Why Does The Loanable Funds Market Use Real Interest Rates Instead Of Nominal Interest Rates

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Why does the loanable funds market use real interest rates instead of nominal interest rates?

Understanding real interest rates is crucial for accurately assessing the true cost of borrowing and the return on lending.

Editor's Note: This article on the use of real interest rates in the loanable funds market provides a comprehensive overview of the topic, examining its theoretical underpinnings and practical implications. Updated economic data and recent research have been incorporated to ensure the information remains current and relevant.

Why Real Interest Rates Matter:

The loanable funds market, a simplified representation of the market for credit, determines the equilibrium interest rate that balances the supply of savings (loanable funds) with the demand for borrowing. While nominal interest rates are readily observable—the stated interest rate on a loan—they don't fully capture the true cost of borrowing or the return on lending. This is because nominal interest rates are influenced by inflation, the rate at which the general price level rises. Real interest rates, on the other hand, adjust for inflation, providing a more accurate reflection of the purchasing power gained or lost through borrowing and lending.

To understand this, consider a scenario where the nominal interest rate is 5%, but inflation is 3%. A lender receives 5% more money nominally, but the real increase in purchasing power is only 2% (5% - 3%). Conversely, a borrower pays a nominal interest rate of 5%, but the real cost of borrowing is reduced by the 3% inflation, effectively paying only 2% in real terms. Ignoring inflation and relying solely on nominal rates can lead to inaccurate investment decisions, flawed economic analysis, and misallocation of resources.

Overview: What This Article Covers:

This article will delve into the reasons why the loanable funds market utilizes real interest rates instead of nominal interest rates. We will explore the concept of real and nominal interest rates, examining their relationship through the Fisher equation. The article will discuss the implications of using nominal rates for economic decision-making and the importance of real interest rates in various economic models, including the loanable funds market. We will also address the limitations and complexities associated with measuring and using real interest rates in practice.

The Research and Effort Behind the Insights:

This article draws upon a wide range of sources, including macroeconomic textbooks, scholarly articles from reputable journals, and data from central banks and international organizations such as the Federal Reserve and the International Monetary Fund. The analysis presented reflects a rigorous examination of established economic principles and their application to the loanable funds market.

Key Takeaways:

- Defining Real and Nominal Interest Rates: A clear distinction between these two key concepts.

- The Fisher Equation: Understanding the mathematical relationship between real, nominal rates, and inflation.

- The Loanable Funds Market Equilibrium: How real interest rates determine the market clearing interest rate.

- Economic Decision-Making: The critical role of real rates in investment, saving, and consumption decisions.

- Limitations of Real Interest Rate Measurement: Acknowledging the challenges in accurately measuring inflation and calculating real rates.

Smooth Transition to the Core Discussion:

Having established the fundamental importance of accurately reflecting the true cost of borrowing and the return on lending, let's examine the intricacies of the loanable funds market and the crucial role of real interest rates within its framework.

Exploring the Key Aspects of Real Interest Rates in the Loanable Funds Market:

1. Defining Real and Nominal Interest Rates:

The nominal interest rate is the stated interest rate on a loan or investment, unadjusted for inflation. It represents the percentage increase in the nominal amount of money received or paid over a given period. The real interest rate, conversely, reflects the percentage increase in the purchasing power of the money received or paid after accounting for inflation. It represents the actual return on an investment or the true cost of borrowing in terms of goods and services.

2. The Fisher Equation:

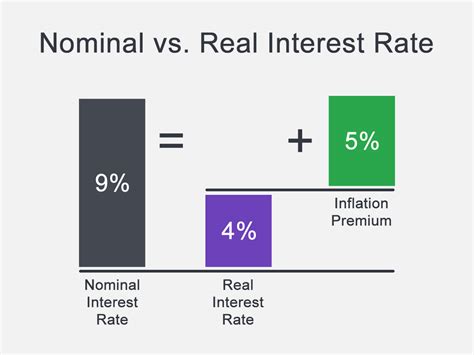

The relationship between nominal interest rates (i), real interest rates (r), and inflation (π) is expressed by the Fisher equation:

(1 + i) = (1 + r)(1 + π)

A simplified approximation of this equation, often used when inflation is relatively low, is:

i ≈ r + π

This equation highlights that the nominal interest rate is approximately the sum of the real interest rate and the expected inflation rate. The expected inflation rate is crucial because it reflects what lenders and borrowers anticipate future inflation to be. Their expectations influence their decisions regarding lending and borrowing, ultimately impacting the equilibrium real interest rate.

3. The Loanable Funds Market Equilibrium:

In the loanable funds market, the supply of loanable funds comes from savings, while the demand stems from investment and government borrowing. The equilibrium real interest rate is the rate at which the quantity of loanable funds supplied equals the quantity demanded. Using nominal interest rates would distort this equilibrium because it wouldn't account for changes in purchasing power caused by inflation. A high nominal interest rate during a period of high inflation might not actually be a high real interest rate, and vice-versa. This means that decisions based on nominal rates might lead to inaccurate assessments of the true cost of borrowing and the return on saving.

