial freedom. While certain countries offer lower tax rates than others, a complete avoidance of income tax within Europe is unrealistic. Understanding the complexities of tax residency, indirect taxes, and the overall cost of living in different locations is crucial for making informed financial decisions. The pursuit of tax optimization should always be guided by legal and ethical considerations. Professional advice is indispensable for navigating this intricate landscape and achieving compliant, effective tax planning.

Latest Posts

Related Post

Thank you for visiting our website which covers about Which European Country Has No Income Tax . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.