4. Economic Decision-Making:

Rational economic agents base their decisions on real returns, not nominal returns. A saver concerned about purchasing power will be more interested in the real return on their savings. Similarly, a borrower assesses the real cost of borrowing to determine if an investment project is worthwhile. Using nominal interest rates to make these decisions can lead to suboptimal outcomes. For example, a borrower might take on a loan with a low nominal interest rate during a high inflation period, believing the loan is inexpensive. However, if inflation is significantly higher than the nominal interest rate, the real cost of borrowing could be negative, a potentially misleading indicator.

5. Limitations of Real Interest Rate Measurement:

Accurately measuring the real interest rate is challenging. Precisely forecasting inflation is inherently difficult, leading to uncertainty regarding the expected inflation component of the Fisher equation. Different inflation measures (e.g., Consumer Price Index (CPI), Producer Price Index (PPI)) can yield different results, leading to variations in calculated real interest rates. Moreover, the Fisher equation assumes a constant inflation rate over the loan's term, which isn't always the case in reality. Unexpected changes in inflation can alter the real return ex-post, meaning the actual real return realized differs from the expected real return at the time of the loan agreement.

Exploring the Connection Between Expected Inflation and Real Interest Rates:

The connection between expected inflation and real interest rates is fundamental to understanding the loanable funds market. Expected inflation influences the supply and demand for loanable funds, ultimately determining the equilibrium real interest rate.

Key Factors to Consider:

-

Roles and Real-World Examples: If borrowers expect high inflation, they might demand higher nominal interest rates to compensate for the erosion of the repayment's purchasing power. Lenders, anticipating inflation, will also demand higher nominal interest rates to maintain a desired real return. This interplay of expectations shapes the nominal interest rate, which in turn, reveals the underlying real interest rate through adjustments for expected inflation.

-

Risks and Mitigations: The biggest risk is the inaccuracy of inflation forecasts. Unexpected changes in inflation can significantly alter the realized real interest rate, impacting both lenders and borrowers. Mitigating this risk involves using sophisticated forecasting models and employing various inflation hedges (e.g., inflation-indexed bonds).

-

Impact and Implications: The accuracy of the equilibrium real interest rate derived from the loanable funds market depends heavily on the accuracy of inflation expectations. Incorrect inflation expectations can lead to misallocation of resources, inefficient investment decisions, and distortions in the financial markets.

Conclusion: Reinforcing the Connection:

The interconnection between expected inflation and real interest rates is integral to the functioning of the loanable funds market. Accurate inflation expectations are vital for determining the equilibrium real interest rate, which, in turn, influences saving, investment, and overall economic activity. Deviations from accurate expectations can lead to market inefficiencies and economic instability.

Further Analysis: Examining Inflation Expectations in Greater Detail:

Inflation expectations are formed through various channels, including past inflation rates, central bank communication, market signals (e.g., inflation-indexed bond yields), and surveys of professional forecasters. Understanding how these different channels influence expectations is crucial for comprehending the dynamics of the loanable funds market. For example, if a central bank consistently communicates its inflation target and maintains credibility, market participants' inflation expectations will align more closely with the central bank's target, leading to a more predictable and efficient loanable funds market. Conversely, if the central bank's actions contradict its communication or if inflation surprises frequently occur, inflation expectations might become volatile and difficult to predict. This uncertainty can amplify the risks and complications associated with determining the equilibrium real interest rate.

FAQ Section: Answering Common Questions About Real Interest Rates:

-

What is the difference between real and nominal interest rates? Nominal interest rates are the stated interest rates on loans or investments without considering inflation. Real interest rates adjust for inflation, showing the true change in purchasing power.

-

Why is the real interest rate more important than the nominal interest rate for economic decisions? Economic agents make decisions based on their expected purchasing power. Real interest rates directly reflect this, while nominal rates can be misleading during periods of high inflation or deflation.

-

How are real interest rates calculated? Real interest rates are calculated using the Fisher equation, which requires an estimate of future inflation. The accuracy of this estimate directly impacts the accuracy of the calculated real interest rate.

-

What are the limitations of using real interest rates? Accurate inflation forecasting is difficult. Different inflation measures can lead to varying results. Unexpected changes in inflation can alter the realized real rate.

Practical Tips: Maximizing the Understanding of Real Interest Rates:

-

Understand the Fisher Equation: Familiarize yourself with the equation and its limitations.

-

Follow Inflation Forecasts: Stay updated on inflation forecasts from reputable sources.

-

Consider Inflation-Indexed Securities: Consider investing in inflation-protected securities to mitigate inflation risk.

Final Conclusion: Wrapping Up with Lasting Insights:

The loanable funds market utilizes real interest rates because they provide a more accurate reflection of the true cost of borrowing and the return on lending. While nominal rates are easily observable, they are susceptible to distortions from inflation. Understanding the relationship between real and nominal rates, particularly through the Fisher equation, is vital for making informed financial decisions and for accurately interpreting economic indicators. However, it's important to recognize the challenges associated with accurately measuring and forecasting inflation, highlighting the inherent limitations in perfectly determining the equilibrium real interest rate. Continuous monitoring of inflation forecasts and awareness of the various factors influencing expectations are crucial for navigating the complexities of the loanable funds market effectively.

Latest Posts

Related Post

Thank you for visiting our website which covers about Why Does The Loanable Funds Market Use Real Interest Rates Instead Of Nominal Interest Rates . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.